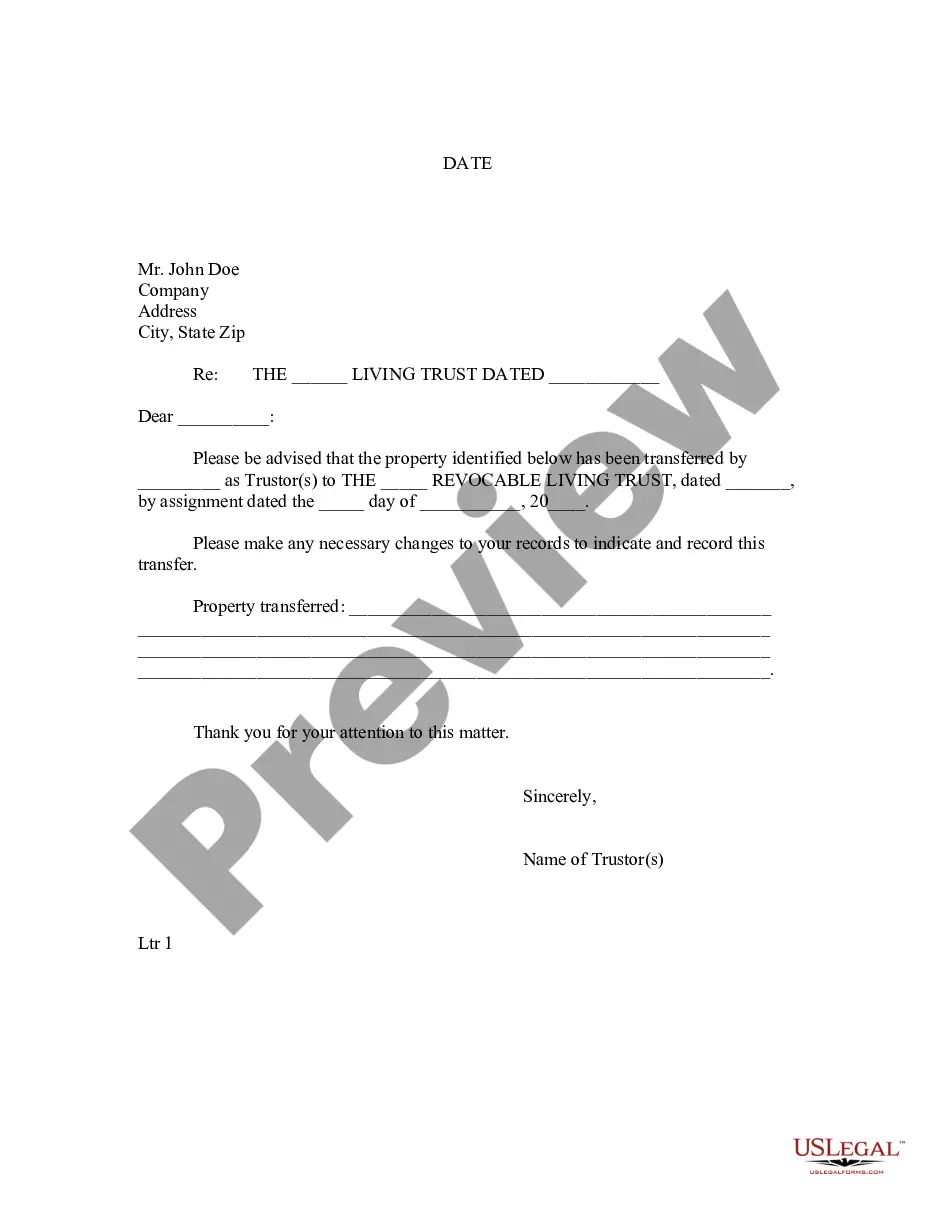

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

Colorado Letter to Lienholder to Notify of Trust

Description

How to fill out Colorado Letter To Lienholder To Notify Of Trust?

The greater the documentation you are required to produce - the more anxious you become.

You can find a vast array of Colorado Letter to Lienholder to Notify of Trust samples online, but you are unsure which ones to rely on.

Eliminate the stress and simplify the process of locating templates with US Legal Forms. Acquire expertly prepared documents that are designed to comply with state requirements.

Provide the requested information to create your account and pay for the order using PayPal or credit card. Choose a convenient document format and download your copy. Access all samples you download in the My documents section. Just go there to complete a new copy of the Colorado Letter to Lienholder to Notify of Trust. Even when using professionally prepared templates, it remains vital to consider consulting your local attorney to double-check the finished form to ensure that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you currently possess a US Legal Forms subscription, Log In to your account, and you will discover the Download button on the webpage for the Colorado Letter to Lienholder to Notify of Trust.

- If you have never utilized our service before, follow the registration process using these instructions.

- Ensure that the Colorado Letter to Lienholder to Notify of Trust is acceptable in your state.

- Verify your choice by reading the description or by utilizing the Preview option if available for the selected document.

- Simply click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

Transferring assets into a trust involves several steps, starting with identifying the assets you wish to include. For each asset, you may need to complete specific documentation, like a title transfer for real estate or changing the names on financial accounts. Using a Colorado Letter to Lienholder to Notify of Trust can be helpful in cases where there are existing loans. By communicating these changes, you ensure that all parties are properly informed and that your trust operates smoothly.

To transfer property into a trust in Colorado, start by drafting the appropriate documents, including a deed that reflects the change of ownership. You will then need to sign and record this deed with your local county office. If applicable, send a Colorado Letter to Lienholder to Notify of Trust to inform any lienholders about the transfer. This process ensures that your property is legally recognized as part of the trust.

While placing property in a trust can offer benefits, there are disadvantages to consider. Transferring property may involve upfront costs, and the process can require ongoing maintenance and management. Additionally, you need to inform lienholders using a Colorado Letter to Lienholder to Notify of Trust, which may complicate matters if there are existing loans. Understanding these factors can help you make an informed decision.

To transfer property into a trust in Colorado, you typically need to prepare a deed that designates the trust as the new owner. It's essential to ensure the deed is properly signed and recorded with the county clerk's office. Additionally, using a Colorado Letter to Lienholder to Notify of Trust may help inform any lienholders about the change in ownership. This step ensures clarity and protects your interests as trust beneficiaries.

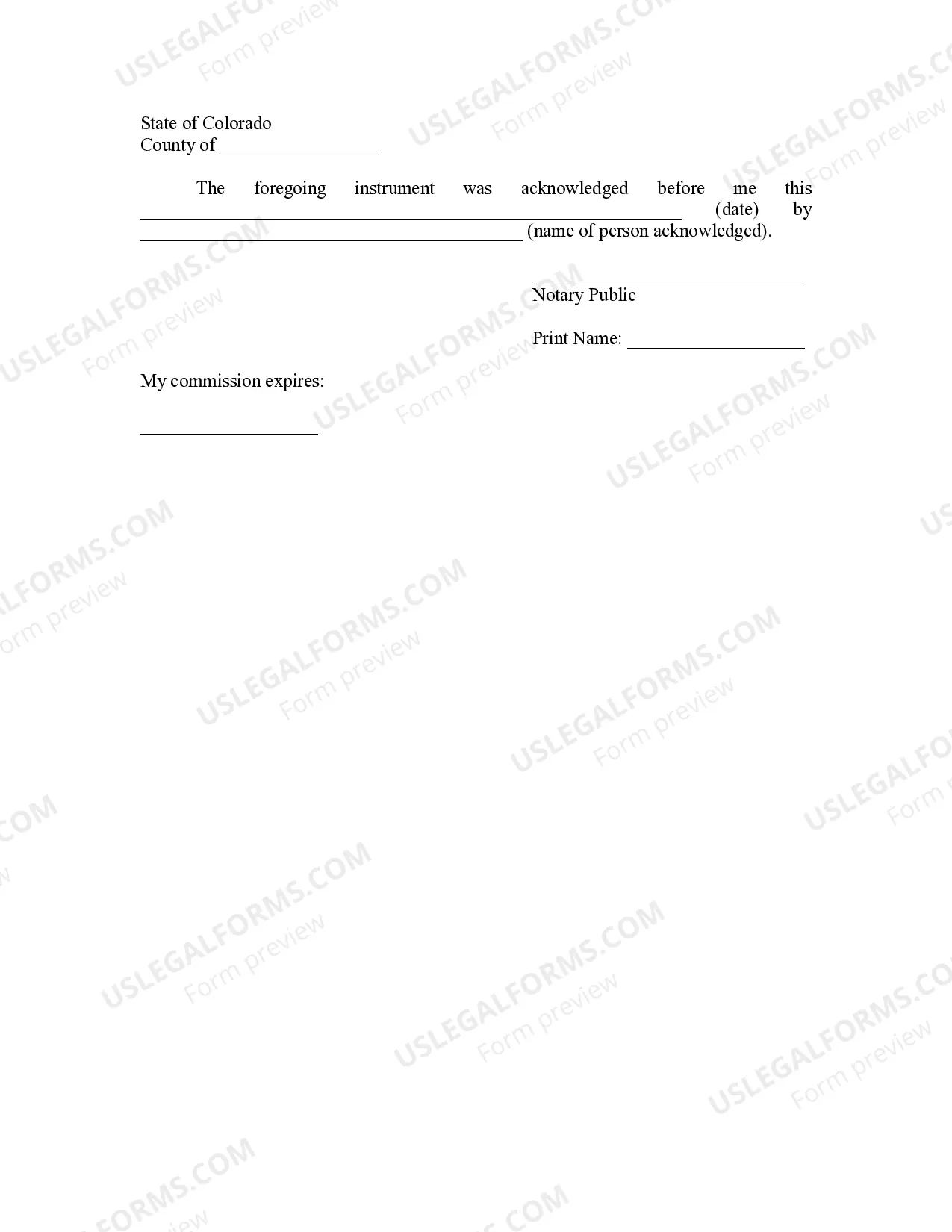

To release a deed of trust, the lender must prepare a release document once the borrower has satisfied their debt. This document is then signed and filed with the county recorder’s office. You can simplify this process by using a Colorado Letter to Lienholder to Notify of Trust to inform all parties that the underlying obligation has been cleared.

A release of Deed of Trust in Weld County, Colorado, serves as a legal statement confirming that a lien on a property has been removed. This document indicates that the borrower has fulfilled their obligations, which eliminates the lender’s claim on the property. For added efficiency, you may choose to create a Colorado Letter to Lienholder to Notify of Trust as part of this process.

Releasing a trust involves several steps, starting with determining the trust's terms and conditions. Next, you should inform all relevant parties, such as beneficiaries and the trustee, about your intention to release the trust. Finally, you may need to file a Colorado Letter to Lienholder to Notify of Trust with the appropriate authorities to ensure legal clarity.

In Colorado, the Deed of Trust is typically held by the lender or a third-party trustee. The lender may be a bank, credit union, or private lender, while the trustee acts on behalf of the lender to enforce the terms of the deed. It is essential to understand who holds your Deed of Trust, as this can impact your financing options. If you have any concerns, contacting your trustee through a Colorado Letter to Lienholder to Notify of Trust can provide you clarity.

Releasing a deed of trust in Colorado involves obtaining a signed Release of Deed of Trust form from your lender. After signing, file this document with the County Clerk and Recorder’s office to officially clear the lien from public records. Make sure to keep copies of all documents for your records. Using a structured approach, like a Colorado Letter to Lienholder to Notify of Trust, can ease misunderstandings during this process.

Filing a notice of intent to lien in Colorado involves preparing a notice that outlines your intent to file a lien for unpaid debts. This notice must be delivered to the property owner and must include specific information about the debt. After notifying the property owner, you can officially file the notice with the county where the property is located. Utilizing a Colorado Letter to Lienholder to Notify of Trust can help in this notification process.