California Contract with Independent Contractor with Provisions for Termination with and without Cause, Confidential Information, and Right to Independent Contractor's Work Product and Inventions

Description

How to fill out Contract With Independent Contractor With Provisions For Termination With And Without Cause, Confidential Information, And Right To Independent Contractor's Work Product And Inventions?

Have you ever been in a situation where you need documents for business or personal reasons every day.

There are numerous authentic document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of document templates, including the California Contract with Independent Contractor containing Provisions for Termination with and without Cause, Confidential Information, and the Right to Independent Contractor’s Work Product and Inventions, designed to comply with state and federal regulations.

Once you identify the right document, click on Acquire now.

Select the payment plan you desire, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Contract with Independent Contractor that includes Provisions for Termination with and without Cause, Confidential Information, and the Right to Independent Contractor’s Work Product and Inventions template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is appropriate for your city/state.

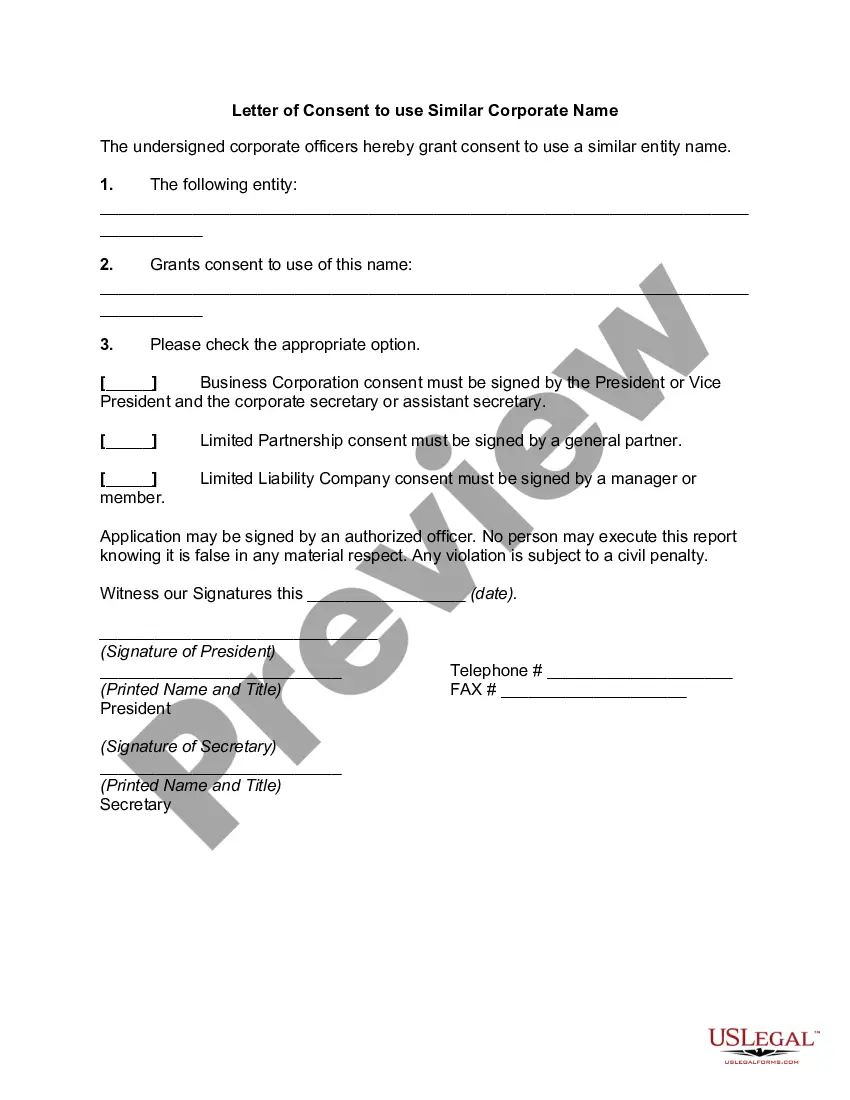

- Utilize the Review button to examine the document.

- Check the details to confirm you have selected the correct document.

- If the document is not what you are looking for, use the Lookup field to find the document that meets your needs.

Form popularity

FAQ

Nelson. Share: ERISA-governed plans define the participants who are eligible to participate in the benefits they provide. Whether a worker is classified as an employee or a contractor is often determinative of eligibility.

To know how to get out of a contract with a contractor, you must go through the terms of the contract and review the wording of the cancellation policy. All contracts should include the "Notice of Right to Cancel Policy."...Notice of Right to CancelContractor's legal name.Type of work required.Payment rate and terms.

For example, some districts hold that the hired to invent doctrine can never apply to independent contractors while other courts will look less to the legal status of the employee and more to the circumstances surrounding the employment in determining whether an employee was hired to invent.

ERISA-governed plans define the participants who are eligible to participate in the benefits they provide. Whether a worker is classified as an employee or a contractor is often determinative of eligibility.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

It is even possible that a worker can be considered an independent contractor for purposes of IRS tax filing, but they are considered an employee under California's wage and hours laws.

Under Labor Code section 226.8, which prohibits the willful misclassification of individuals as independent contractors, there are civil penalties of between $5,000 and $25,000 per violation. Willful misclassification is defined as voluntarily and knowingly misclassifying an employee as an independent contractor.

The new law was effective on January 1, 2020. AB 5 requires companies to reclassify independent contractors as employees with a few exceptions to the rule. The bill was designed to increase regulation over companies that hire gig workers in large numbers, including DoorDash, Shipt, Postmates, Uber, and Lyft.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Labor Code sections 2870-2872 govern assignments of inventions to employers by employees but not independent contractors.