Colorado Disclosure Regarding Receivers is a document used to provide a record of all receivership transfers from a company in Colorado. This document is used to ensure that the receivership process is handled properly and that all parties involved are aware of their rights and obligations. The document is required whenever a company in Colorado is placed into receivership. There are two types of Colorado Disclosure Regarding Receivers: the Initial Disclosure Regarding Receivers and the Final Disclosure Regarding Receivers. The Initial Disclosure Regarding Receivers must be filed before the receivership process begins and must include the name of the receiver, the terms of the receivership, and the rights of creditors and other parties to the receivership. The Final Disclosure Regarding Receivers must be filed after the receivership process is complete and must include a full accounting of the assets and liabilities of the company, as well as all payments made during the receivership process.

Colorado Disclosure Regarding Receivers

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Disclosure Regarding Receivers?

Drafting legal documents can be a significant hassle unless you have accessible, fillable templates at your disposal.

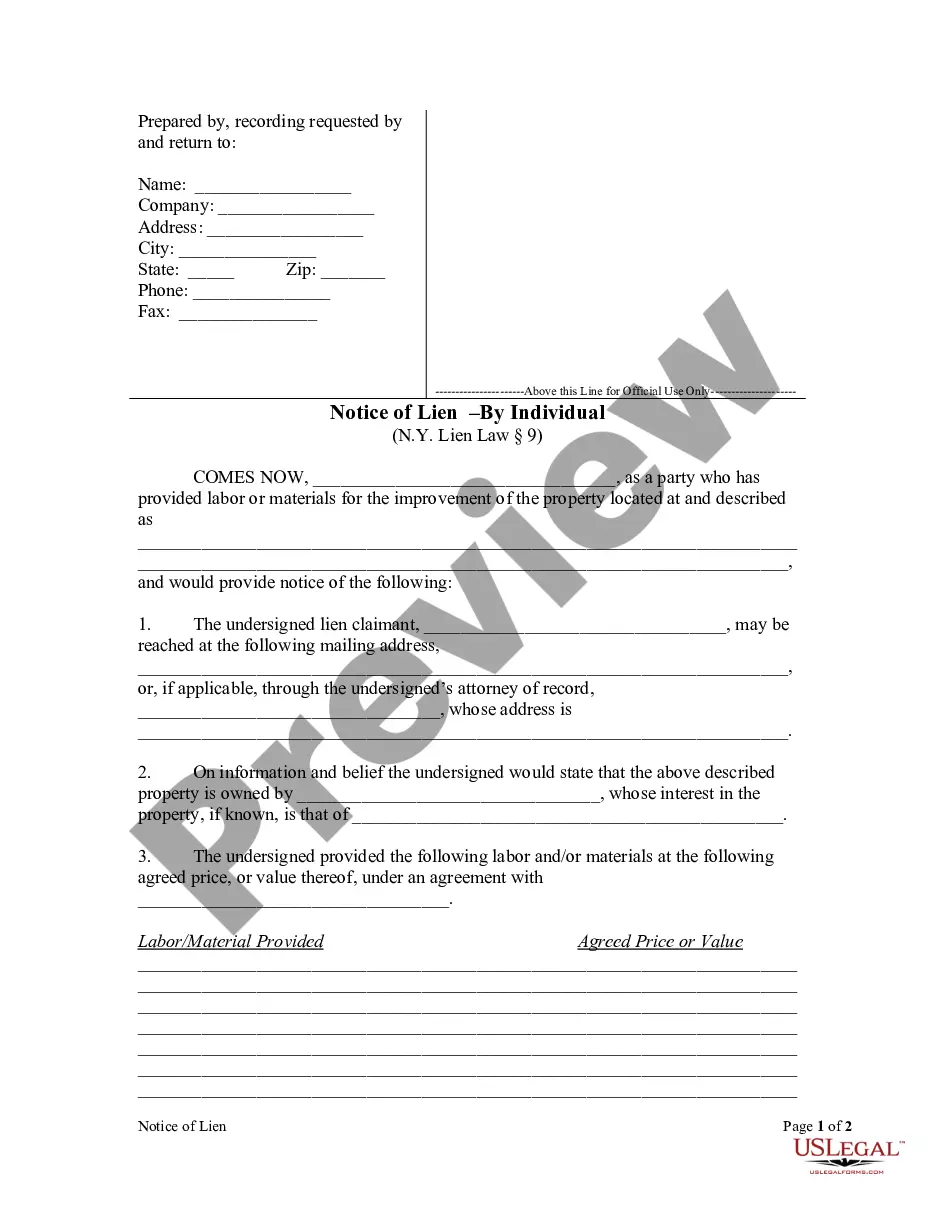

With the US Legal Forms online database of official paperwork, you can have confidence in the forms you acquire, as each one aligns with federal and state regulations and has been verified by our experts. Therefore, if you need to complete the Colorado Disclosure Regarding Receivers, our platform is the ideal source for downloading it.

Here’s a quick guide for you: Document compliance check. It is essential to carefully examine the form's content you wish to use and ensure it meets your requirements and adheres to your state law guidelines. Reviewing your document and checking its general description will assist you in this process.

- Obtaining your Colorado Disclosure Regarding Receivers from our collection is as simple as 1-2-3.

- Previously verified users with an active subscription only need to Log In and click the Download button after identifying the correct template.

- Later on, if desired, users can access the same document from the My documents section of their account.

- However, even if you are new to our service, registering for a valid subscription will require just a few minutes.

Form popularity

FAQ

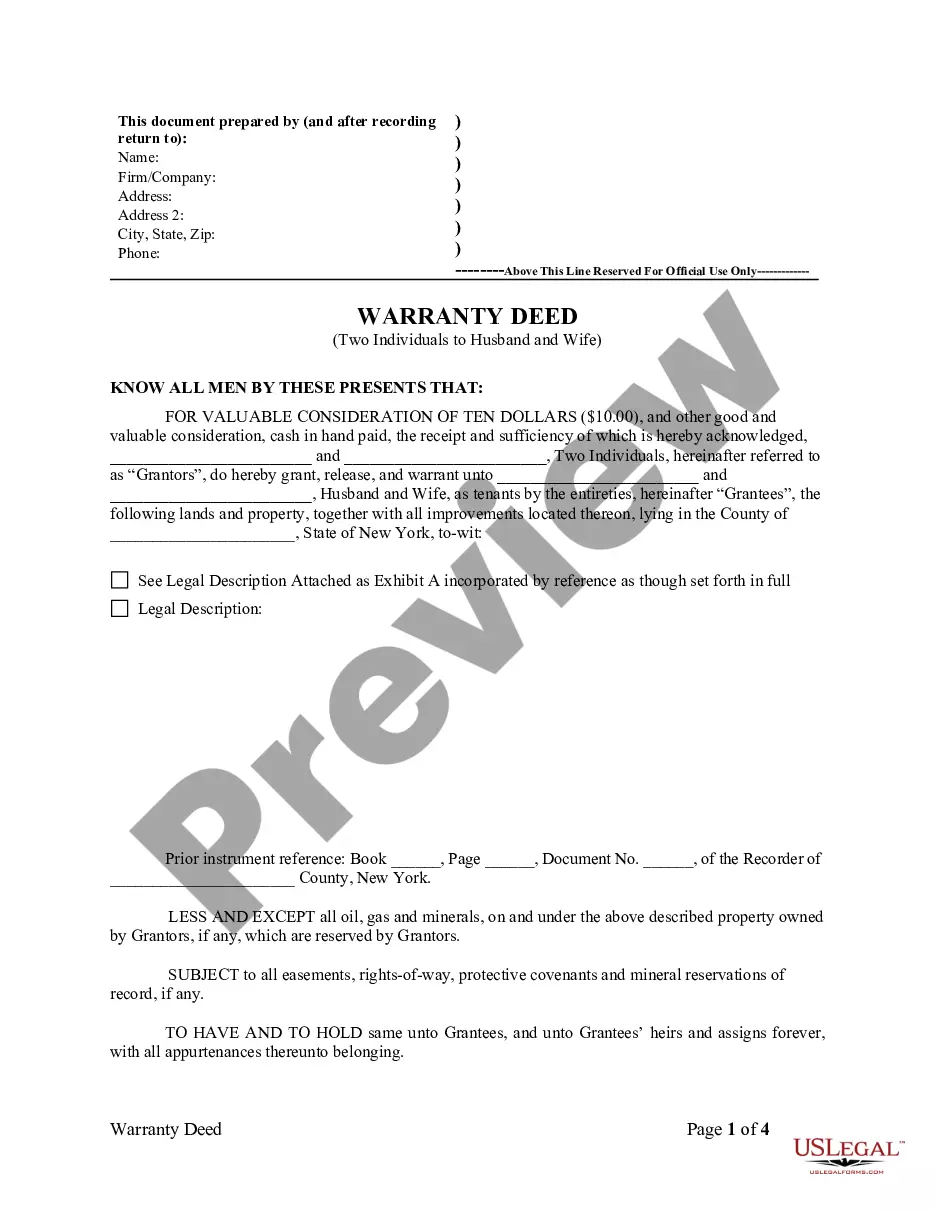

It is the seller's responsibility to fully disclose all items on the seller disclosure form, as well as any known material defects not included in that form. Sellers must provide complete and truthful information to protect themselves from potential legal issues down the line. In this context, the Colorado Disclosure Regarding Receivers plays a crucial role by ensuring sellers comply with the legal obligations while maintaining buyer trust. Doing so can prevent misunderstandings during the sale process.

The transfer disclosure statement is typically completed by the seller of the property. This document provides potential buyers with important information about the property’s condition and history. Sellers should take care to list all known defects and issues thoroughly. Utilizing the Colorado Disclosure Regarding Receivers can guide sellers in accurately filling out this statement to avoid future disputes.

When selling a house in Colorado, you must legally disclose any known material defects that could affect the property's value or the buyer's decision. This includes issues such as structural damage, plumbing problems, or any environmental hazards. Failing to disclose these details can lead to legal ramifications, highlighting the importance of the Colorado Disclosure Regarding Receivers. Thoroughly reviewing the property’s condition helps ensure compliance with these disclosure requirements.

The property disclosure form can be filled out by the seller, a real estate agent, or a representative acting on behalf of the seller. However, it is the seller's obligation to ensure that all information provided is truthful and comprehensive. They should be familiar with the property's history to disclose relevant details accurately. This adherence is vital to the Colorado Disclosure Regarding Receivers.

In Colorado, the seller is ultimately responsible for completing the seller's property disclosure form. This form is crucial in detailing the condition of the property and must be filled out accurately. While real estate agents can assist, it's essential that the seller provides honest and complete information. Proper completion of this form complies with the Colorado Disclosure Regarding Receivers and protects both the seller and the buyer.