California Performance Evaluation for Nonexempt Employees

Description

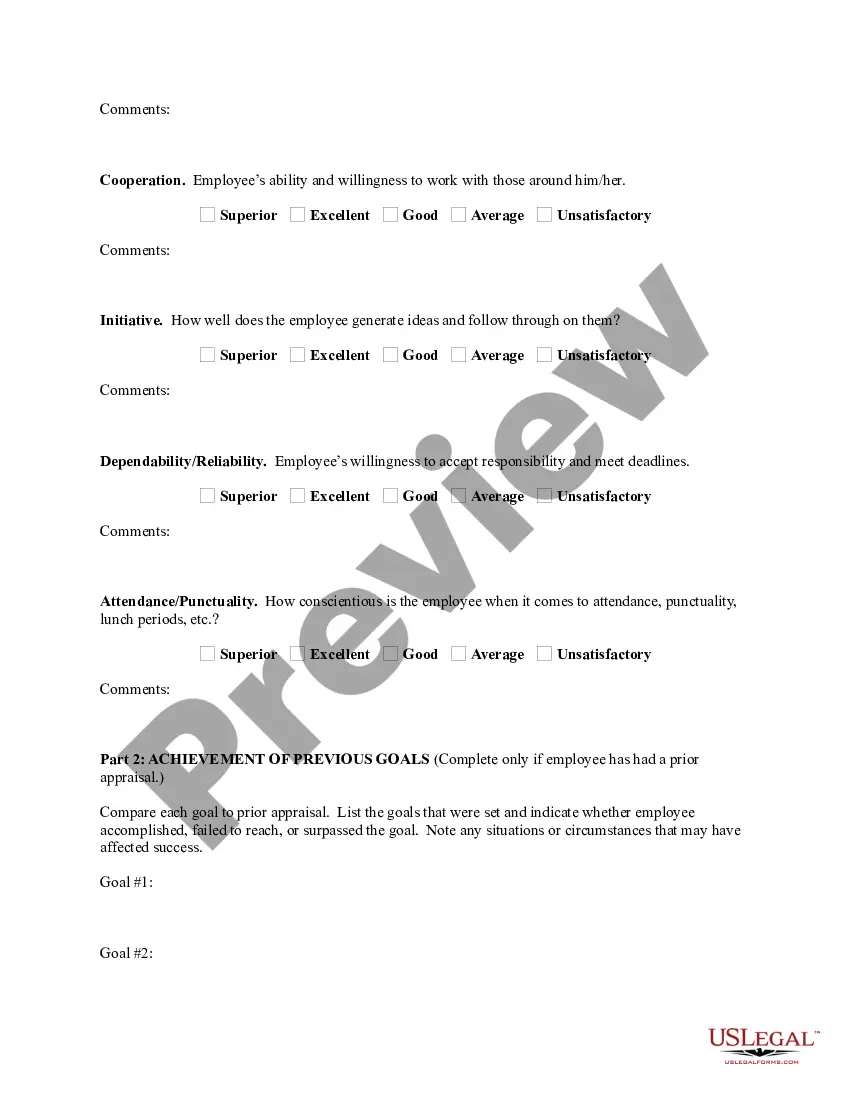

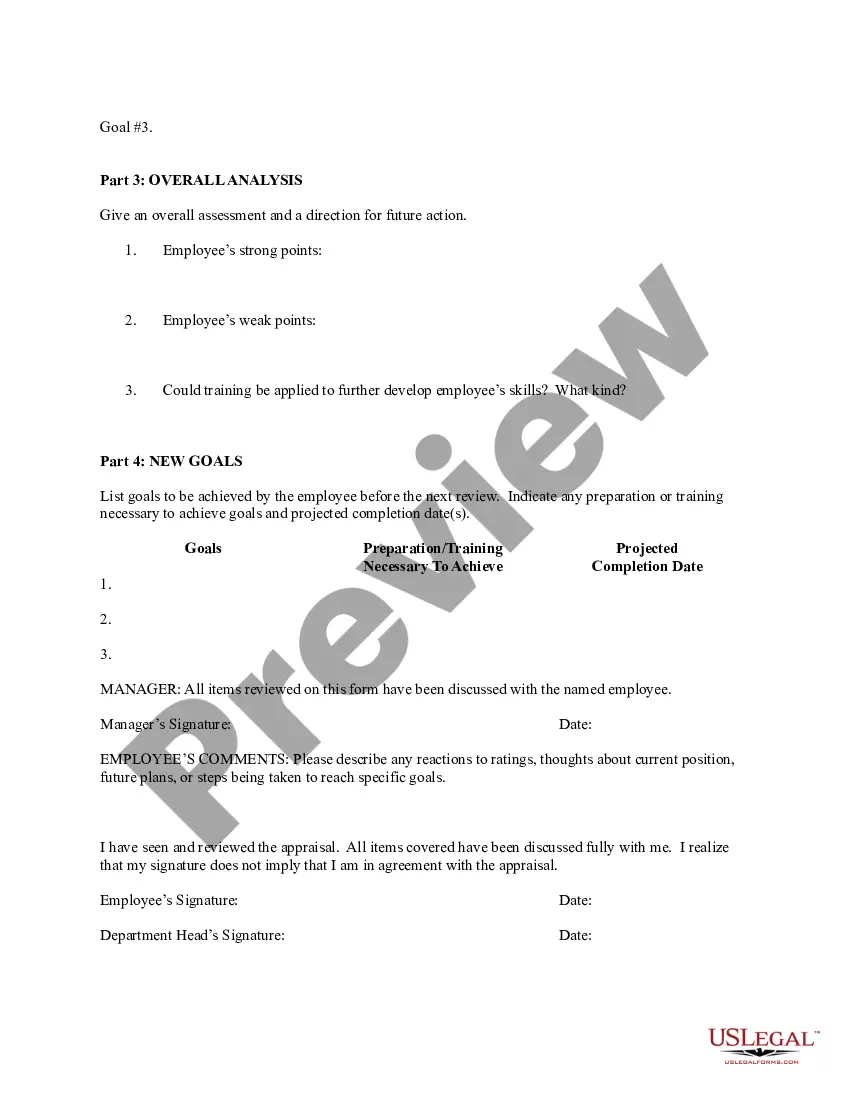

How to fill out Performance Evaluation For Nonexempt Employees?

Locating the appropriate authorized document template can be a challenge.

Of course, there are numerous designs accessible online, but how do you acquire the legal form you need.

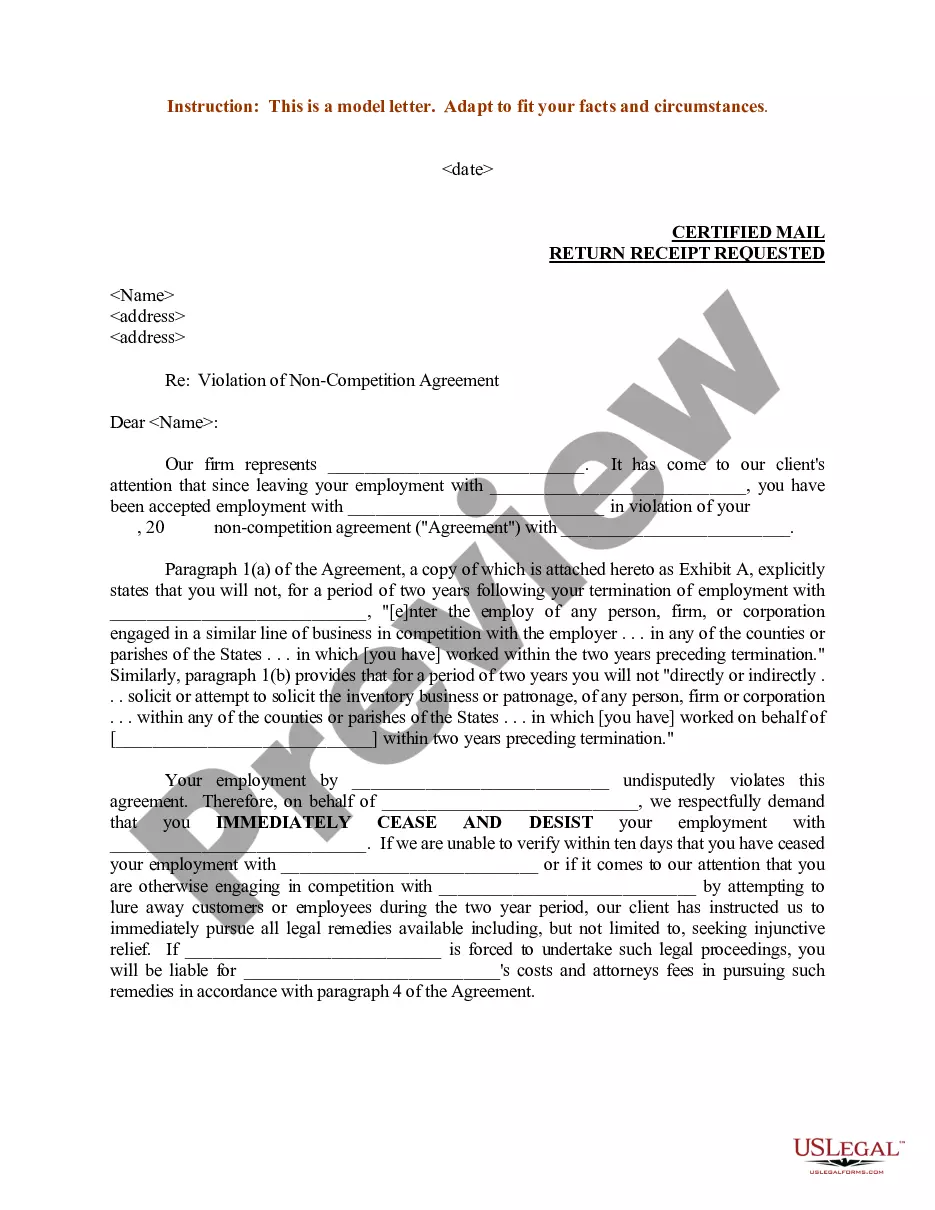

Utilize the US Legal Forms website. This service offers thousands of templates, including the California Performance Evaluation for Nonexempt Employees, which can be used for both business and personal purposes.

You can review the form using the Preview button and read the form description to ensure it is suitable for you.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already a registered user, Log In to your account and click on the Download button to obtain the California Performance Evaluation for Nonexempt Employees.

- Use your account to access the legal forms you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Exempt employees may not be eligible for overtime or breaks. However, exempt employees must be paid at twice the minimum hourly wage based on a 40-hour workweek. As an exempt employee, an employer could require the employee to work more than 40-hours per week without overtime pay.

Under California labor law, three requirements determine whether an employee is exempt or non-exempt: Minimum salary, White-collar duties, and. Independent judgment.

In California, non-exempt employees are ones who must be paid on a wage and hourly basis because their job duties do not fall within an overtime exemption.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Salaried non-exempt employees cannot be paid less than the state minimum wage. Salaried non-exempt employees are also protected by California wage and hour lawsincluding overtime laws and laws requiring meal and rest breaks.

Exempt employees are exempt from California overtime laws. This means that, if you are an exempt employee, your employer does not need to pay you time and a half if you work: more than eight hours in a workday, or. more than 40 hours in a workweek, or. otherwise work off the clock.

Salary Threshold The salary threshold in California is two times the state minimum wage. For 2021, this is $14 per hour X 2080 hours/year X 2 = $58,240. This means that any California employee earning less than $58,240 per year cannot be considered an exempt employee.

An employee who meets this test will be exempt from several rights, including: The right to 10-minute rest periods, The right to overtime compensation, and. The right to a minimum wage (provided, of course, that they met the minimum salary requirement).

In order to qualify as an exempt employee in California in 2021, an employee working for a company with 26 or more employees must earn $1,120 per week, or $58,240 annually; an employee working for a company with fewer than 26 employees must earn $1,040 per week, or $54,080 annually, exclusive of board, lodging, and

An exempt employee under California law may be paid on a salary basis, without overtime wages, without meal and rest periods, without certain record-keeping rights and without some of the other legal protections provided to workers who are nonexempt.