"Form of Mortgage Deed of Trust and Variations" is an American Lawyer Media form. The following form is for a mortgage deed of trust with variations.

California Form of Mortgage Deed of Trust and Variations

Description

How to fill out Form Of Mortgage Deed Of Trust And Variations?

Choosing the best legitimate record design can be quite a have difficulties. Obviously, there are plenty of themes available on the net, but how can you discover the legitimate kind you will need? Make use of the US Legal Forms website. The services provides a large number of themes, like the California Form of Mortgage Deed of Trust and Variations, which can be used for enterprise and private requirements. All of the varieties are inspected by professionals and satisfy state and federal specifications.

In case you are presently authorized, log in in your accounts and click the Down load option to have the California Form of Mortgage Deed of Trust and Variations. Use your accounts to appear through the legitimate varieties you may have bought previously. Check out the My Forms tab of your own accounts and get yet another version from the record you will need.

In case you are a brand new consumer of US Legal Forms, allow me to share simple instructions that you should comply with:

- Initially, ensure you have chosen the right kind for the area/area. You may look over the shape using the Review option and read the shape description to guarantee it will be the right one for you.

- If the kind does not satisfy your needs, make use of the Seach industry to discover the right kind.

- Once you are certain that the shape is proper, click the Get now option to have the kind.

- Pick the prices strategy you want and enter the essential details. Build your accounts and purchase an order with your PayPal accounts or charge card.

- Pick the document file format and acquire the legitimate record design in your gadget.

- Complete, revise and printing and signal the received California Form of Mortgage Deed of Trust and Variations.

US Legal Forms is definitely the greatest library of legitimate varieties for which you can find numerous record themes. Make use of the company to acquire expertly-made files that comply with status specifications.

Form popularity

FAQ

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

When is a Deed of Trust Invalid? There are two main reasons a deed of trust may be considered invalid: (1) lack of required formalities in executing the deed of trust, or (2) there is some fact outside execution that makes the deed of trust invalid.

A deed of variation is a legal document that is used to change the details of an existing trust. In most circumstances, in order to properly execute a Deed of Variation, it is important that the Appointor (sometimes referred to as a Principal or Guardian) along with Trustee consents to the proposed change. Trust Deed of Variation - Abbots - Incorporation Services abbots.com.au ? deed-variations abbots.com.au ? deed-variations

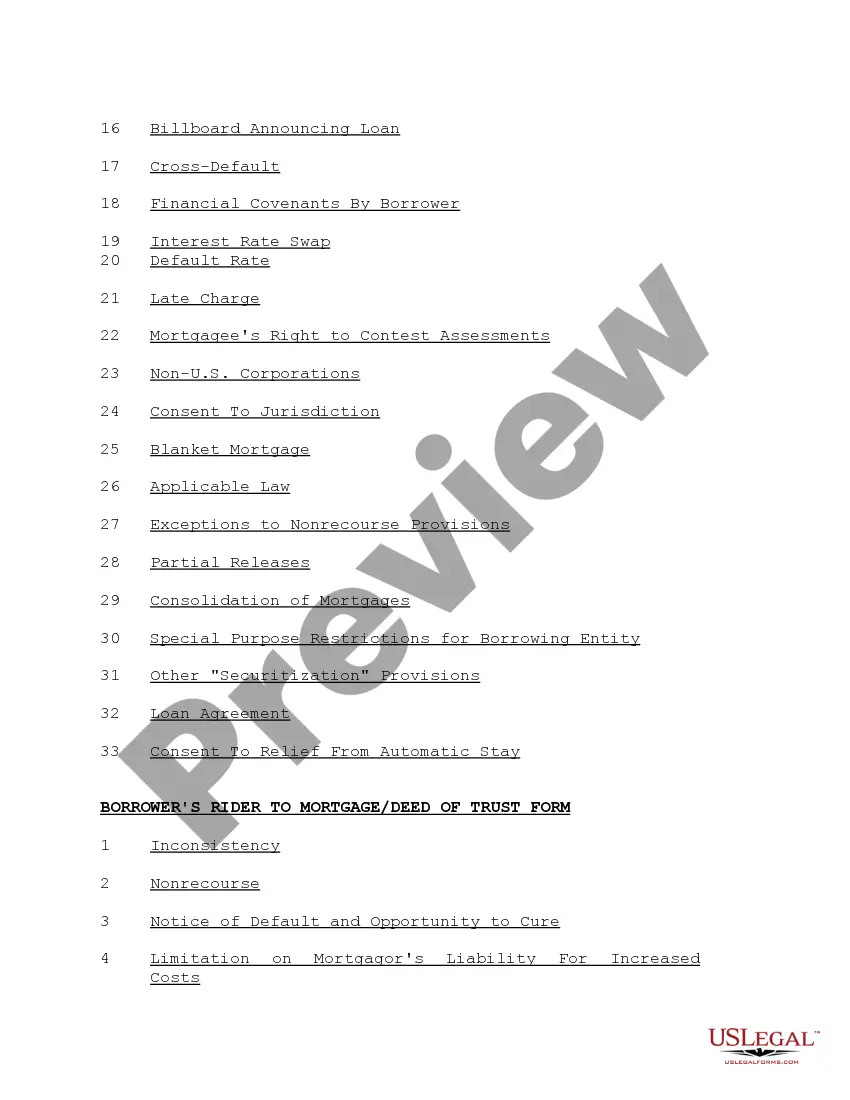

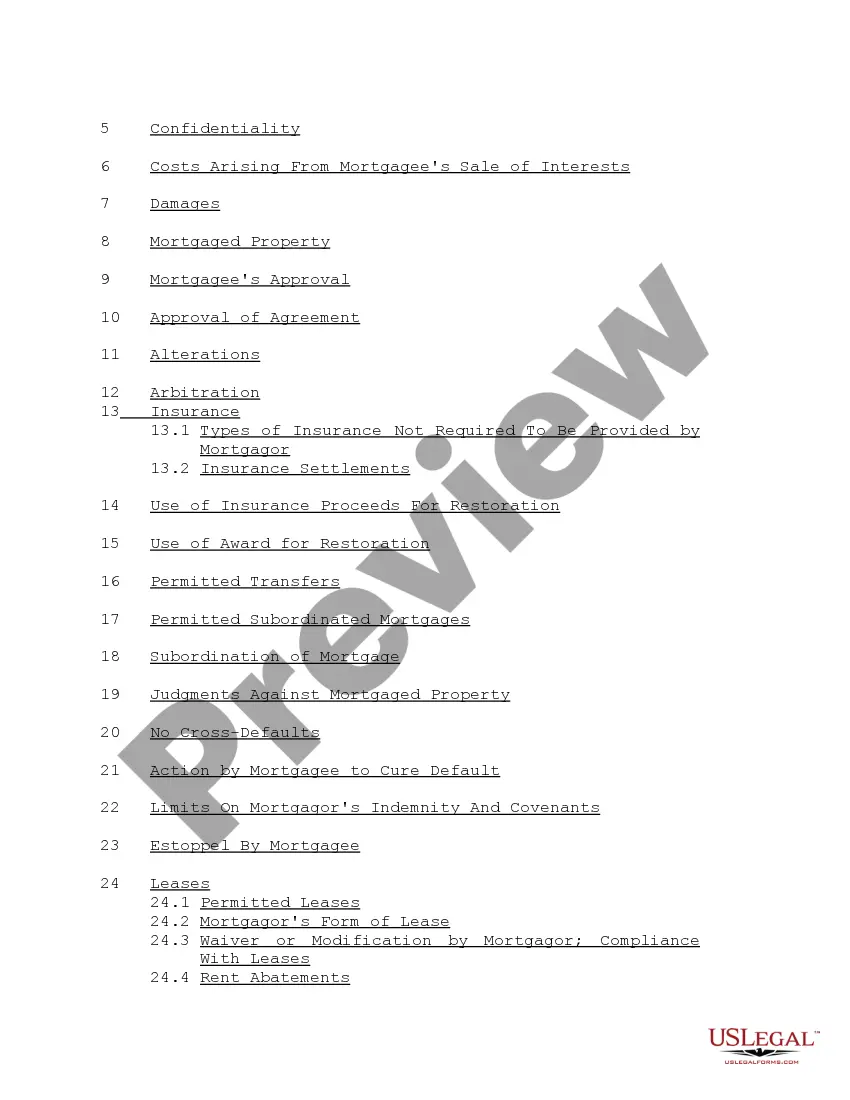

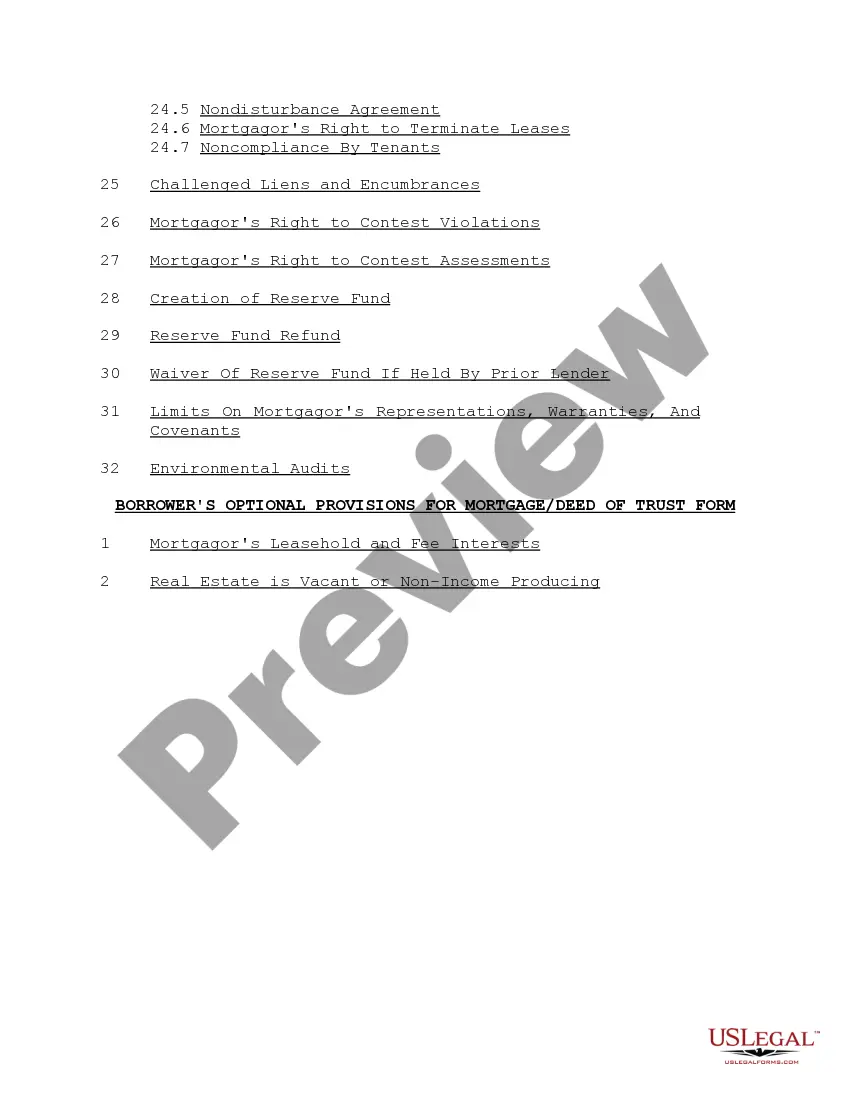

There are two basic types of Deeds of Trust, the Long Form and the Short Form. The Long Form, which could be 20-30 pages long, is the one used by institutional lenders. The Short Form is the one that is most usually prepared by your Escrow Officer. Deeds of Trust Explained | Viva Escrow | Los Angeles, CA Viva Escrow ? deeds-trust-escrow Viva Escrow ? deeds-trust-escrow

How to Write Step 1 ? Obtain The California Deed Of Trust Form For Your Use. ... Step 2 ? Determine And Present Where This Deed Must Be Returned. ... Step 3 ? Report The Assessor's Parcel Number. ... Step 4 ? Record The Effective Date Of This Deed. ... Step 5 ? Produce The Debtor's Identity As The Trustor. Free California Deed of Trust Form - PDF | Word - eForms eforms.com ? deeds ? california-deed-of-trust-form eforms.com ? deeds ? california-deed-of-trust-form

Title to the California real estate is held by the Trustee or Trustees of the trust who retains complete control over the trust and has complete power of direction over the real property.

There are plenty of mortgage options in California. The most common types of loans include: California conventional mortgages: Rates and requirements will vary depending on the area you want to live in and your financial situation. You can compare mortgage rates to find the option that's right for you.

In California, many people sign a Deed of Trust to finance their house purchase. A Deed of Trust is commonly referred to as a mortgage. A Deed of Trust is a three party document prepared, signed and recorded to secure repayment of a loan. Paid Off Deeds - County Of Sonoma - CA.gov ca.gov ? frequently-asked-questions ca.gov ? frequently-asked-questions