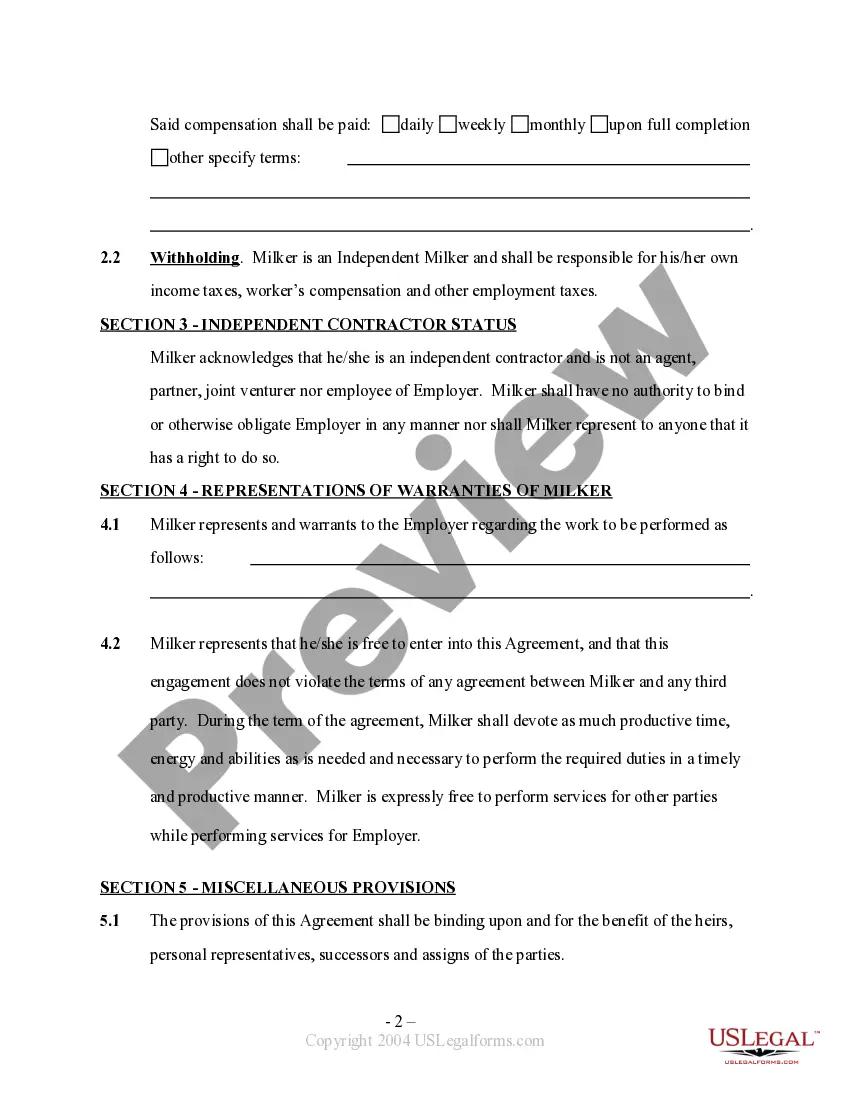

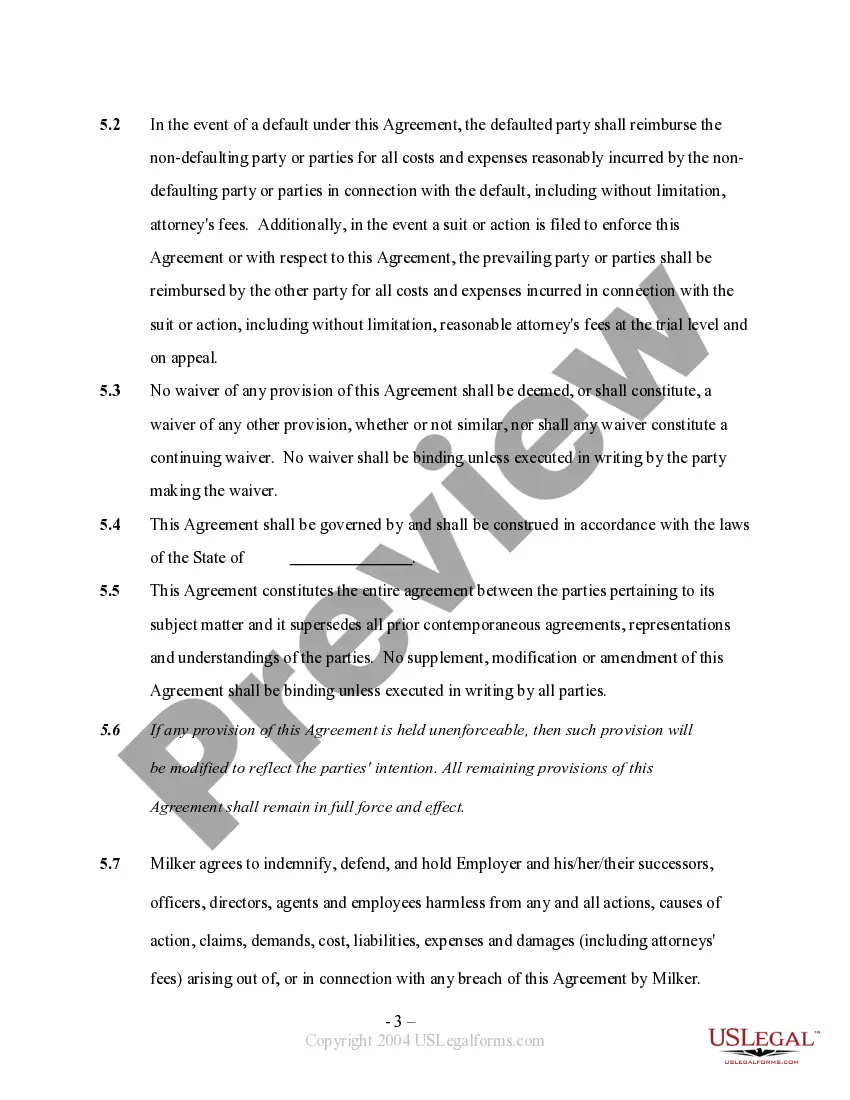

California Milker Services Contract - Self-Employed

Description

How to fill out Milker Services Contract - Self-Employed?

If you intend to total, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the California Milker Services Agreement - Self-Employed with just a few clicks.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the California Milker Services Agreement - Self-Employed. Each legal document template you buy is yours forever. You will have access to every form you purchased in your account. Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the California Milker Services Agreement - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the California Milker Services Agreement - Self-Employed.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

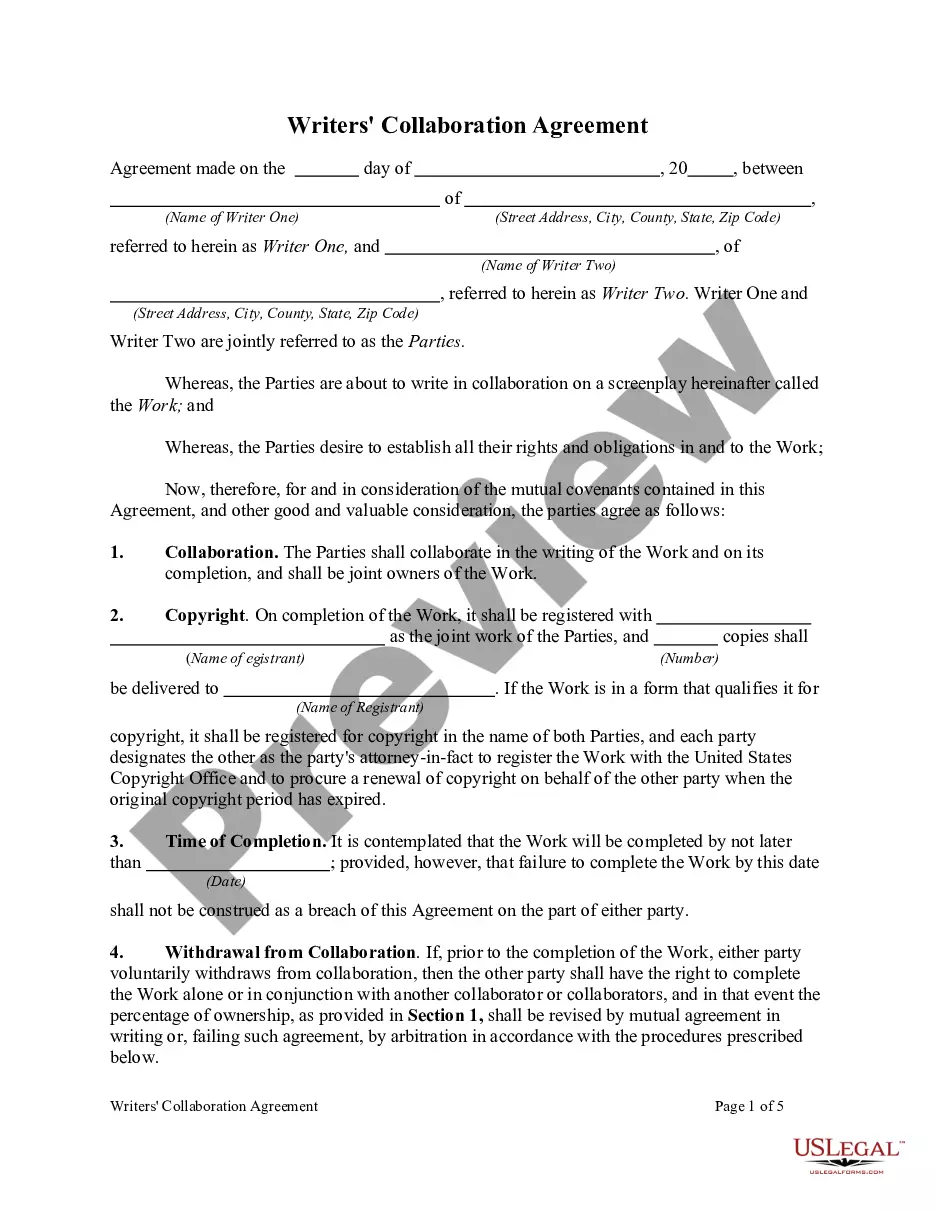

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To file your taxes as an independent contractor, start by gathering your financial records, including income statements and receipts for expenses. Use IRS Form 1040 and attach Schedule C for profit or loss from business, while ensuring you account for self-employment tax. Platforms like USLegalForms can provide templates to help streamline this process, making it easier to manage your California Milker Services Contract - Self-Employed.

Yes, a self-employed person can certainly have a contract. In fact, having a detailed contract, such as a California Milker Services Contract - Self-Employed, protects both parties by clearly outlining terms, payment schedules, and responsibilities. A well-structured contract helps avoid misunderstandings and disputes, ensuring a smooth working relationship.

The independent contractor rule in California defines the relationship between workers and businesses. Under this rule, a worker is considered an independent contractor if they control their own work, have the freedom to set their own hours, and provide their own tools. This classification is crucial when drafting a California Milker Services Contract - Self-Employed, as it delineates rights and responsibilities.

To establish yourself as an independent contractor, begin by defining your services clearly and creating a business plan. You can then obtain a California Milker Services Contract - Self-Employed through platforms like US Legal Forms, which provides customizable contracts tailored to your needs. Additionally, market your services and network within your industry to build credibility and attract clients.

In California, you typically do not need a special license to work as an independent contractor. However, specific industries may require permits or licenses, depending on the services offered. For instance, if you plan to work under a California Milker Services Contract - Self-Employed, ensure that you meet local health and safety regulations relevant to your services. It’s advisable to check with local authorities to stay compliant.

The upcoming freelance law in California, effective in 2025, sets new regulations for freelance workers. It focuses on protecting freelancers' rights and providing clarity around their classifications and working conditions. For those in the milker services industry, crafting a compliant California Milker Services Contract - Self-Employed will be essential as these laws evolve.

In California, 1099 employees must adhere to distinct rules regarding classification and tax responsibilities. These rules specify how to classify workers correctly to avoid penalties. If you're self-employed, familiarizing yourself with these regulations is vital, as they impact how you draft your California Milker Services Contract - Self-Employed.

Yes, you can and should have a contract as a self-employed individual. Contracts serve to establish a formal agreement between you and your clients. When you create a California Milker Services Contract - Self-Employed, it can protect your interests and outline expectations that benefit both you and your clients.

Absolutely, self-employed individuals regularly operate under contracts. Having a contract provides clarity and security for both parties involved in a business transaction. Furthermore, a well-structured California Milker Services Contract - Self-Employed can help ensure that your rights and responsibilities are clearly defined.

The latest law in California significantly affects how independent contractors are classified. It emphasizes the need for stringent criteria when determining whether someone qualifies as an independent contractor. For those self-employed, drafting a compliant California Milker Services Contract - Self-Employed is crucial to adhere to these regulations.