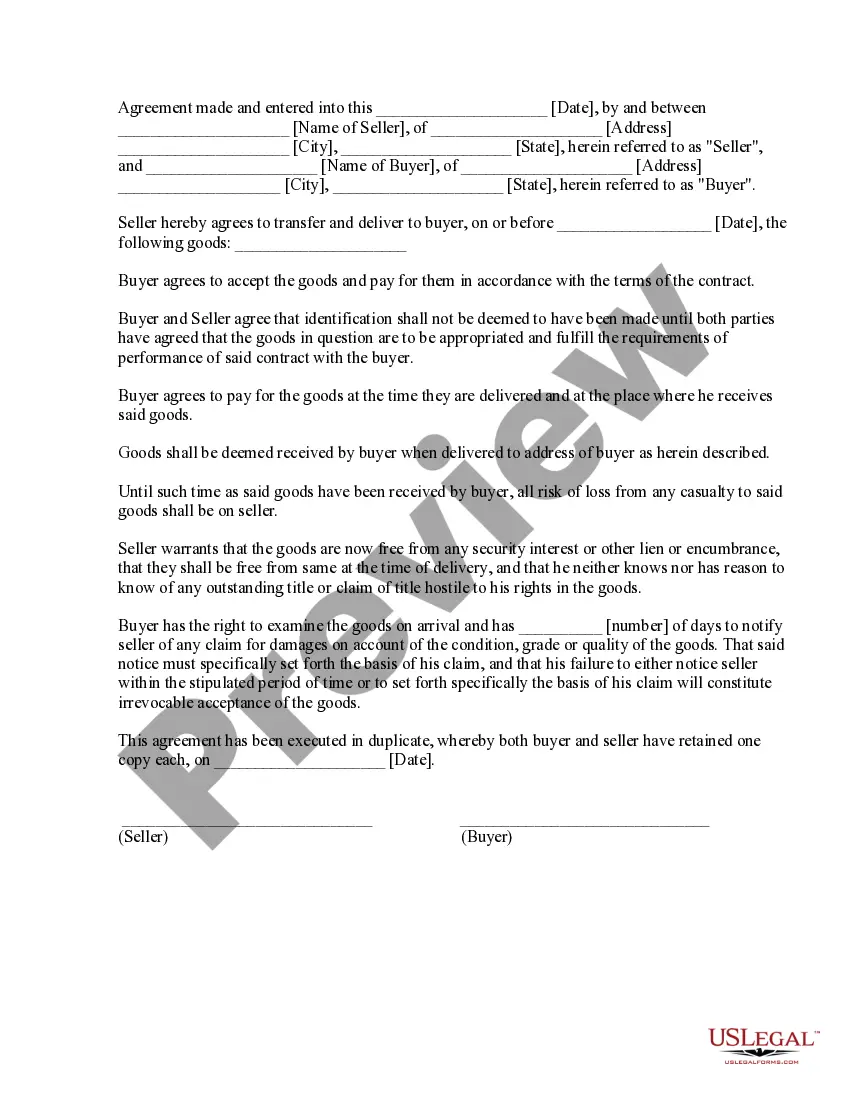

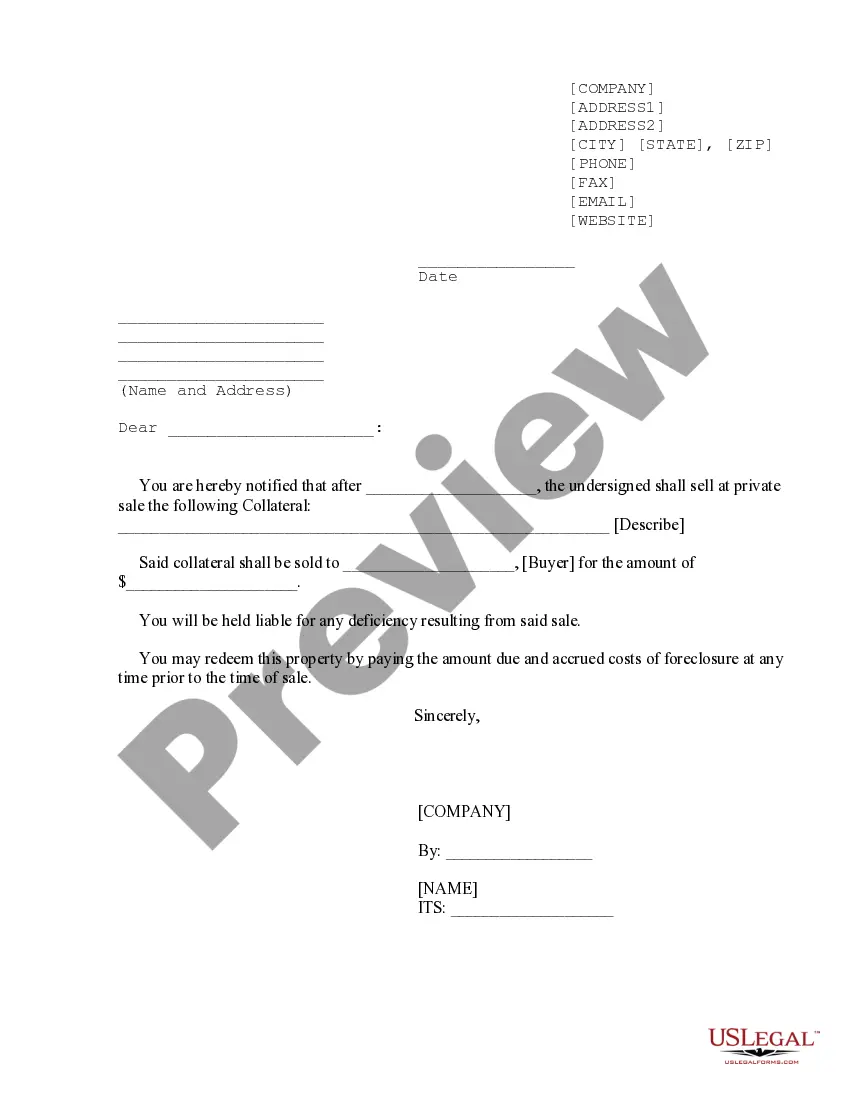

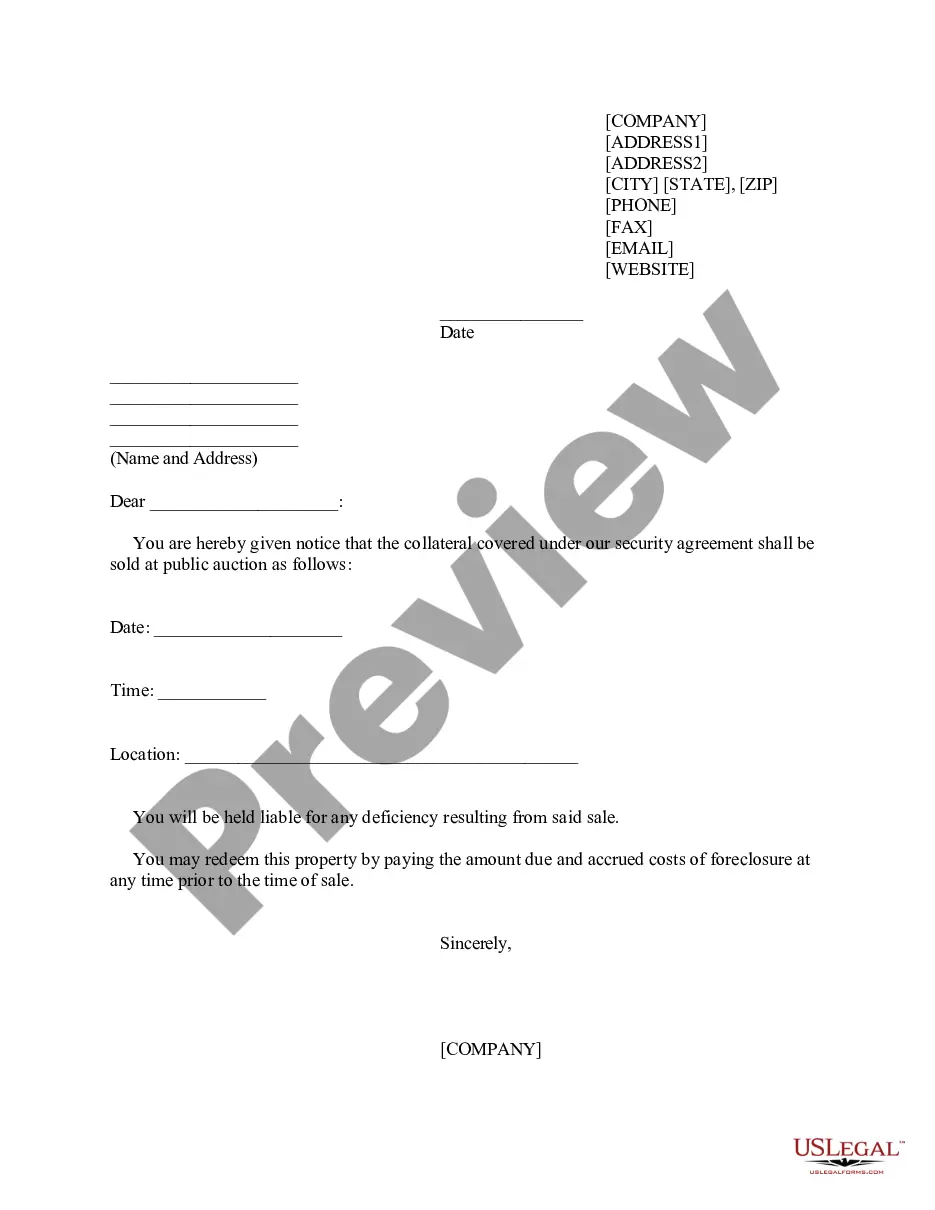

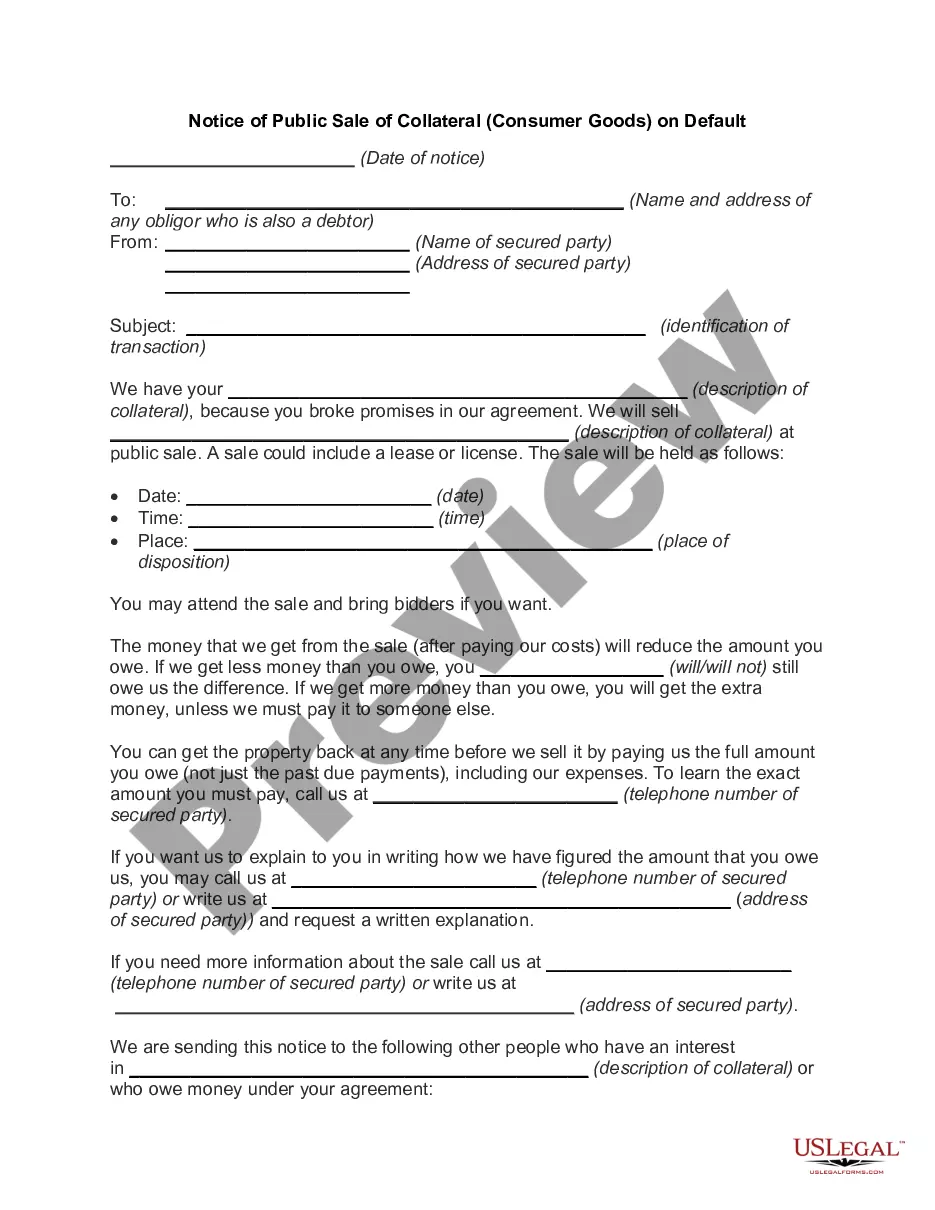

California Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

You can spend hours online looking for the legal document template that satisfies the state and federal requirements you need. US Legal Forms offers thousands of legal forms that are evaluated by experts.

It is easy to download or print the California Notice of Private Sale of Collateral (Non-consumer Goods) on Default from the service.

If you possess a US Legal Forms account, you can Log In and click on the Obtain button. After that, you can complete, modify, print, or sign the California Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Each legal document template you purchase is your own possession indefinitely.

Complete the transaction. You can use your Visa, Mastercard, or PayPal account to acquire the legal form. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the California Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Obtain and print thousands of document layouts using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- To get an additional copy of any acquired form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/town you choose. Review the form information to confirm you have picked the appropriate form.

- If available, utilize the Review button to browse the document template at the same time.

- If you wish to find another version of your form, make use of the Search area to locate the template that fits your needs and specifications.

- Once you have found the template you need, click on Buy now to proceed.

- Select the pricing plan you require, provide your details, and register for an account on US Legal Forms.

Form popularity

FAQ

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

As noted in Chapter 3 (The Nature of Secured Credit under Article 9), Article 9 generally governs only consensual liens on personal property, i.e., security interests in personal property created by agreement. The creation of most other types of liens is largely outside the scope of Article 9.

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

In "consumer-goods transactions," Revised Article 9 contains specific provisions delineating the proper notice which secured parties must give regarding the disposition of collateral upon default.

Generally, a secured creditor may seek to enforce its rights on its collateral upon a borrower's default. A secured creditor's remedies include an Article 9 sale, the right to sell the collateral to a third party in a private or public sale without judicial proceedings.

When a debtor sells collateral, he or she receives , something that is exchanged for collateral. Which statement is correct regarding a secured party's interest in proceeds when a debtor sells collateral? A secured party automatically has an interest in proceeds.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

A PMSI is created in goods when a seller retains a security interest in the goods sold on credit by a security agreement. A debtor need not sign the financing statement. Attachment must occur in order to make a security interest enforceable against the debtor and against third parties.