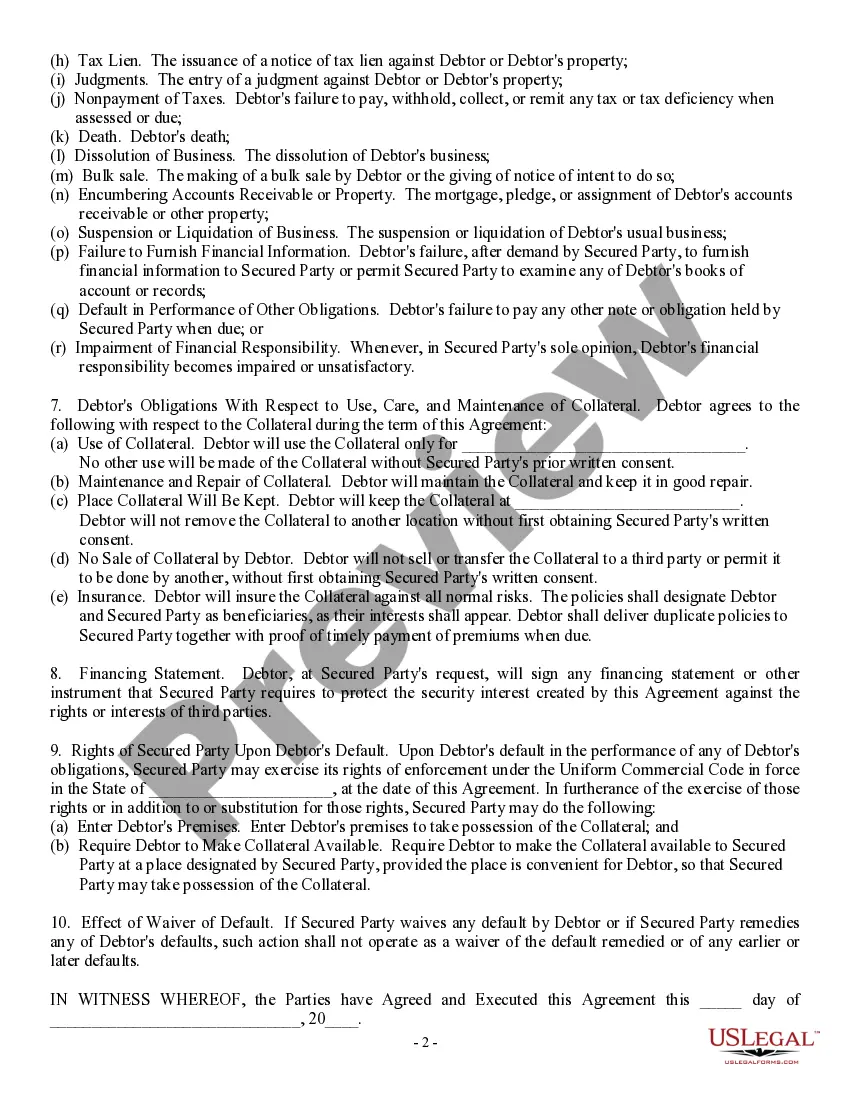

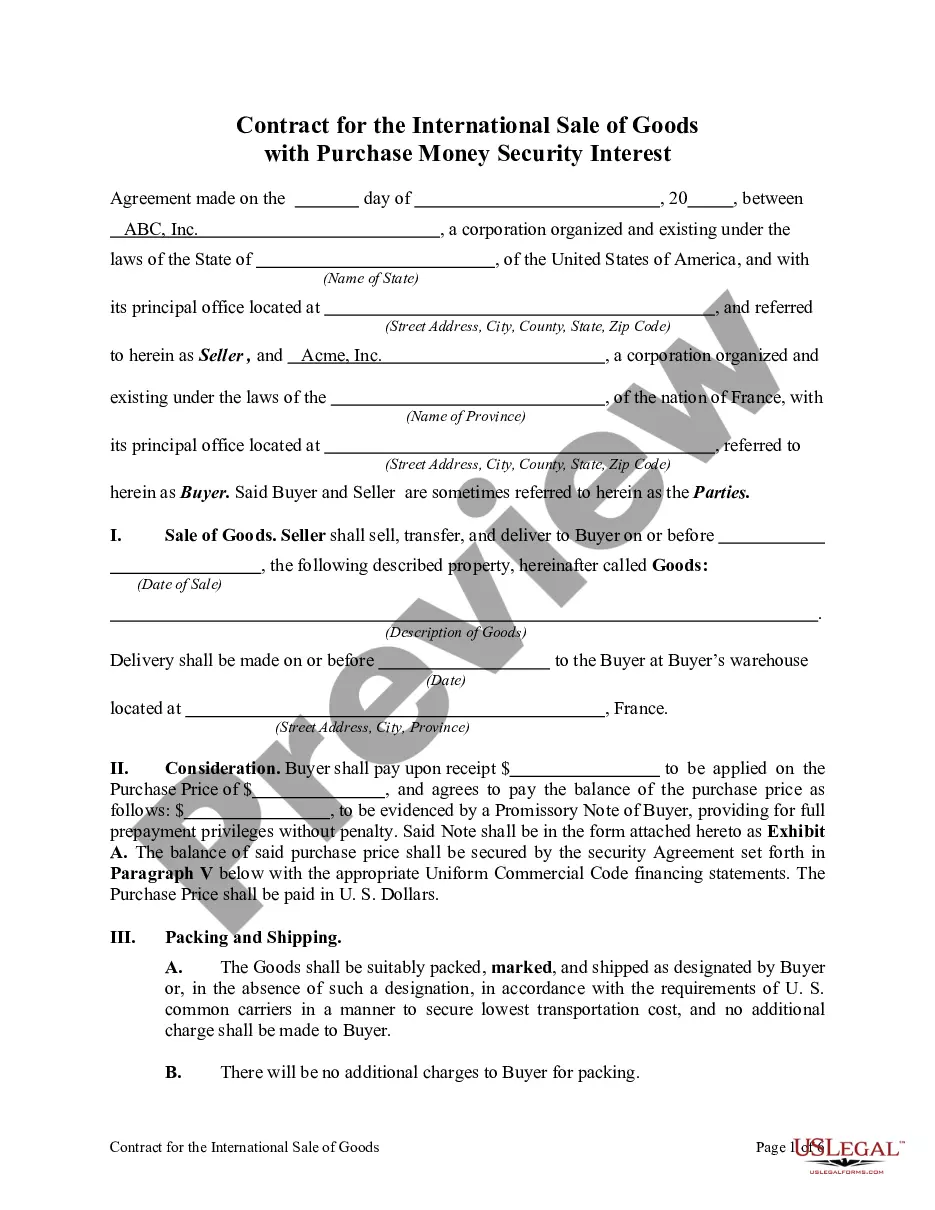

California Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Have you ever found yourself needing documents for either business or personal purposes almost constantly.

There are many legal document templates accessible on the web, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the California Security Agreement concerning Sale of Collateral by Debtor, designed to fulfill federal and state requirements.

Choose the payment plan you prefer, enter the necessary information to create your account, and finalize the order using your PayPal or Visa or Mastercard.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Security Agreement concerning Sale of Collateral by Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to review the document.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the document that fits your needs and requirements.

- Once you locate the appropriate form, click Purchase now.

Form popularity

FAQ

To have an enforceable security interest, a creditor must meet three key requirements: attachment, rights in the collateral, and proper documentation. First, the security agreement must be valid, and the creditor must have rights to the collateral. Lastly, a California Security Agreement involving Sale of Collateral by Debtor must be adequately perfected, often requiring the filing of financial statements. Understanding these requirements helps protect your interests and ensures legal compliance.

A UCC security agreement refers to a legal document governed by the Uniform Commercial Code that establishes a security interest in personal property. This type of agreement is often used in the context of a California Security Agreement involving Sale of Collateral by Debtor, ensuring that both debtors and creditors understand their rights and responsibilities. Utilizing the UCC framework can simplify secured transactions and provide clarity in commercial dealings.

An authenticated security agreement is a written document that is signed or otherwise authenticated by the debtor, confirming the security interest granted to the creditor. This type of agreement is essential for establishing a California Security Agreement involving Sale of Collateral by Debtor, as it provides legal proof of the arrangement between the parties. Having this agreement in place can prevent disputes and enhance confidence in the transaction.

Section 9203 focuses on the attachment and enforceability of security interests. It describes how a California Security Agreement involving Sale of Collateral by Debtor takes effect, detailing the prerequisites for a creditor to establish a claim over the collateral. Understanding this section is vital for both parties to ensure that their interests are adequately protected.

Section 9601 outlines the creation and enforcement of security interests in personal property within California. It specifies the conditions under which a California Security Agreement involving Sale of Collateral by Debtor can be established, detailing the rights of creditors and obligations of debtors. This section is crucial for clarifying the legal framework around secured transactions.

The California commercial code governs transactions involving personal property, ensuring fair practices in the sale and leasing of goods, as well as secured transactions. It provides guidelines for creating a California Security Agreement involving Sale of Collateral by Debtor, which protects both creditors and debtors in a transaction. By understanding this code, businesses can operate smoothly while adhering to the law.

Collateral enforceability refers to the legal validity of a security interest in the collateral and its ability to be upheld in court. When tied to a California Security Agreement involving Sale of Collateral by Debtor, enforceability ensures that the creditor can take action if the debtor defaults on their obligations. Having a well-drafted security agreement and proper filing process are key to maintaining enforceability and protecting the creditor's rights.

A security agreement is a legal document that establishes a creditor's interest in a debtor's assets, while a UCC filing is a public record that gives notice of that interest to third parties. In a California Security Agreement involving Sale of Collateral by Debtor, the security agreement lays out the terms between the debtor and the creditor, while the UCC filing protects the creditor's rights in court against other potential claimants. Understanding both aspects is crucial for effective risk management.

A security interest becomes enforceable when the security agreement is properly executed, the debtor has rights in the collateral, and the secured party either possesses the collateral or has control over it. In the case of a California Security Agreement involving Sale of Collateral by Debtor, these conditions create a clear framework for asserting rights against the collateral. Ensuring enforceability protects both parties and clarifies expectations.

In California, you typically file a security agreement with the Secretary of State. This filing places a public notice of the creditor's security interest in the collateral, which is crucial for establishing priority over other creditors. For a California Security Agreement involving Sale of Collateral by Debtor, proper filing is essential to protect your investment and ensure your rights are recognized. Utilizing a platform like uslegalforms can simplify the filing process.