California Memorandum to Stop Direct Deposit

Description

How to fill out Memorandum To Stop Direct Deposit?

Selecting the appropriate authorized document template may be a challenge.

Certainly, there are numerous designs available online, but how do you find the official form you desire.

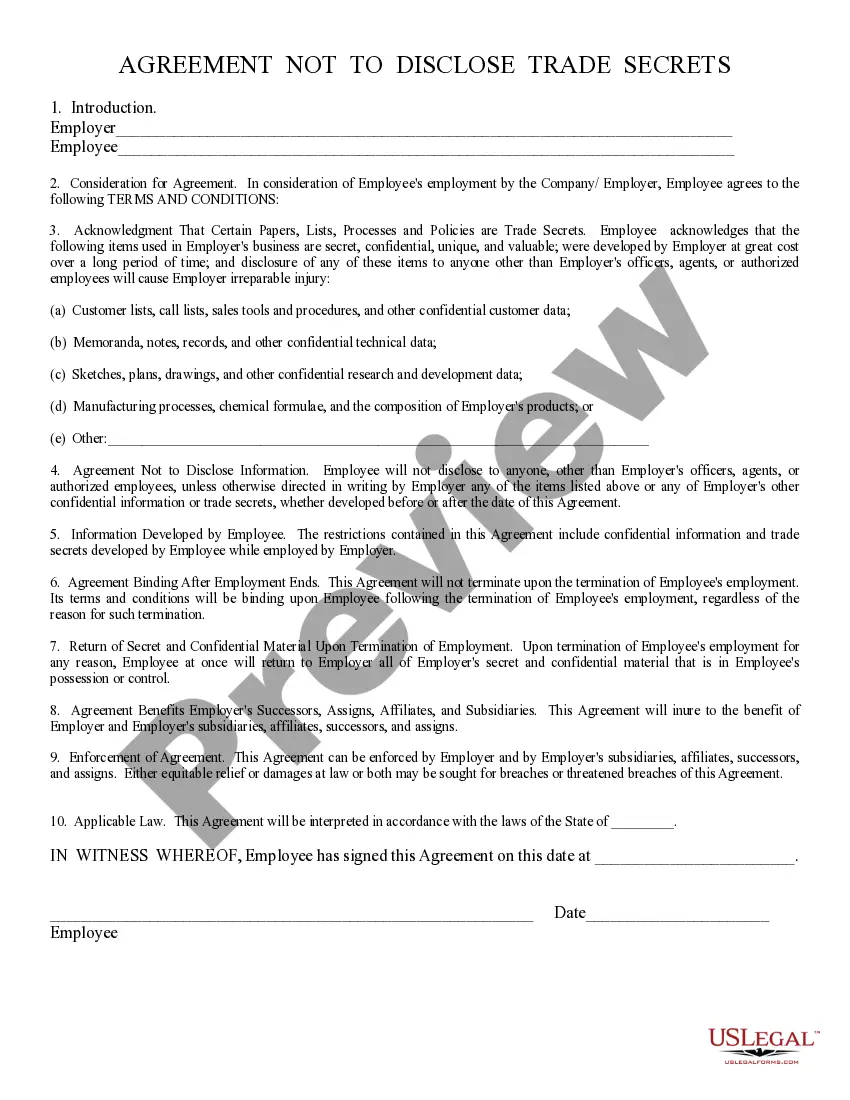

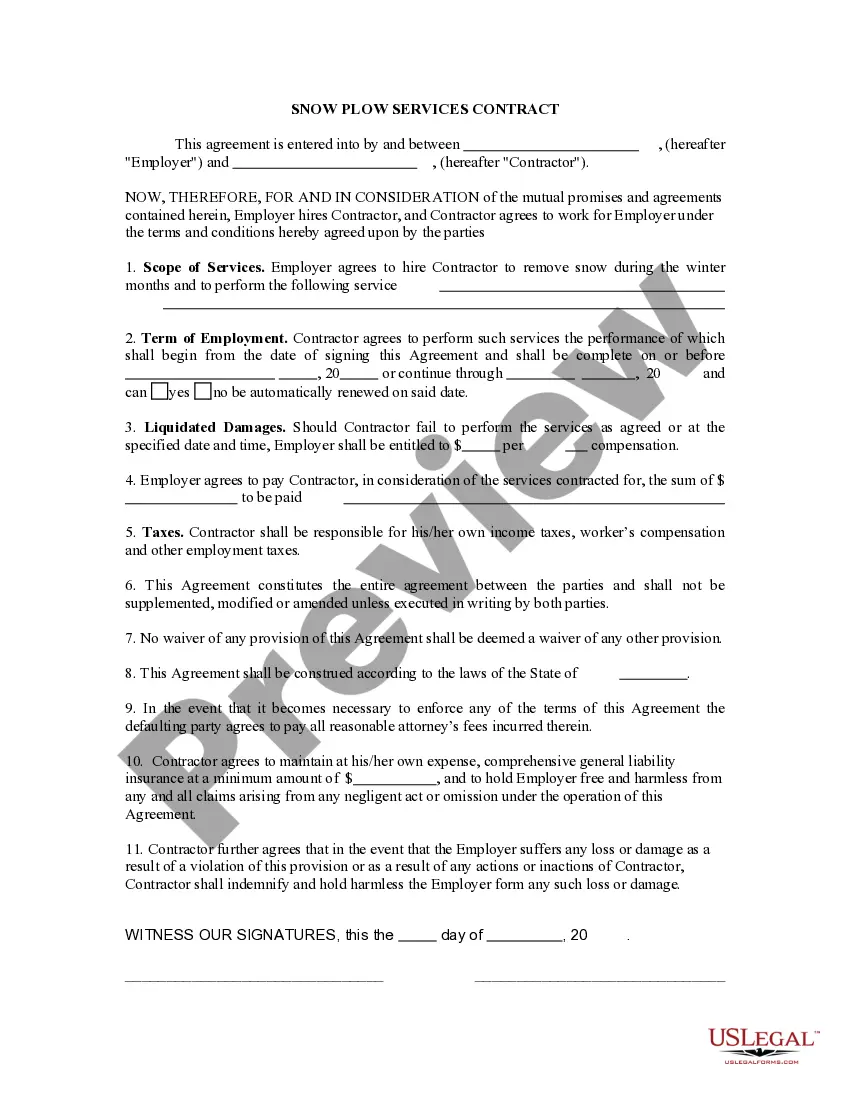

Utilize the US Legal Forms website. The service offers thousands of templates, such as the California Memorandum to Cease Direct Deposit, which can be utilized for both business and personal needs.

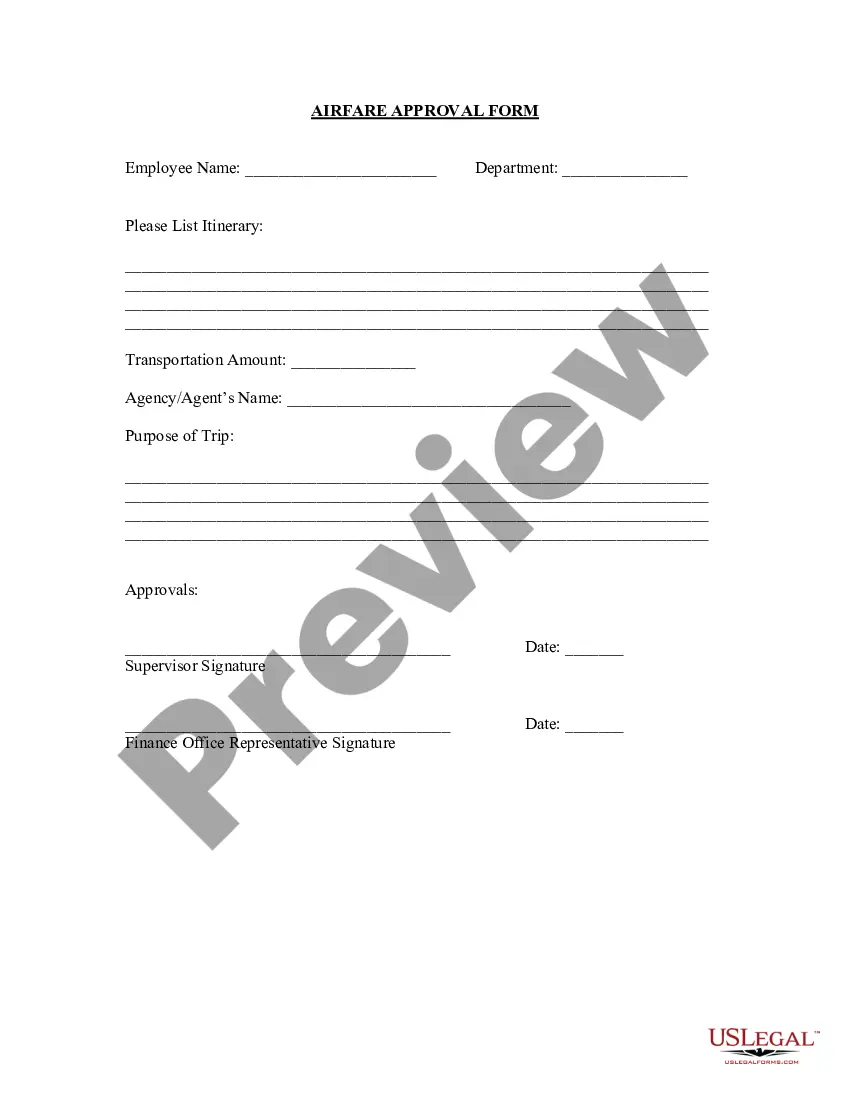

You can review the form using the Review button and read the form description to ensure it's suitable for you.

- All the forms are reviewed by experts and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the California Memorandum to Cease Direct Deposit.

- Use your account to browse the legal documents you may have purchased previously.

- Go to the My documents section of your account and retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct document for your city/state.

Form popularity

FAQ

Federal Law The Electronic Fund Transfer Act (EFTA), also known as federal Regulation E, permits employers to make direct deposit mandatory, as long as the employee is able to choose the bank that his or her wages will be deposited into.

You will receive a Direct Deposit Advice when payment is distributed on payday. You can review your paycheck by enrolling in the Cal Employee Connect portal. Direct deposit payments begin with a paycheck number of 05- through 09-.

Yes. The National Automated Clearinghouse Association (NACHA) guidelines say that an employer is permitted to reverse a direct deposit within five business days. Assuming there is no applicable state law that overrides this guideline, an employer must follow it.

Some states require agreement in writing before enrolling in direct deposit; some do not:Alaska.California.Connecticut.Colorado.Delaware.Florida.Idaho.Illinois.More items...?

If your employee is in a state where direct deposit reversals are restricted, such as California, the employee must either sign an approval for the reversal or they can pay you back manually with a personal check.

States that Allow Required Direct DepositIndiana, Kansas, Minnesota, Missouri, South Carolina, Texas, Virginia, Washington, and West Virginia allow employers to require direct deposit.

Direct Deposit Reversal If you have direct deposit, your employer can issue a reversal request to your bank, which then attempts to take the wages out of your account. The reversal must be for the full amount of the transaction that went into your account.

Sometimes when your direct deposit doesn't show up as planned, the reason is simply that it has just taken a few extra days to process. This might be due to holidays or because the request to transfer money accidentally went out after business hours. Give it at least 24 hours before you start worrying.

Yes. Pursuant to Labor Code Section 226(a), semimonthly or every time you are paid your wages, whether by check, in cash, or otherwise, you must be given a detachable part of the check or a separate writing showing required information.

Can an employer require direct deposit in California? Under California Labor Code section 213, employers cannot require an employee to receive payment of wages by direct deposit. A California employer can pay an employee by direct deposit only if the employee expressly consents.