"Instructions for Completing Mortgage Deed of Trust Form" is a American Lawyer Media form. The following form is for instructions for completing mortgage deed of trust.

California Instructions for Completing Mortgage Deed of Trust Form

Description

How to fill out Instructions For Completing Mortgage Deed Of Trust Form?

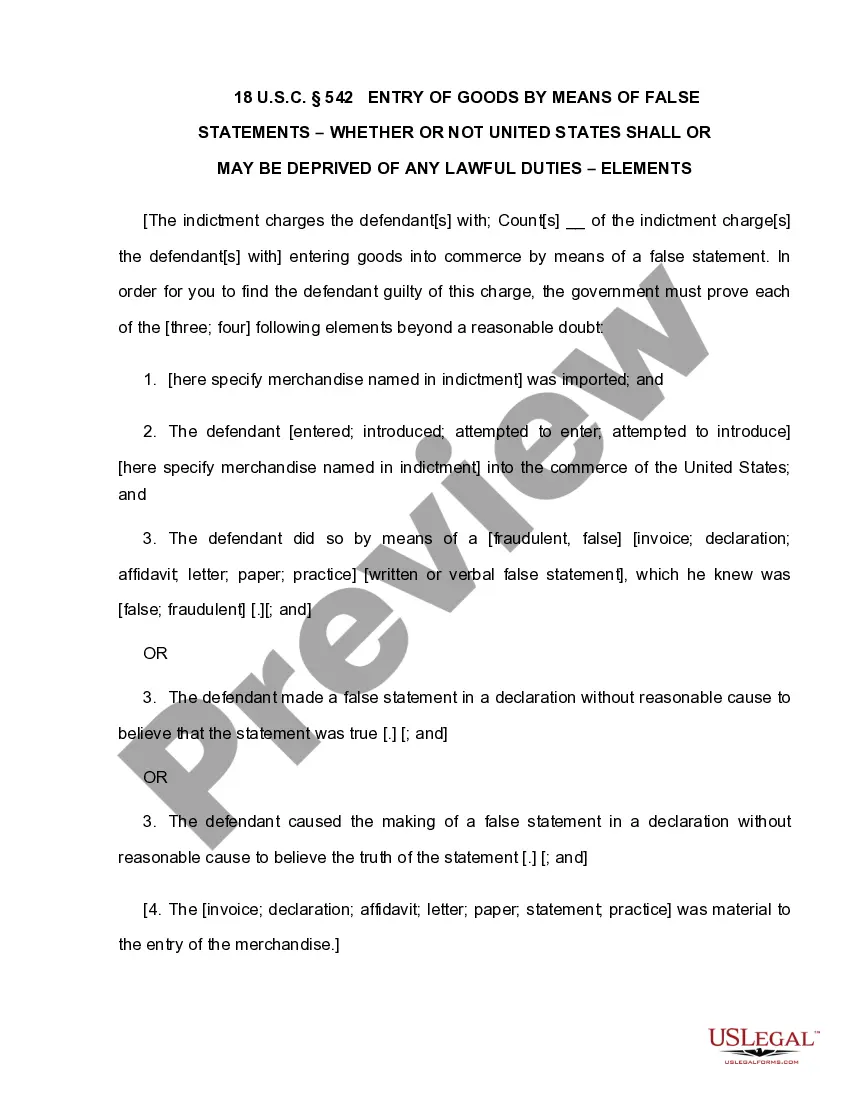

Discovering the right legal document template can be a battle. Obviously, there are a lot of web templates available online, but how can you find the legal develop you require? Use the US Legal Forms web site. The service gives a large number of web templates, such as the California Instructions for Completing Mortgage Deed of Trust Form, that you can use for organization and private demands. Every one of the kinds are inspected by experts and meet up with state and federal needs.

Should you be already listed, log in for your account and then click the Down load key to have the California Instructions for Completing Mortgage Deed of Trust Form. Utilize your account to search through the legal kinds you might have ordered in the past. Proceed to the My Forms tab of your account and obtain yet another copy in the document you require.

Should you be a whole new consumer of US Legal Forms, listed here are simple instructions that you should adhere to:

- First, be sure you have chosen the appropriate develop to your area/area. You are able to check out the form using the Preview key and look at the form information to make sure this is basically the best for you.

- In case the develop is not going to meet up with your needs, make use of the Seach area to discover the right develop.

- When you are positive that the form would work, click on the Get now key to have the develop.

- Choose the rates strategy you need and enter in the necessary information and facts. Build your account and pay money for an order utilizing your PayPal account or charge card.

- Select the file structure and download the legal document template for your device.

- Complete, edit and produce and signal the obtained California Instructions for Completing Mortgage Deed of Trust Form.

US Legal Forms is the greatest collection of legal kinds in which you can find a variety of document web templates. Use the service to download skillfully-created documents that adhere to condition needs.

Form popularity

FAQ

Transferring real property into a revocable living trust is the same process as transferring real property to any other individual, business or entity. The grantor places the mortgaged home into the trust by properly executing a deed from the current owners to the trust.

A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees. Additional pages or non-conforming documents will accrue an additional filing fee.

In a deed of trust, the borrower (trustor) transfers the Property, in trust, to an independent third party (trustee) who holds conditional title on behalf of the lender or note holder (beneficiary) for the purpose of exercising the following powers: (1) to reconvey the deed of trust once the borrower satisfies all ...

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

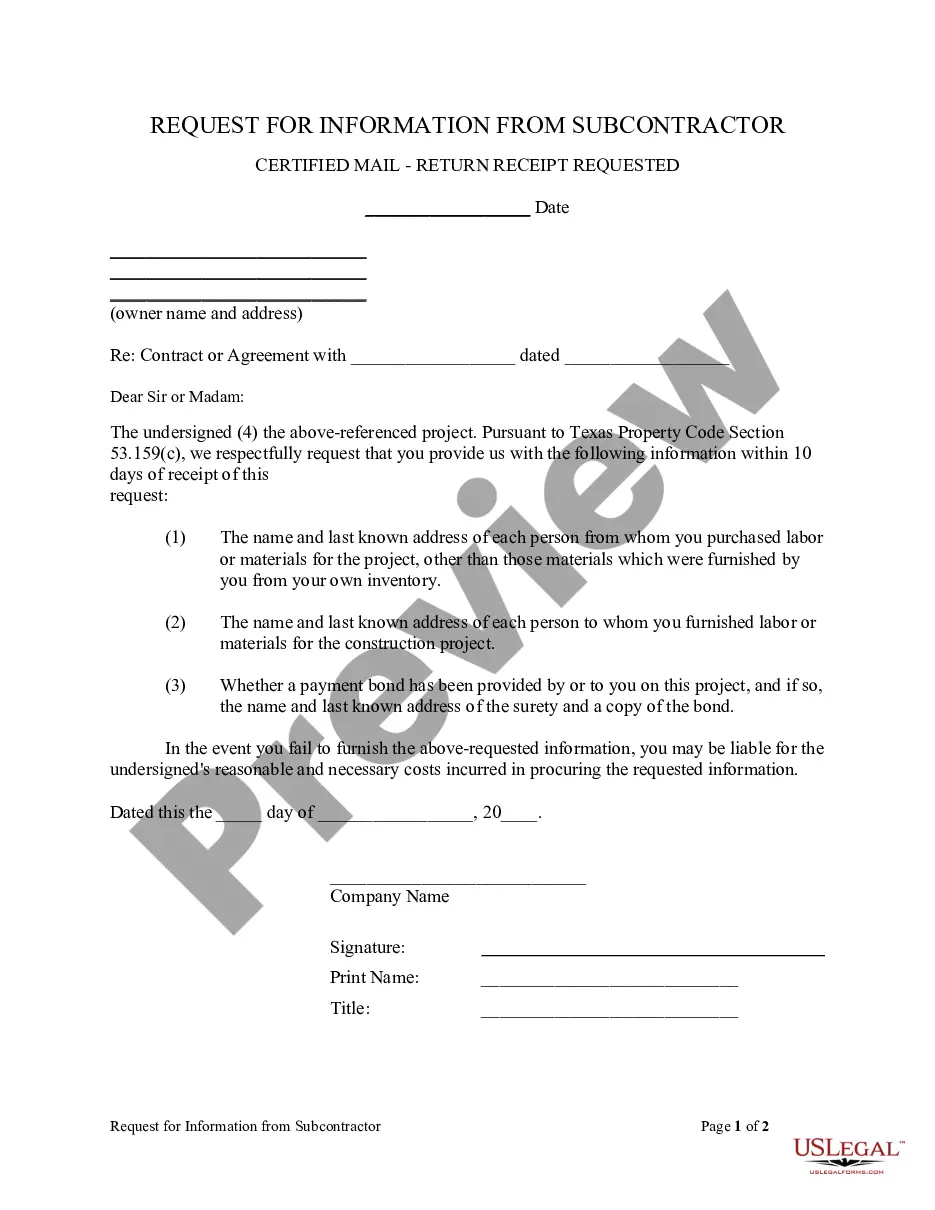

How to Write Step 1 ? Obtain The California Deed Of Trust Form For Your Use. ... Step 2 ? Determine And Present Where This Deed Must Be Returned. ... Step 3 ? Report The Assessor's Parcel Number. ... Step 4 ? Record The Effective Date Of This Deed. ... Step 5 ? Produce The Debtor's Identity As The Trustor.

Once a deed is signed and notarized, the next step is to record it. You can record a deed in person or by mailing it to the appropriate recorder's office in the locale in which the property sits.