New York Disclaimer of Warranties - Horse Equine Forms

Description

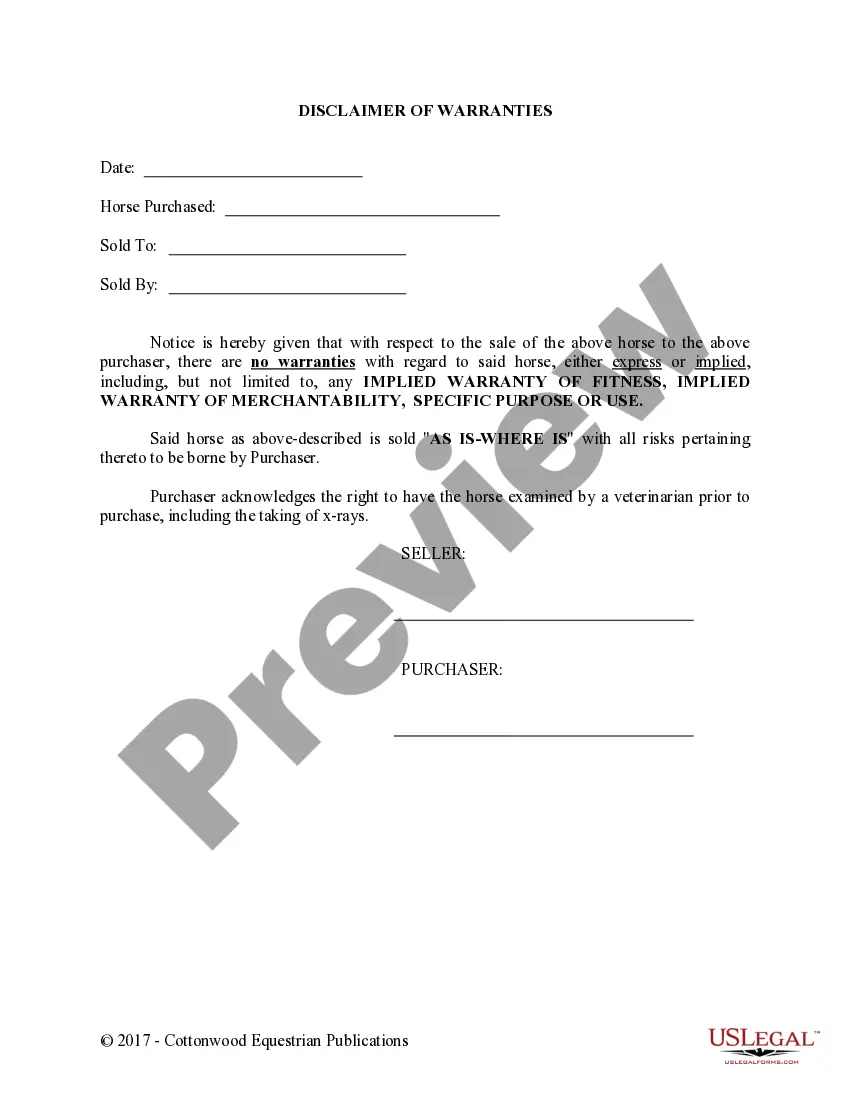

How to fill out New York Disclaimer Of Warranties - Horse Equine Forms?

US Legal Forms is a special platform where you can find any legal or tax form for submitting, including New York Disclaimer of Warranties - Horse Equine Forms. If you’re tired of wasting time seeking perfect samples and paying money on document preparation/attorney charges, then US Legal Forms is exactly what you’re trying to find.

To experience all of the service’s advantages, you don't have to install any software but simply choose a subscription plan and sign up your account. If you already have one, just log in and get a suitable template, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New York Disclaimer of Warranties - Horse Equine Forms, take a look at the guidelines listed below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to get to the sign up webpage.

- Select a pricing plan and carry on registering by entering some information.

- Select a payment method to complete the registration.

- Download the file by choosing the preferred file format (.docx or .pdf)

Now, submit the document online or print it. If you are uncertain about your New York Disclaimer of Warranties - Horse Equine Forms form, contact a attorney to analyze it before you send or file it. Get started without hassles!

Form popularity

FAQ

The California statute of limitations for breach of contract and breach of implied warranty is two years for oral agreements and four years for written ones.

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Service, repair, and maintenance services are subject to sales tax.Sales of service contracts in New York are considered to be sales of taxable repair and maintenance services. Businesses located in New York State that make sales of service contracts must be registered as New York State sales tax vendors.

Does tax apply when I make a warranty repair? Tax does not apply when a warranty repair includes only labor and does not require parts. However, tax may apply if you furnish parts.

Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

Coverage is provided for workmanship and materials on most components during the first year. For example, most warranties on new construction cover siding and stucco, doors and trim, and drywall and paint during the first year. Coverage for HVAC, plumbing, and electrical systems is generally two years.

Do you have to pay sales tax on an extended warranty? Yes. The sale at retail or use of maintenance, service and warranty contracts constitutes prepayment for services to tangible personal property and is subject to tax.

A one year warranty is the minimum you should expect. New York State law requires the buyer have certain warranties when buying a new home. One year's protection against faulty workmanship and defective materials.

AppleCare+ is a product as well as an implied service. Sales tax is applied if required by the state you live in if purchased online.