California Assignment of Equipment Lease by Dealer to Manufacturer

Description

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

Finding the appropriate legal document template can be challenging. Admittedly, there are numerous templates accessible online, but how can you acquire the legal form you need? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the California Assignment of Equipment Lease from Dealer to Manufacturer, suitable for both business and personal purposes. All forms are verified by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to obtain the California Assignment of Equipment Lease from Dealer to Manufacturer. Use your account to browse the legal forms you have ordered previously. Go to the My documents tab in your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired California Assignment of Equipment Lease from Dealer to Manufacturer. US Legal Forms is the largest repository of legal forms where you can find various document templates. Leverage the service to obtain professionally crafted documents that comply with state guidelines.

- First, ensure you have selected the appropriate form for your city/region.

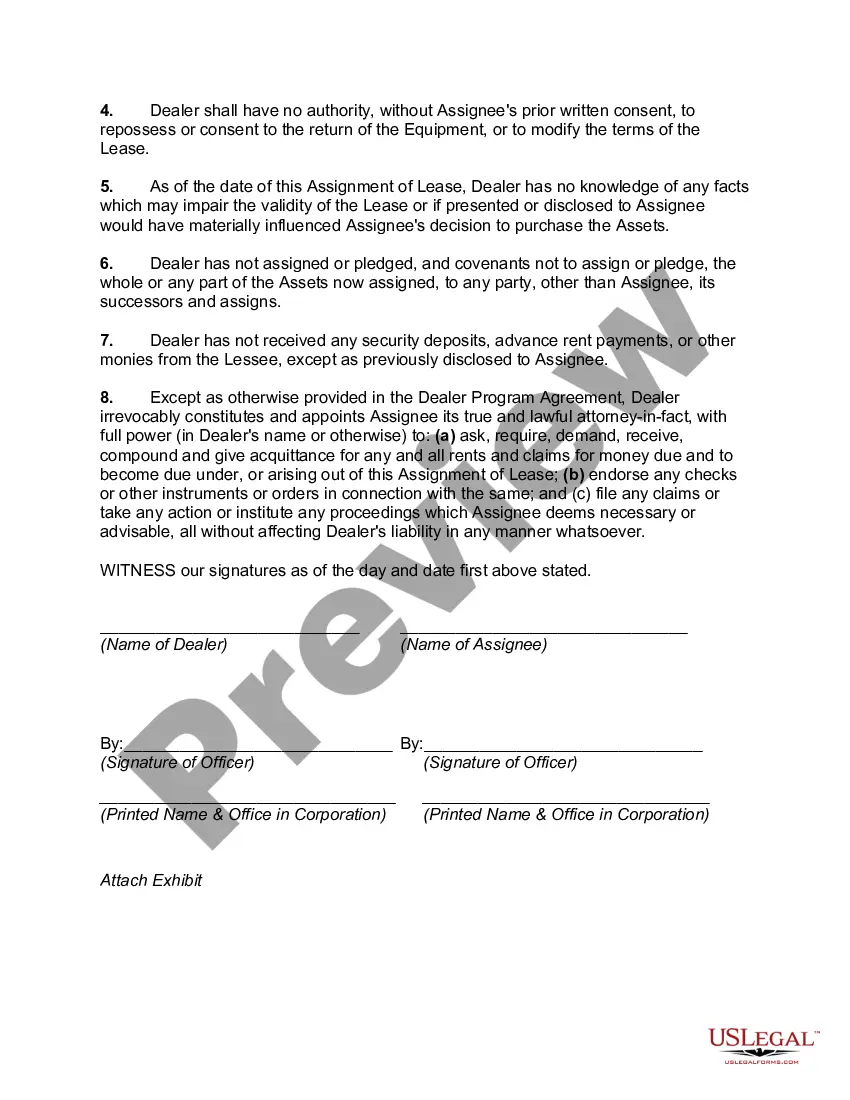

- You can preview the document using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not satisfy your requirements, utilize the Search field to find the correct document.

- Once you are confident that the form is appropriate, click the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and process the payment using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

Getting out of an equipment lease usually involves checking your lease agreement for early termination options or negotiating with your dealer for an exit strategy. Another potential solution includes assigning the lease to another party, provided this is allowed under your California Assignment of Equipment Lease by Dealer to Manufacturer. Always ensure you comply with all legal obligations to avoid penalties.

To record an equipment lease in accounting, you need to identify whether the lease is an operating lease or a capital lease. For an operating lease, record lease payments as an expense on your income statement. In contrast, a capital lease requires you to recognize the asset and the liability on your balance sheet. The California Assignment of Equipment Lease by Dealer to Manufacturer outlines these processes clearly.

Leasing works like a rental agreement. You pay the equipment's owner a set fee every agreed period and you can use the asset as though it was your own. Under a lease, nobody else can use the equipment without your permission and for all intents and purposes, it's as though you own the piece of equipment.

Overview. California's sales tax generally applies to the sale of merchandise, including vehicles, in the state. California's use tax applies to the use, storage, or other consumption of those same kinds of items in the state.

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

In addition to the California sales tax exemption for manufacturing, this exemption also extends to purchases of machinery and equipment used in research and development (R&D).

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan. This document is usually attached to a mortgage loan agreement.

California generally does charge sales tax on the rental or lease of tangible personal property unless a specific exemption applies. As a lessor, you may have the option to pay sales tax up-front on the asset purchase, rather than charge your lessees sales tax.

Entities (including consumers) in California are taxed on their purchases or consumption of various physical products, such as cleaning supplies, clothing, school supplies, and so on. However, they don't pay taxes for using the services of a lawyer, a dentist, or a plumber.

Because they are both a form of lease, they have one thing in common. That is, the owner of the equipment (the lessor) provides to the user (the lessee) the authority to use the equipment and then returns it at the end of a set period.