California Triple-Net Office Lease of Commercial Building

Description

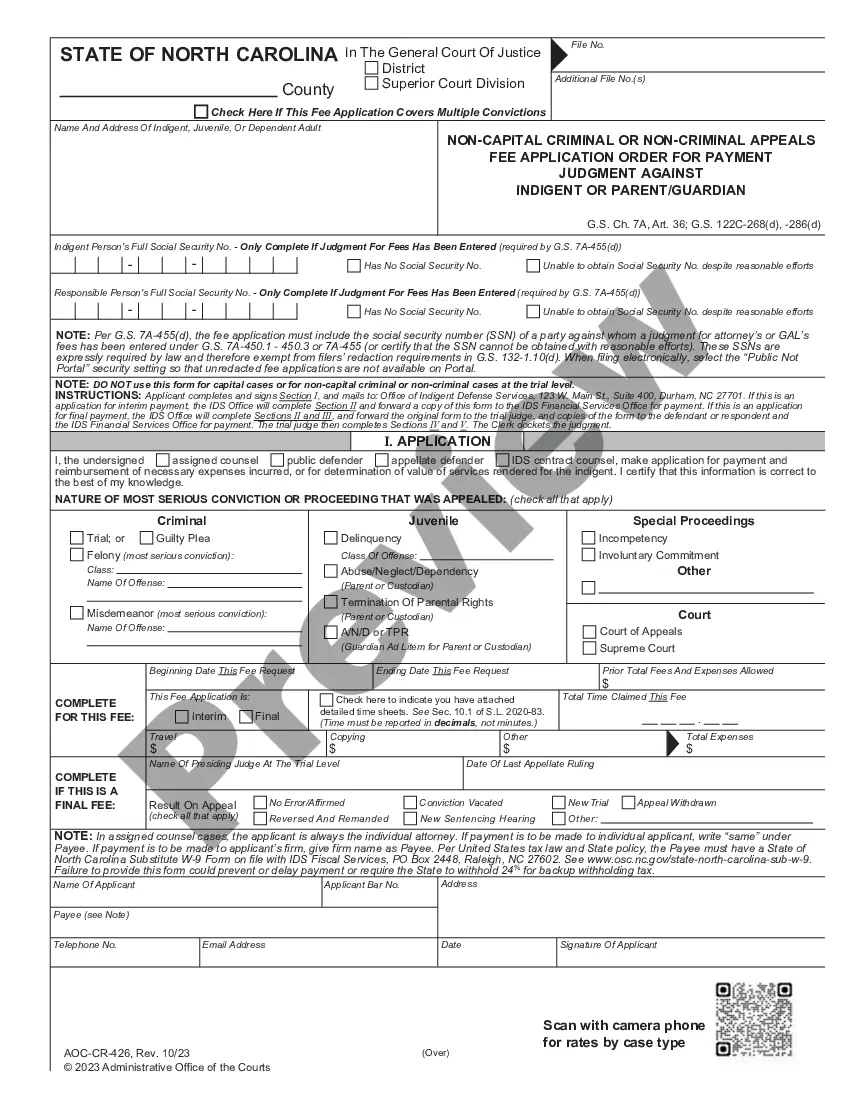

How to fill out Triple-Net Office Lease Of Commercial Building?

Are you in a place that you need documents for either business or individual reasons almost every time? There are a variety of legitimate document templates available on the Internet, but locating kinds you can rely on isn`t effortless. US Legal Forms provides a large number of type templates, just like the California Triple-Net Office Lease of Commercial Building, which are composed to satisfy state and federal needs.

Should you be presently familiar with US Legal Forms web site and have your account, basically log in. Following that, you may down load the California Triple-Net Office Lease of Commercial Building design.

Should you not have an profile and want to start using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for the proper city/area.

- Take advantage of the Review option to examine the form.

- See the information to ensure that you have chosen the correct type.

- In case the type isn`t what you are searching for, take advantage of the Look for field to obtain the type that suits you and needs.

- Whenever you obtain the proper type, simply click Purchase now.

- Opt for the prices prepare you need, fill out the desired information and facts to create your money, and pay for the transaction using your PayPal or credit card.

- Choose a hassle-free document file format and down load your duplicate.

Locate all the document templates you have purchased in the My Forms menu. You can obtain a more duplicate of California Triple-Net Office Lease of Commercial Building at any time, if necessary. Just click on the essential type to down load or print out the document design.

Use US Legal Forms, one of the most extensive collection of legitimate types, to conserve efforts and steer clear of faults. The support provides appropriately created legitimate document templates that can be used for a range of reasons. Produce your account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Landlords typically cover major structural repairs, property taxes, insurance costs, and common area maintenance. However, it's important to carefully negotiate lease terms and consider potential risks and expenses associated with triple net leases.

Triple net leases, though popular in commercial real estate, aren't without a few drawbacks. The main concern for a tenant is the higher monthly costs as opposed to those in double or single net lease structures.

How to calculate a triple net lease. For a triple net lease, the lessee must pay the base rent, property taxes, insurance, and common area maintenance (CAM) expenses. These charges are often lumped into one estimated annual rate that the lessee is required to pay.

With a triple net lease (NNN), the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities. Triple net leases are commonly found in commercial real estate.

Triple nets are typically calculated by projecting the total amount of expenses for the coming year, dividing it by the total rentable square footage of the building, and then dividing that by 12. This calculation gives you a monthly dollar-per-square-foot amount to charge each tenant.

NNN ? Triple Net ?This type of lease rate includes the base rental rate plus the three N's. One ?N? stands for property taxes, one for property insurance, and the final ?N? stands for common area maintenance (CAMs).

The triple net (NNN) lease is a lease agreement structure where the tenant pays all of the operating expenses for the property. Therefore, they handle building insurance, property insurance, and real estate taxes on top of paying rent.

NNN leases are computed by multiplying the total annual property taxes and insurance for the area by the entire rental square footage of the building. When a whole building is leased to one tenant, the procedure of computing a triple net lease is simpler.