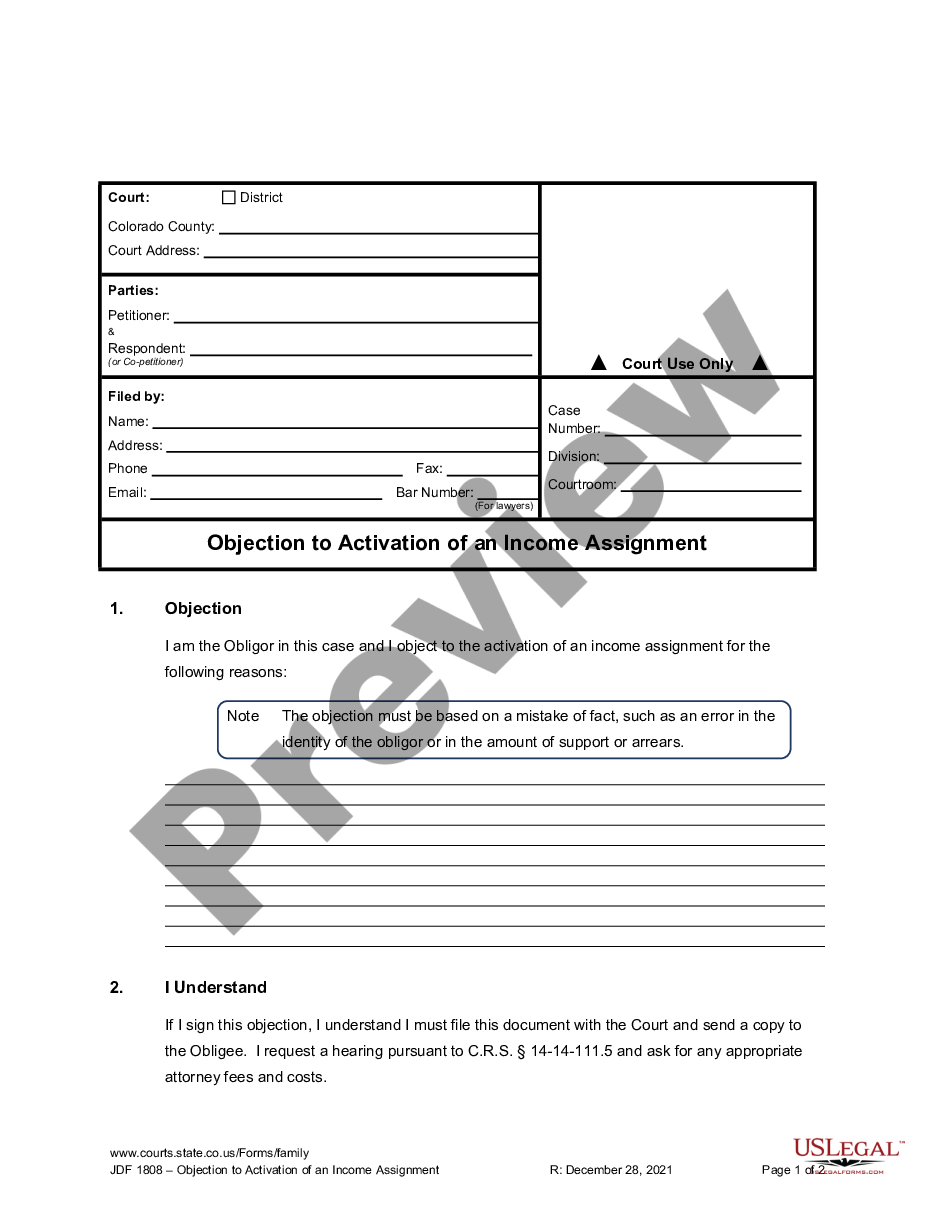

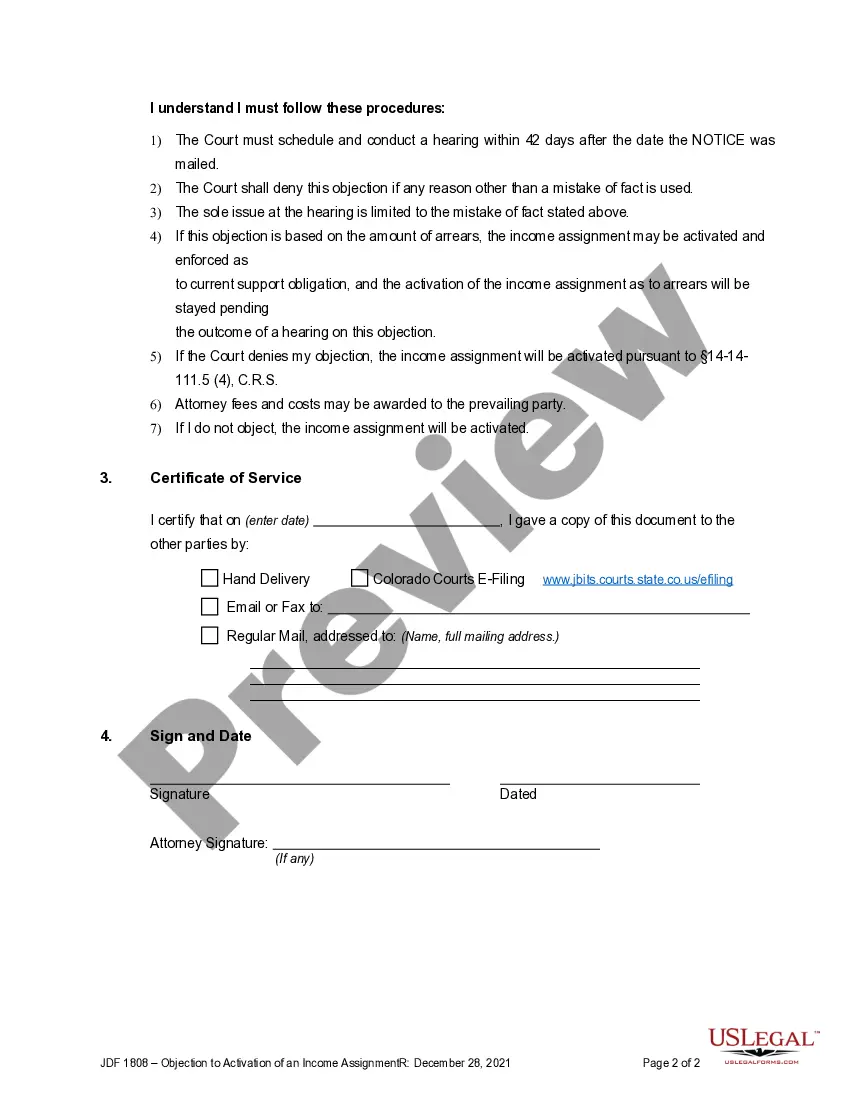

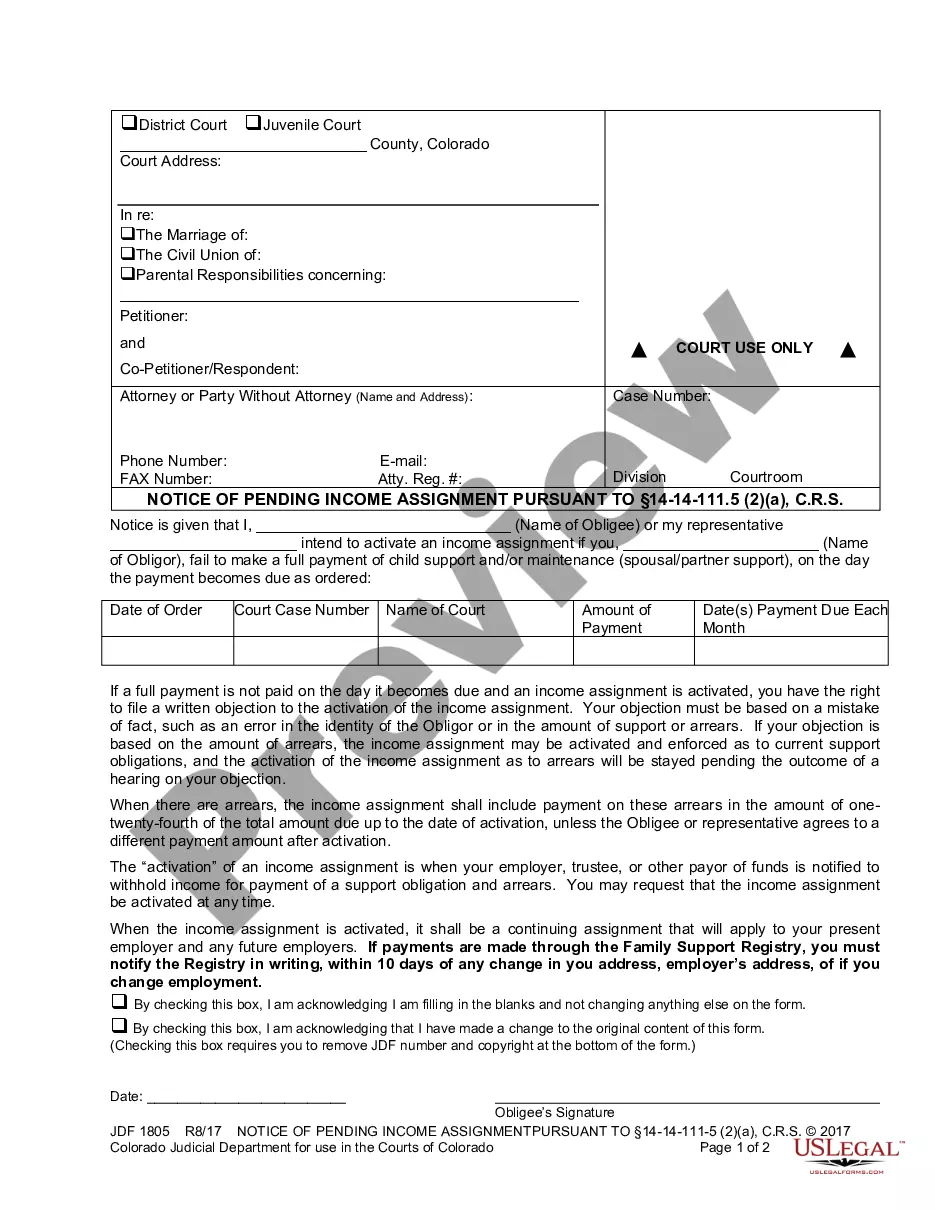

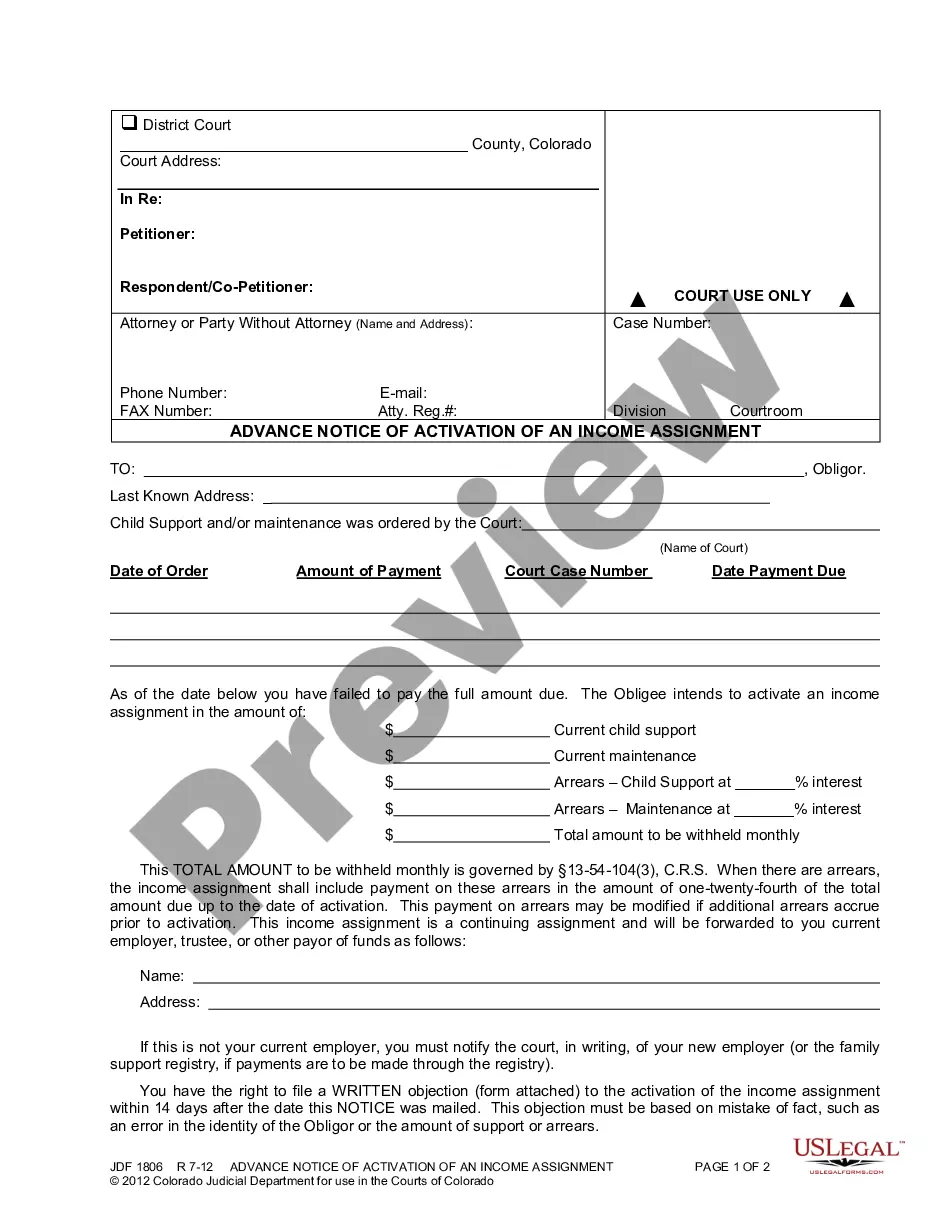

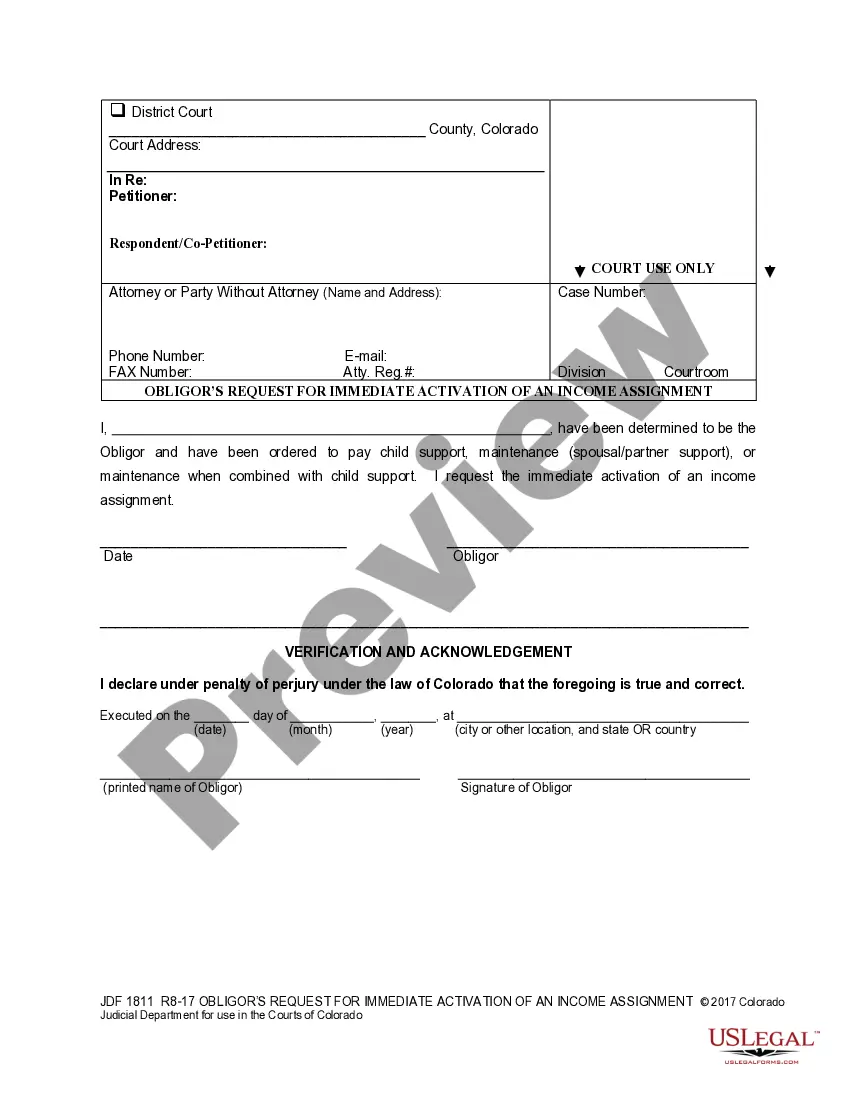

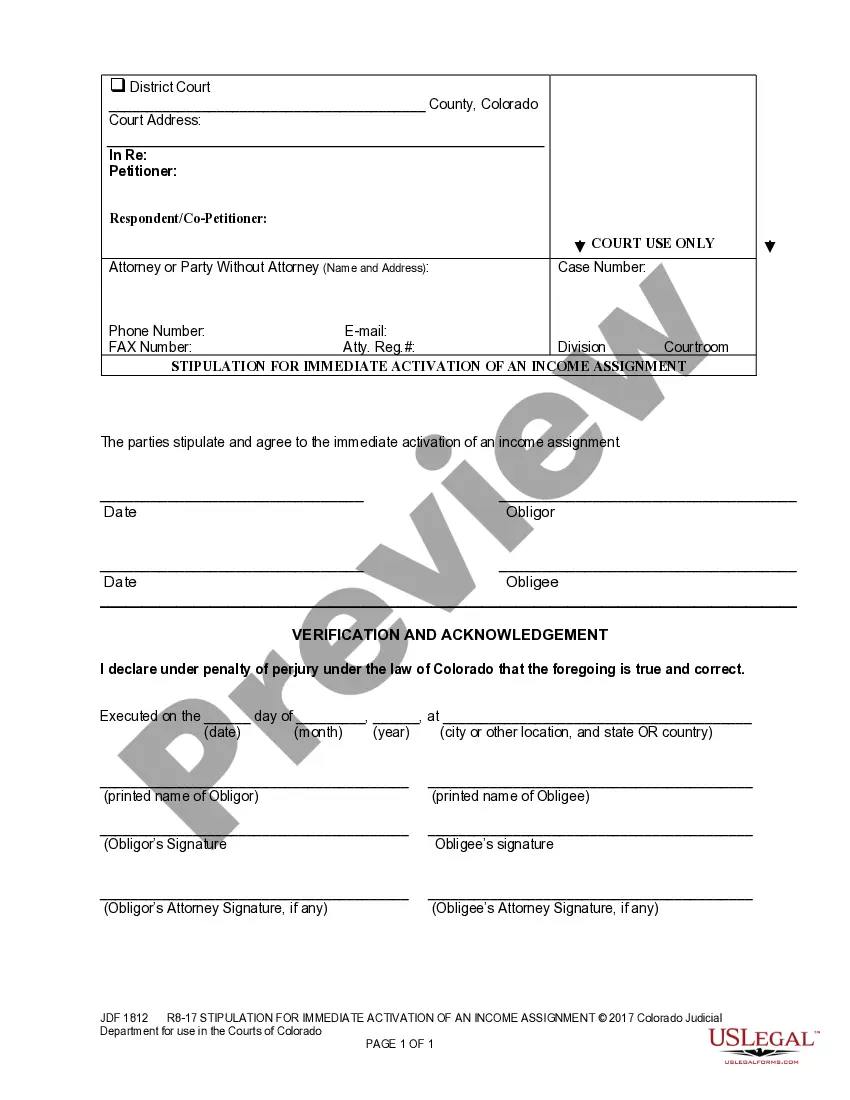

Colorado Objection to the Activation of an Income Assignment

Description

How to fill out Colorado Objection To The Activation Of An Income Assignment?

The larger amount of documentation you are required to prepare - the more anxious you feel.

You can find countless Colorado Objection to the Activation of an Income Assignment forms online, yet you are uncertain which to trust.

Eliminate the trouble and simplify finding samples with US Legal Forms. Obtain expertly crafted forms that comply with state requirements.

Enter the required information to set up your account and pay for the order using PayPal or a credit card. Select a convenient document format and receive your copy. Locate each document you download in the My documents section. Simply access it to fill out a new copy of the Colorado Objection to the Activation of an Income Assignment. Even with well-prepared templates, it is still essential to consider consulting your local attorney to double-check the completed sample to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you'll find the Download button on the Colorado Objection to the Activation of an Income Assignment’s page.

- If you haven't used our service before, complete the registration process by following these steps.

- Ensure the Colorado Objection to the Activation of an Income Assignment is acceptable in your residing state.

- Verify your selection by reviewing the description or by utilizing the Preview feature if available for the selected file.

- Click on Buy Now to start the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

In Colorado, income for child support calculations encompasses a variety of earnings. This can include salary, wages, bonuses, rental income, and self-employment earnings. Knowing what qualifies as income can help you prepare for discussions around support obligations, especially if you are contemplating a Colorado Objection to the Activation of an Income Assignment.

Yes, child support in Colorado is primarily based on the income of both parents. The amount can vary depending on the incomes reported, so accurate reporting is essential. If your financial situation changes or you believe the current amount isn't fair, you might need to consider a Colorado Objection to the Activation of an Income Assignment to address this matter.

For child support purposes in Colorado, various types of payments can count as income. This includes wages, bonuses, commissions, and certain government benefits. Understanding what counts as income is key, especially when preparing for situations like a Colorado Objection to the Activation of an Income Assignment. You want to ensure your financial situation is accurately represented.

Colorado law stipulates a maximum withholding limit for child support that is crucial for custodial parents. Generally, this amount cannot exceed 50% of an individual’s disposable income if they are supporting another spouse or child. This limit protects the non-custodial parent's ability to maintain a basic living standard. If you find yourself needing to challenge this, a Colorado Objection to the Activation of an Income Assignment may be an option.

In Colorado, child support calculations consider several key factors. These include the income of both parents, the number of overnight stays each parent has with the child, and any special needs the child may have. Additionally, adjustments may occur based on health insurance costs and childcare expenses. Understanding these elements is crucial, especially if you're considering a Colorado Objection to the Activation of an Income Assignment.

Cost elements are defined in the controlling module of SAP and are assigned to various objects such as cost centers, internal orders, etc. Basically, their function is to classify and analyze the cost for internal reporting purposes.

CO object is the cost element(GL account defined as a cost element). U need to assign cost element with cost centre in tcode OKP9. Check in the config whether cost centre is assigned to cost element or not.

Use transaction code: KA02: enter G/L account(Cost element) and in default acct assinmt TAB,assign the Cost Center and save.

Multiple account assignment allows you to apportion the cost of a material covered by a PO among your own cost center and several others, for example.The nature of the account assignment (cost center, sales order, and so on) Which accounts are to be charged when the incoming invoice or goods receipt is posted.

CO object is the cost element(GL account defined as a cost element). U need to assign cost element with cost centre in tcode OKP9. Check in the config whether cost centre is assigned to cost element or not.