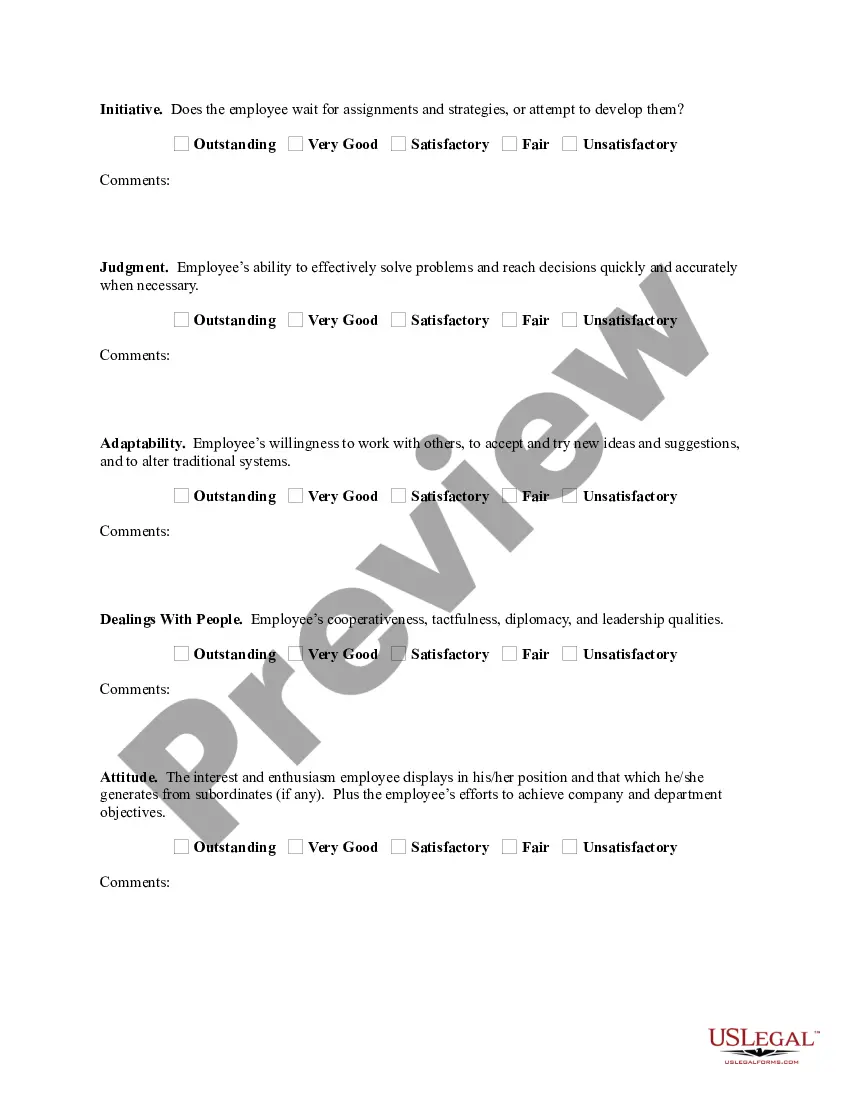

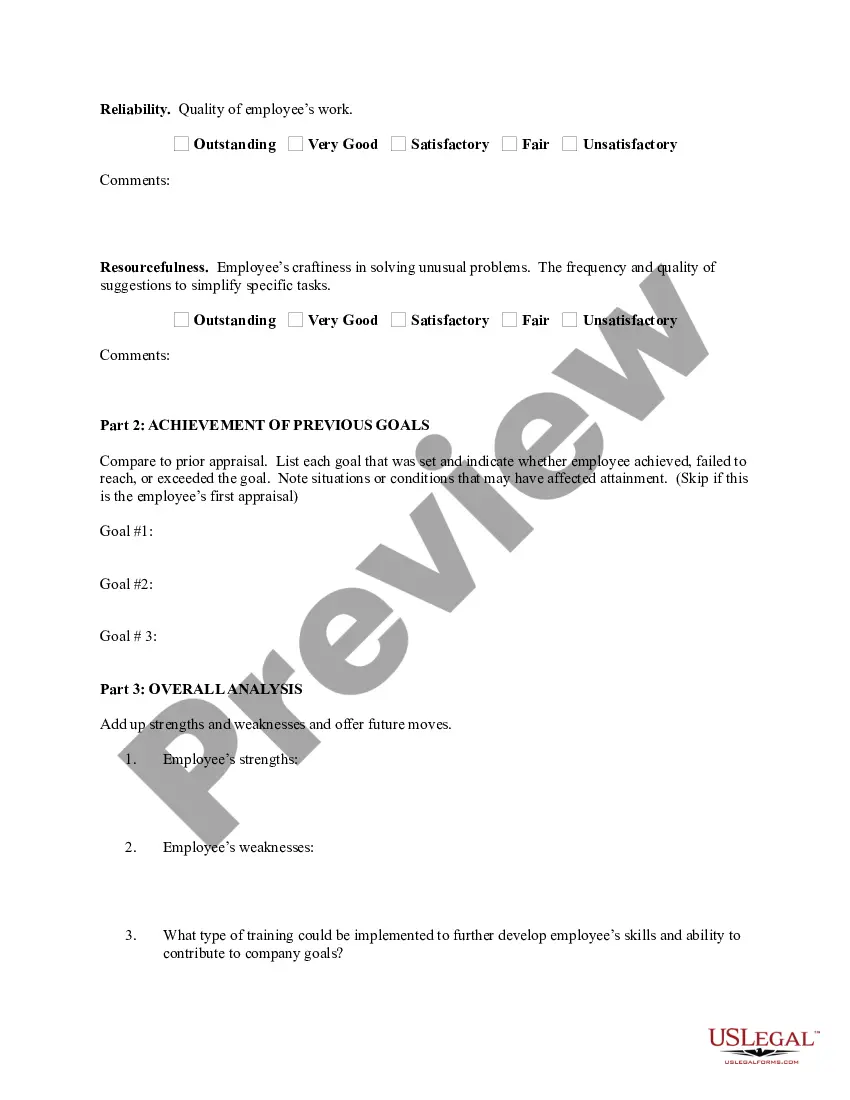

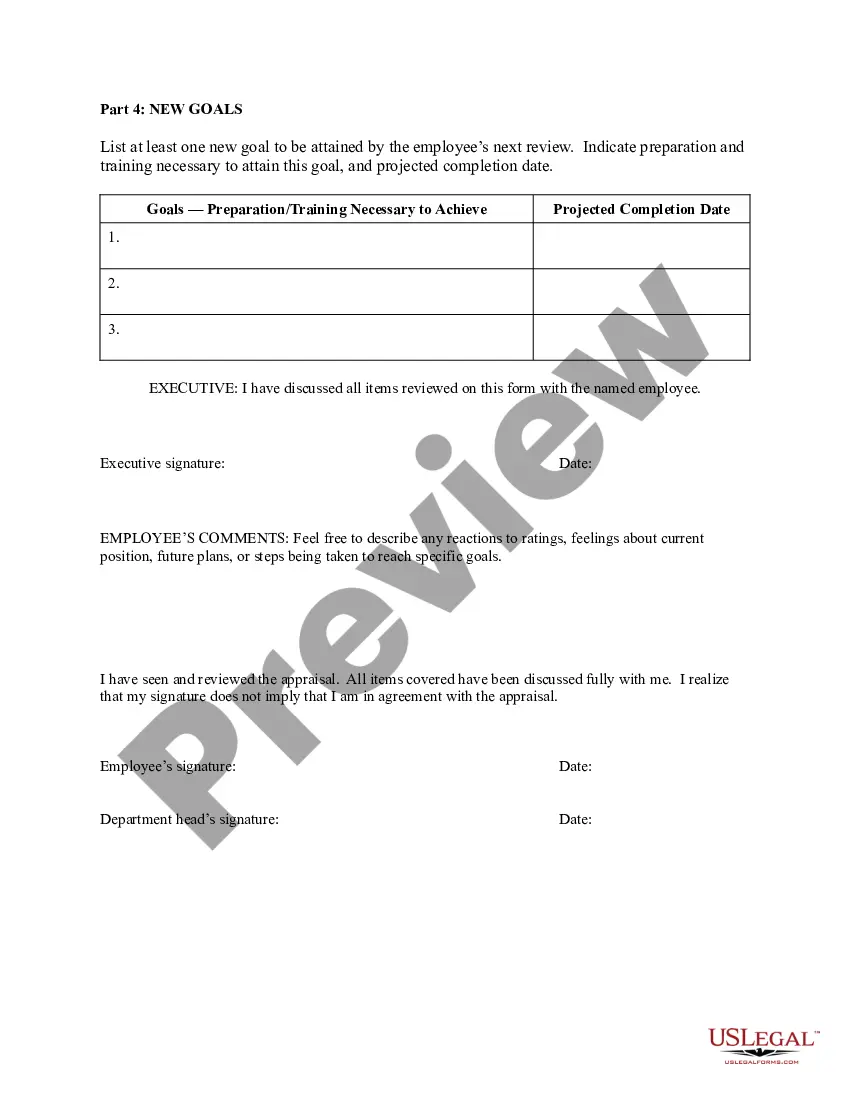

California Performance Evaluation for Exempt Employees

Description

How to fill out Performance Evaluation For Exempt Employees?

Locating the appropriate valid document format can be quite a challenge.

Of course, there is a range of templates accessible online, but how will you find the legitimate template you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the California Performance Evaluation for Exempt Employees, which you can use for both business and personal purposes.

You can view the form by using the Review button and read the form description to verify that it meets your requirements.

- All forms are reviewed by experts and adhere to state and federal standards.

- If you are currently registered, Log In to your account and click the Download button to acquire the California Performance Evaluation for Exempt Employees.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents section of your account to obtain an additional copy of the document that you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure that you have chosen the correct form for your city/state.

Form popularity

FAQ

Exempt employees in California generally must earn a minimum monthly salary of no less than two times the state minimum wage for full time employment. Simply paying an employee a salary does not make them exempt, nor does it change any requirements for compliance with wage and hour laws.

The Minimum Required Salary Amount260d This means that the minimum salary for exempt employees in 2022 is either: $4,853.34 per month (or $58,240.00 annually) if the employee works for an employer of 25 or fewer people, or. $5,200.00 per month (or $62,400202c.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

The Fair Labor Standards Act (FLSA) does not require performance evaluations. Performance evaluations are generally a matter of agreement between an employer and employee (or the employee's representative).

An employee who meets this test will be exempt from several rights, including: The right to 10-minute rest periods, The right to overtime compensation, and. The right to a minimum wage (provided, of course, that they met the minimum salary requirement).

No law requires companies to conduct job reviews, but businesses that do may have a better understanding of their employees. The information gained from performance reviews can be used to determine raises, succession plans and employee-development strategies.

Salaried employees cannot have their pay deducted by their employer if they work less than 40 hours per week or the employee may be seen as nonexempt and entitled to overtime compensation when working more than 40 hours a week.

Summary. Generally, California law does not restrict private communications involving opinions, such as performance appraisals, particularly when those communications are truthful, reasonable, businesslike, and kept confidential between management and the employee.

Salaried non-exempt employees cannot be paid less than the state minimum wage. Salaried non-exempt employees are also protected by California wage and hour lawsincluding overtime laws and laws requiring meal and rest breaks.

In order to qualify as an exempt employee in California in 2021, an employee working for a company with 26 or more employees must earn $1,120 per week, or $58,240 annually; an employee working for a company with fewer than 26 employees must earn $1,040 per week, or $54,080 annually, exclusive of board, lodging, and