California Personal Guaranty - General

Description

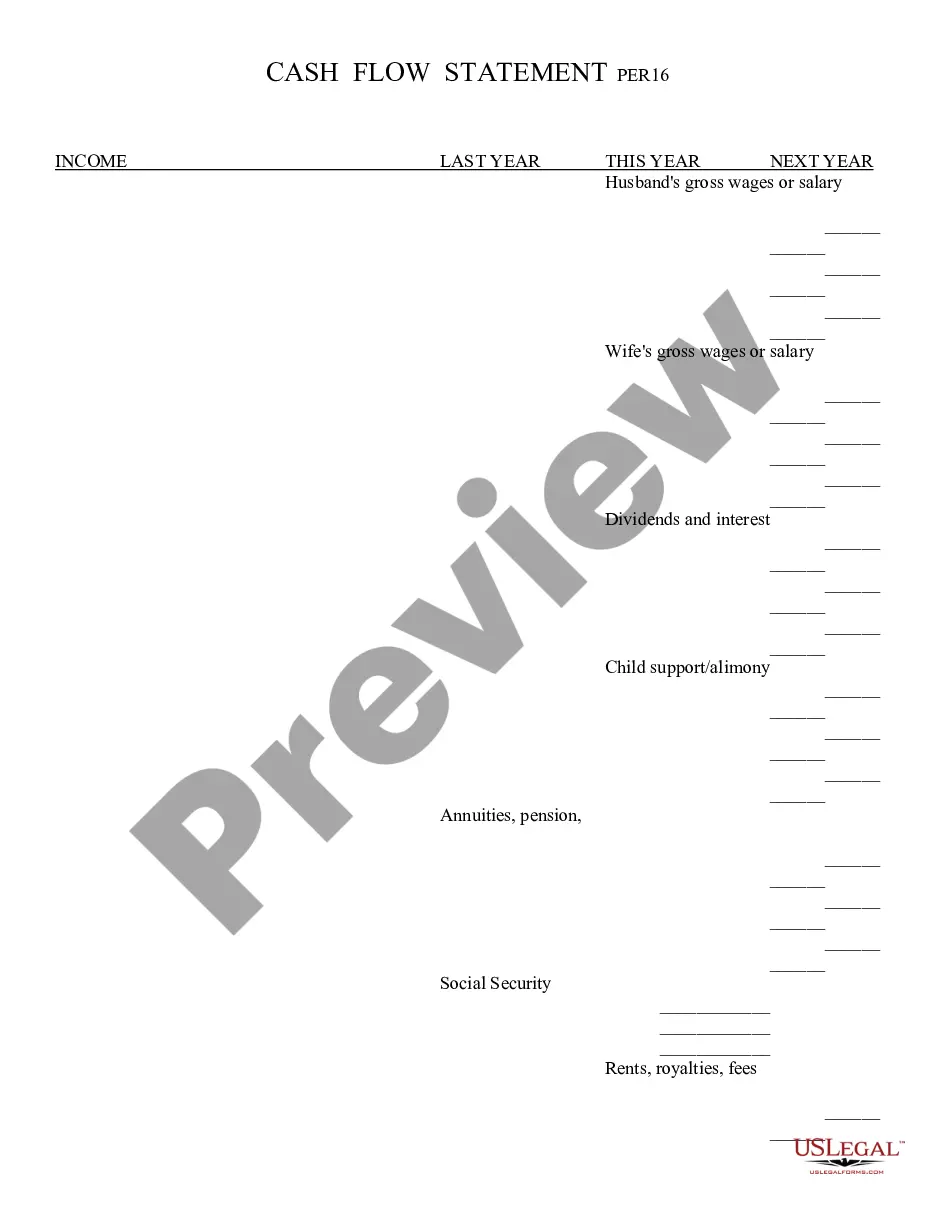

How to fill out Personal Guaranty - General?

Selecting the appropriate valid document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you find the correct type you need.

Visit the US Legal Forms website. This service provides thousands of templates, such as the California Personal Guaranty - General, suitable for both business and personal requirements.

You can preview the document using the Preview button and review the document details to confirm it is suitable for you.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to obtain the California Personal Guaranty - General.

- Use your account to view the legal forms you have purchased previously.

- Navigate to the My documents section of your account to retrieve another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the appropriate form for your specific city/state.

Form popularity

FAQ

One of the significant risks of a California Personal Guaranty - General is the potential for financial loss if the primary borrower defaults. You could face significant liability, affecting everything from your credit score to your assets. Moreover, misjudgments in assessing the borrower's ability to repay may lead to serious consequences for your finances. It's crucial to weigh these risks carefully and consider using platforms like USLegalForms to better understand your obligations.

The one action rule in California limits creditors to a single legal action against a guarantor. In essence, creditors must choose whether to pursue the borrower or the guarantor, but not both at the same time. This rule is beneficial because it offers some protection to guarantors under a California Personal Guaranty - General. Always consult a legal professional to navigate these laws effectively.

A personal guarantee in California is generally enforceable, provided it meets specific legal criteria. Courts typically uphold these agreements when they are clear and well-documented, especially if both parties have entered into the contract knowingly. However, factors like duress, fraud, or ambiguity can affect enforceability. Therefore, understanding the terms and consulting with legal counsel is advisable.

Yes, in certain circumstances, a California Personal Guaranty - General can put your home at risk. If you default on a personal guarantee, creditors may pursue legal action against you, potentially leading to foreclosure on your home. This risk underscores the importance of fully understanding your obligations before signing any guarantee. Therefore, it is crucial to assess your financial situation and consult a legal expert if needed.

Yes, personal guarantees generally hold up in court as long as they meet legal requirements and are properly documented. Courts in California recognize the validity of a California Personal Guaranty - General when the terms are clear and agreed upon by all parties. However, if the guarantee is ambiguous or not executed correctly, it may be challenged. It’s wise to utilize resources such as US Legal Forms to ensure your guarantee is compliant and enforceable.

To create a personal guarantee, you typically need to provide identifiable information, including your name and financial details, and sign a clear agreement. The California Personal Guaranty - General requires explicit terms that outline your obligations. It's important to ensure you fully comprehend the agreement's language, as it binds you legally. Platforms like US Legal Forms can help you find the right documentation and understand your responsibilities.

Common examples of personal guarantees include business loans, rental agreements, and credit lines where an individual agrees to repay if the primary borrower defaults. In the context of California Personal Guaranty - General, this means your personal finances may come into play if the business fails. These guarantees offer security to lenders, making it vital for individuals to consider their implications. Always analyze your financial situation carefully before committing.

Yes, you can lose your house if you default on obligations tied to a personal guarantee. In a California Personal Guaranty - General, lenders may pursue your personal assets, including your home, to recover debts. It is crucial to fully understand the terms of a personal guarantee before signing. Consulting legal advice can help you navigate potential risks.

To write a personal guarantee, begin by clearly stating your name and the obligation you are accepting. Detail the amount you are guaranteeing and include any specific terms that apply. Resources from uslegalforms can guide you in formatting your document effectively, aligning it with California Personal Guaranty - General requirements.

To file a complaint with the California Attorney General, visit their official website to access the complaint form. Ensure that you provide clear, concise information about your issue and relevant documentation. If your complaint relates to California Personal Guaranty - General issues, be specific about how it impacts you to receive appropriate assistance.