California Restricted Endowment to Religious Institution

Description

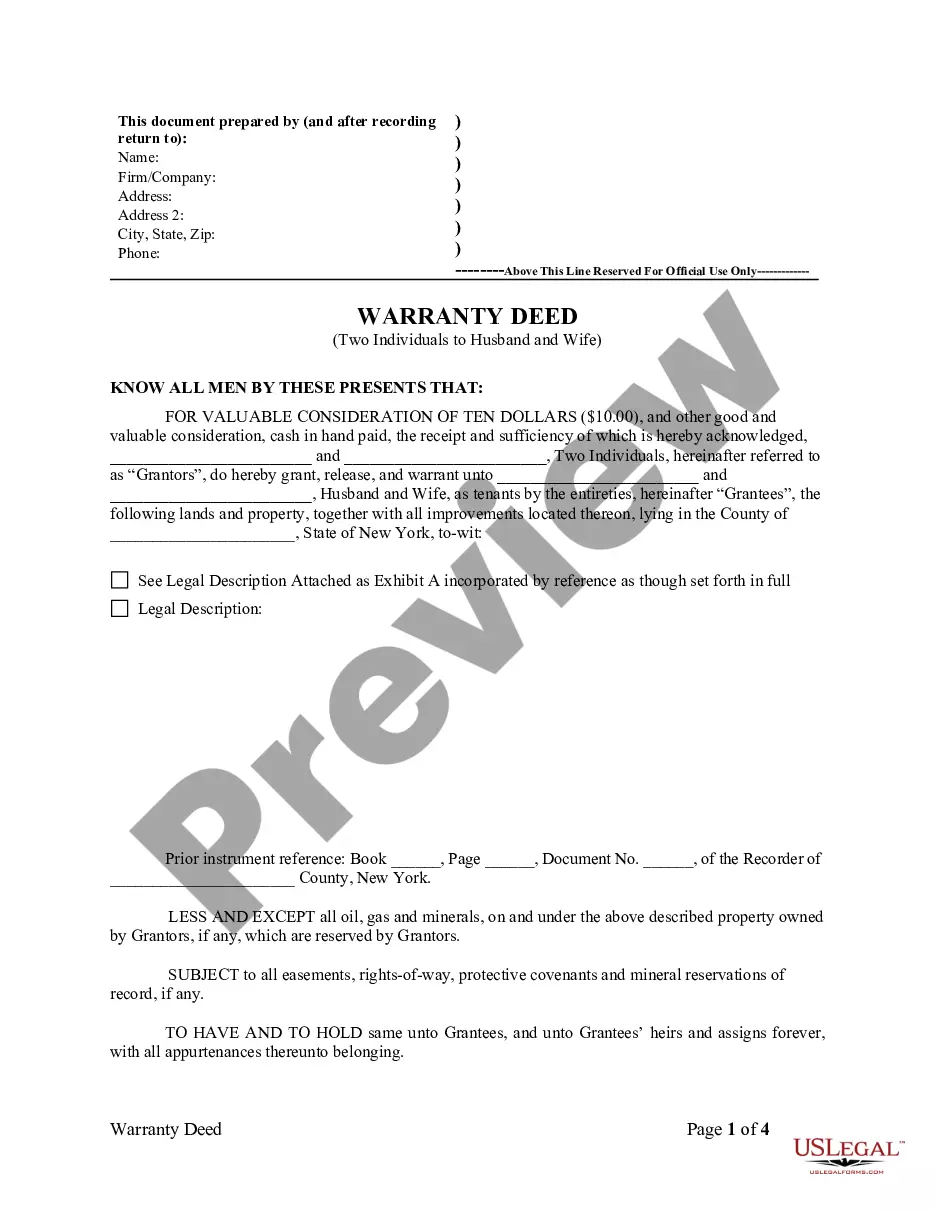

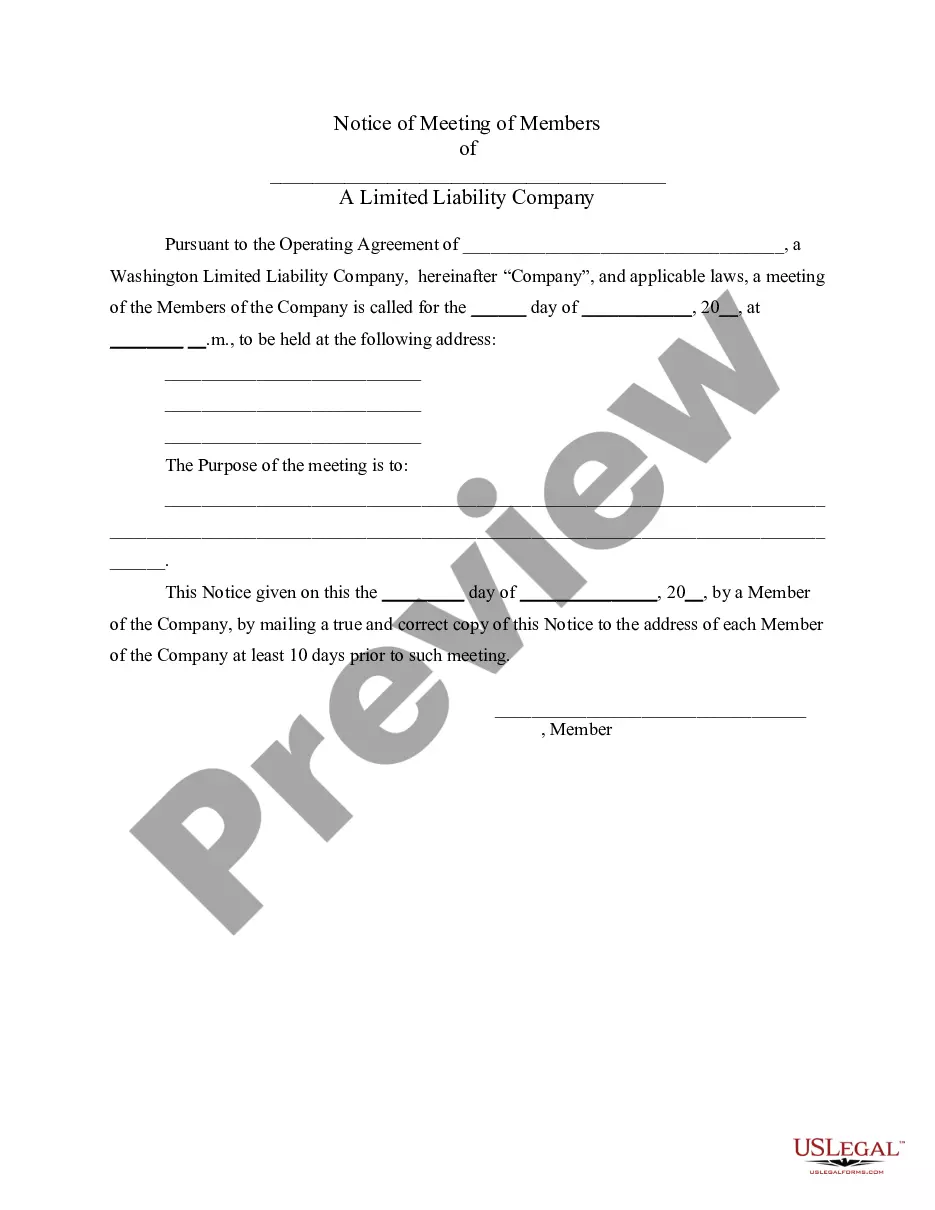

How to fill out Restricted Endowment To Religious Institution?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can discover the most recent versions of forms such as the California Restricted Endowment to Religious Institution in moments.

If the form doesn’t meet your requirements, use the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and enter your information to register for the account.

- If you already have an account, Log In and download the California Restricted Endowment to Religious Institution from the US Legal Forms directory.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To get started with US Legal Forms for the first time, here are some simple steps.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Withdrawal from a California Restricted Endowment to Religious Institution typically depends on specific guidelines set by the endowment's governing documents. Often, these endowments prioritize long-term support and restrict withdrawals to preserve the principal. If you need flexibility, consider exploring alternatives on platforms like uslegalforms, which can provide additional insights into managing your endowment effectively.

Endowment funds, including the California Restricted Endowment to Religious Institution, can present certain challenges. For instance, they often have restrictions on how funds can be used, which may limit immediate access to capital. Additionally, managing an endowment requires ongoing administration and investment management, which can incur costs over time, potentially impacting the overall growth of the fund.

Withdrawing from a California Restricted Endowment to Religious Institution can be complex. Generally, endowment policies are designed to provide long-term financial stability to religious entities, making withdrawal not straightforward. If you are considering this, it's important to consult the specific terms of your policy and understand any potential impacts on the intended benefits of the endowment.

The three types of endowments include true endowments, term endowments, and quasi-endowments. True endowments, for example, are set up for a specific purpose, such as a California Restricted Endowment to Religious Institution, where the principal amount is kept intact. Understanding these types can help organizations choose the right approach for securing and growing their resources.

Yes, organizations can file the CA RRF-1 form electronically, making the process more efficient and convenient. This is especially beneficial for those managing a California Restricted Endowment to Religious Institution, as timely submission is crucial. Online filing reduces paperwork and speeds up the processing time, ensuring compliance without added hassle.

Yes, if your charity operates in California and solicits donations, you must register with the state. This registration process applies to organizations benefiting from a California Restricted Endowment to Religious Institution. Proper registration not only fulfills legal requirements but also enhances your charity’s credibility with potential donors.

To start a religious nonprofit organization in California, you need to draft and file your Articles of Incorporation. Once established, you can apply for tax-exempt status and may consider creating a California Restricted Endowment to Religious Institution to ensure long-term financial support. Utilizing a platform like uslegalforms can simplify this process by providing templates and guidance tailored for religious nonprofits.

An endowment is a fund that provides ongoing financial support, often to a specific purpose, like a California Restricted Endowment to Religious Institution. In contrast, a foundation is a nonprofit organization that typically makes grants to other organizations or individuals. While both serve philanthropic purposes, endowments focus on sustainability and income generation, whereas foundations may emphasize broader charitable activities.

Organizations that operate in California and plan to solicit charitable donations must file the CA RRF 1. This includes nonprofits that manage a California Restricted Endowment to Religious Institution. By completing this form, you ensure compliance with state regulations and help maintain your organization’s good standing.

The Uniform Prudent Management of Institutional Funds Act (Upmifa) governs the management and investment of endowment funds for charities. Under Upmifa, organizations with a California Restricted Endowment to Religious Institution can determine how much of the endowment's income can be spent while preserving the fund’s value. This law empowers institutions to make informed financial decisions, helping to ensure sustainability and effective fund use over time.