California Salaried Employee Appraisal Guidelines - Employee Specific

Description

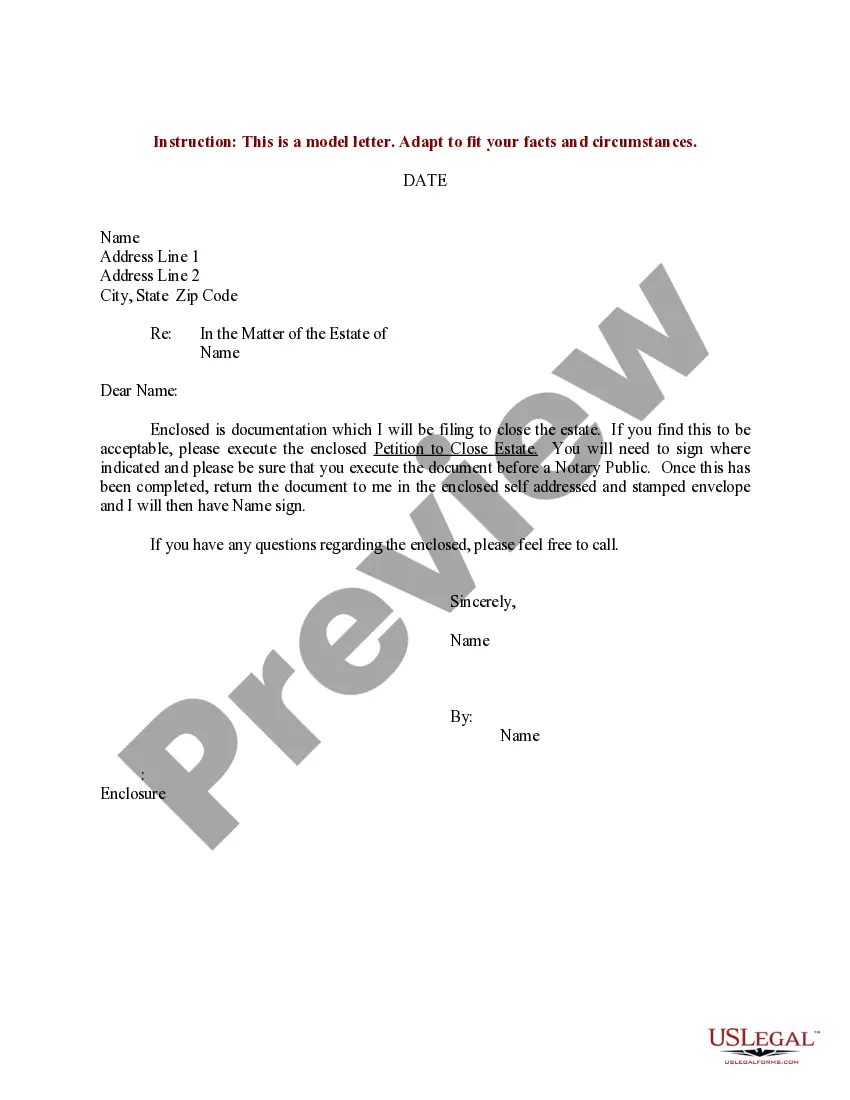

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

Are you inside a situation in which you need files for sometimes organization or personal reasons almost every day time? There are tons of lawful file web templates available online, but getting types you can rely isn`t easy. US Legal Forms provides 1000s of form web templates, just like the California Salaried Employee Appraisal Guidelines - Employee Specific, which can be written in order to meet federal and state requirements.

When you are currently informed about US Legal Forms website and get a merchant account, just log in. Following that, you can obtain the California Salaried Employee Appraisal Guidelines - Employee Specific format.

If you do not offer an account and wish to start using US Legal Forms, abide by these steps:

- Find the form you want and ensure it is for your right town/state.

- Take advantage of the Preview option to analyze the form.

- Browse the explanation to ensure that you have chosen the right form.

- If the form isn`t what you are searching for, make use of the Research field to obtain the form that meets your requirements and requirements.

- If you get the right form, click Buy now.

- Pick the pricing prepare you need, fill out the required info to create your account, and pay for your order with your PayPal or charge card.

- Select a convenient paper file format and obtain your version.

Find all of the file web templates you possess bought in the My Forms food list. You may get a further version of California Salaried Employee Appraisal Guidelines - Employee Specific anytime, if needed. Just click the needed form to obtain or produce the file format.

Use US Legal Forms, by far the most substantial collection of lawful varieties, to save some time and steer clear of blunders. The support provides expertly manufactured lawful file web templates which you can use for an array of reasons. Create a merchant account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Employers Cannot Prohibit Employees from Discussing Pay When employees are prohibited from inquiring about, disclosing, or discussing their compensation2026 compensation discrimination is much more difficult to discover2026and more likely to persist.

Salaried non-exempt employees cannot be paid less than the state minimum wage. Salaried non-exempt employees are also protected by California wage and hour lawsincluding overtime laws and laws requiring meal and rest breaks.

Pursuant to Labor Code section 432.3, an applicant may voluntarily disclose his or her salary history information to a prospective employer, as long as it is being done without prompting from the prospective employer.

Nonexempt salaried workers who work more than 40 hours a week also get overtime an employer cannot require them to work more than that without overtime pay.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

In 2015, Governor Jerry Brown signed the California Equal Pay Act, a piece of legislation determined to expand existing anti-discrimination laws in California workplaces. The Act prohibits employers from forbidding employees from discussing their wages or the wages of other employees.

Exempt employees may not be eligible for overtime or breaks. However, exempt employees must be paid at twice the minimum hourly wage based on a 40-hour workweek. As an exempt employee, an employer could require the employee to work more than 40-hours per week without overtime pay.

Salaried employees cannot have their pay deducted by their employer if they work less than 40 hours per week or the employee may be seen as nonexempt and entitled to overtime compensation when working more than 40 hours a week.