US Legal Forms - one of several largest libraries of authorized types in America - provides an array of authorized record themes it is possible to obtain or printing. Using the web site, you can find a huge number of types for enterprise and personal uses, categorized by types, says, or keywords and phrases.You can find the newest types of types just like the District of Columbia Guide to Complying with the Red Flags Rule under FCRA and FACTA within minutes.

If you currently have a registration, log in and obtain District of Columbia Guide to Complying with the Red Flags Rule under FCRA and FACTA from your US Legal Forms catalogue. The Obtain key will appear on each and every form you look at. You have access to all earlier delivered electronically types in the My Forms tab of the profile.

If you want to use US Legal Forms initially, here are easy instructions to help you began:

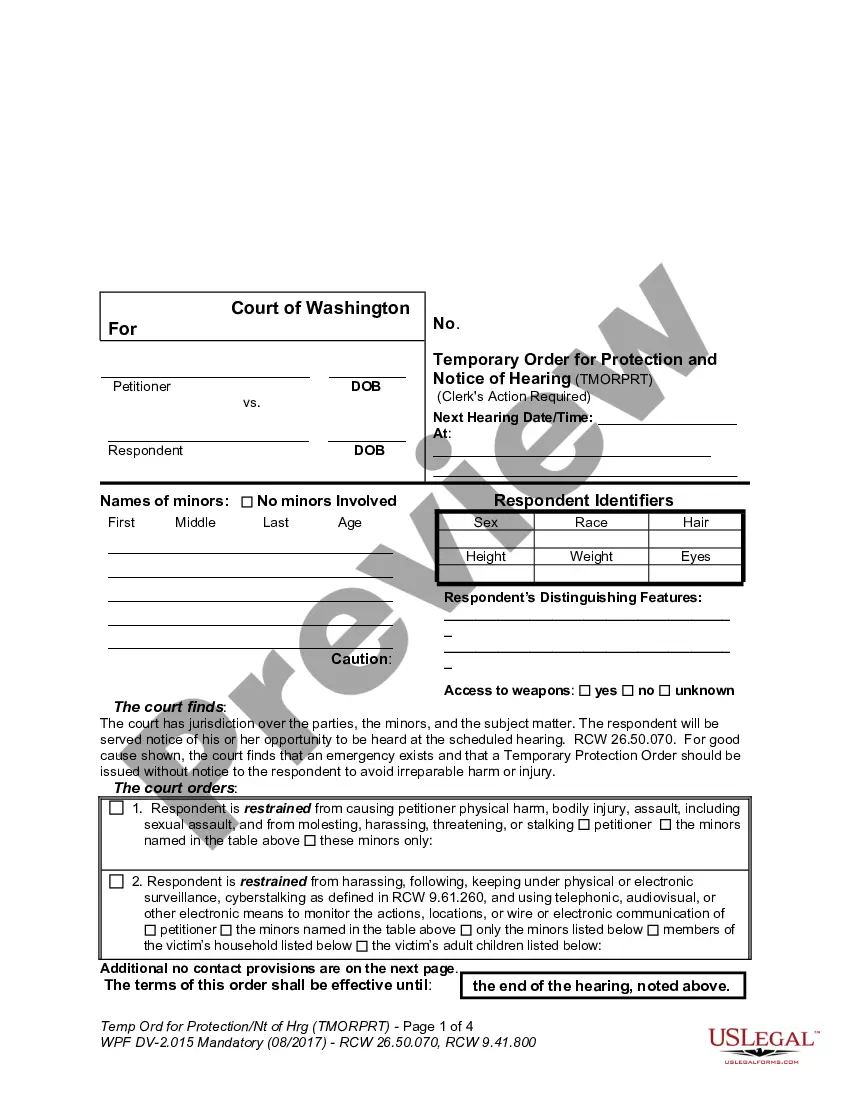

- Ensure you have picked the proper form for the city/area. Click the Review key to examine the form`s content material. Look at the form outline to ensure that you have chosen the proper form.

- In case the form does not suit your specifications, take advantage of the Search area on top of the screen to obtain the one which does.

- In case you are content with the shape, verify your choice by clicking on the Buy now key. Then, pick the costs program you want and give your references to sign up for an profile.

- Procedure the financial transaction. Make use of your bank card or PayPal profile to complete the financial transaction.

- Find the file format and obtain the shape on the gadget.

- Make modifications. Load, modify and printing and indication the delivered electronically District of Columbia Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Each and every design you put into your bank account does not have an expiry time and it is your own for a long time. So, if you would like obtain or printing yet another version, just check out the My Forms section and click on on the form you will need.

Obtain access to the District of Columbia Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms, probably the most substantial catalogue of authorized record themes. Use a huge number of skilled and state-specific themes that meet your business or personal needs and specifications.