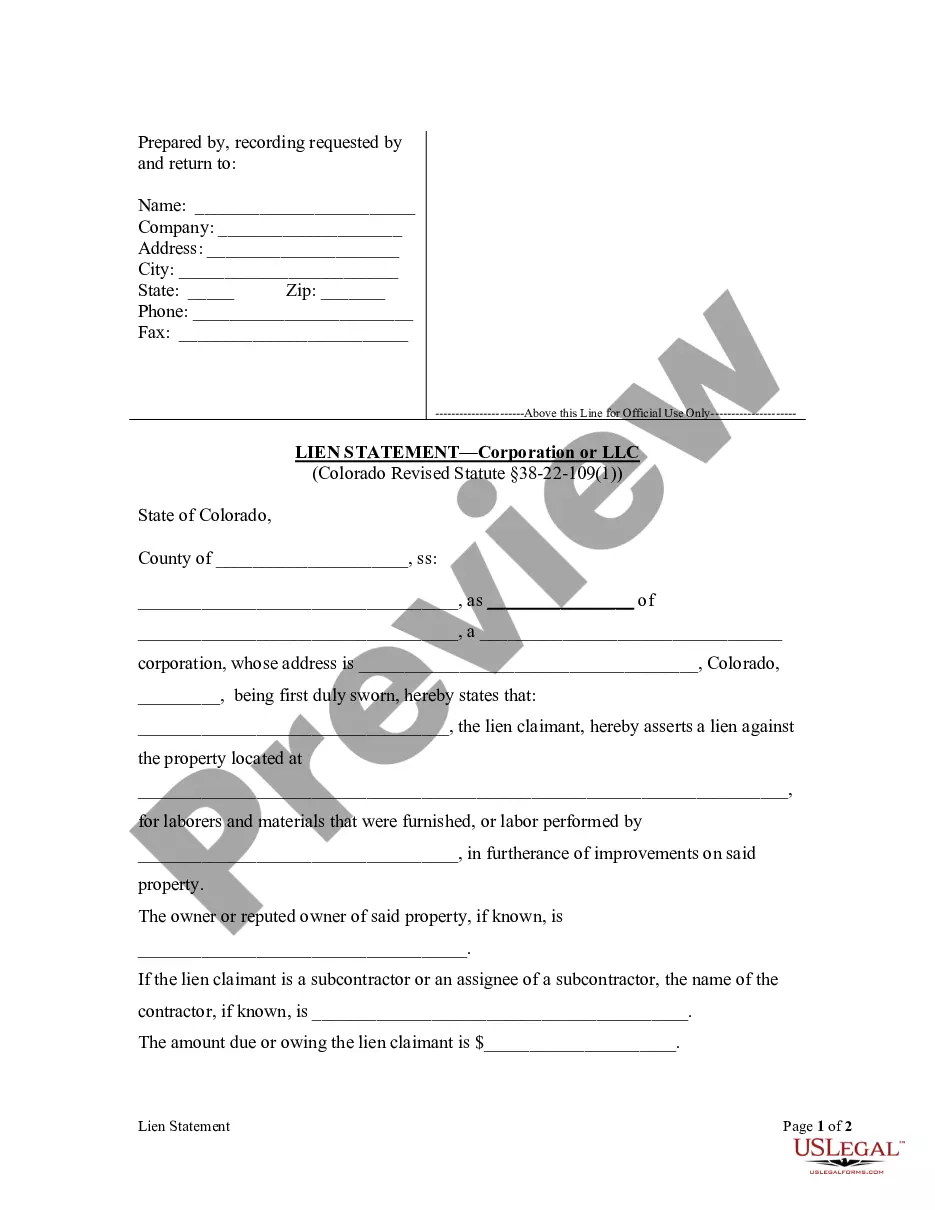

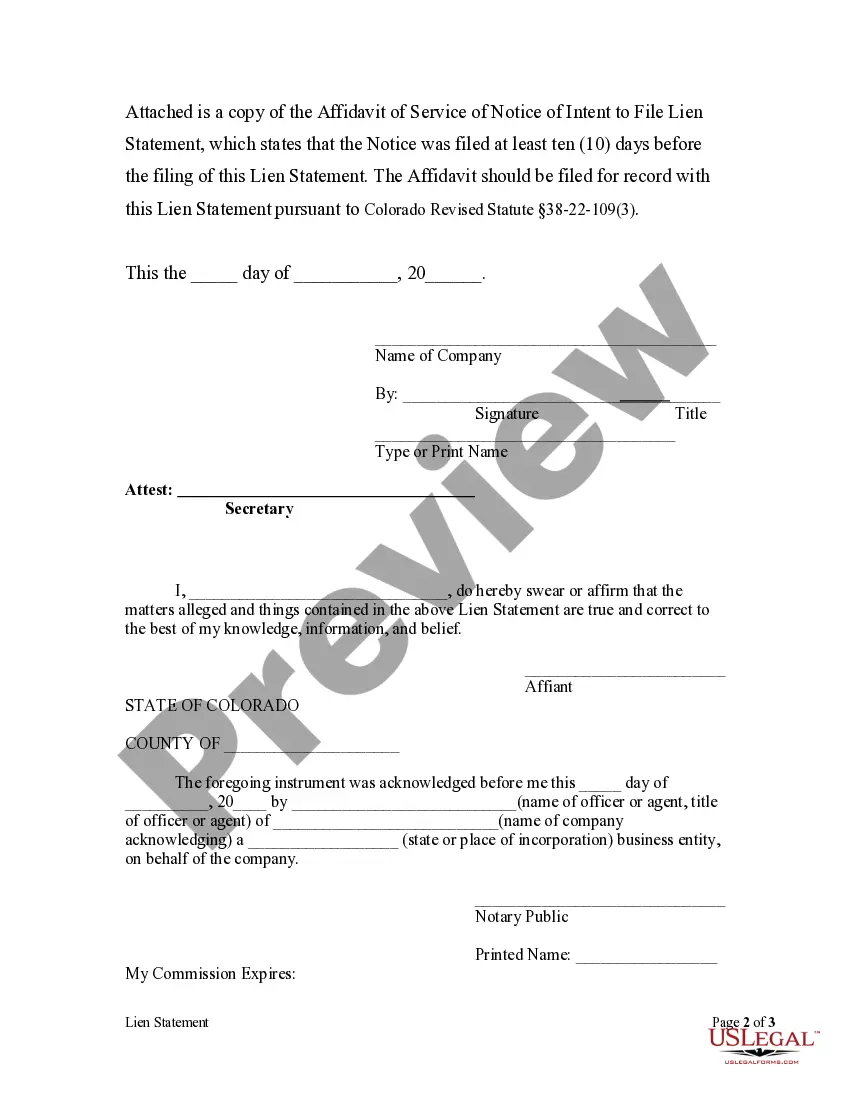

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Colorado Lien Statement by Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Lien Statement By Corporation?

If you're searching for accurate Colorado Lien Statement by Corporation or LLC duplicates, US Legal Forms is what you require; find documents crafted and reviewed by state-authorized attorneys.

Utilizing US Legal Forms not only spares you from worries about legal documentation; additionally, you save effort, time, and money! Acquiring, printing, and completing a professional form is significantly more economical than hiring an attorney to do it for you.

And that’s it! Within a few simple clicks, you possess an editable Colorado Lien Statement by Corporation or LLC. Once you set up an account, all future purchases will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button found on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Do not waste your time and energy comparing numerous forms on different websites. Purchase professional documents from a single secure service!

- To initiate, finish your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and find the Colorado Lien Statement by Corporation or LLC template to meet your needs.

- Use the Preview option or examine the document description (if available) to confirm that the form is what you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay with your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

In Colorado, the priority of liens is typically determined by the order in which they are recorded. A Colorado Lien Statement by Corporation filed first usually holds priority over later filed liens. This prioritization is crucial because it affects your ability to recover payment if the property goes into foreclosure. Understanding lien priority can significantly influence your contracting decisions.

Yes, Colorado has specific lien laws designed to protect contractors and suppliers. These laws allow you to file a Colorado Lien Statement by Corporation if payment is not received for work completed. Knowing these laws can save your business from significant losses and enhance your ability to collect owed payments. Consider consulting resources that clarify these laws for better compliance.

Colorado lien laws govern how and when a lien can be filed against a property. Generally, these laws provide the framework for filing a Colorado Lien Statement by Corporation to secure payment for construction-related services. It is crucial to adhere to these regulations to ensure that your claim is legitimate and enforceable. Familiarity with these laws can help you navigate potential disputes with property owners.

Yes, Colorado is a pre-liens state. This means that contractors and suppliers must provide a Colorado Lien Statement by Corporation to secure their right to file a lien. By submitting this statement, they notify property owners of their right to claim payment for services rendered. Understanding this process is essential to protect your business interests in Colorado.

Filling out a lien affidavit in Colorado involves gathering necessary details such as the property identification, the lienholder's information, and specifics of the debt. When completing the Colorado Lien Statement by Corporation, ensure all information is accurate and legible. If you need further assistance, resources like US Legal Forms offer templates to simplify this process.

If you've lost your title complete notice in Colorado, you should request a replacement from the relevant department, as this document is crucial for any lien or ownership claims. Along with the replacement, utilizing a Colorado Lien Statement by Corporation can help clarify any outstanding issues. Be sure to contact your local DMV or county office for specific procedures.

To secure a lien release in Colorado, you'll need the original lien documentation and a completed Colorado Lien Statement by Corporation. It's also beneficial to have proof that the debt has been settled or the agreement fulfilled. Submitting these documents to the county clerk will finalize the release.

In Colorado, lien waivers do not always need to be notarized but having them notarized can provide extra legal protection. This adds a layer of authenticity to your Colorado Lien Statement by Corporation. Always check with legal guidelines or consult a professional to ensure compliance.

To get a lien release in Colorado, you must request the release document from the lienholder who filed the lien. They will usually provide you with a Colorado Lien Statement by Corporation to complete and file. Once submitted, this document will serve to clear your obligations concerning the lien.

To remove a lien in Colorado, you typically need to obtain a lien release from the lienholder. Once you have the Colorado Lien Statement by Corporation, ensure it's filled out correctly, and then file it with the appropriate county office. This action will officially remove the lien from your records.