This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

Are you presently in a situation where you require documents for potential business or personal motives almost all the time.

There are countless legal document templates accessible online, but finding reliable ones isn't simple.

US Legal Forms provides thousands of form templates, including the California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, which can be tailored to comply with federal and state regulations.

Choose a suitable paper format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete any time, if necessary. Just click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct locality.

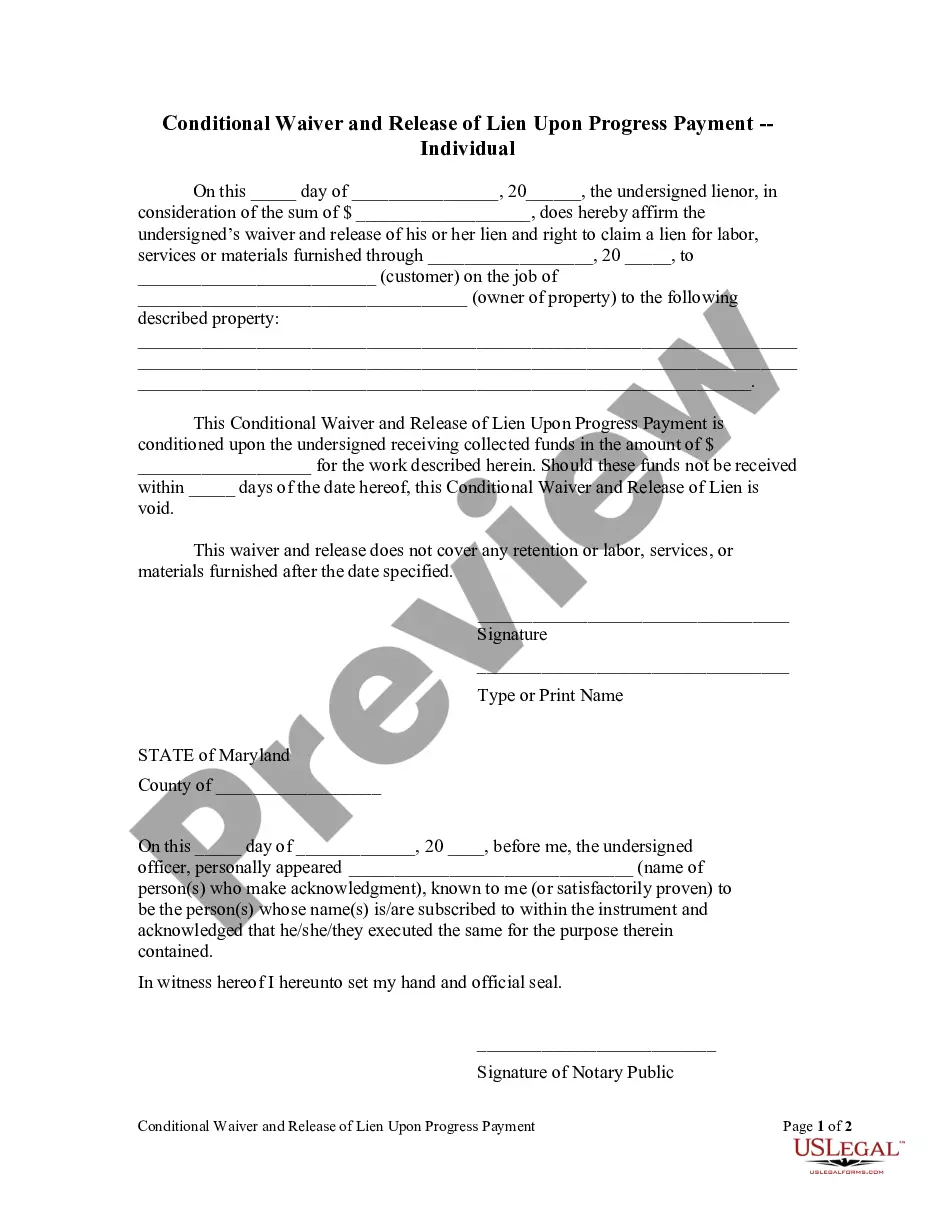

- Utilize the Preview option to examine the form.

- Review the description to confirm you have chosen the right document.

- If the form isn’t what you need, use the Search area to locate the document that fits your needs and specifications.

- When you find the correct form, click on Acquire now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

An example of a confidentiality clause in a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete might include a statement such as: 'The Consultant agrees to keep all client information confidential, including but not limited to, trade secrets and business strategies, both during and after the term of this agreement.' Such clauses are designed to shield both parties from potential breaches of trust.

The confidentiality clause in an employment contract serves a similar purpose to that found in a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. It restricts employees from sharing sensitive information with third parties. Both clauses emphasize the importance of maintaining privacy to protect competitive business advantages.

The indemnification clause in a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete protects you from certain legal claims or liabilities. This clause typically states that you are not responsible for any damages or losses that occur due to the client's actions. It provides peace of mind and encourages a more secure working relationship.

If you signed a non-compete agreement as part of your California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, your ability to work for a competitor may be limited. Typically, these agreements restrict you from engaging in similar work for a specified time and within a specific geographic area. Always consult with a legal professional to understand the implications of your contract before making any decisions.

A confidentiality clause for independent contractors is a crucial section in a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. It obligates you to keep confidential information private, even after the contract ends. This legal protection helps establish boundaries and ensures that sensitive information remains protected from competitors and other unauthorized entities.

The confidentiality clause in a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete protects sensitive information shared during the working relationship. This clause ensures that you do not disclose any proprietary data or trade secrets to outside parties. By including this clause, you maintain trust with your clients and safeguard your business interests.

To protect yourself when hiring an independent contractor, it is essential to create a detailed California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. This contract should outline the scope of work, payment terms, and ownership of any intellectual property created during the engagement. Additionally, including clauses for confidentiality and non-competition can safeguard your business interests. Using a reliable platform like UsLegalForms can simplify this process, ensuring you have a comprehensive and legally sound agreement.

Several factors can void a non-compete agreement in California. A court may find such an agreement overly broad, unreasonable in duration or geography, or harmful to public interest. If you are entering a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, understanding these factors can help you create a more effective agreement without enforceable non-compete clauses.

Non-compete agreements are generally not enforceable for independent contractors in California. The state places a strong emphasis on promoting fair competition and employee mobility. Hence, if you are looking into a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, keep in mind that non-compete clauses will likely not offer the protection one might expect.

Enforcing a non-compete on a 1099 employee is challenging in California, as the state consistently finds these agreements to be unenforceable. If you are a contractor, being bound by such a clause can hinder your ability to grow in your career. Thus, if you are drafting a California Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, it is best to avoid including a non-compete clause altogether.