Have you been in a situation where you need to have paperwork for either company or person functions nearly every day? There are plenty of authorized record web templates available on the net, but getting kinds you can rely isn`t easy. US Legal Forms offers a huge number of develop web templates, such as the Florida Guide to Complying with the Red Flags Rule under FCRA and FACTA, which can be published to fulfill federal and state specifications.

When you are previously familiar with US Legal Forms internet site and also have an account, basically log in. Following that, you can down load the Florida Guide to Complying with the Red Flags Rule under FCRA and FACTA template.

Unless you provide an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is to the appropriate city/region.

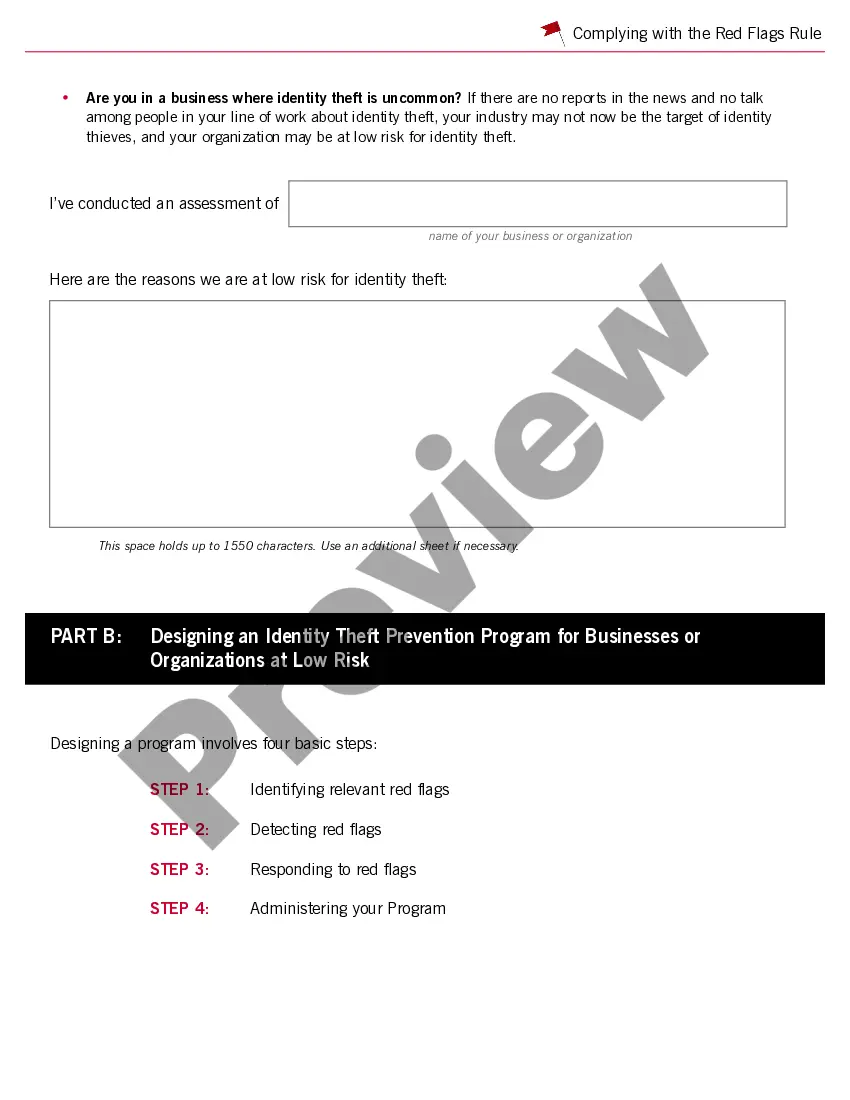

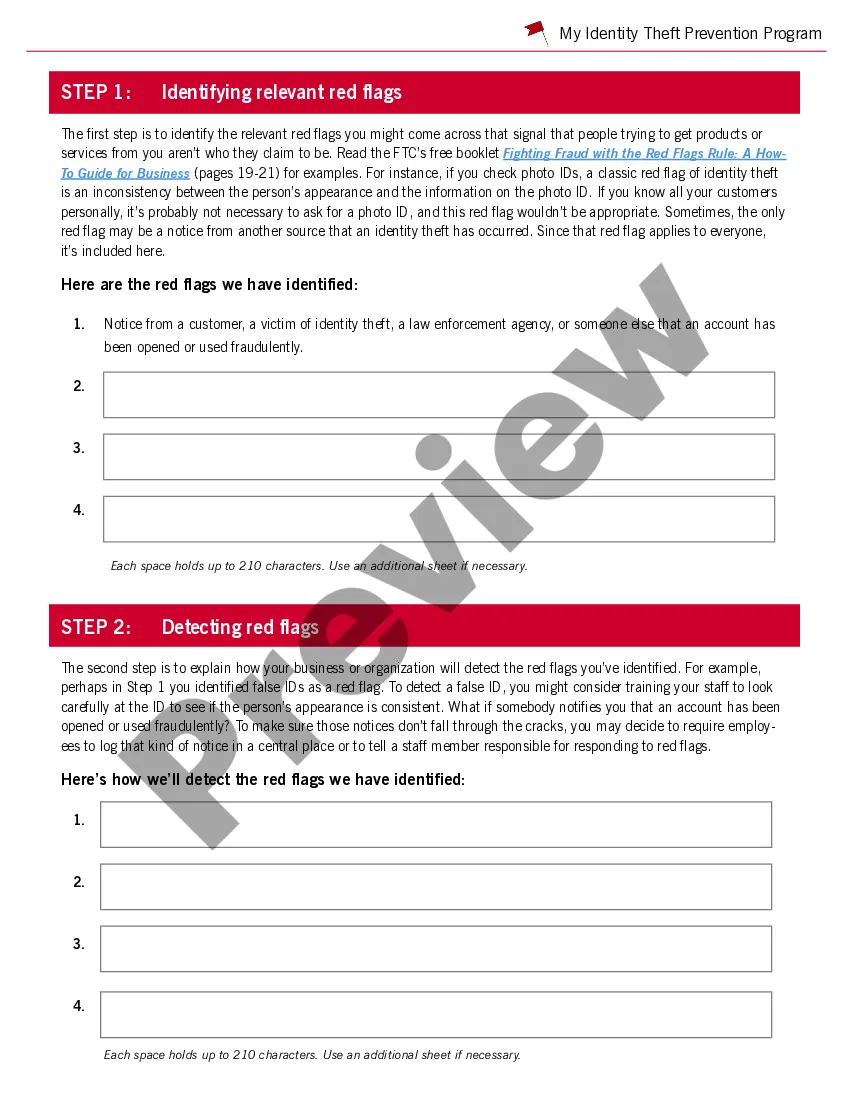

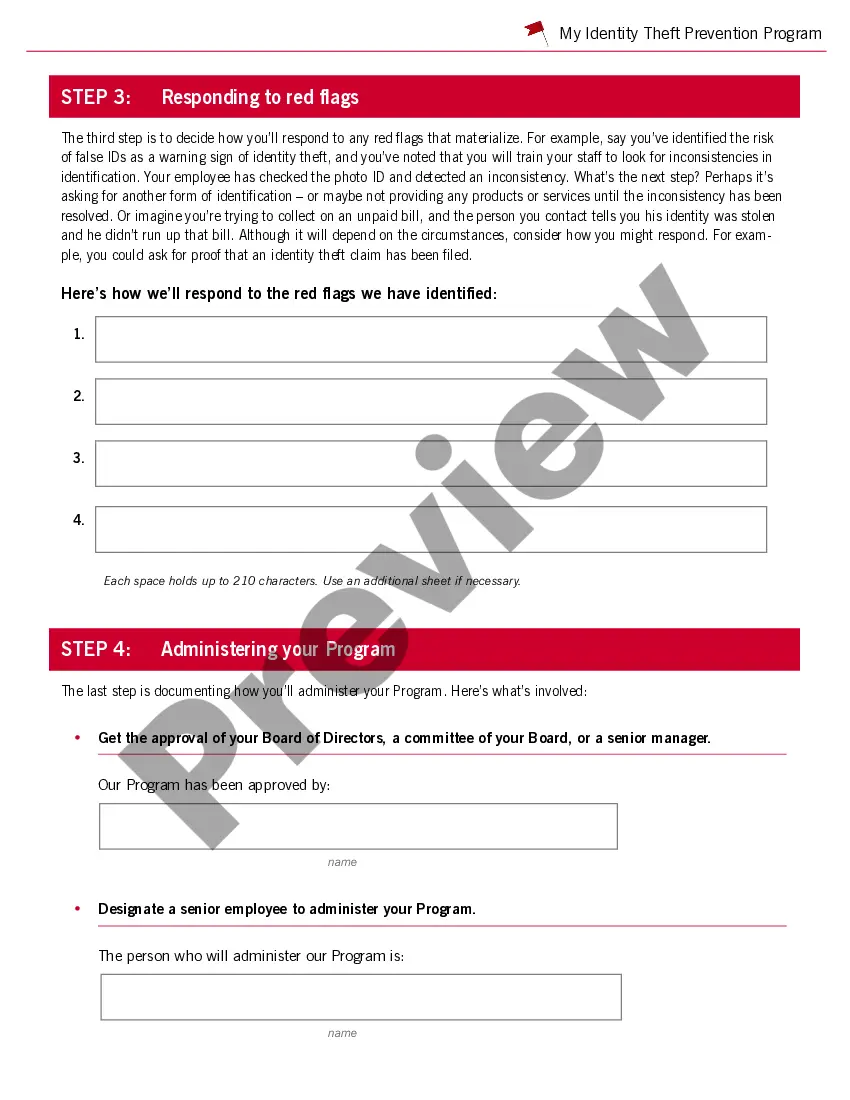

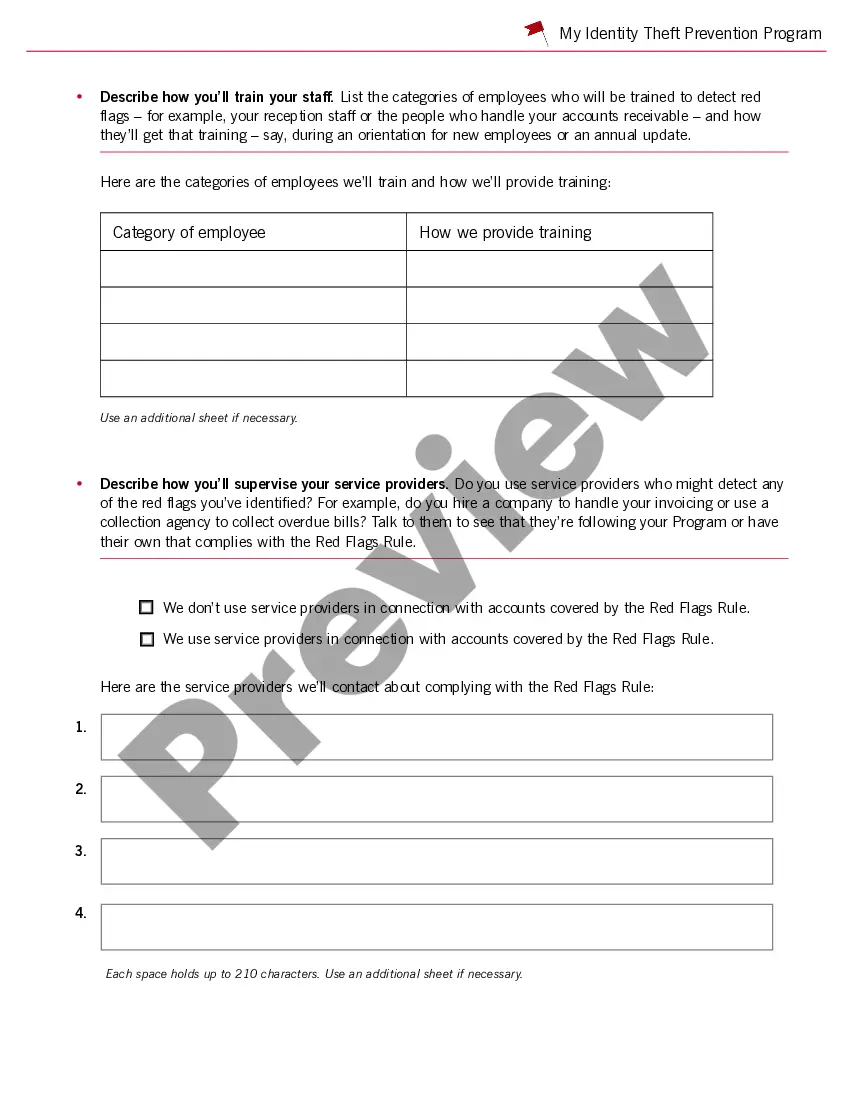

- Utilize the Review option to review the form.

- Read the description to actually have selected the proper develop.

- In the event the develop isn`t what you are trying to find, utilize the Research industry to obtain the develop that meets your requirements and specifications.

- When you get the appropriate develop, simply click Acquire now.

- Pick the rates strategy you need, submit the specified details to create your bank account, and pay for an order using your PayPal or Visa or Mastercard.

- Pick a practical paper format and down load your version.

Get every one of the record web templates you might have purchased in the My Forms food selection. You can get a further version of Florida Guide to Complying with the Red Flags Rule under FCRA and FACTA anytime, if needed. Just select the required develop to down load or produce the record template.

Use US Legal Forms, by far the most considerable variety of authorized types, to conserve time as well as stay away from mistakes. The support offers professionally produced authorized record web templates which you can use for a range of functions. Generate an account on US Legal Forms and start creating your lifestyle easier.