California Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

Are you currently in a circumstance where you require documents for both business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers thousands of form templates, like the California Triple Net Lease for Commercial Real Estate, designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Choose your desired pricing plan, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Triple Net Lease for Commercial Real Estate template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Get the form you need and ensure it is for the correct jurisdiction/county.

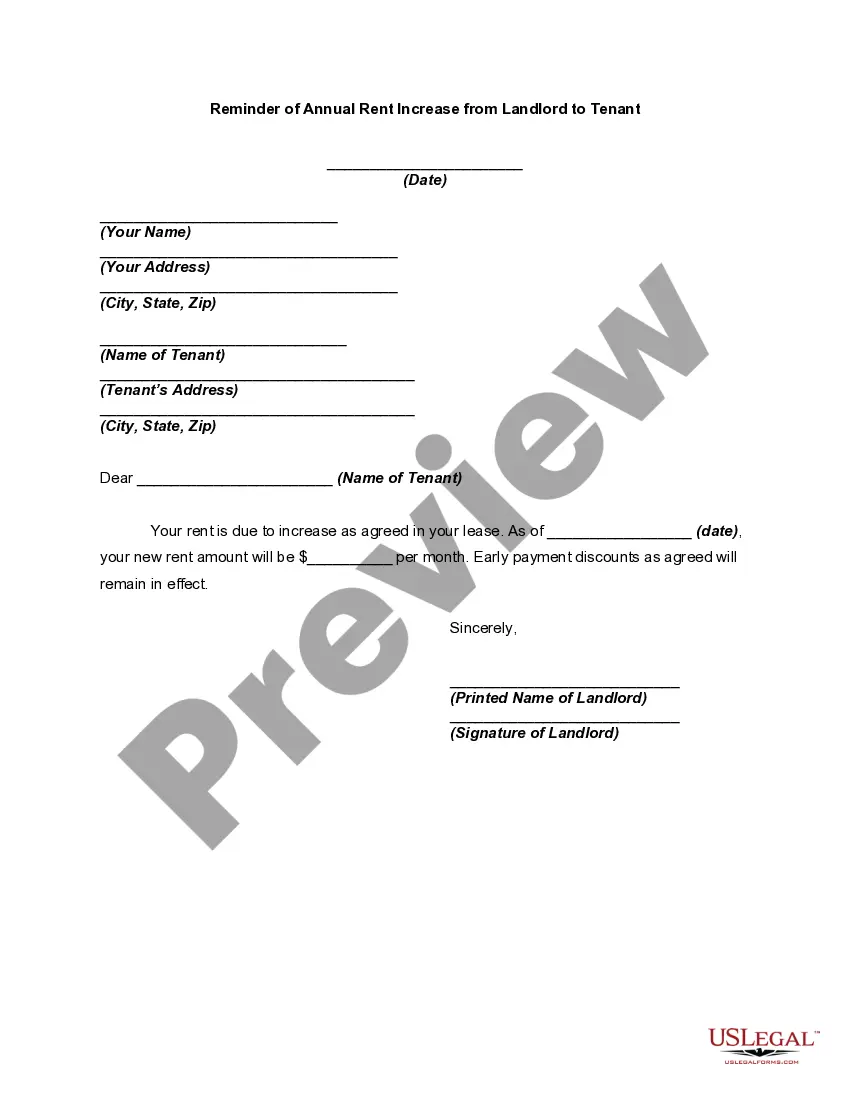

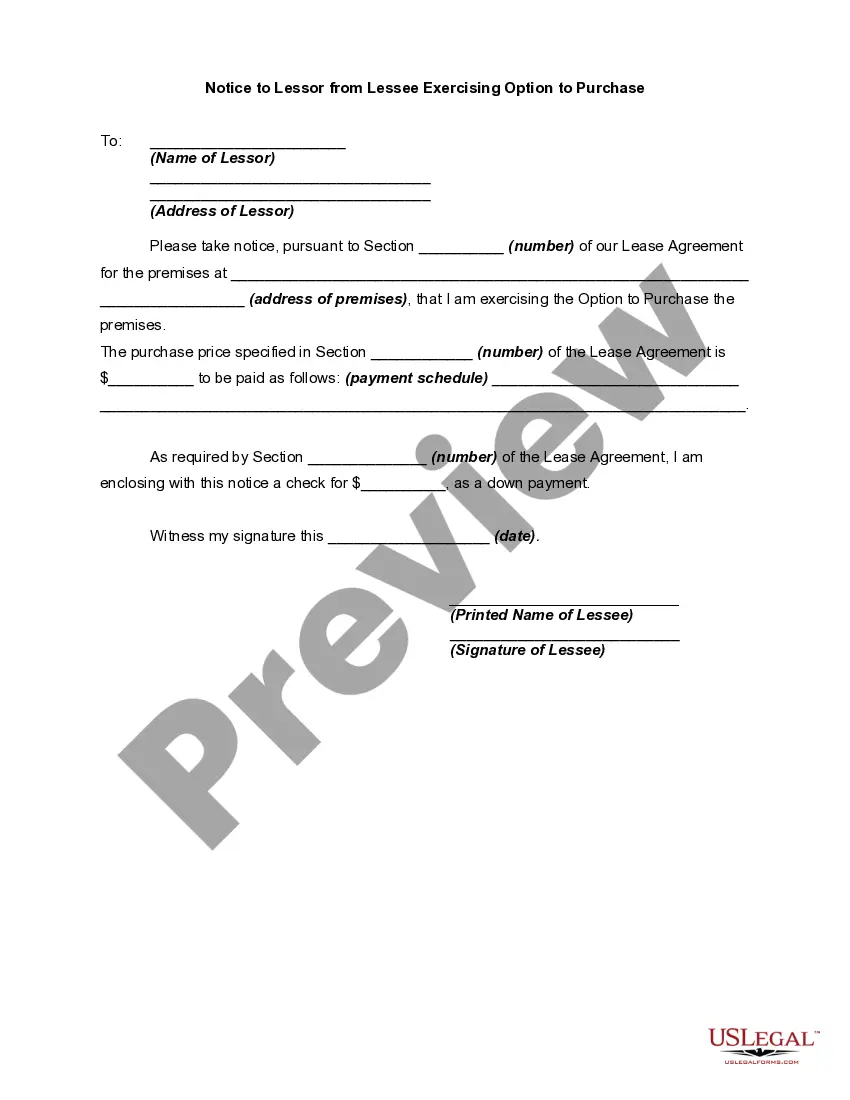

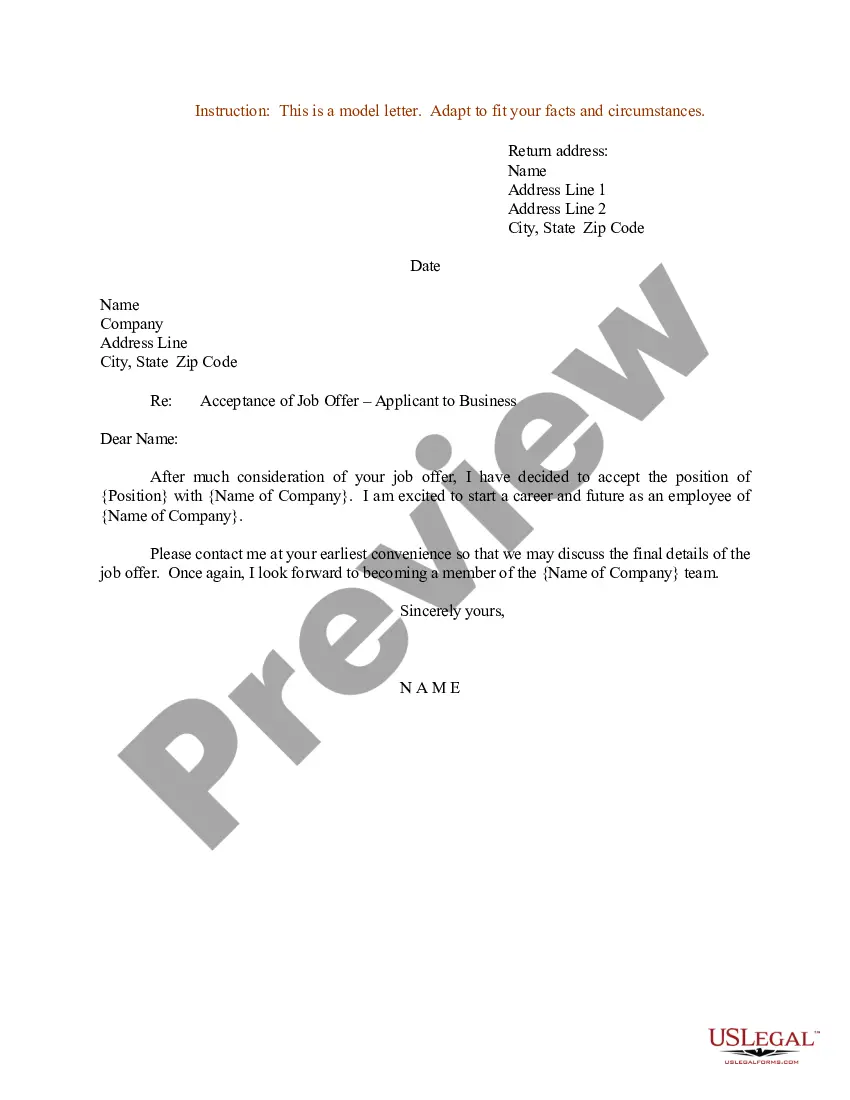

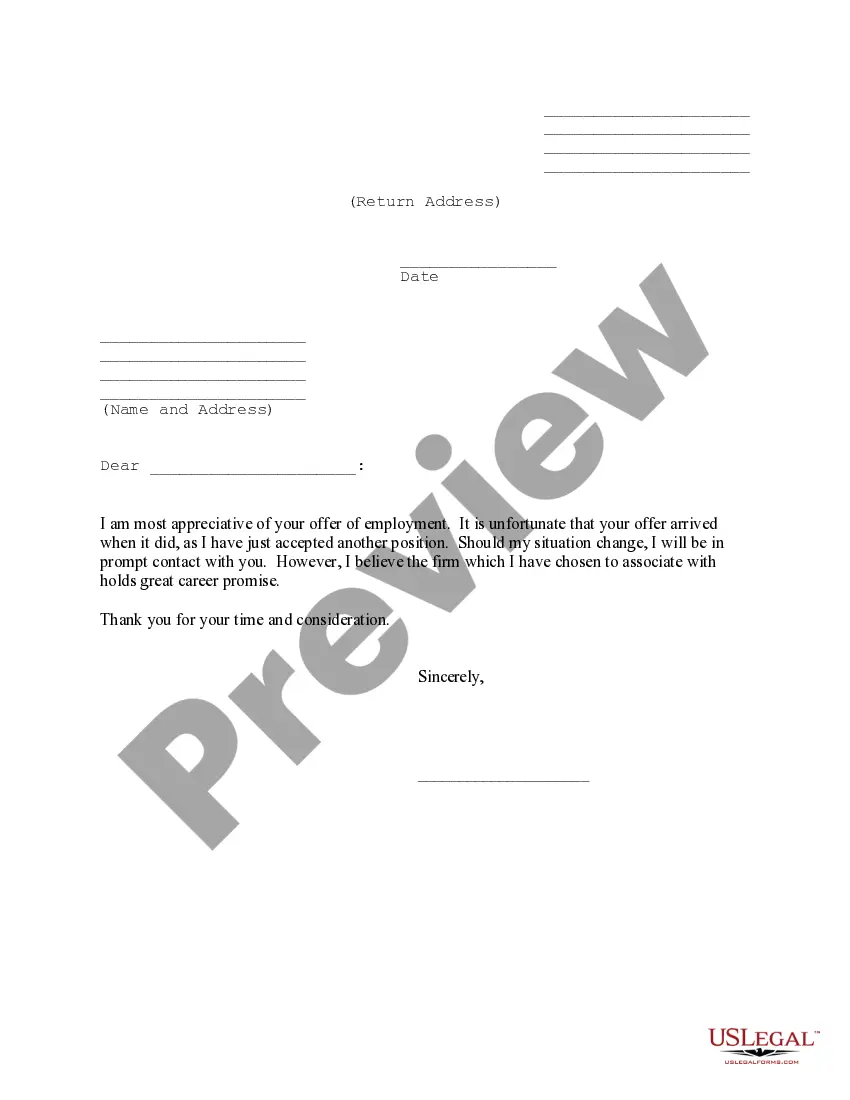

- Use the Preview option to review the form.

- Check the information to make sure you have selected the right form.

- If the form isn’t what you are looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

Structuring a California Triple Net Lease for Commercial Real Estate involves detailing responsibilities for rent, property taxes, insurance, and maintenance in a lease agreement. Clearly outlining each party’s obligations avoids misunderstandings later on. Working with uslegalforms can streamline this process, providing templates and guidance tailored to your specific needs.

Calculating commercial net involves understanding all expenses related to the property, divided by the rental income. In a California Triple Net Lease for Commercial Real Estate, these costs may include taxes, insurance, and maintenance fees. Properly calculating these figures allows you to determine the net profit or loss from the investment, ensuring informed decision-making.

$24.00 sf yr refers to an annual rent of $24 per square foot for a commercial space. In the context of a California Triple Net Lease for Commercial Real Estate, this means the tenant understands they are responsible for additional expenses such as property taxes and insurance on top of the base rent. Clarifying these terms ensures both parties are on the same page regarding costs.

To calculate commercial rent under a California Triple Net Lease for Commercial Real Estate, start with the base rent per square foot, then add estimates for property taxes, insurance, and maintenance costs. It’s essential to negotiate these additional costs upfront, as they can significantly affect the total monthly expense. Using a reliable resource like uslegalforms can help you navigate these calculations effectively.

The Tenant Protection Act, or AB 1482, is designed to protect residential tenants and does not extend its provisions to commercial properties. This means that commercial landlords and tenants can negotiate terms freely without the constraints imposed by this residential law. Therefore, if you are considering a California Triple Net Lease for Commercial Real Estate, this act will not influence your leasing negotiations.

To get approved for a triple net (NNN) lease, you will need to demonstrate a solid financial standing. Landlords typically look for tenants with a reliable credit history, stable income, and relevant business experience. Using platforms like US Legal Forms can help streamline the process, providing the necessary leasing documents and legal guidance you may need for a California Triple Net Lease for Commercial Real Estate.

AB 1482, also known as the Tenant Protection Act of 2019, primarily addresses residential rental agreements. This law places limits on rent increases for many residential properties but does not apply to commercial real estate. Thus, if you are exploring a California Triple Net Lease for Commercial Real Estate, AB 1482 will not impact your leasing terms.

As of now, California does not have statewide commercial rent control laws. Local municipalities may have specific regulations, but overall, the market for commercial properties operates with less restriction. Therefore, when pursuing a California Triple Net Lease for Commercial Real Estate, you enjoy greater freedom and responsiveness to market conditions.

California rent control laws generally do not apply to commercial properties. These laws focus more on residential units, leaving commercial landlords and tenants to negotiate lease terms independently. Thus, when engaging in a California Triple Net Lease for Commercial Real Estate, rent control regulations typically do not influence your agreements, allowing for more flexibility in terms.

Yes, many commercial leases are structured as triple net leases, also known as NNN leases. In a triple net lease, tenants are responsible for paying property taxes, insurance, and maintenance costs in addition to their rent. This arrangement benefits both landlords and tenants, especially in the context of a California Triple Net Lease for Commercial Real Estate, as it ensures a more predictable income stream for property owners.