California Space, Net, Net, Net - Triple Net Lease

Description

How to fill out Space, Net, Net, Net - Triple Net Lease?

If you need to extensive, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms, accessible on the Internet.

Employ the site’s simple and convenient search to locate the documents you need.

Numerous templates for business and personal needs are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the California Space, Net, Net, Net - Triple Net Lease with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the California Space, Net, Net, Net - Triple Net Lease.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct area/region.

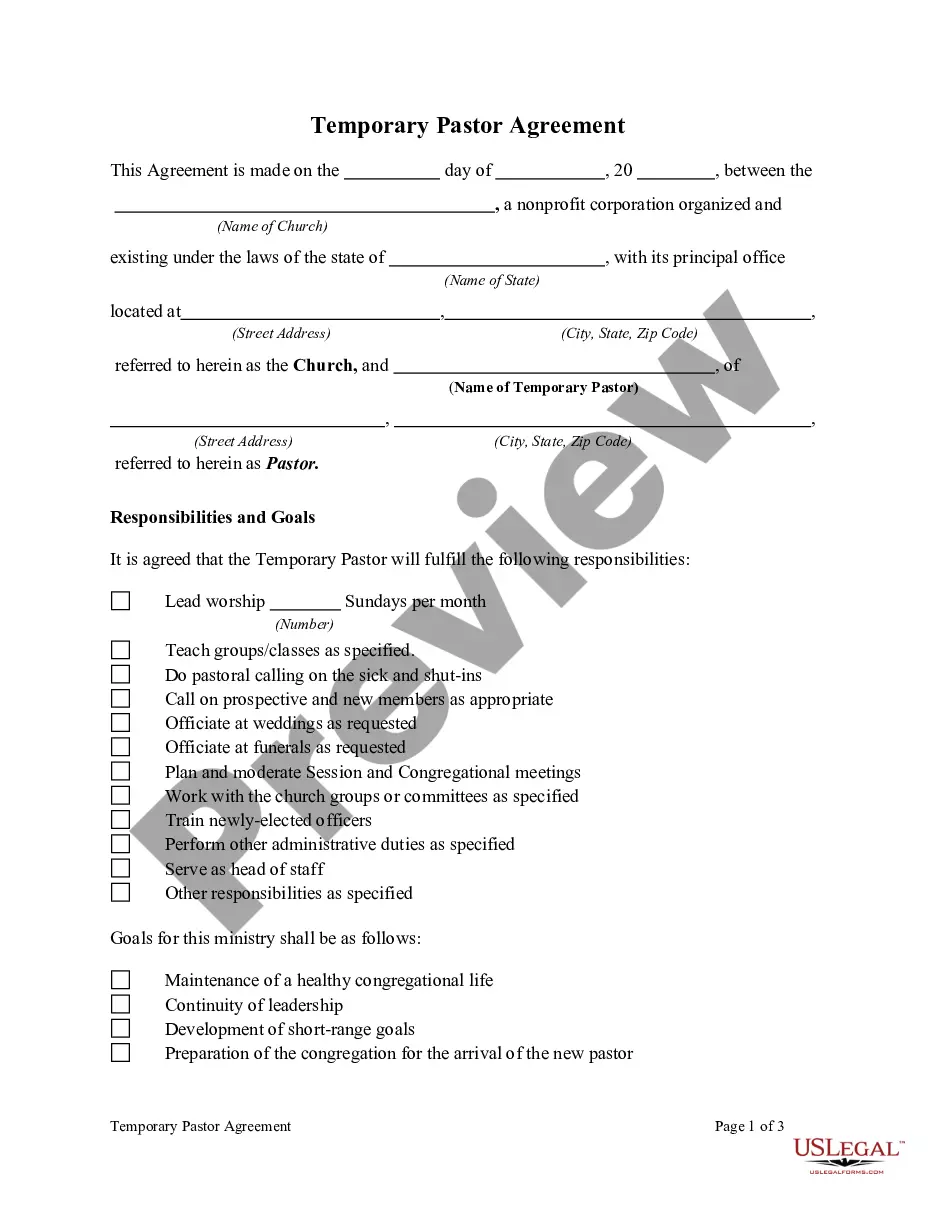

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read through the details.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To structure a California Space, Net, Net, Net - Triple Net Lease, start by clearly defining the responsibilities of both the landlord and tenant. The landlord typically covers property ownership costs, while the tenant pays for maintenance, insurance, and property tax. It is important to outline these terms in writing to avoid confusion later. A well-structured lease enhances accountability and protects both parties involved.

A triple net lease in California refers to a rental agreement where the tenant assumes responsibility for property taxes, insurance, and maintenance costs, in addition to the base rent. This type of lease, commonly referred to as California Space, Net, Net, Net - Triple Net Lease, is popular among investors due to its predictable income. It offers significant benefits to landlords, such as reduced management responsibilities. For tenants, this lease structure fosters transparency in estimating total costs.

In a California Space, Net, Net, Net - Triple Net Lease, the term 'nets' refers to the three major expenses that tenants are responsible for: property taxes, insurance, and maintenance costs. This arrangement allows landlords to transfer financial responsibilities to tenants, providing a predictable income stream. By understanding these nets, tenants can better estimate their total costs. This lease structure is often favorable for both parties.

Accountability in a California Space, Net, Net, Net - Triple Net Lease involves recording rental income, as well as related expenses like taxes, insurance, and maintenance costs. Tenants should track these expenses separately to determine their profitability accurately. Proper accounting helps tenants understand their total costs and act as a reference for future negotiations. Platforms like uslegalforms can aid tenants in structuring these records efficiently.

NNN fees can vary widely based on property location, size, and other factors, but they generally consist of property taxes, insurance, and maintenance costs. For a California Space, Net, Net, Net - Triple Net Lease, it is essential to calculate these fees accurately to avoid unexpected expenses. On average, tenants might see these costs range from a few dollars per square foot to significantly higher amounts, depending on the property condition and location. Always review these fees before signing a lease.

In a California Space, Net, Net, Net - Triple Net Lease, the landlord typically handles structural repairs and major property issues. This means that costs related to building foundations or roof replacement are not passed on to the tenant. However, tenants must be aware that all operational expenses, including property taxes and utilities, are their responsibility. Understanding these nuances helps tenants budget accurately.

The primary difference between a net net lease and a California Space, Net, Net, Net - Triple Net Lease lies in the responsibilities assigned to the tenant. In a net net lease, the tenant pays property taxes and insurance while the landlord handles maintenance. Conversely, in a triple net lease, the tenant is responsible for all costs, including maintenance. This distinction influences a tenant’s financial planning and risk exposure.

One main disadvantage of a California Space, Net, Net, Net - Triple Net Lease is that tenants bear more financial responsibilities compared to traditional leases. This arrangement can lead to increased costs, as tenants need to cover taxes, insurance, and maintenance. If a property requires extensive repairs or increases in property taxes, these costs fall directly on the tenant, which can affect profitability. Additionally, understanding these obligations can be complex for new tenants.

A California Space, Net, Net, Net - Triple Net Lease can significantly influence your tax situation. The expenses passed through from the landlord, such as property taxes, may be deductible for the business. Consulting a tax professional can help you understand how to maximize these benefits while ensuring compliance with tax regulations.

Valuing a California Space, Net, Net, Net - Triple Net Lease requires assessing factors such as location, lease term, and the quality of the tenant. A common method involves calculating the net operating income and dividing it by the desired capitalization rate. This calculation provides a clear view of the property's potential return on investment, helping you make informed decisions.