California Nursing Agreement - Self-Employed Independent Contractor

Description

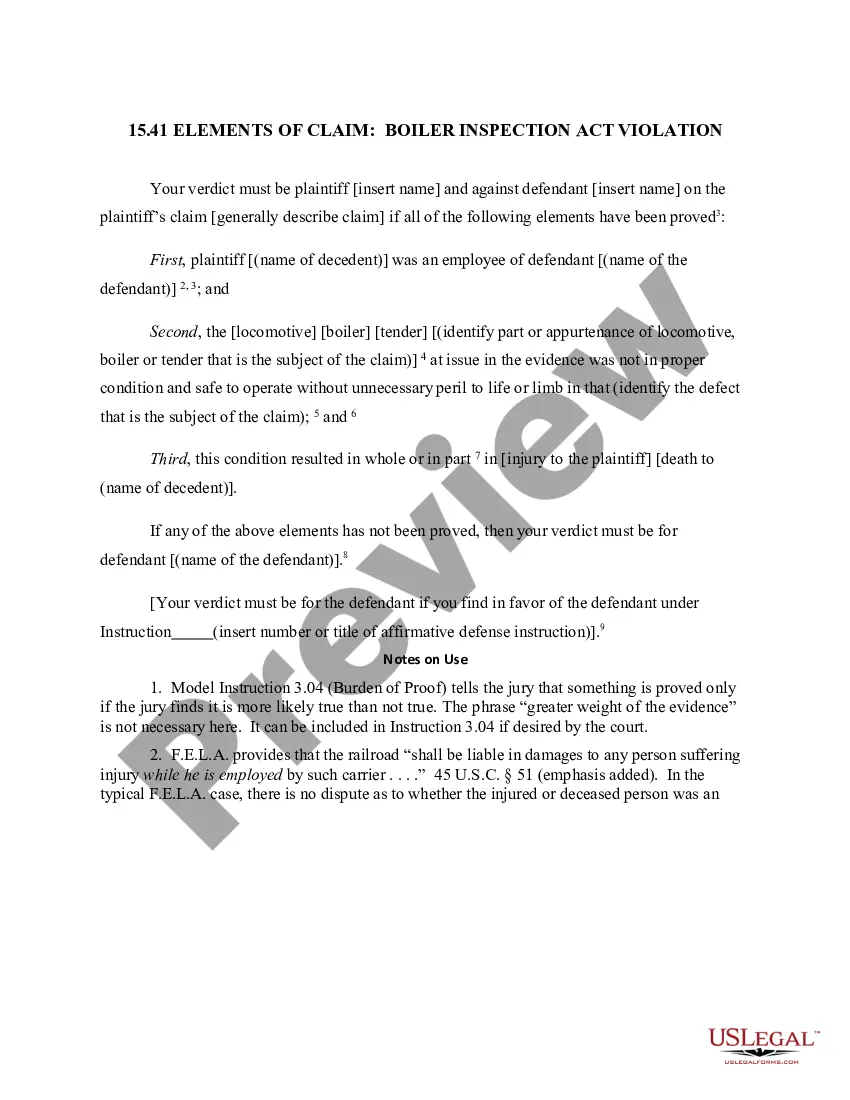

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

Finding the right legitimate papers template might be a have difficulties. Of course, there are plenty of web templates accessible on the Internet, but how will you get the legitimate kind you need? Utilize the US Legal Forms internet site. The support provides a huge number of web templates, such as the California Nursing Agreement - Self-Employed Independent Contractor, which can be used for organization and private requirements. Each of the varieties are examined by experts and satisfy federal and state requirements.

Should you be already listed, log in in your accounts and click on the Acquire key to have the California Nursing Agreement - Self-Employed Independent Contractor. Make use of your accounts to search with the legitimate varieties you may have ordered previously. Check out the My Forms tab of your own accounts and get one more duplicate of the papers you need.

Should you be a fresh customer of US Legal Forms, allow me to share easy instructions that you should follow:

- First, make sure you have chosen the correct kind to your town/state. It is possible to check out the shape using the Review key and look at the shape description to make certain this is basically the right one for you.

- In the event the kind does not satisfy your expectations, utilize the Seach area to discover the correct kind.

- When you are certain that the shape is acceptable, click on the Get now key to have the kind.

- Pick the costs program you need and type in the required info. Make your accounts and purchase the order with your PayPal accounts or Visa or Mastercard.

- Select the file format and acquire the legitimate papers template in your device.

- Total, change and print out and sign the acquired California Nursing Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the greatest catalogue of legitimate varieties for which you can see numerous papers web templates. Utilize the service to acquire appropriately-created documents that follow state requirements.

Form popularity

FAQ

While AB 5 has exemptions for physicians, dentists, podiatrists and psychologists, it currently does not provide any exemption for nurse practitioners, nurse anesthetists, pharmacists, occupational/physical/speech/respiratory therapists, medical technicians or physician's assistants many of whom serve as independent

If the NP is working for a facility or office that provides medical services, the NP cannot work as an independent contractor. The number of hours is no longer valid. Even if the NP works four hours, s/he must be an employee. If the NP is an employer, s/he cannot hire other providers as independent contractors.

The Legislation With the advent of apps like CareRev and other nurse-for-hire services popping up, California has introduced legislation to legally declare that any nurse or healthcare worker using digital services to book shifts be classified as an independent contractor.

While AB 5 has exemptions for physicians, dentists, podiatrists and psychologists, it currently does not provide any exemption for nurse practitioners, nurse anesthetists, pharmacists, occupational/physical/speech/respiratory therapists, medical technicians or physician's assistants many of whom serve as independent

If the NP is working for a facility or office that provides medical services, the NP cannot work as an independent contractor. The number of hours is no longer valid. Even if the NP works four hours, s/he must be an employee. If the NP is an employer, s/he cannot hire other providers as independent contractors.

How to become a nurse independent contractorGet a nursing degree.Pass the NCLEX.Work as an RN.Consider becoming an advanced practice registered nurse.Join an independent nurse contractor organization.Form a corporation.Find clients.Maintain good business and nursing standings.

Prop 22 was a ballot measure that passed on November 3, 2020. It declares that app-based transportation companies, such as rideshare (i.e. Uber and Lyft) and food delivery companies (i.e. Grubhub), are exempt from AB5 and its drivers are classified as independent contractors.

AB5 has been blocked from being implemented in California's trucking sector because of an injunction handed down by a U.S. District Court in California at the start of January 2020.

With the advent of apps like CareRev and other nurse-for-hire services popping up, California has introduced legislation to legally declare that any nurse or healthcare worker using digital services to book shifts be classified as an independent contractor.