This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

California Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Are you presently in the situation where you require documents for possibly business or personal use nearly every day.

There are numerous legal document templates available on the internet, yet finding ones you can trust is challenging.

US Legal Forms provides a vast array of document templates, such as the California Notice of Default in Payment Due on Promissory Note, designed to fulfill state and federal regulations.

Once you find the appropriate document, click Purchase now.

Choose the pricing plan you desire, fill out the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the California Notice of Default in Payment Due on Promissory Note template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct area/county.

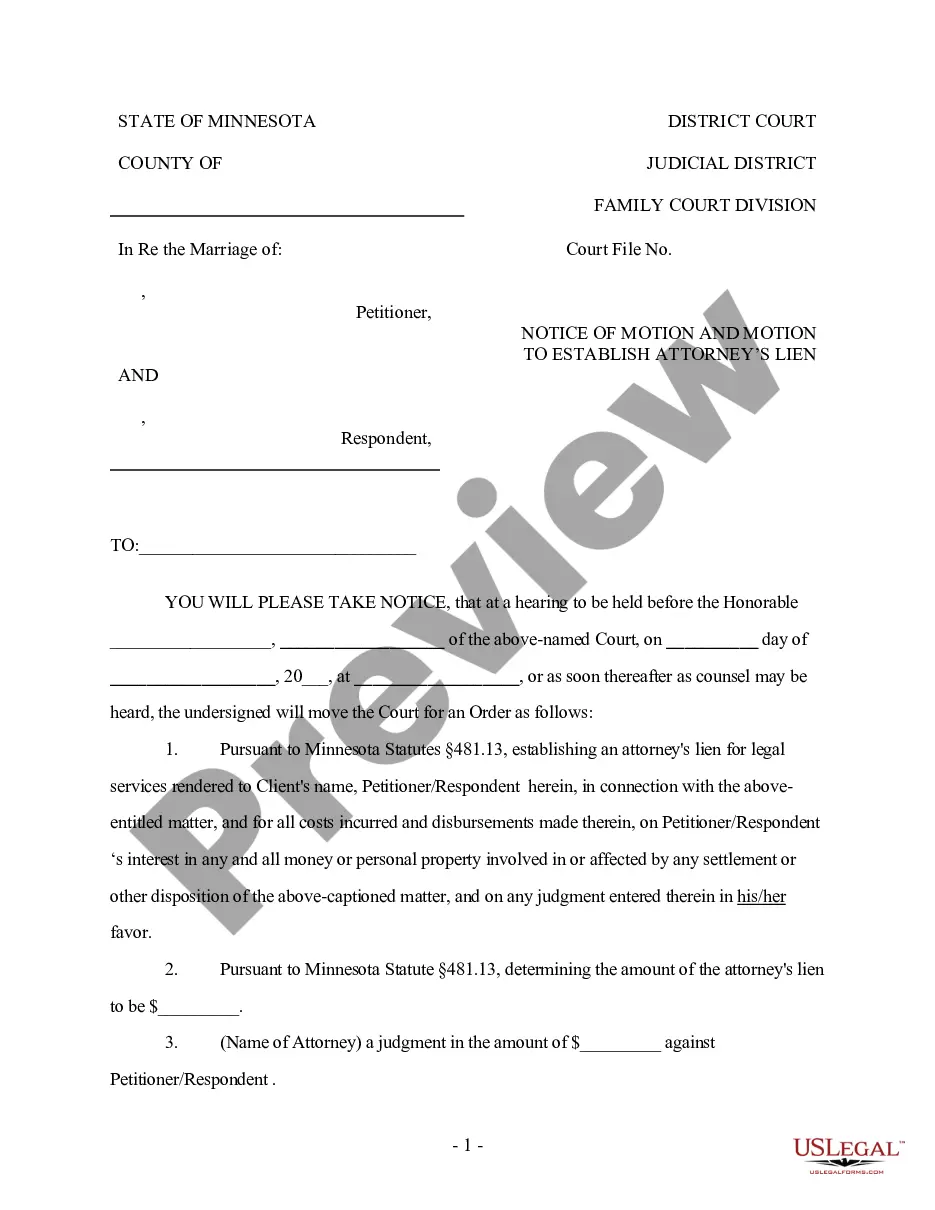

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the document is not what you`re looking for, use the Search section to find the document that meets your needs and requirements.

Form popularity

FAQ

A standard California Notice of Default in Payment Due on Promissory Note is a formal declaration that a borrower has failed to meet their payment obligations. This document can initiate the process towards potential legal action, signaling the start of a serious situation. Typically, this notice must follow state regulations regarding format and delivery to be legally effective. To navigate this process efficiently, consider using uslegalforms to ensure compliance and accuracy.

A California Notice of Default in Payment Due on Promissory Note should contain essential details such as the names of the involved parties, the description of the property, and the exact amount of the overdue payment. It should also outline actions the borrower must take to remedy the default, including any deadlines. Additionally, including information about potential foreclosure consequences adds clarity and urgency, facilitating better communication between lender and borrower.

To issue a California Notice of Default in Payment Due on Promissory Note, you should first verify that the borrower is indeed in default according to your records. Prepare the notice using the proper legal format, ensuring it contains all required information. After signing the notice, deliver it to the borrower via certified mail or personal service to provide formal notification. Utilizing platforms like uslegalforms can simplify this process, offering templates and guidance on compliance.

A California Notice of Default in Payment Due on Promissory Note typically includes the names of the borrower and lender, the property address, and the specific amount that is overdue. You'll find a statement indicating that the borrower has failed to make required payments. Additionally, the document may include a warning regarding potential foreclosure proceedings if the default is not resolved. It is important to ensure the notice is clear and formal, as it serves a significant legal purpose.

Writing a notice of default requires attention to detail and clarity. Include the borrower's information, the amount owed, and reference the terms of the promissory note. Furthermore, draft a California Notice of Default in Payment Due on Promissory Note that outlines the consequences of non-payment. If you need assistance, consider using platforms like uslegalforms to access templates that can simplify this process.

A properly drafted promissory note generally holds up in court. To ensure its enforceability, the note should include clear terms regarding payment, interest rates, and default conditions. If a borrower defaults, a California Notice of Default in Payment Due on Promissory Note can strengthen your case by providing documented evidence of the default.

If someone defaults on a promissory note, take action to address the situation. Start by sending a California Notice of Default in Payment Due on Promissory Note to formally notify the borrower of their missed payments. This may encourage them to engage in discussions regarding repayment. If the issue persists, consider seeking legal advice to explore further options.

When someone defaults on a promissory note, it's important to take prompt action. First, you should review the terms of the note to determine the default provisions. Then, consider sending a California Notice of Default in Payment Due on Promissory Note, which serves as a formal notification. This document can facilitate discussions on repayment options or legal actions if necessary.

When a borrower defaults on a promissory note, a California Notice of Default in Payment Due on Promissory Note may be issued. This document can lead to serious consequences, including foreclosure or legal action by the lender to recover the owed amount. The borrower may have options to resolve the default, such as negotiating with the lender or filing for bankruptcy. It's important to act quickly and seek legal advice if you receive a notice to mitigate potential repercussions.

A California Notice of Default in Payment Due on Promissory Note is a formal legal document informing the borrower that they have failed to make a scheduled payment. This notice marks the beginning of the foreclosure process if the debt remains unpaid. The borrower typically receives this notice when they are at least 30 days past due on their payments. Understanding this notice is crucial for borrowers to address their financial situation promptly.