Colorado Interrogatories to Judgment Debtor

Understanding this form

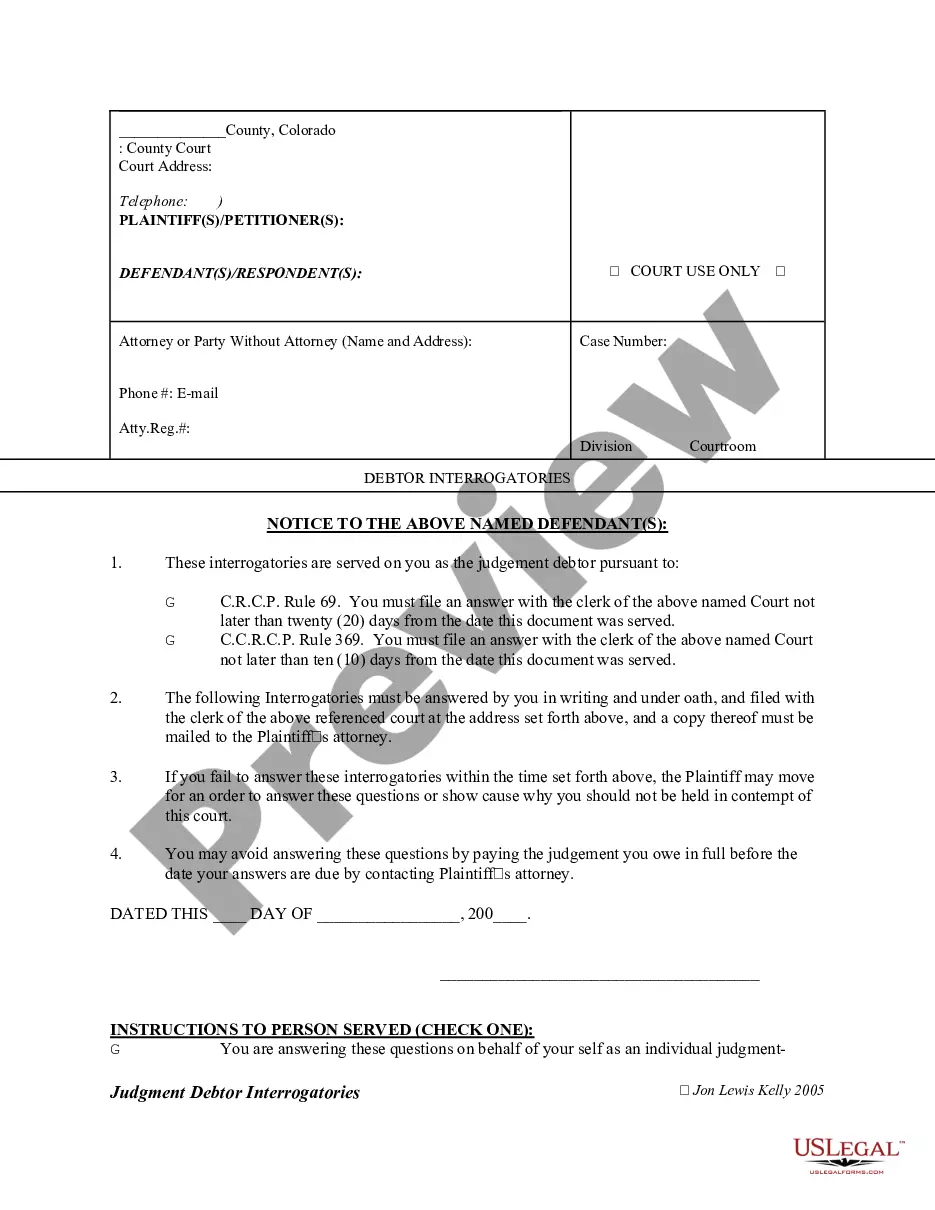

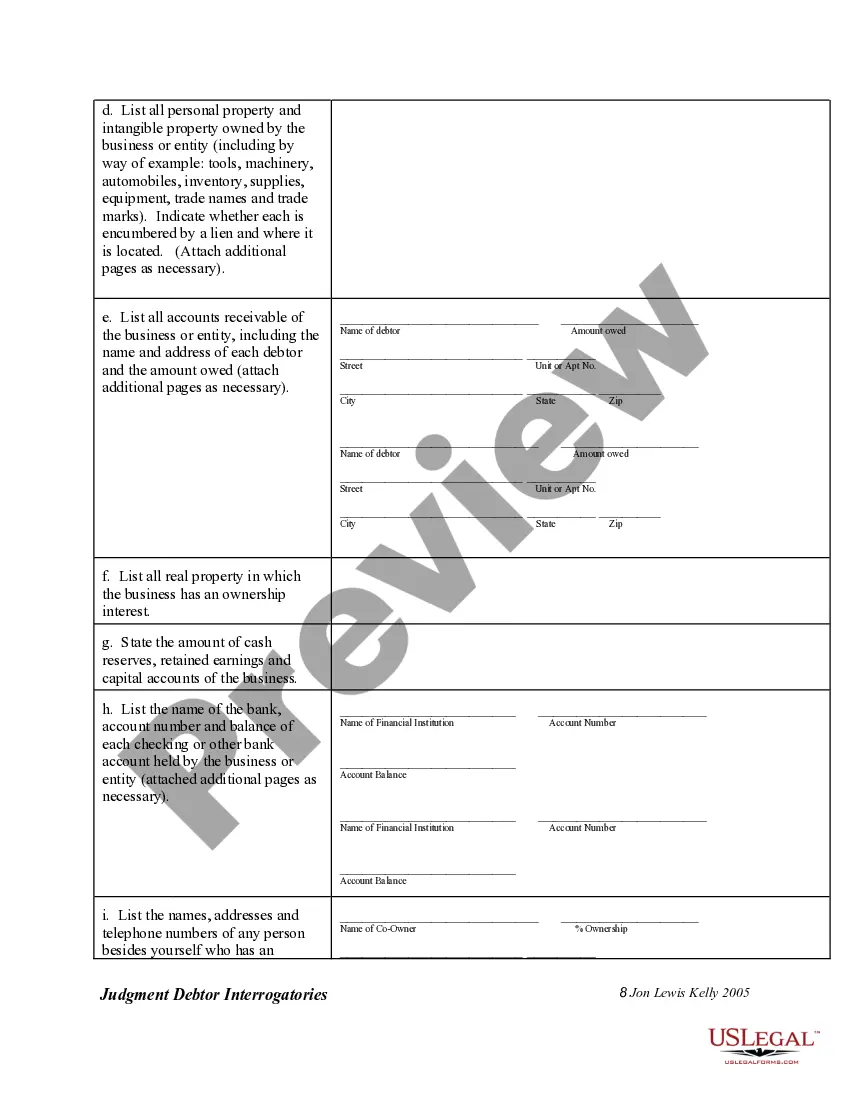

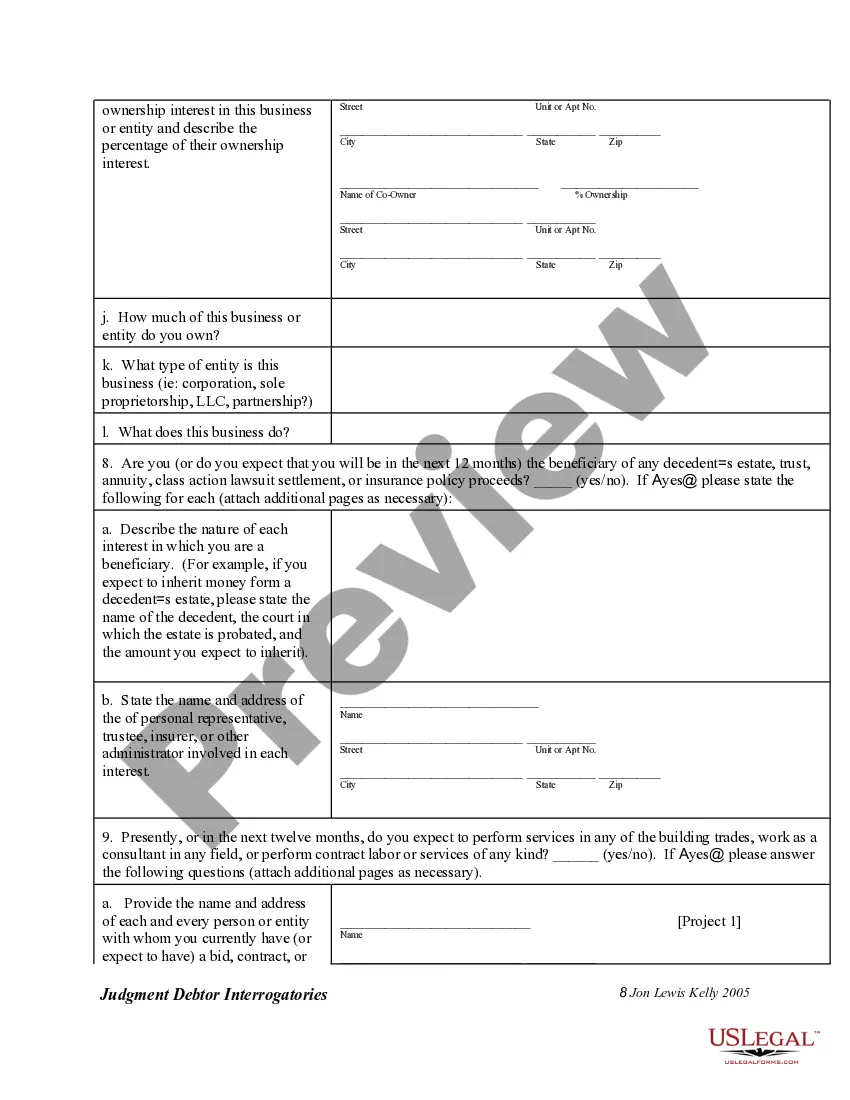

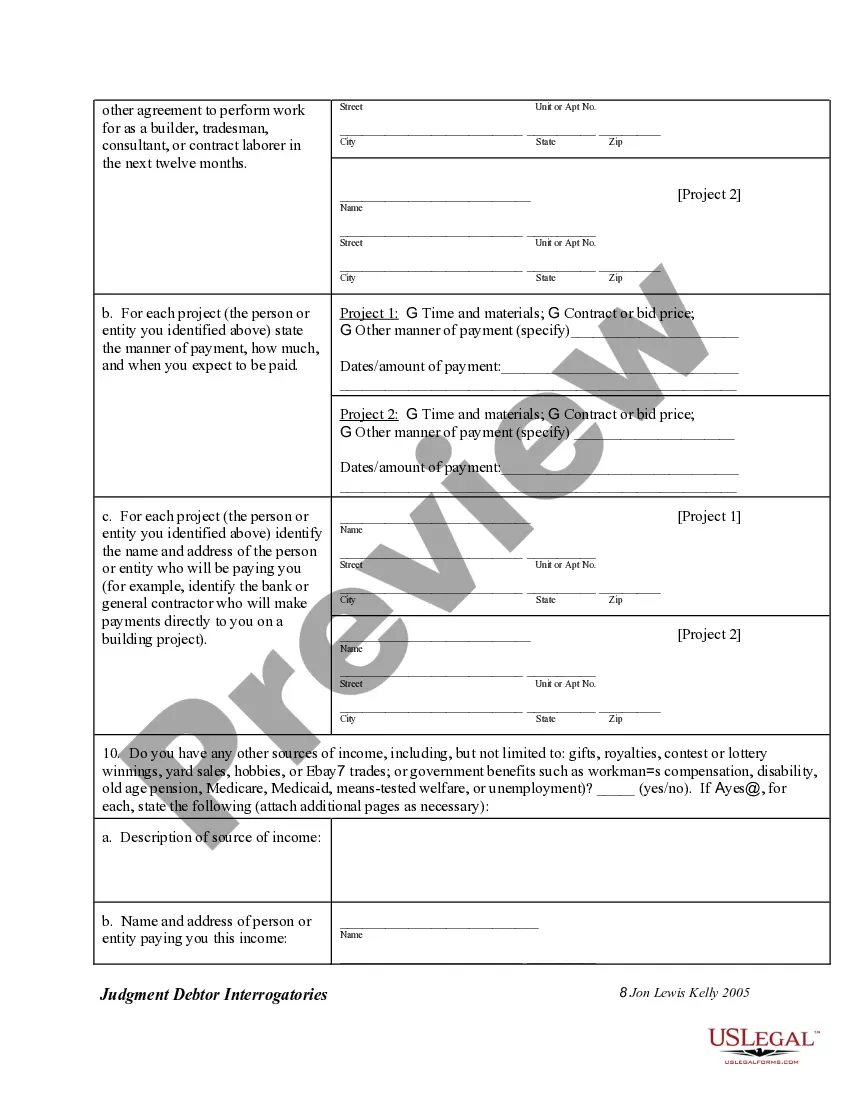

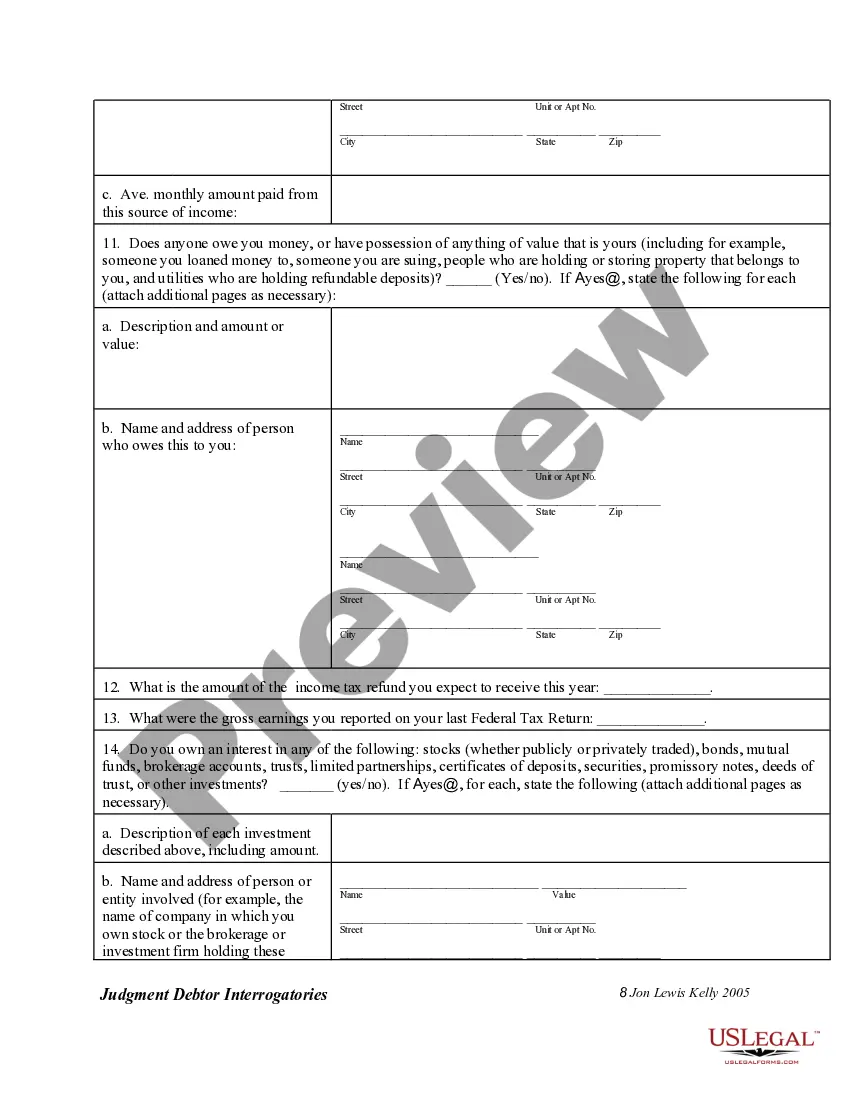

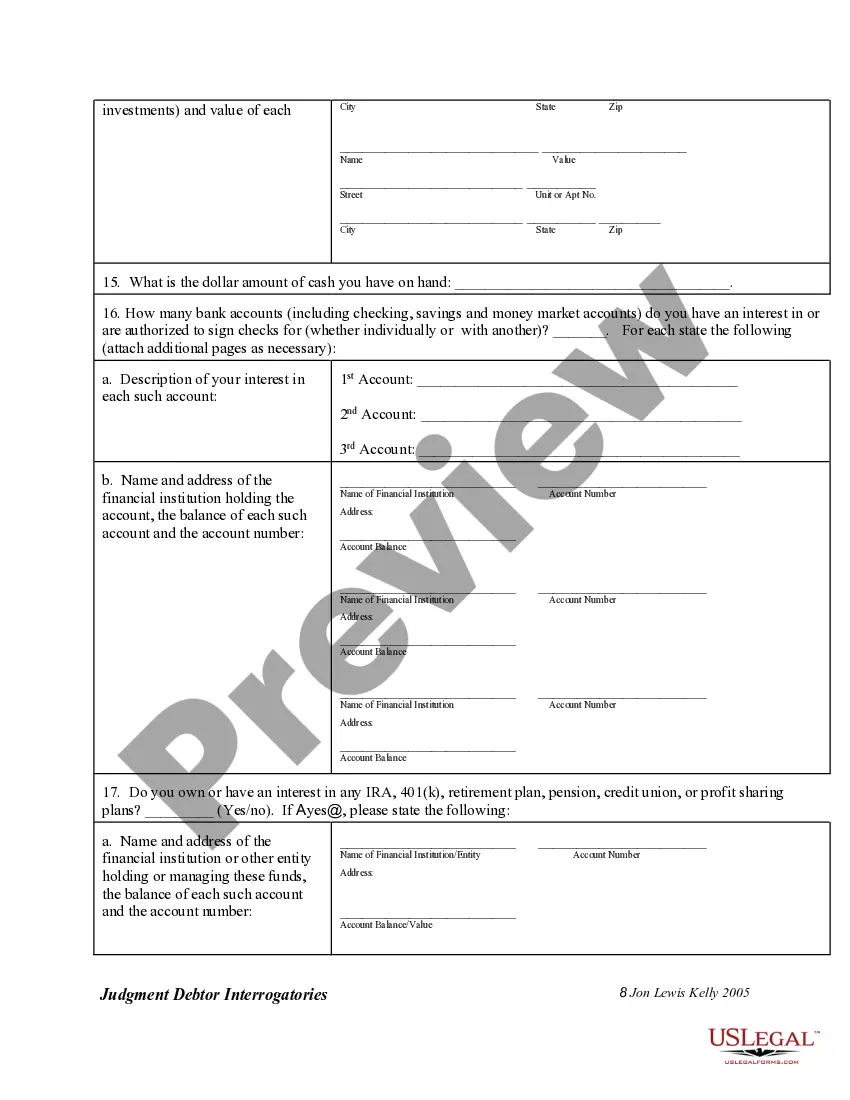

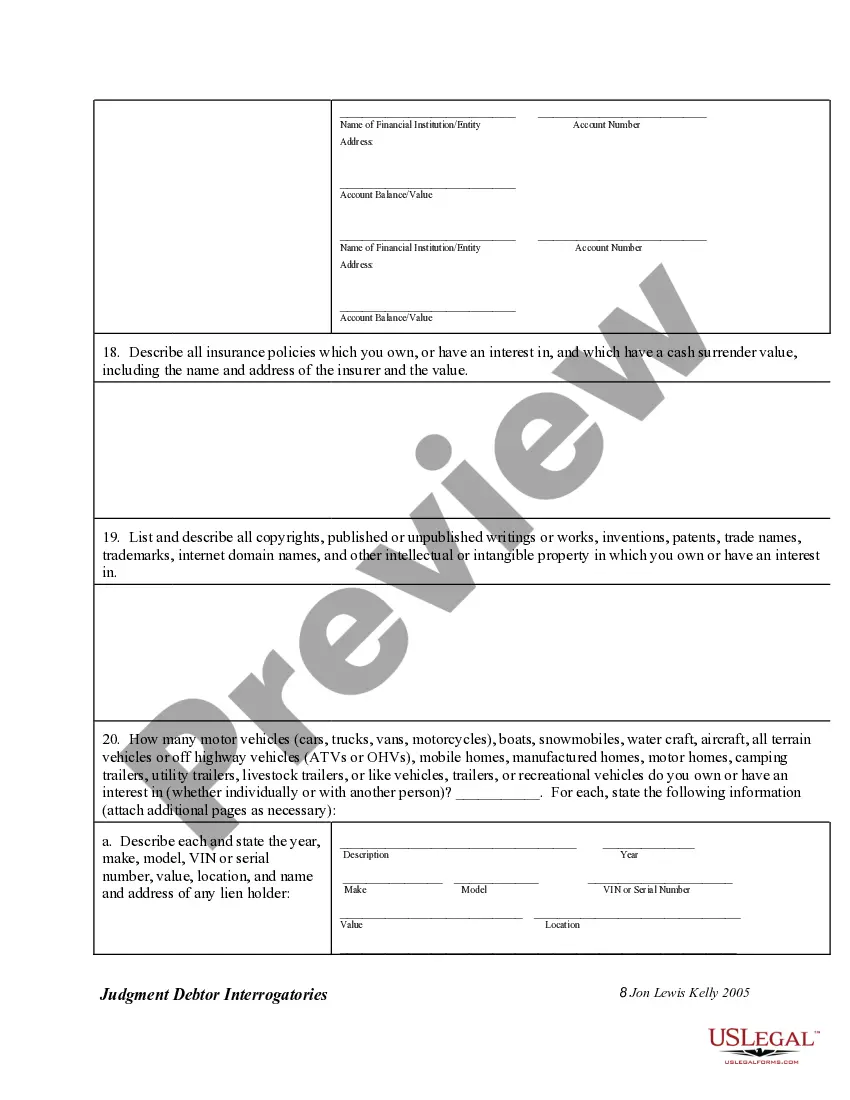

The Interrogatories to Judgment Debtor is a legal document used to collect information from a debtor regarding their financial status after a judgment has been issued against them. This form includes a series of questions designed to shed light on the debtor's assets, income, and financial obligations. It differs from other forms in that it is specifically tailored for the post-judgment stage, allowing creditors to understand the debtor's capacity to pay the owed amount.

Key components of this form

- Identification of the parties involved, including the debtor and creditor.

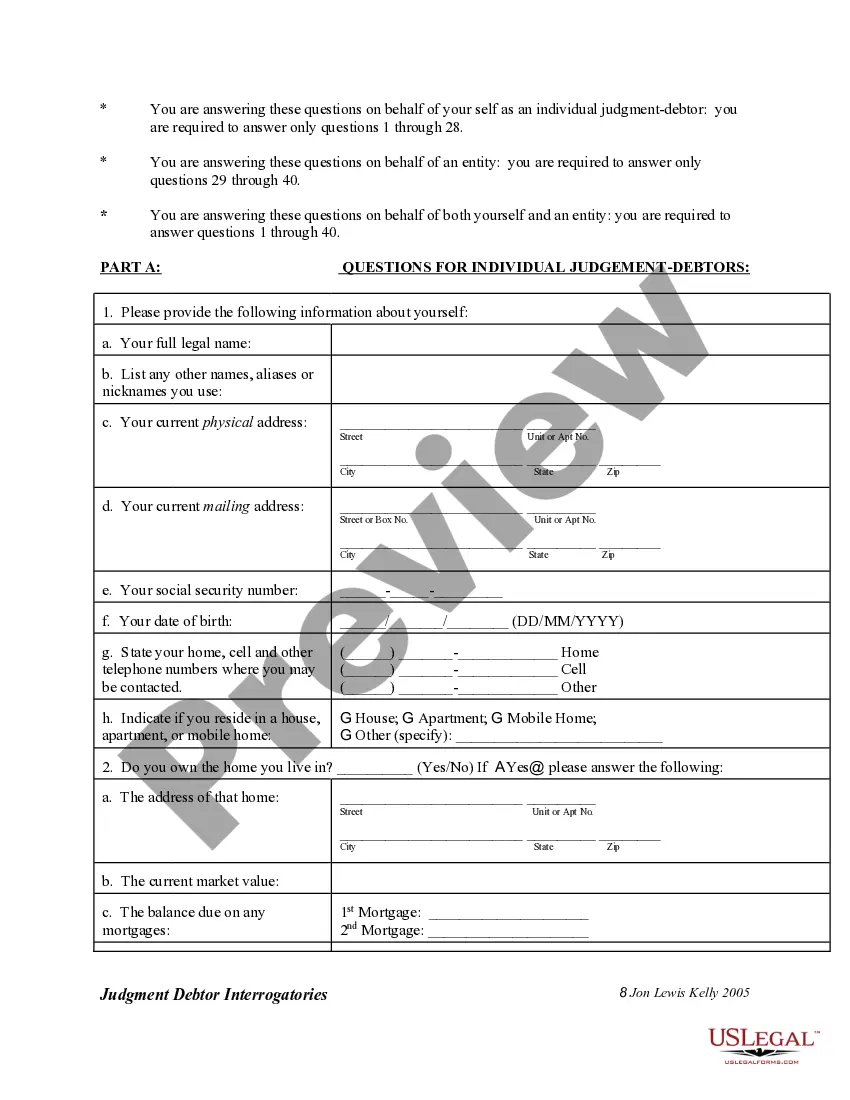

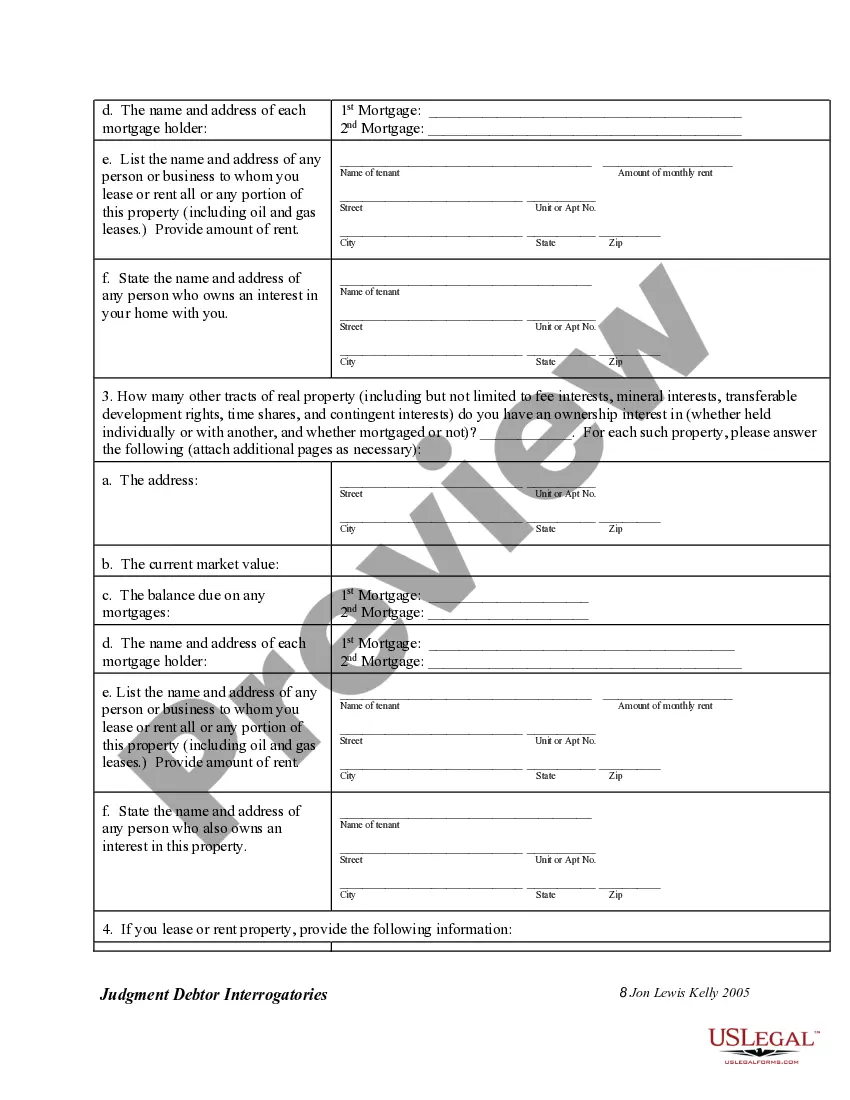

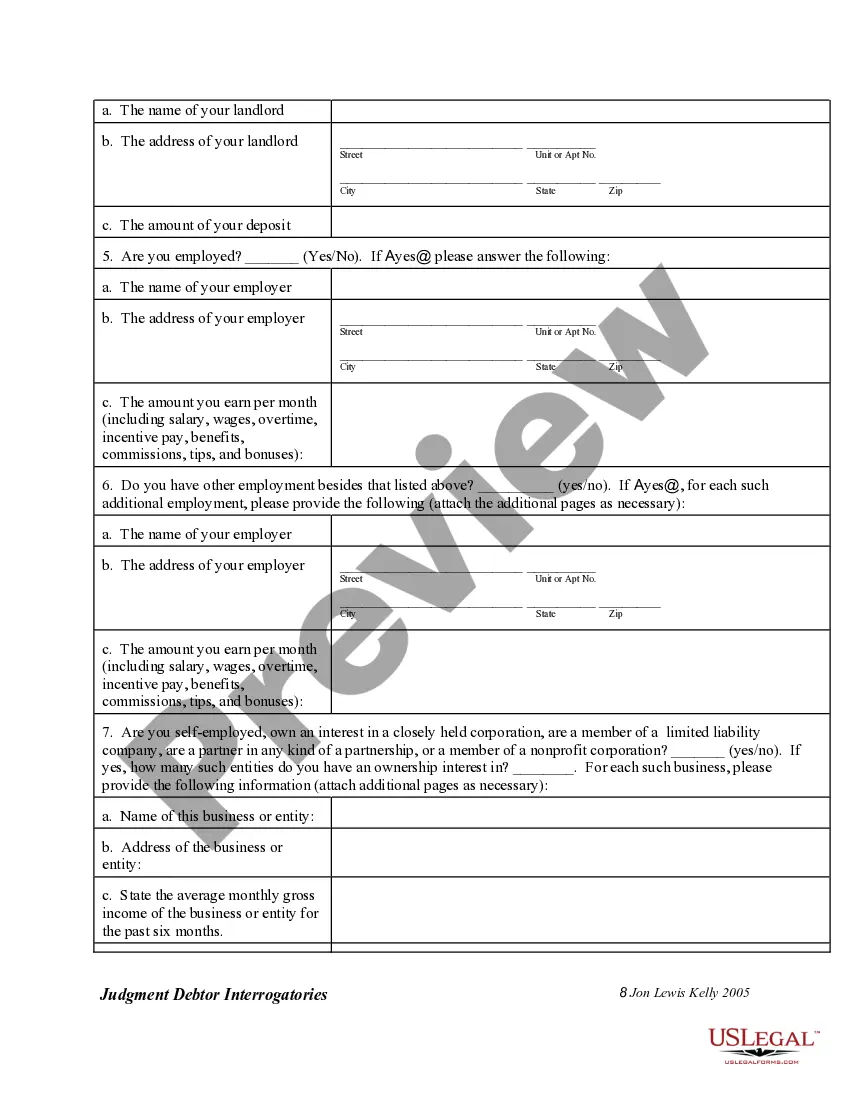

- A detailed list of questions about the debtor's income, assets, and financial obligations.

- Instructions regarding the timeframe for answering the interrogatories.

- Legal consequences for failing to respond adequately or timely.

- Specific requirements for individual versus business debtors.

Common use cases

This form should be used when a creditor has obtained a judgment against a debtor and seeks to gather financial information to facilitate the collection of the debt. It is particularly useful in cases where the debtor's ability to pay is uncertain or disputed, or when the creditor suspects that the debtor may be concealing assets.

Who needs this form

- Creditors who have secured a court judgment against a debtor.

- Lawyers representing creditors in collection actions.

- Any individual or business entity seeking to assess the financial standing of a judgment debtor.

Completing this form step by step

- Identify all parties involved by filling in the names and addresses of the plaintiff and defendant.

- Complete the interrogatories by providing truthful and comprehensive answers to each question concerning income, assets, and debts.

- Ensure the completed form is signed and notarized where applicable.

- File the form with the court clerk and send a copy to the plaintiff's attorney within the specified deadline.

- Keep a copy for your records to maintain a clear trail of documentation.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to respond within the required timeframe, which may lead to contempt of court.

- Providing incomplete or inaccurate information that could result in legal penalties.

- Not filing the form correctly with the court, leading to it being overlooked or rejected.

- Forgetting to notarize the document if required.

Why complete this form online

- Convenience of downloading and printing the form anytime from anywhere.

- Editability allows users to customize the form to their specific needs.

- Reliability as these forms are drafted by licensed attorneys to ensure legal compliance.

Summary of main points

- The Interrogatories to Judgment Debtor is crucial for creditors wanting to enforce judgments.

- Accurate and complete answers are vital to avoid legal repercussions.

- This form is specific to Colorado law and should be used accordingly.

- Timely responses and notarization are essential steps in the process.

Looking for another form?

Form popularity

FAQ

Failure to respond to discovery, including interrogatories, can lead to restrictions on evidence and information during trial proceedings. In Colorado Interrogatories to Judgment Debtor cases, such failures can disadvantage the non-compliant party. Courts may impose sanctions, which can escalate quickly. To avoid such complications, ensure you meet all discovery requirements and consider using resources from US Legal Forms to aid in compliance.

If someone does not respond to interrogatories, there may be severe repercussions. The court can impose fines or even issue default judgments against the non-responding party. In the context of Colorado Interrogatories to Judgment Debtor, this lack of response can significantly weaken your case and limit your options. It's crucial to adhere to the deadlines and respond appropriately.

Yes, you must respond to interrogatories. In Colorado, the law requires parties to answer interrogatories related to the case, including Colorado Interrogatories to Judgment Debtor. Responding not only helps you comply with legal obligations but also plays a crucial role in your ability to present your case effectively. Failure to respond may hurt your standing in court.

Ignoring interrogatories is not an option. In the context of Colorado Interrogatories to Judgment Debtor, failing to respond can have serious legal consequences. The court may impose penalties, and your case could be negatively affected. It's essential to address each interrogatory thoroughly and timely.

Yes, judgments in Colorado do have a time limit. Generally, a judgment expires after six years unless it is renewed. To maintain your ability to collect, consider using Colorado Interrogatories to Judgment Debtor periodically to gather updated information on the debtor's financial situation before the judgment expires.

In Colorado, interrogatories do not generally require notarization. However, it's important to follow the correct process outlined in the Colorado Rules of Civil Procedure to ensure they are valid. Utilizing Colorado Interrogatories to Judgment Debtor can simplify this process, as you ensure you collect necessary information without needing additional steps like notarization.

Enforcing a judgment in Colorado requires specific legal steps, beginning with locating the debtor’s assets. You have the option to use tools like wage garnishments, bank levies, or liens on property. Colorado Interrogatories to Judgment Debtor are essential because they help you uncover the information needed to effectively enforce the judgment and recover your funds.

In Colorado, creditors can seize certain types of personal property to satisfy a judgment. This includes bank accounts, vehicles, and personal belongings, but some items, like necessary clothing or tools for work, are protected. Understanding the specifics of seizable property is crucial, and Colorado Interrogatories to Judgment Debtor can aid in identifying what may be at risk.

Filing a judgment lien in Colorado involves several steps. First, you must ensure that you have a valid, enforceable judgment. Next, you file your judgment with the appropriate county clerk to create a lien on the debtor's real property. Utilizing Colorado Interrogatories to Judgment Debtor can help identify the debtor’s property, making the filing process more straightforward and effective.

Rule 369 G of the Colorado Rules of Civil Procedure governs the use of interrogatories in civil cases. This rule allows a creditor to ask a debtor about their assets and finances after a judgment is entered. By using Colorado Interrogatories to Judgment Debtor, creditors can gather information necessary to locate and claim the debtor’s property. Understanding this rule is essential for anyone looking to enforce a judgment.