California Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

It is feasible to spend numerous hours online searching for the sanctioned document format that complies with the local and federal standards you require.

US Legal Forms offers thousands of official templates that can be examined by experts.

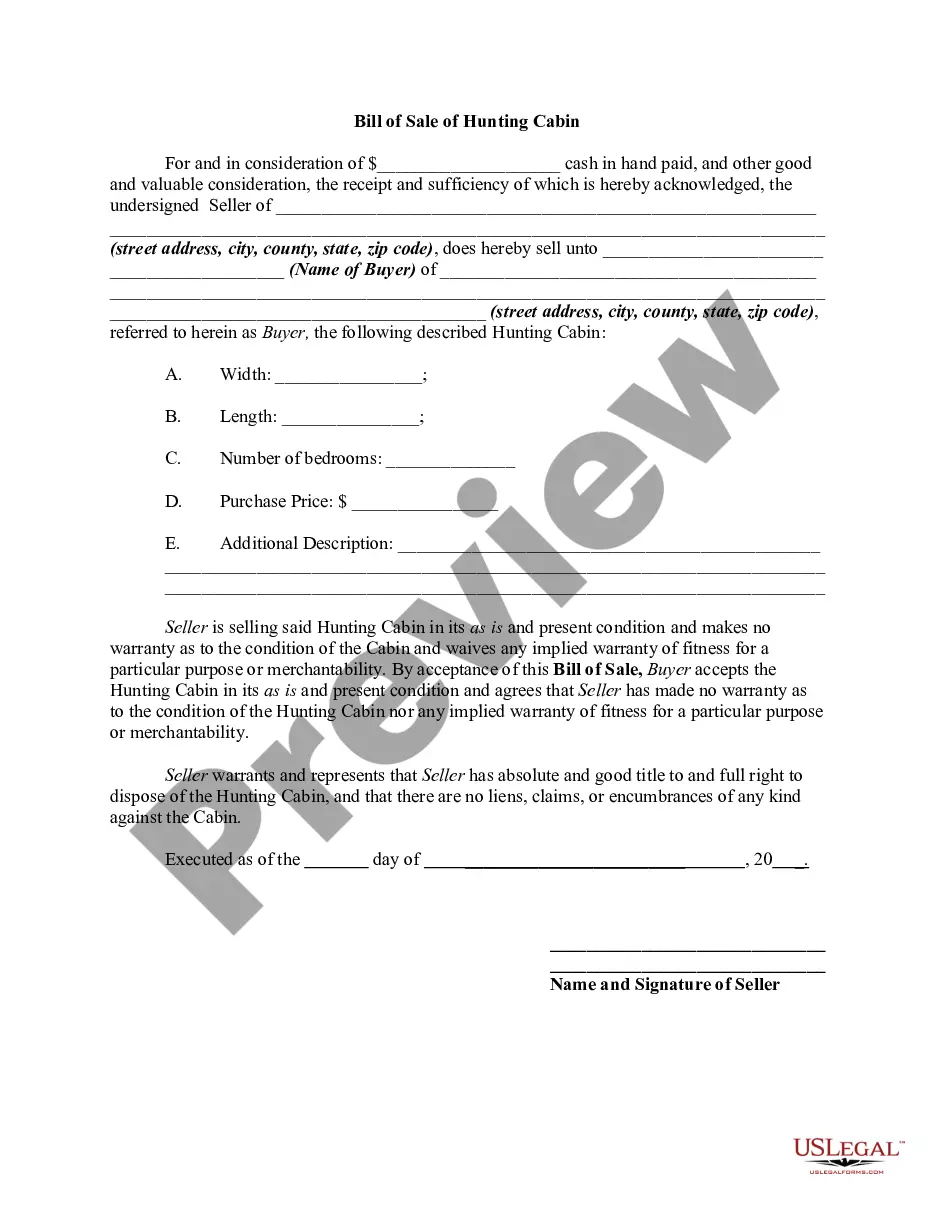

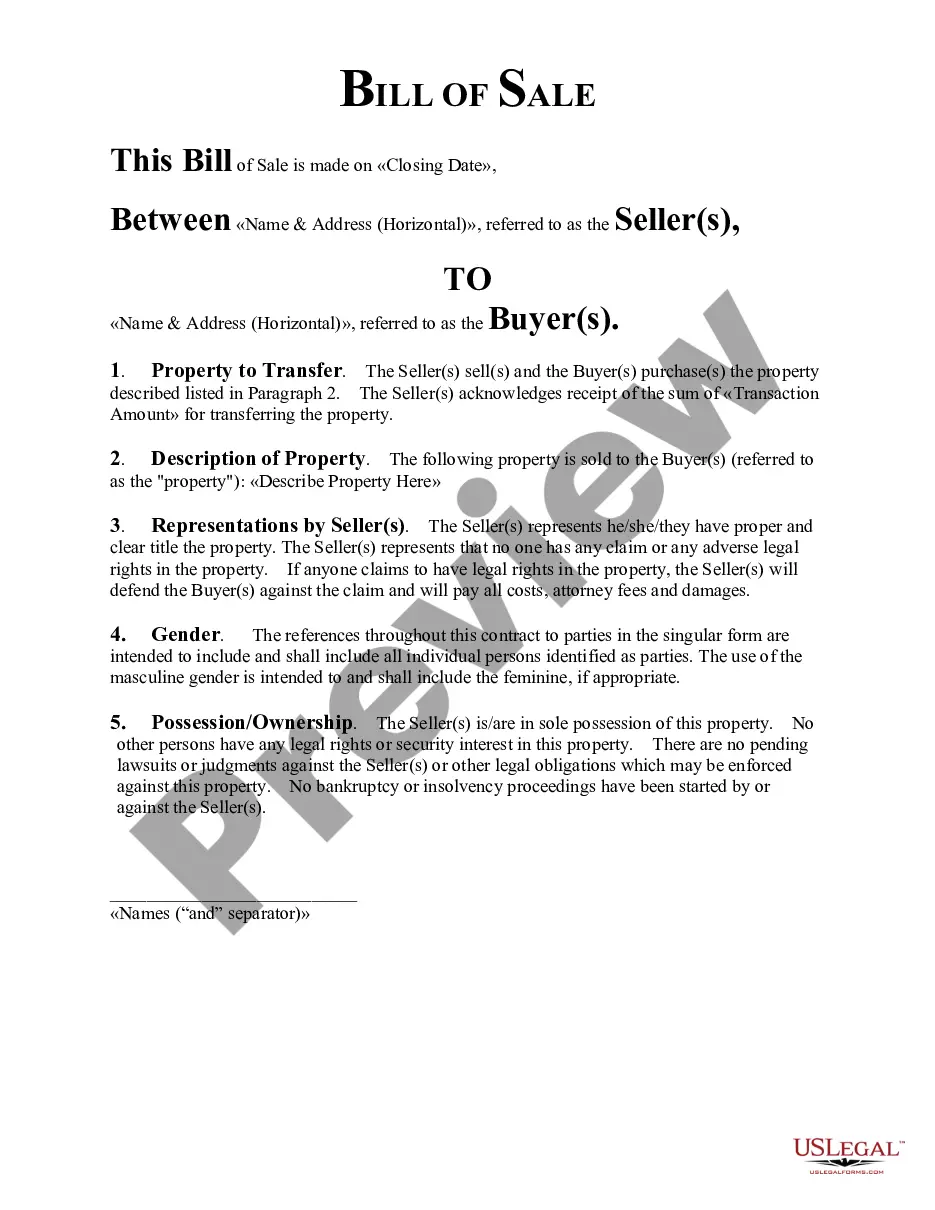

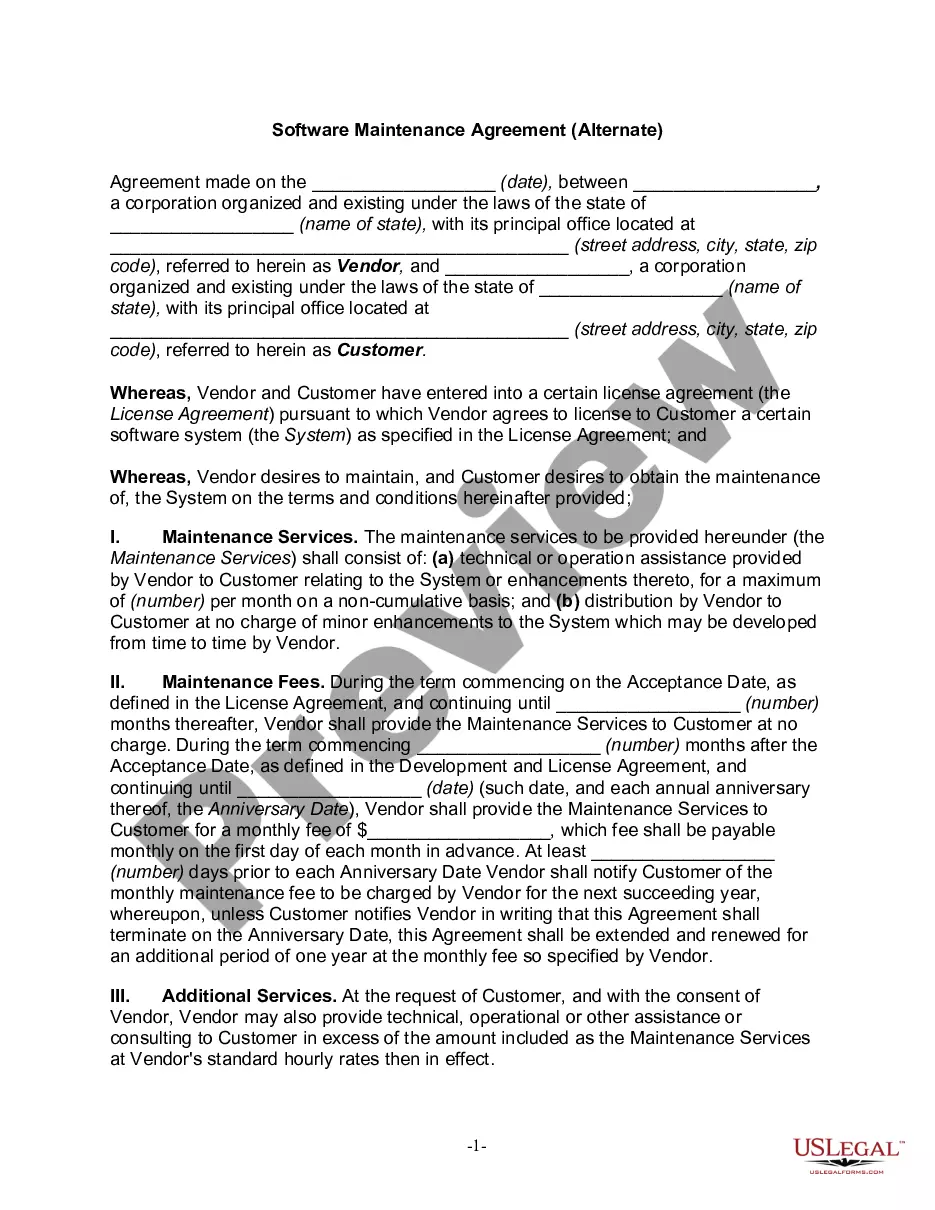

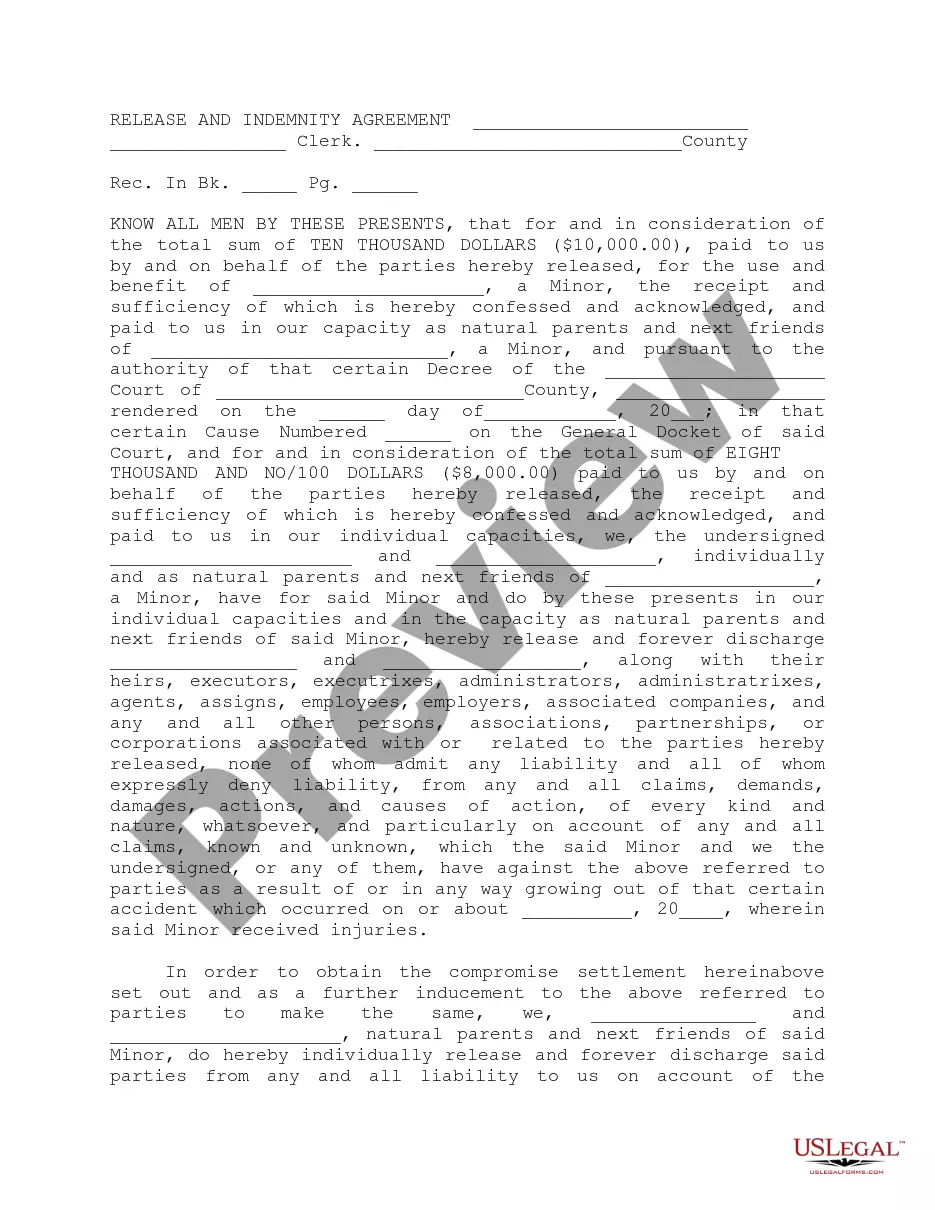

You can easily download or print the California Bill of Sale of Personal Property - Reservation of Life Estate in Seller from the service.

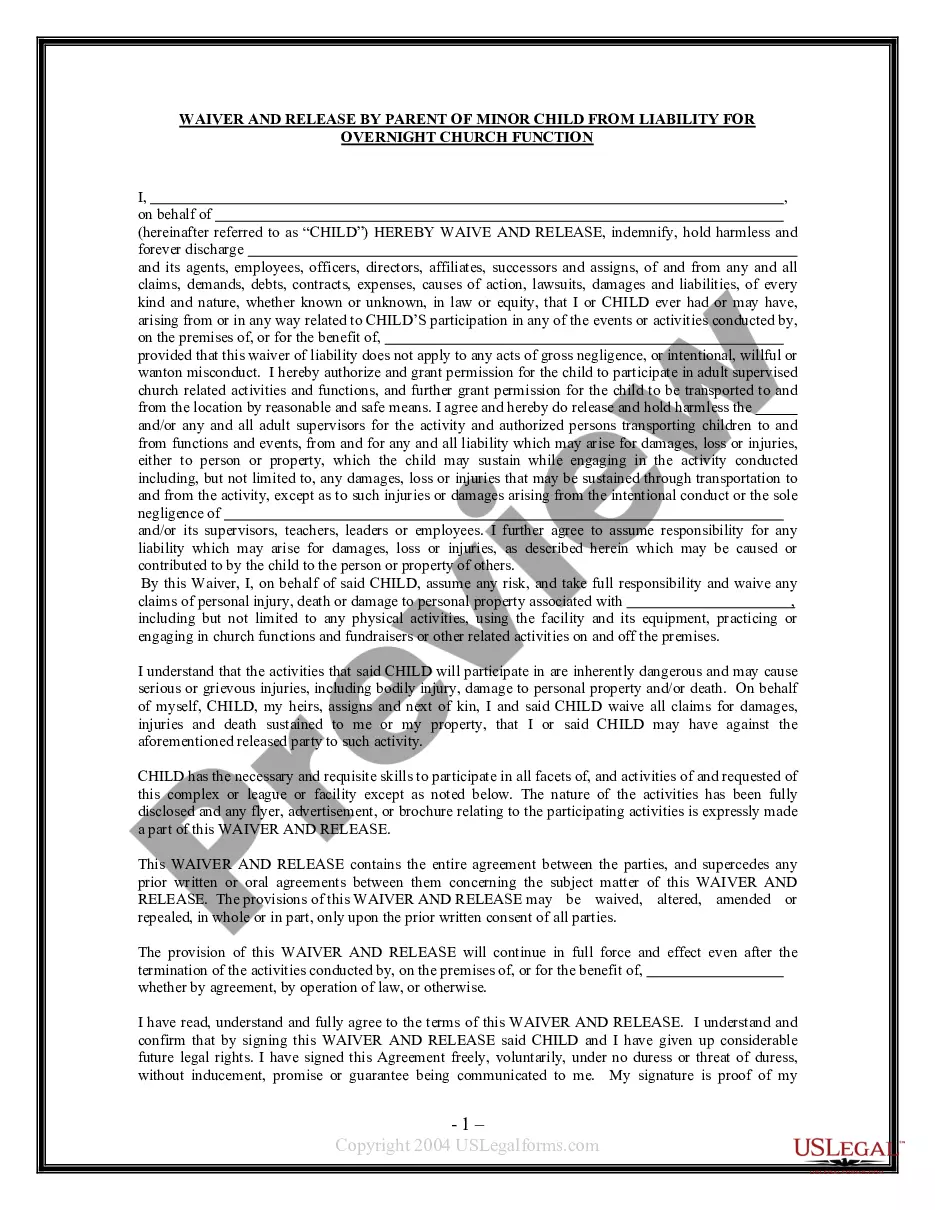

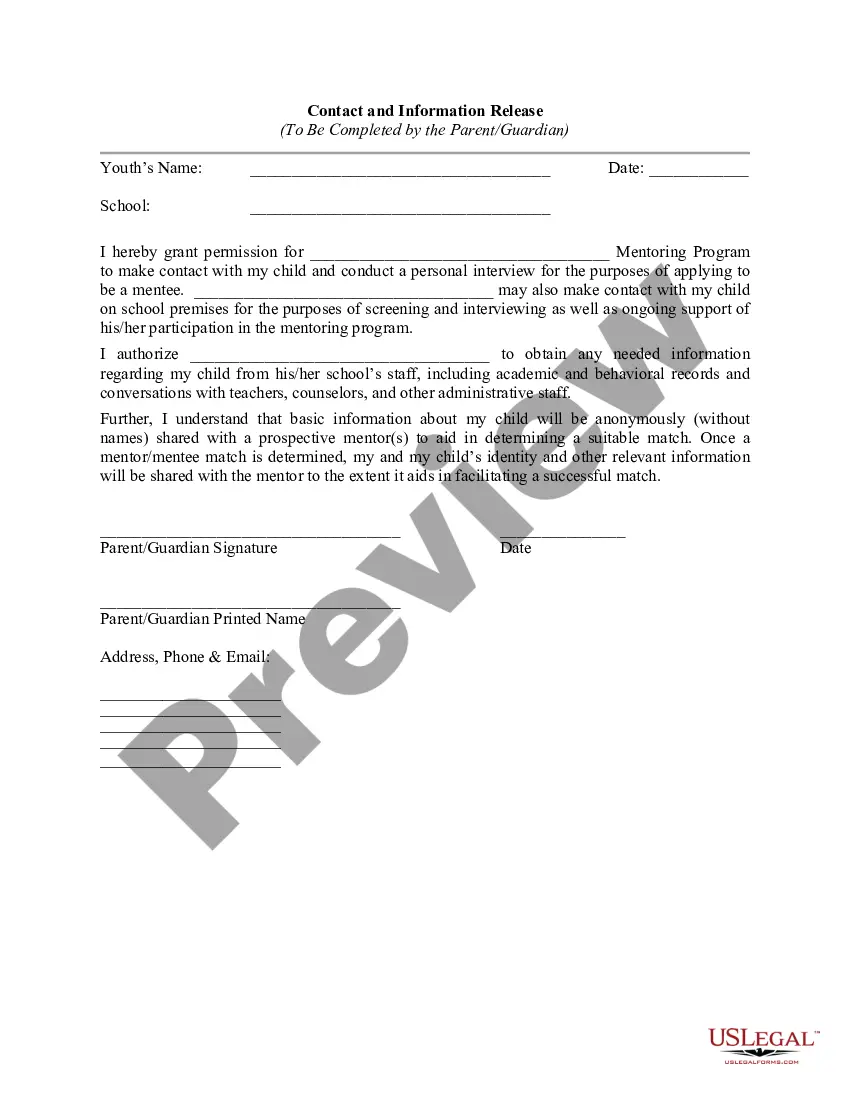

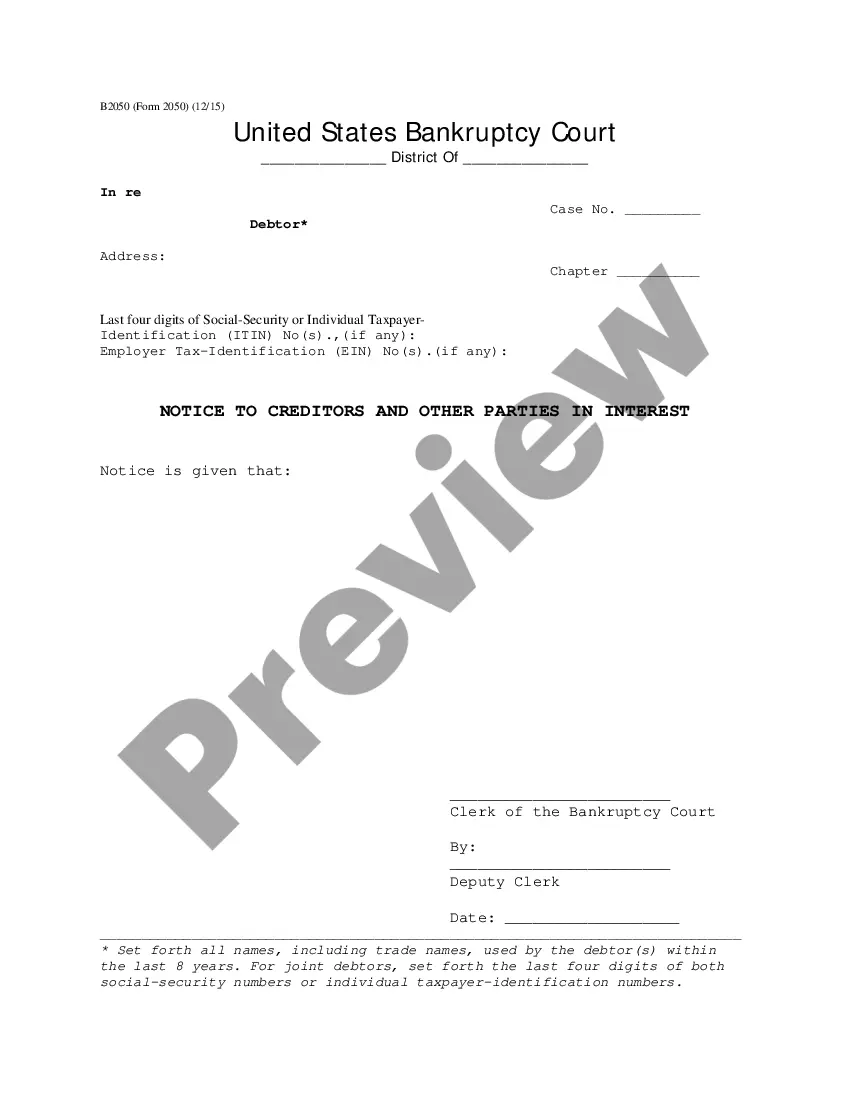

If available, utilize the Preview option to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you can complete, modify, print, or sign the California Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- Every official document template you buy is yours permanently.

- To retrieve another copy of a purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for your state/region.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Can Someone With a Life Estate Sell the Property? A life tenant cannot sell the property or take out a mortgage loan against it without the agreement of the remainderman. The reverse is also true: The remainderman cannot sell or mortgage the property during the lifetime of the life tenant.

Pur autre vie (per o-truh vee) is a French legal phrase which means for another's life. This phrase is durational in meaning as it is another's life, not that of the possessor, that is used to measure the amount of time someone has a right to possess real property.

An interest in land that lasts only as long as the life of a specific person. Life Estate Pur Autre Vie: A life estate that is measured by any life other than the life of the holder of the life estate.

Unless specially restricted, a life estate can be sold, leased or mortgaged. Because beneficial use of the property accompanies a life estate, the creation, transfer or termination of a life estate is a change of ownership under Proposition 13.

If the life estate is based on the life tenant's life, it is known as an ordinary life estate. Once the owner dies, the estate terminates. If the estate is based on a life other than the life tenant, it is known as a pur autre vie life estate, which means for another's life.

The legal term "pur autre vie" means "for the life of another" in French and when used in property law refers to a life estate that a grantor bestows on another person, known as a life tenant, who can hold and use an estate, often a family residence, during the life of third person.

The property belongs to you jointly and on the death of one spouse it automatically passes to the survivor. You cannot leave jointly owned property in your will. To create a life interest under your will you need to hold the property as tenants in common.

For example, if Bob is given use of the family house for as long as his mother lives, he has possession of the house pur autre vie.

A person with life interest generally (as we have not perused the Will) does not have the right to sell, transfer or alienate the property to the detriment of the absolute owner, which in your case is the son, i.e., you. It is a limited right to enjoy the property up to the death of the life holder.

A life estate pur autre vie is just like a regular life estate but it lasts as long as another persons life. Like the French's definition its for another's life, meaning again, the the life estate is for another person.