California Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by type, state, or keywords.

You can acquire the latest versions of forms similar to the California Telecommuting Worksheet in a matter of moments.

Review the description of the form to confirm that you have chosen the right one.

If the form does not meet your requirements, utilize the Search field at the top of the screen to locate one that does.

- If you already have an account, Log In and download the California Telecommuting Worksheet from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are a new user of US Legal Forms, here are some easy steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

California Tax Rules For Remote Employees Generally if you work in California, whether you're a resident or not, you have to pay income taxes on the wages you earn for those services. That's due to the source rule: California taxes all taxable income with a source in California regardless of the taxpayer's residency.

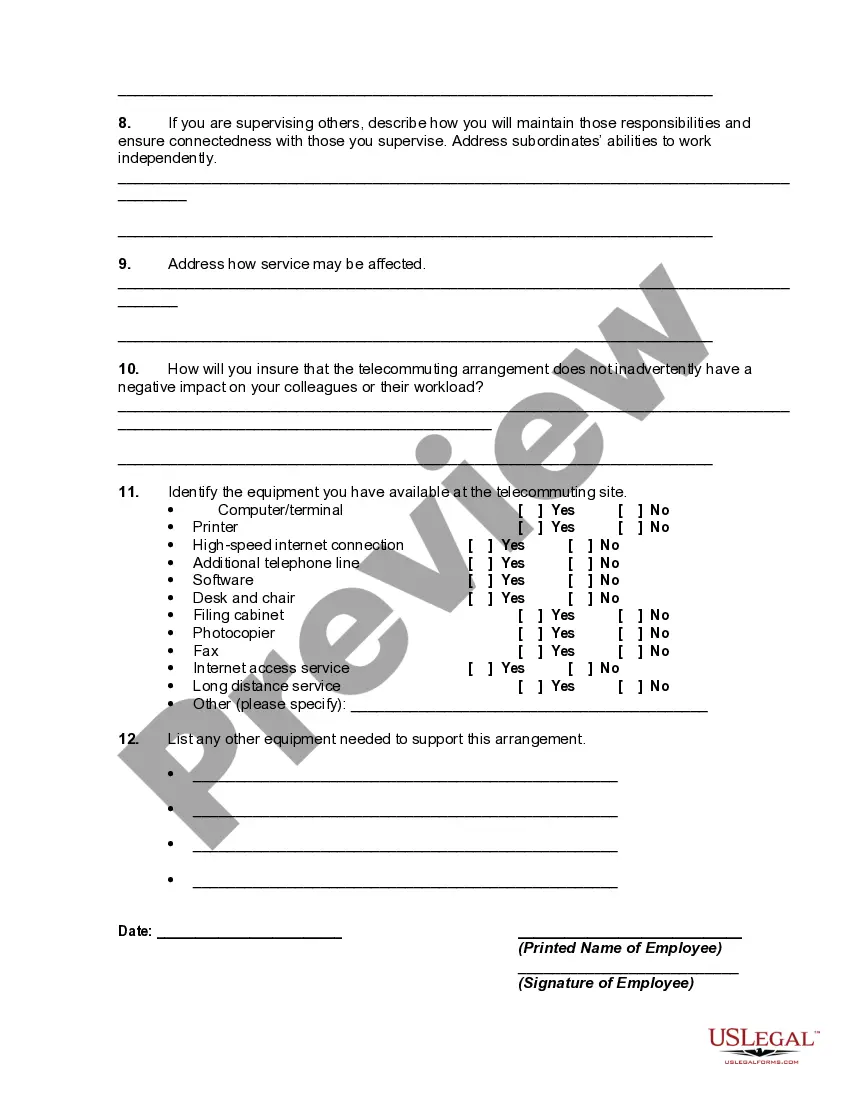

For instance, remote workers may need:Computer/laptop.Internet connection.Mobile device and service.Apps or software (particularly for timekeeping and scheduling).Printers (if documents cannot be utilized virtually for the position).Supplies (pens, paper, scanner).Transportation (to visit clients, etc.)

If you want to know if a job can be done remotely, use technology as a guide in determining if that job can be done virtually. A run through FlexJobs' list of 100 Top Companies with Remote Jobs can give you a sense of the broad landscape for jobs that can be done from home.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

You are ultimately taxed on all income as a resident, and California-sourced income as a part-year resident or nonresident. Any state you move to, even temporarily, may have an income tax requirement for anyone working in their state. This can lead to being taxed by both your new state of residence and California.

Positions that can be regularly performed remotely are those that: o Don't require a traditional office or clinical space to interact with internal and external customers. o Have access to required systems and software associated with the position responsibilities. o Have remote access to files. o Have supervisors who

THE REMOTE-WORK TAX RULE The rule is, if a nonresident receives W-2 wages for work performed out of state, even if it's from a California employer, the income is not subject to California income taxes.

As a nonresident, you pay tax on your taxable income from California sources. Sourced income includes, but is not limited to: Services performed in California. Rent from real property located in California.

Sample Policy: Telecommuting Arrangements.Definition.Employee Eligibility.Position Eligibility.Types of Arrangements.Equipment/Furnishings/Office Supplies.Request Process.Other Requirements/Restrictions.