California Release of Mechanic Lien

Form popularity

FAQ

Generally, this requires the assistance of a lawyer. The homeowner may petition the courts under Civil Code Section 8480 in California to remove the mechanic's lien when it is not timely issued or recorded. A lawsuit is usually necessary to file it against the owner by the contractor or subcontractor.

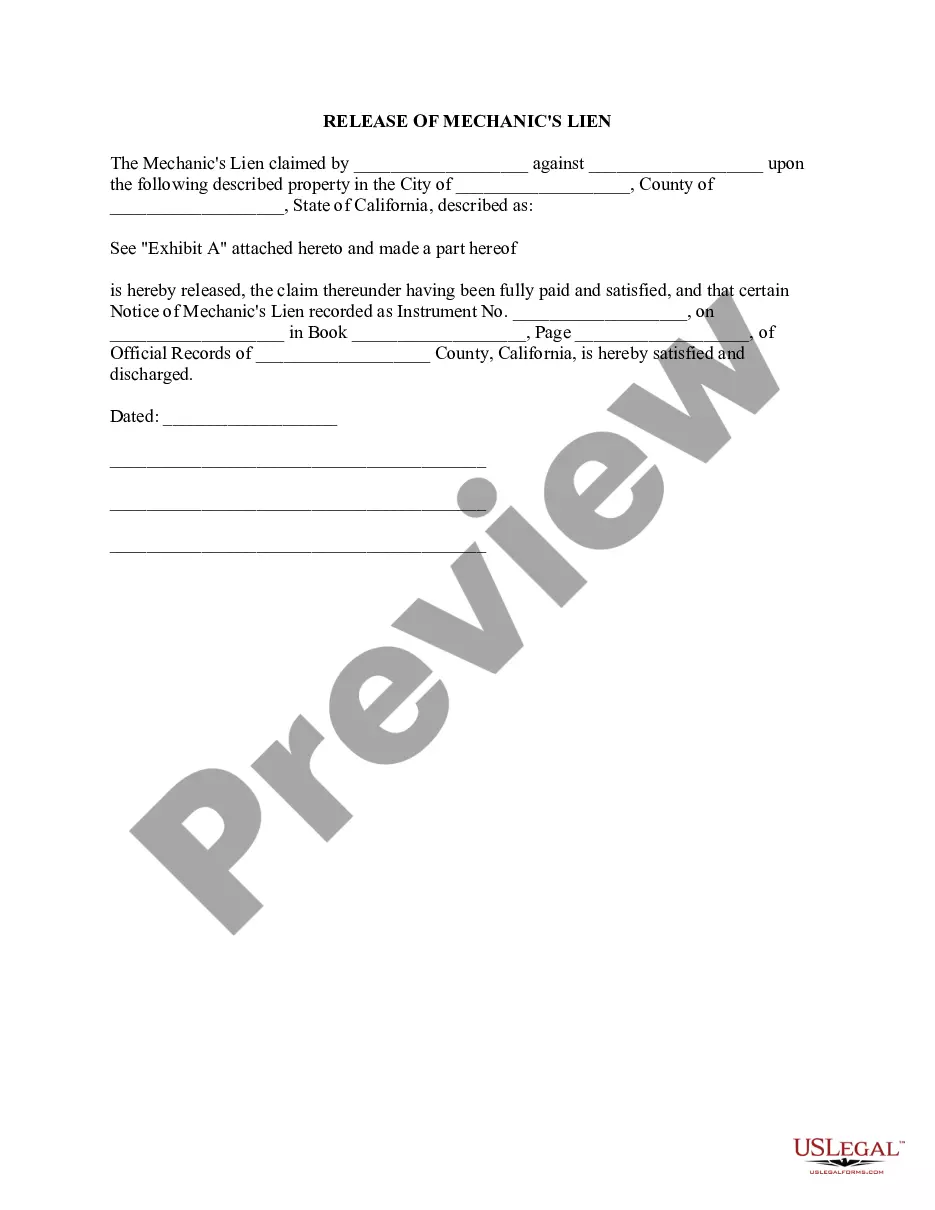

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

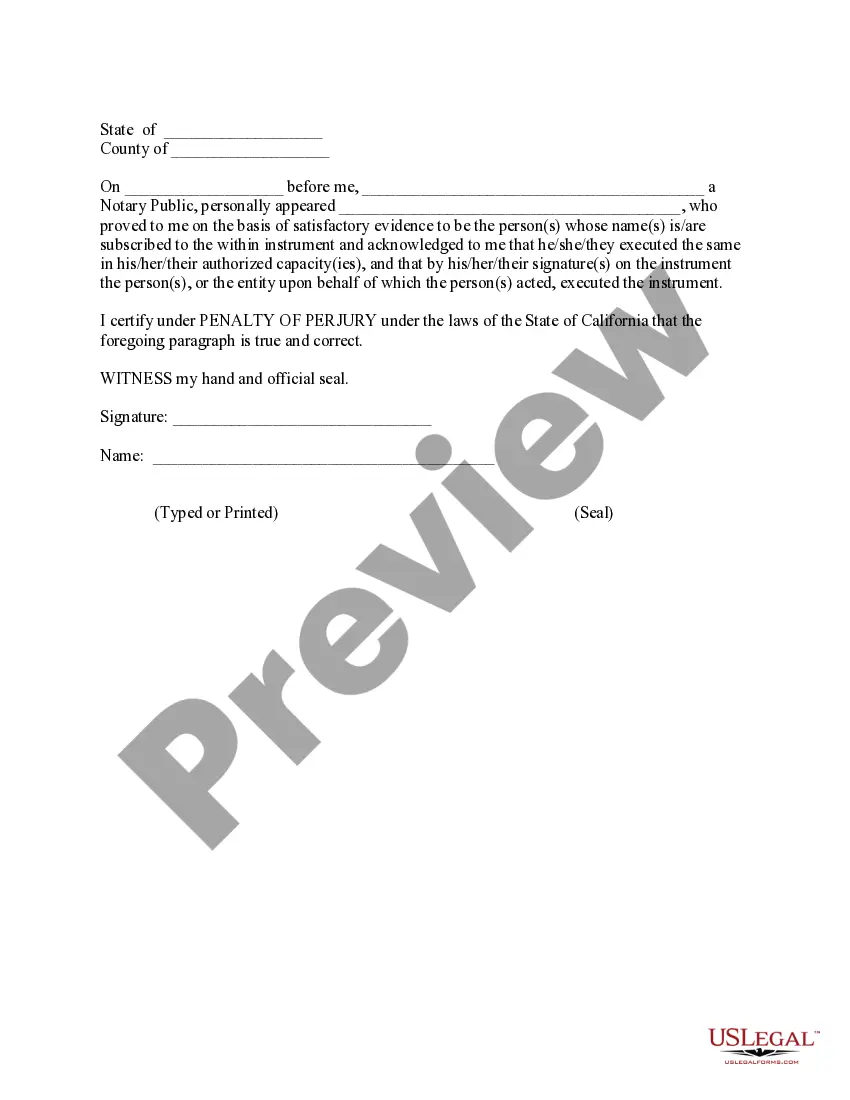

This may be the case in many circumstances. However, when it comes to lien waivers, in particular, it may make matters worse. Only a handful of states require lien waivers to be notarized. In California, this not only is this not required but could also potentially invalidate the lien waiver.

If you have not been paid, a California mechanics lien must be enforced through a lien foreclosure action within 90 days from when the Claim of Lien has been filed. If no action is taken within 90 days, then the lien claim will expire and no longer be enforceable.

Court Petition to Release the Property Lien If the lien claimant doesn't remove the invalid lien, and the time has expired to record the mechanics lien and take action to foreclose, you may petition the court for a decree to release the property from the lien.

For example, for most cases in the state of California, a mechanics lien will expire 90 days from the date on which the lien was recorded. However, in Florida, mechanics liens generally last for a year after the recording date.

The quickest way we will release a Notice of State Tax Lien is for you to pay your liened tax debt in full (including interest, penalties, and fees). We will begin the lien release process once the payment is posted. If you pay in full using: Bank account (Web Pay) : Make separate payments for each tax year.