The California Order Waiving Requirement For Business Evaluation (also known as the Business Evaluation Waiver or BEW) is a document issued by the California Department of Business Oversight that allows a business to bypass the requirement to obtain an evaluation from an independent third-party evaluator. This waiver permits the business to proceed with its proposed activities without the need for an evaluation. This waiver is most commonly used by businesses that are not required to obtain a license to operate in California, such as those operating through an LLC or a corporation. The types of California Order Waiving Requirement For Business Evaluation include: • Corporation: Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator. • Limited Liability Company (LLC): Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator. • Limited Partnership (LP): Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator. • Sole Proprietorship: Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator. • General Partnership: Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator. • Limited Liability Partnership (LLP): Allows a business to bypass the requirement to obtain a business evaluation from an independent third-party evaluator.

California Order Waiving Requirement For Business Evaluation

Description

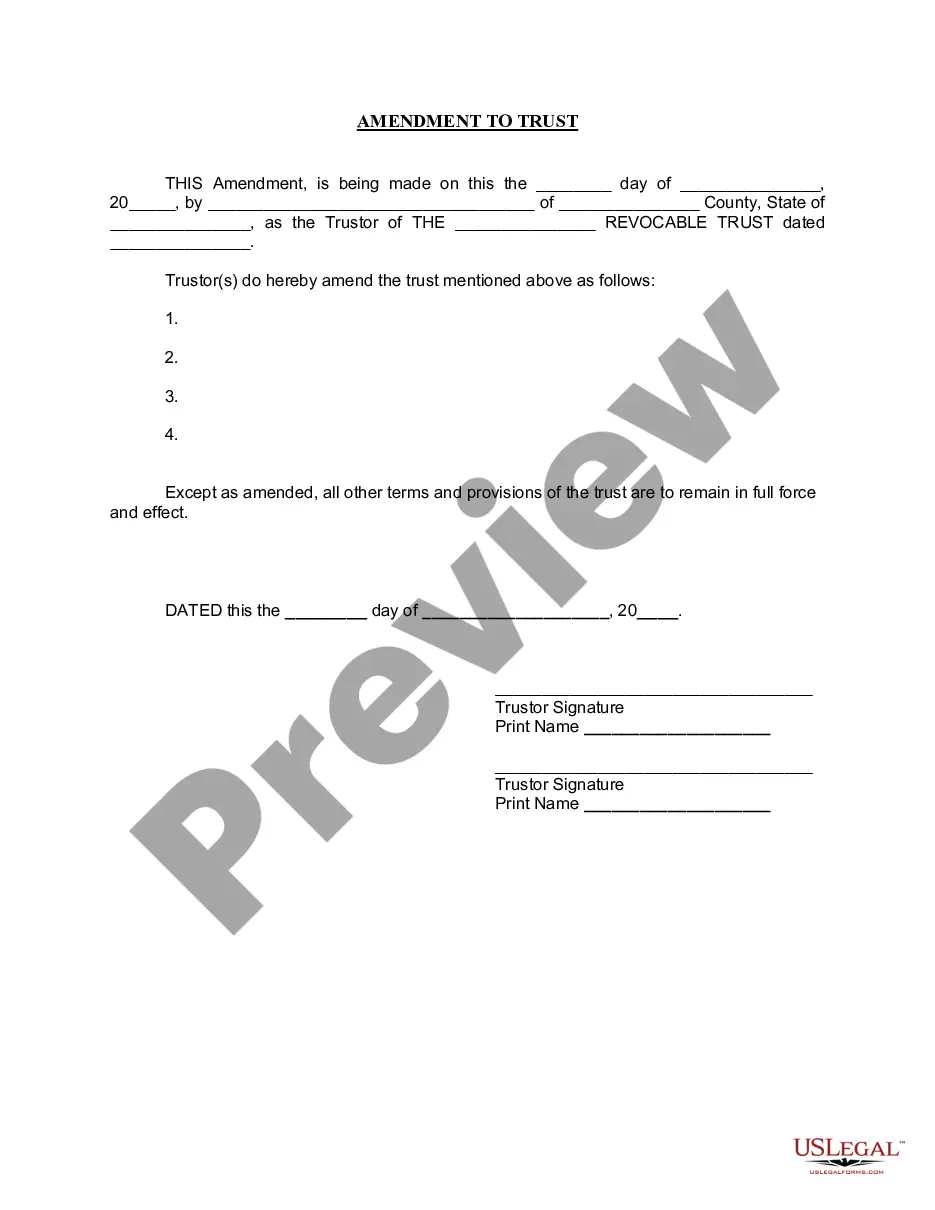

How to fill out California Order Waiving Requirement For Business Evaluation?

How much effort and resources do you frequently allocate to preparing formal documents.

There's a superior option for acquiring such forms than hiring legal professionals or spending hours searching the internet for a suitable template.

Another advantage of our service is that you can reach previously downloaded documents that you securely keep in your profile within the My documents tab. Retrieve them anytime and recreate your paperwork as often as needed.

Conserve time and effort while completing formal documents with US Legal Forms, one of the most dependable online solutions. Join us today!

- Inspect the document content to ensure it adheres to your state regulations. To accomplish this, read the document description or utilize the Preview option.

- If your legal template does not meet your requirements, locate another one using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the California Order Waiving Requirement For Business Evaluation. Otherwise, follow the subsequent steps.

- Click Buy now when you discover the appropriate blank. Choose the subscription plan that best fits your needs to access the complete offerings of our library.

- Create an account and process your subscription payment. You can pay using a credit card or via PayPal - our service is completely trustworthy for that.

- Download your California Order Waiving Requirement For Business Evaluation onto your device and fill it out on a printed version or electronically.

Form popularity

FAQ

Use Form 592-B to report to the payee the amount of payment or distribution subject to withholding and tax withheld as reported on Form 592, Resident and Nonresident Withholding Statement, Form 592-PTE, or Form 592-F, Foreign Partner or Member Annual Withholding Return.

SOS imposes a $250 penalty if you do not file your Statement of Information. We collect the penalty on behalf of the SOS .

Use Form 590, Withholding Exemption Certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding. Form 590 does not apply to payments for wages to employees.

Use Form 590, Withholding Exemption Certificate. # The payee is a corporation, partnership, or limited liability company (LLC) that has a permanent place of business in California or is qualified to do business in California.

through entity should use Form 592 if: It is reporting withholding from payments made to domestic nonresident independent contractors or domestic nonresident recipients of rents, endorsement income, or royalties.

Payments subject to withholding include: Payments to nonresident independent contractors who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Use Form 588, Nonresident Withholding Waiver Request, to request a waiver from withholding on payments of California source income to nonresident payees. Do not use Form 588 to request a waiver if you are a foreign (non-U.S.) partner or member.

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)