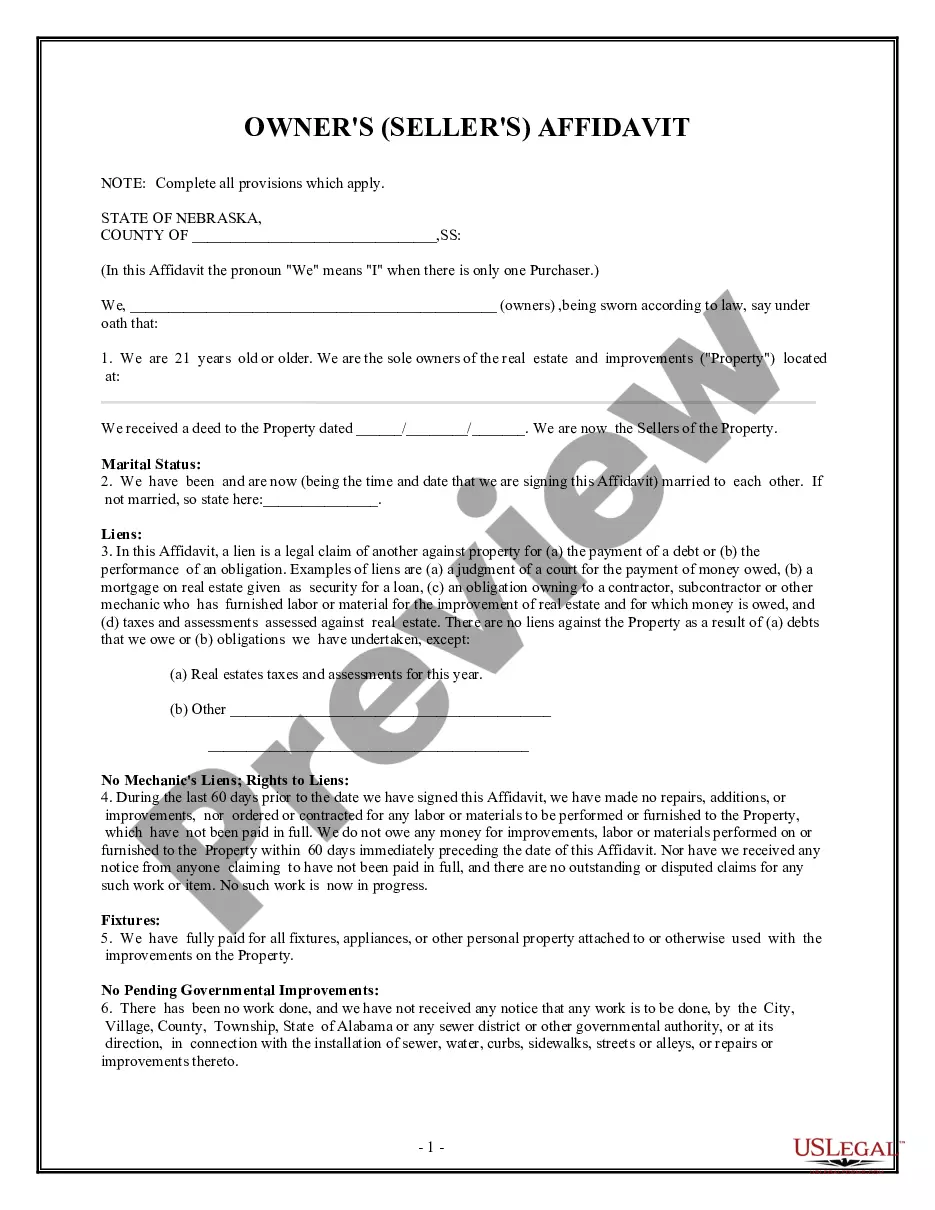

The California Change in Ownership Statement Death of Real Property Owner (Alameda) is a form used to notify the Alameda County Assessor/Recorder's Office of the death of a real property owner. This form is used to transfer the real property to the deceased owner's heirs or beneficiaries in accordance with California law. There are two types of California Change in Ownership Statement Death of Real Property Owner (Alameda): the Notarial Certificate of Death and the Affidavit for Transfer Without Probate. The Notarial Certificate of Death requires a notarial officer to certify that the decedent's death has been proven. The Affidavit for Transfer Without Probate requires the executor or administrator of the estate to certify that the decedent's death has been proven and that the real property is being transferred in accordance with California law. Both of these forms must be completed and accompanied by a copy of the death certificate and other relevant documents.

California Change In Ownership Statement Death Of Real Property Owner (Alameda)

Description

How to fill out California Change In Ownership Statement Death Of Real Property Owner (Alameda)?

Engaging with legal paperwork demands focus, precision, and the utilization of well-structured templates.

US Legal Forms has been assisting individuals nationwide for 25 years, ensuring that when you select your California Change In Ownership Statement Death Of Real Property Owner (Alameda) template from our platform, it adheres to both federal and state regulations.

All documents are designed for multiple uses, including the California Change In Ownership Statement Death Of Real Property Owner (Alameda) featured on this page. If you require them again, you can complete them without additional payment - simply access the My documents tab in your account and fill out your document whenever necessary. Experience US Legal Forms and quickly prepare your business and personal documents while ensuring full legal compliance!

- Verify the content of the form and its alignment with general and legal standards by previewing it or reviewing its description.

- Search for another official template if the one accessed earlier does not align with your needs or regional laws (the option for that is located at the top page corner).

- Log In to your account and save the California Change In Ownership Statement Death Of Real Property Owner (Alameda) in your preferred format. If this is your inaugural visit to our site, click Buy now to move forward.

- Create an account, select your subscription option, and complete your payment using your credit card or PayPal.

- Choose the format in which you wish to receive your document and click Download. Print the empty form or upload it to a professional PDF editor to prepare it digitally.

Form popularity

FAQ

Certain transfers of title do not trigger a reassessment event in California, including transfers between spouses or domestic partners, as well as transfers resulting from a will or trust. These scenarios allow for smoother transitions without affecting tax assessments. When dealing with the California Change In Ownership Statement Death Of Real Property Owner (Alameda), it's important to identify these exceptions, as they can simplify the estate process. Always consider using platforms like uslegalforms for guidance on these legal scenarios.

A change in ownership refers to any event that leads to the transfer of title of real property from one entity to another. In California, this can include various scenarios such as sales, inherited property, or legal transfers. Understanding this definition is essential when completing the California Change In Ownership Statement Death Of Real Property Owner (Alameda). Properly defining change in ownership helps in accurate tax assessment and compliance.

A property reassessment in California typically occurs when there is a change in ownership or when new construction is completed. This means that when a property is transferred, such as during the California Change In Ownership Statement Death Of Real Property Owner (Alameda), it often leads to reassessment to establish the current market value. Reassessment can affect property taxes, so understanding when it happens is important for any property owner.

In California, a change in ownership includes any transfer of real property that results in a new owner. This can occur through sales, gifts, or inheritance. When a property owner passes away, the California Change In Ownership Statement Death Of Real Property Owner (Alameda) must be filed to properly document this transfer. This is crucial for property tax purposes and ensures the new owner is recognized.

To change the deed on a house after the death of a spouse in California, you will need to complete a California Change In Ownership Statement Death Of Real Property Owner (Alameda). First, gather the necessary documents, including the death certificate and the existing deed. Next, fill out the required forms, ensuring you comply with any local regulations. If you feel uncertain, uslegalforms can provide guidance and necessary forms to simplify this process.

When the owner of a house dies in California, the property does not automatically change ownership until the legal transfer occurs. The heirs may decide to sell, retain, or manage the property, often requiring a California Change In Ownership Statement Death Of Real Property Owner (Alameda). Understanding this process can help you navigate the responsibilities and rights associated with property ownership after a death.

To transfer property from one person to another in California, you must prepare a grant deed or quitclaim deed and file it with the appropriate county recorder's office. This process may also involve submitting a California Change In Ownership Statement Death Of Real Property Owner (Alameda) to ensure proper property tax updates. For efficiency, consider using uslegalforms to easily navigate the required legal documentation.

In California, property inheritance generally follows the guidelines of state law unless a will specifies otherwise. Typically, spouses, children, or other relatives are first in line to inherit assets, including real property. Consulting a legal resource like uslegalforms can provide clarity on different scenarios and requirements under the California Change In Ownership Statement Death Of Real Property Owner (Alameda).

A transfer on death deed in Alameda County allows a property owner to designate beneficiaries who will inherit the property upon their death, avoiding probate. It is an efficient way to handle property transfers, in line with California Change In Ownership Statement Death Of Real Property Owner (Alameda). If you're considering this option, uslegalforms offers useful templates and guidance.

To report the death of a property owner in California, you typically need to submit a California Change In Ownership Statement Death Of Real Property Owner (Alameda) along with the deceased's death certificate. This report is essential for the local assessor's office to update property records and ensure accurate tax assessments moving forward.