California Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

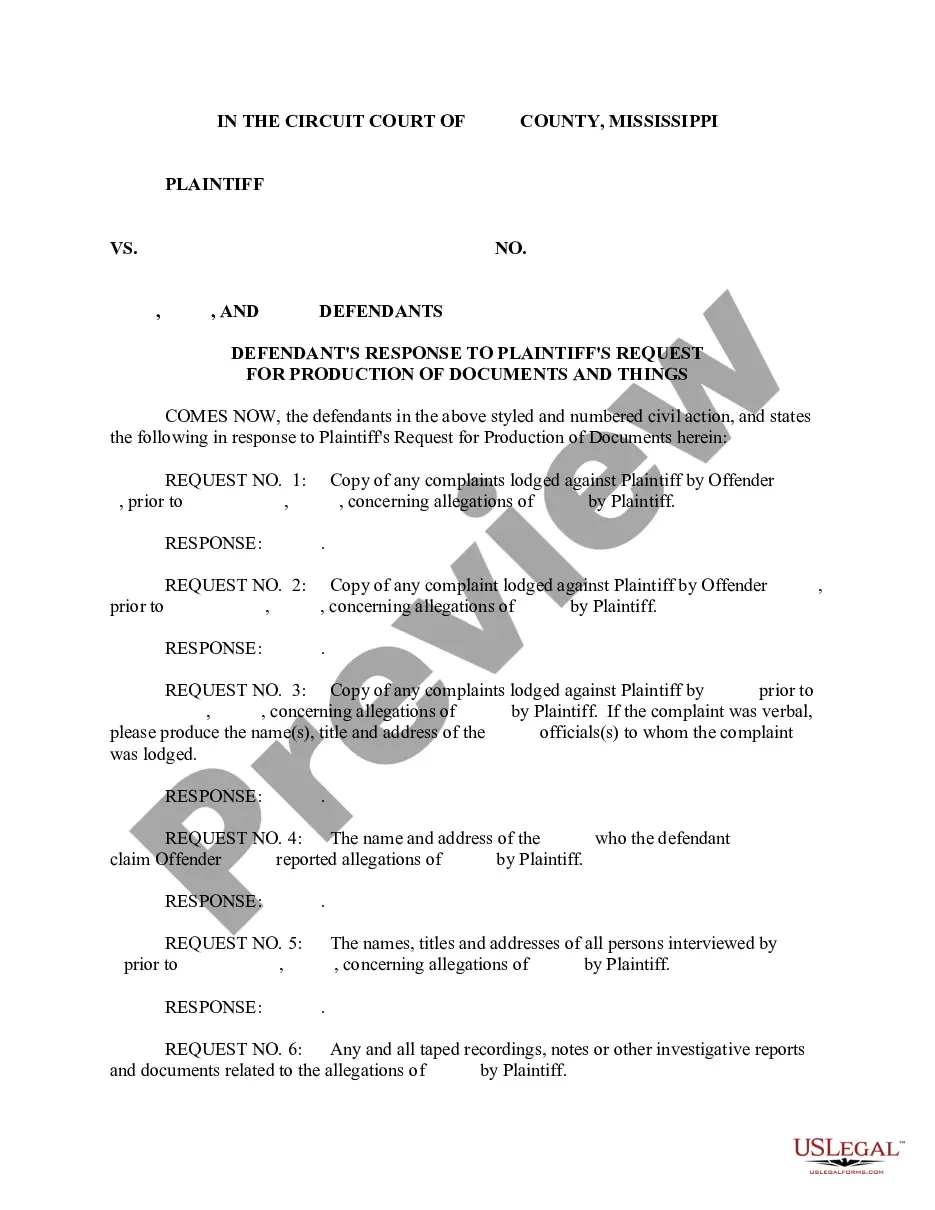

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

If you have to full, download, or printing authorized papers layouts, use US Legal Forms, the most important assortment of authorized forms, which can be found on-line. Take advantage of the site`s simple and easy hassle-free search to discover the papers you want. Various layouts for business and personal functions are sorted by classes and states, or keywords. Use US Legal Forms to discover the California Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property in just a number of mouse clicks.

If you are previously a US Legal Forms consumer, log in to your accounts and click on the Obtain button to obtain the California Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. You can even gain access to forms you in the past delivered electronically in the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that correct city/region.

- Step 2. Use the Review solution to check out the form`s content material. Do not forget about to read through the outline.

- Step 3. If you are not satisfied with the form, take advantage of the Lookup discipline towards the top of the monitor to locate other versions of the authorized form format.

- Step 4. Once you have identified the shape you want, select the Get now button. Select the rates plan you prefer and put your accreditations to register on an accounts.

- Step 5. Procedure the deal. You may use your charge card or PayPal accounts to complete the deal.

- Step 6. Pick the structure of the authorized form and download it in your gadget.

- Step 7. Total, modify and printing or sign the California Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

Each authorized papers format you purchase is the one you have permanently. You possess acces to every single form you delivered electronically within your acccount. Go through the My Forms portion and pick a form to printing or download once again.

Contend and download, and printing the California Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property with US Legal Forms. There are thousands of skilled and express-specific forms you may use to your business or personal needs.

Form popularity

FAQ

How to Change a Deed When Inheriting a House Step 1: Get a Copy of the Probated Will. ... Step 2: Confirm the Nature of Property Ownership. ... Step 3: Get a Certified Copy of the Death Certificate. ... Step 4: Draft a New Deed that Names You as the Property Owner. ... Step 5: Sign the Deed. ... Step 6: Have the New Deed Notarized.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

Disclaiming means that you give up your right to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Specifically, Probate Code section 275 provides: ?A beneficiary may disclaim any interest, in whole or in part, by filing a disclaimer of as provided in this part.?

A beneficiary may also choose to disclaim only a percentage of the inherited assets. This is acceptable if the disclaimer meets certain requirements, in which case the asset will be treated as though it never were the property of the original beneficiary.

The Process of Disclaiming an Inheritance in California Firstly, ing to the California Probate Code, a disclaimer must be in writing for it to be valid. The disclaimant must also sign the disclaimer and; Identify the person who created the interest. Describe the interest that is being disclaimed.

Key Takeaways. If a beneficiary properly disclaims inherited retirement assets, their status as the beneficiary is fully annulled. Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets.