California Release For Surface Damages For Pipeline Right of Way / Easement

Description

How to fill out Release For Surface Damages For Pipeline Right Of Way / Easement?

If you want to complete, download, or printing legal document layouts, use US Legal Forms, the greatest selection of legal types, that can be found on the web. Use the site`s easy and hassle-free research to discover the documents you require. Various layouts for organization and person purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to discover the California Release For Surface Damages For Pipeline Right of Way / Easement in a couple of click throughs.

If you are presently a US Legal Forms customer, log in for your account and click the Down load option to find the California Release For Surface Damages For Pipeline Right of Way / Easement. You can also access types you in the past delivered electronically inside the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the appropriate metropolis/country.

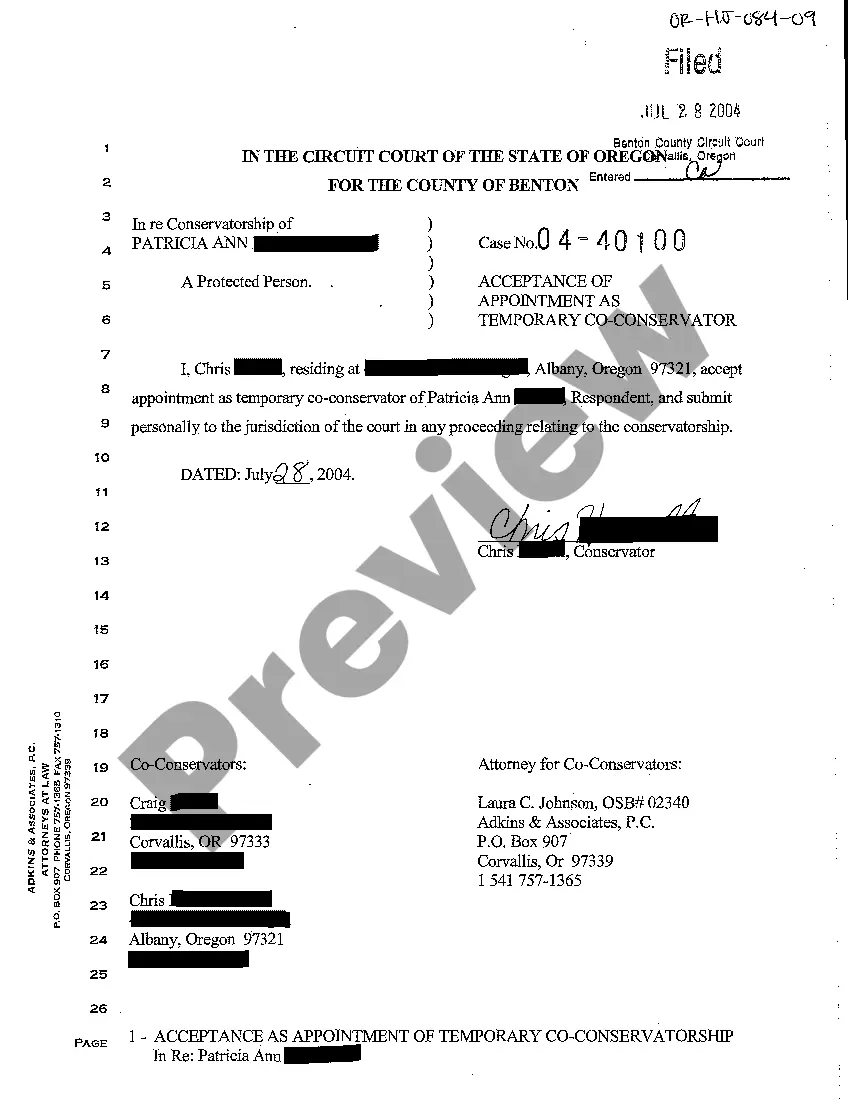

- Step 2. Use the Preview option to check out the form`s articles. Don`t forget about to read through the description.

- Step 3. If you are not satisfied together with the kind, use the Research discipline near the top of the display screen to get other types in the legal kind template.

- Step 4. When you have identified the shape you require, click on the Buy now option. Opt for the prices plan you choose and add your references to register to have an account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the file format in the legal kind and download it on your own product.

- Step 7. Complete, modify and printing or sign the California Release For Surface Damages For Pipeline Right of Way / Easement.

Every single legal document template you purchase is your own property eternally. You may have acces to each and every kind you delivered electronically in your acccount. Select the My Forms segment and pick a kind to printing or download once again.

Contend and download, and printing the California Release For Surface Damages For Pipeline Right of Way / Easement with US Legal Forms. There are many skilled and status-distinct types you can use for your personal organization or person requires.

Form popularity

FAQ

Federal Capital Gain Taxes ing to the IRS, land is considered a capital asset. Generally, when you sell your land for more than you paid for it, you will end up with a capital gain. If you sell your land for less than you originally bought it, you will have a capital loss.

Payments for anticipated surface damages (as opposed to payments for loss of surface use) are taxable as ordinary rental income. Easement/right-of-way payments: The tax treatment of these payments can vary depending on the nature of the easement.

In general, only the transfer of a perpetual easement is treated as a sale of property and eligible for capital gain or loss treatment. Grants or sales of limited easements are usually not treated as taxable sales of property.

Generally, an easement is a legal interest that allows someone the right to use another's property for a certain purpose. A pipeline easement specifically gives the easement holder the right to build and maintain a pipeline on a landowner's property. Landowner Resources for Pipeline Easements and Rights-of-Way chescoplanning.org ? pic ? pdf ? Landowne... chescoplanning.org ? pic ? pdf ? Landowne...

An easement is considered a capital asset, and so when it is sold, it is treated as a capital gain to the extent that the proceeds exceed the basis in the property. Tax Implications of Selling an Agricultural Conservation Easement ingham.org ? Portals ? Farmland ? Tax_Implic... ingham.org ? Portals ? Farmland ? Tax_Implic...

term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The longterm capital gains tax rate is 0%, 15% or 20%, depending on your taxable income and filing status. Longterm capital gains tax rates are generally lower than shortterm capital gains tax rates.