California Net Worth Statement is a form used to calculate the net worth of an individual, business, or other entity. It is used to measure the financial position of an entity by taking into account all of its assets, liabilities, and net worth. This statement is commonly used by businesses to calculate the value of their assets, liabilities, revenues, and expenses. It is also used by individuals to calculate their overall net worth. The California Net Worth Statement is typically created in a spreadsheet format and is used for both personal and business purposes. There are two types of California Net Worth Statements: 1. Personal California Net Worth Statement: This statement is used by individuals to calculate their overall net worth by taking into account their assets, liabilities, and net worth. 2. Business California Net Worth Statement: This statement is used by businesses to calculate the value of their assets, liabilities, revenues, and expenses.

California Net Worth Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

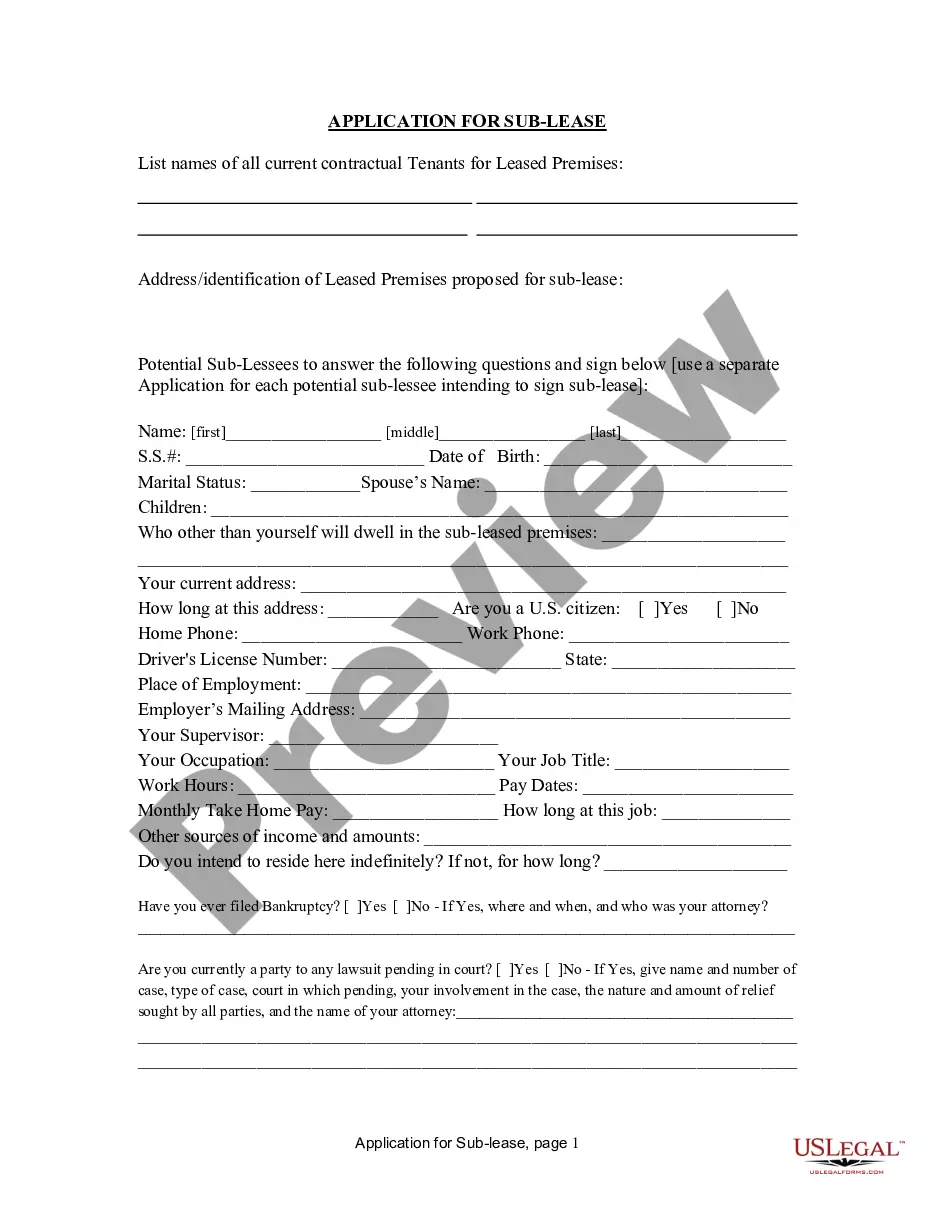

How to fill out California Net Worth Statement?

If you are looking for a method to correctly draft the California Net Worth Statement without employing a legal advisor, you have come to the right place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for any personal and business circumstance. Every document available on our platform is crafted in accordance with federal and state regulations, ensuring that your papers are in order.

Another excellent feature of US Legal Forms is that you can always access the paperwork you obtained - you can find any of your downloaded templates in the My documents section of your profile whenever you need them.

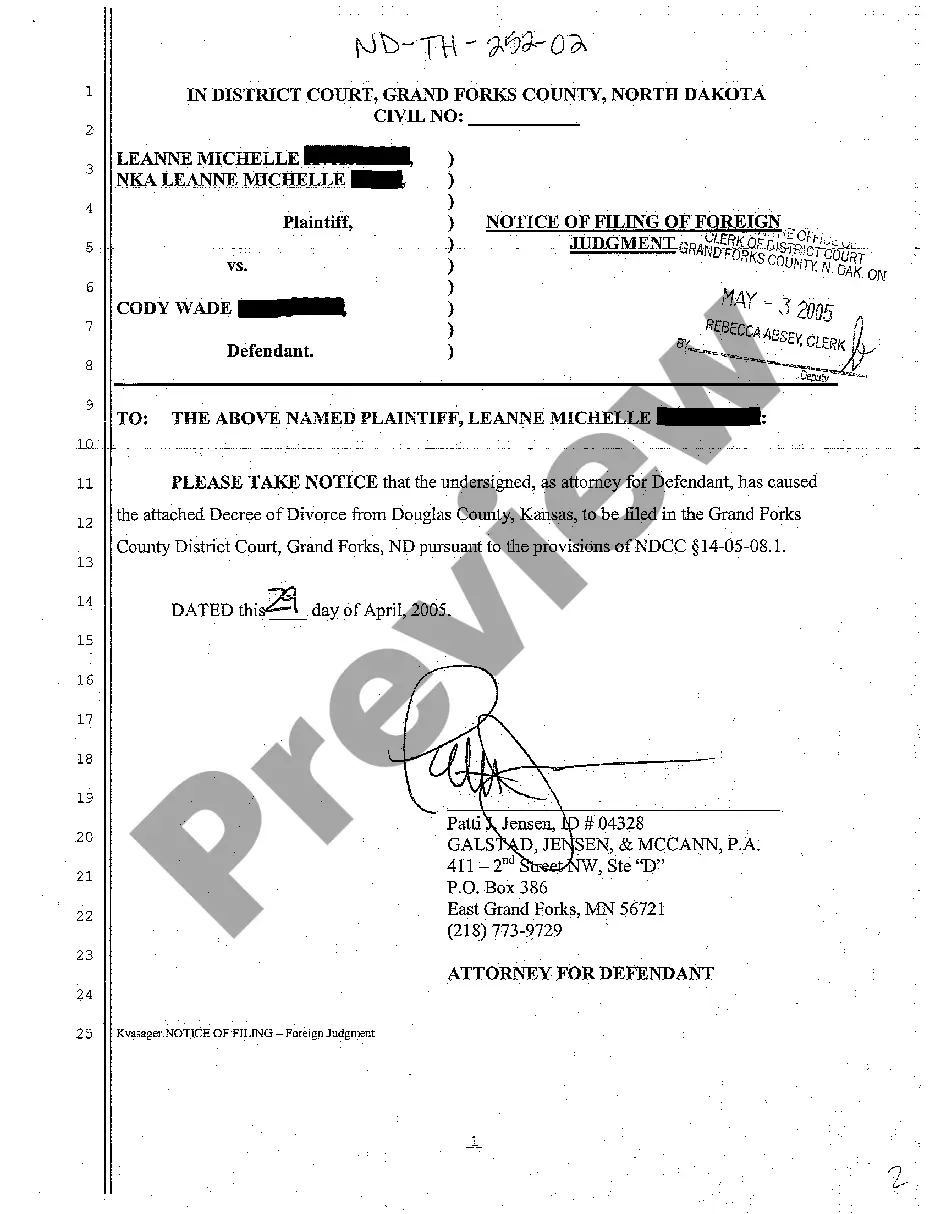

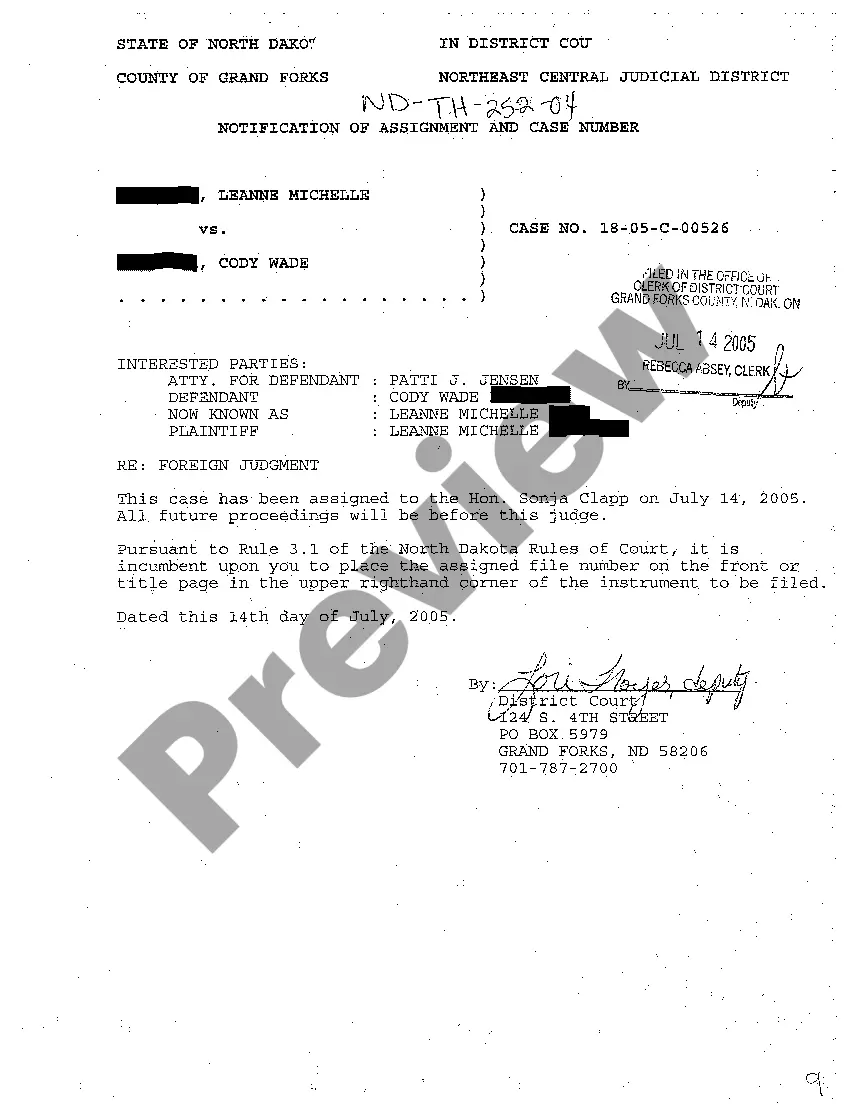

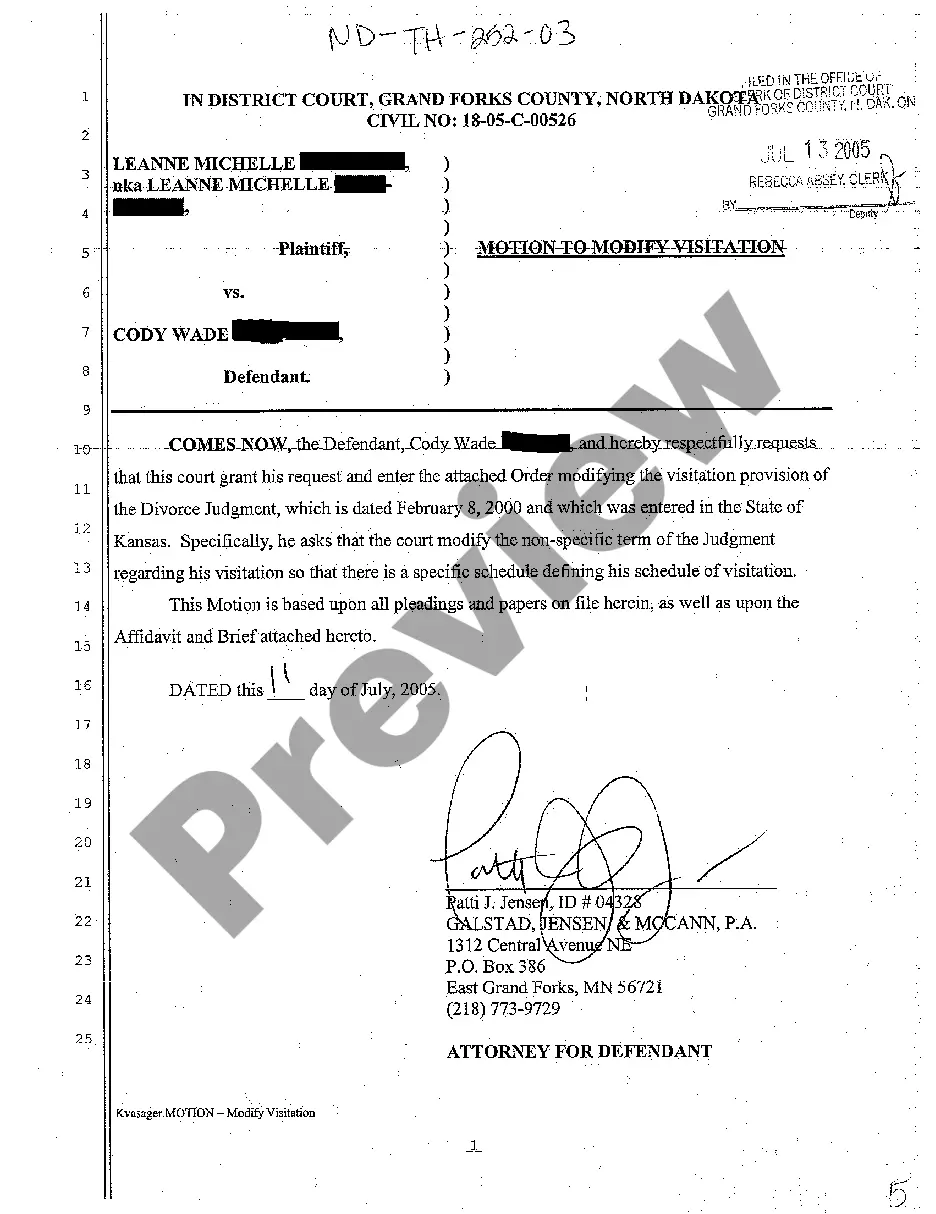

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or browsing through the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown list to find an alternate template if there are any discrepancies.

- Repeat the content review and click Buy now when you are satisfied with the compliance of the paperwork with all the requirements.

- Log In to your account and click Download. If you do not have one yet, register for the service and choose a subscription plan.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Select the format in which you wish to receive your California Net Worth Statement and download it by clicking the relevant button.

- Upload your template to an online editor to fill it out and sign it quickly, or print it to prepare your physical copy manually.

Form popularity

FAQ

To find your net worth statement, start by listing all your assets and liabilities. You can create your California Net Worth Statement using a simple spreadsheet or financial software that organizes your data neatly. If you prefer an easier solution, platforms like uslegalforms offer templates that guide you through the process, ensuring you capture all necessary details.

A net worth example includes calculating assets like savings accounts, real estate, and investments, minus liabilities such as mortgages, loans, and credit card debt. For instance, if you own a home valued at $500,000, have $50,000 in savings, and owe $300,000 on a mortgage, your net worth would be $250,000. This calculation is an important part of compiling your California Net Worth Statement.

In California, net worth distribution varies significantly across different demographics and regions. The state has some of the wealthiest individuals, as well as a considerable number of people with lower net worth. Understanding this distribution is essential for analyzing economic inequality. If you're creating a California Net Worth Statement, you can gain insights by exploring regional statistics.

Receiving a 1099-G from the California Franchise Tax Board typically indicates that you received a tax refund or state payment during the tax year. This form provides important information that contributes to your overall income reporting. It’s advisable to include this information when calculating your California Net Worth Statement, as it impacts your financial position and tax obligations.

Yes, California offers a first year exemption under the CA 800 form, which can benefit property owners during their initial year of ownership. This exemption is designed to reduce property taxes, allowing homeowners to maximize their financial decisions effectively. Understanding how this exemption interacts with your California Net Worth Statement will help you maintain a clear view of your financial landscape.

To obtain California state tax forms, visit the California Franchise Tax Board website or your local tax office. You can easily download the necessary forms and print them at home. For those preferring assistance, consider using online services or tax software that can provide these forms, ensuring you easily manage your California Net Worth Statement and any related tax requirements.

Submitting a Statement of Information in California is straightforward. You need to complete the required form, which can be done online or by mail. This statement often includes information tied to your California Net Worth Statement, ensuring you disclose detailed asset data. Various resources are available to assist you through the submission process, making it easier to comply with California regulations.

Yes, you can file your California Form 540 online. This streamlined process allows you to complete your California Net Worth Statement electronically, making it easier to report your income and assets. By using online services, you can ensure accuracy and stay organized. Additionally, many platforms offer guidance throughout the process, so you feel confident in your submissions.

When determining what to put for your net worth on a California Net Worth Statement, list your total assets and total liabilities. The result of subtracting your liabilities from your assets will give you your net worth figure. U.S. Legal Forms can provide the necessary templates to help you present this information in a clear and organized manner.

Before completing your California Net Worth Statement, gather all your financial documents and categorize them into assets and liabilities. Take time to review your financial history for accuracy, ensuring you account for every significant item. U.S. Legal Forms offers resources that can guide you through this preparatory stage, making the completion process smoother.