California Affidavit - Death of Joint Tenant

Definition and meaning

The California Affidavit - Death of Joint Tenant is a legal document used to officially declare the passing of a co-owner in a property held under joint tenancy. This affidavit is essential to facilitate the transfer of property ownership to the surviving joint tenant without the need for probate proceedings.

How to complete a form

To complete the California Affidavit - Death of Joint Tenant, follow these steps:

- Collect the necessary information, including the decedent's name, date of death, and property details.

- Obtain a certified copy of the death certificate.

- Fill in the required sections of the affidavit, ensuring accuracy in the names and dates.

- Attach the certified death certificate as part of the form.

- Sign the document in the presence of a notary public.

Legal use and context

This affidavit serves a specific legal function within California property law. When one joint tenant dies, the surviving joint tenant gains full ownership of the property by right of survivorship. This affidavit is the formal declaration needed to confirm this transfer of interest and can be used to update property records accordingly.

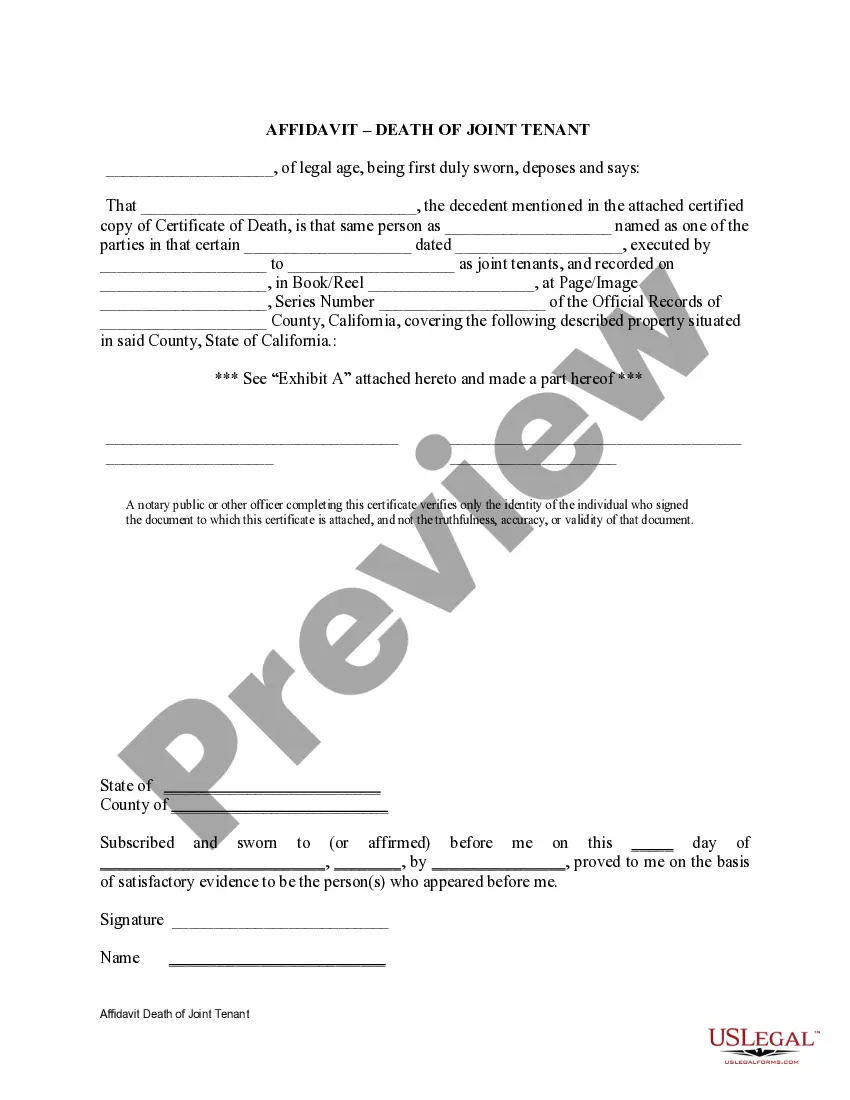

Key components of the form

The California Affidavit - Death of Joint Tenant includes several critical sections:

- Identification of the decedent: Name and details as stated in the death certificate.

- Property description: Clear identification of the property held in joint tenancy.

- Surviving tenant details: Information regarding the surviving joint tenant.

- Notary section: A section for notarization to validate the affidavit.

What to expect during notarization or witnessing

During the notarization process, the notary public will verify the identity of the signatories using valid identification. The joint tenant must present the affidavit for signing in the presence of the notary, who will then stamp and sign the document, confirming its authenticity.

Common mistakes to avoid when using this form

When completing the California Affidavit - Death of Joint Tenant, be cautious of the following common errors:

- Inaccurate property descriptions, which can lead to legal complications.

- Failing to attach the certified death certificate.

- Not having the form notarized correctly, which could invalidate the affidavit.

Benefits of using this form online

Utilizing the California Affidavit - Death of Joint Tenant online offers several advantages:

- Convenience by allowing users to fill out the form at their own pace.

- Access to attorney-drafted templates ensures legal compliance.

- Immediate availability of downloadable formats to streamline the filing process.

Form popularity

FAQ

If an ?other than original transferor? joint tenant dies or transfers his interest then then whether there is a change in ownership depends on if an ?original transferor? joint tenant remains. So long as there is an original transferor there is no reassessment.

Joint tenancy is a way for two or more people to own property in equal shares so that when one of the joint tenants dies, the property can pass to the surviving joint tenant(s) without having to go through probate court.

HOW DO I RECORD AN AFFIDAVIT? Take a certified copy of the death certificate of the deceased joint tenant and your affidavit to the recorder's office in the county where the real property is located. The recorder's office also requires a Preliminary Change of Ownership Report (PCOR) when filing the affidavit.

California Affidavit of Surviving Spouse Information Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution.

If parties hold title as joint tenants and one is deceased, the survivor may file an Affidavit of Death of Joint Tenant. It may be advisable to consult an attorney due to the legal aspects involving a change in ownership of real property. The above forms can be purchased at most office supply or stationery stores.

Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together.

Record the Affidavit and file the PCOR at the Recorder's Office in the county where the property is located. If you attached the property description (instead of typing it out), be sure to include the attachment when you record the Affidavit.

Where it is held as joint tenants, on the death of one of the owners, the property becomes owned by the other joint owner. For example, Joe owns a property as a joint tenant with his dad, Stan. When Stan dies, the property automatically passes to Joe as sole owner.