This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

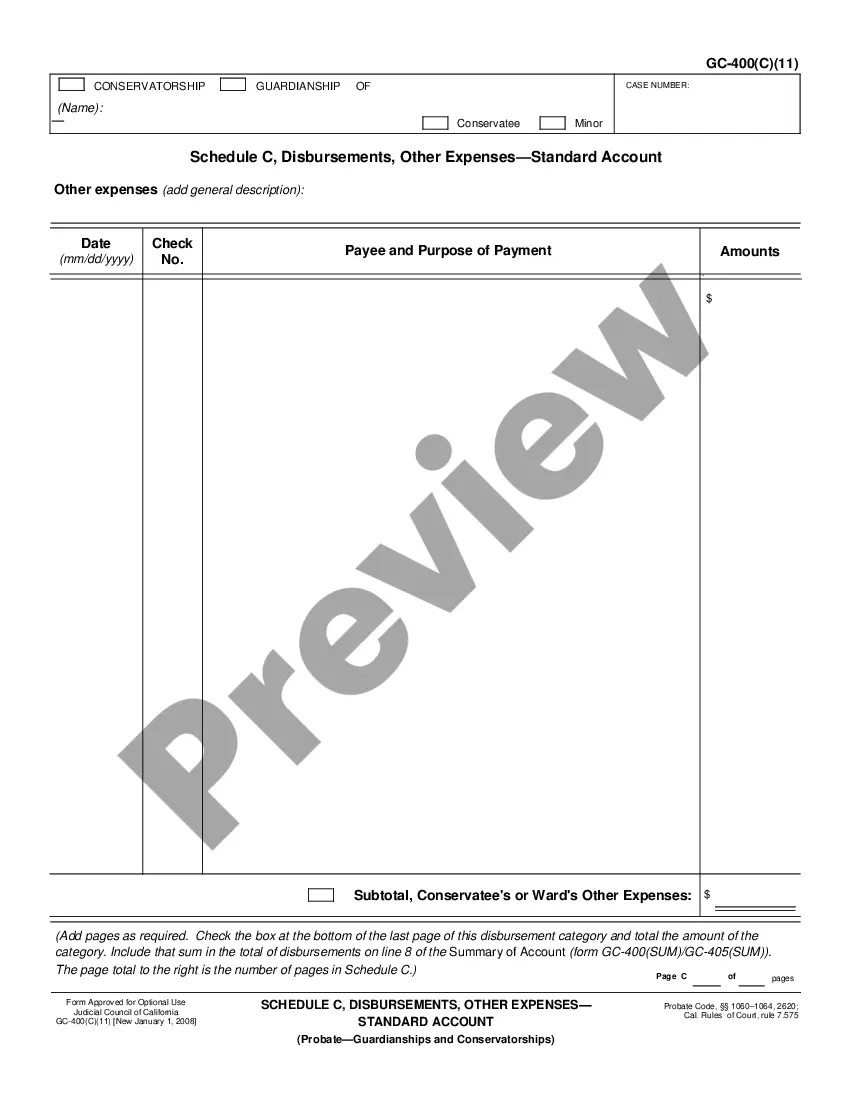

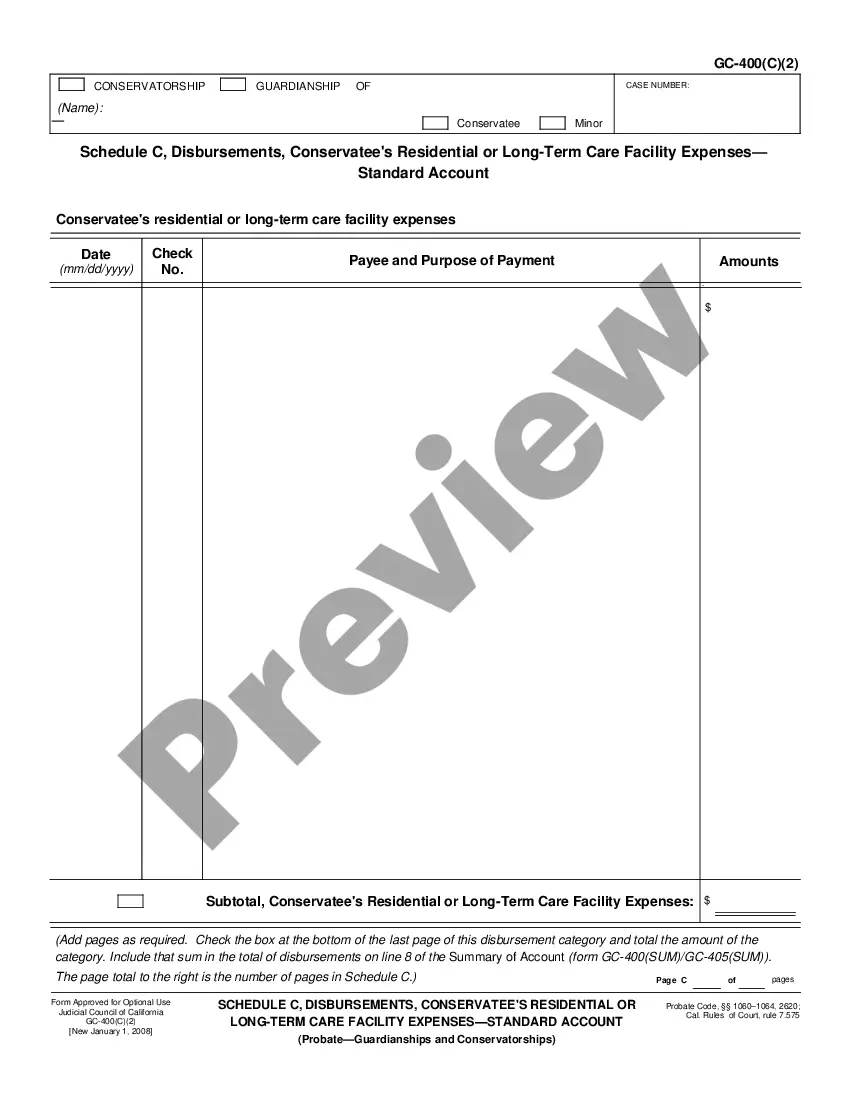

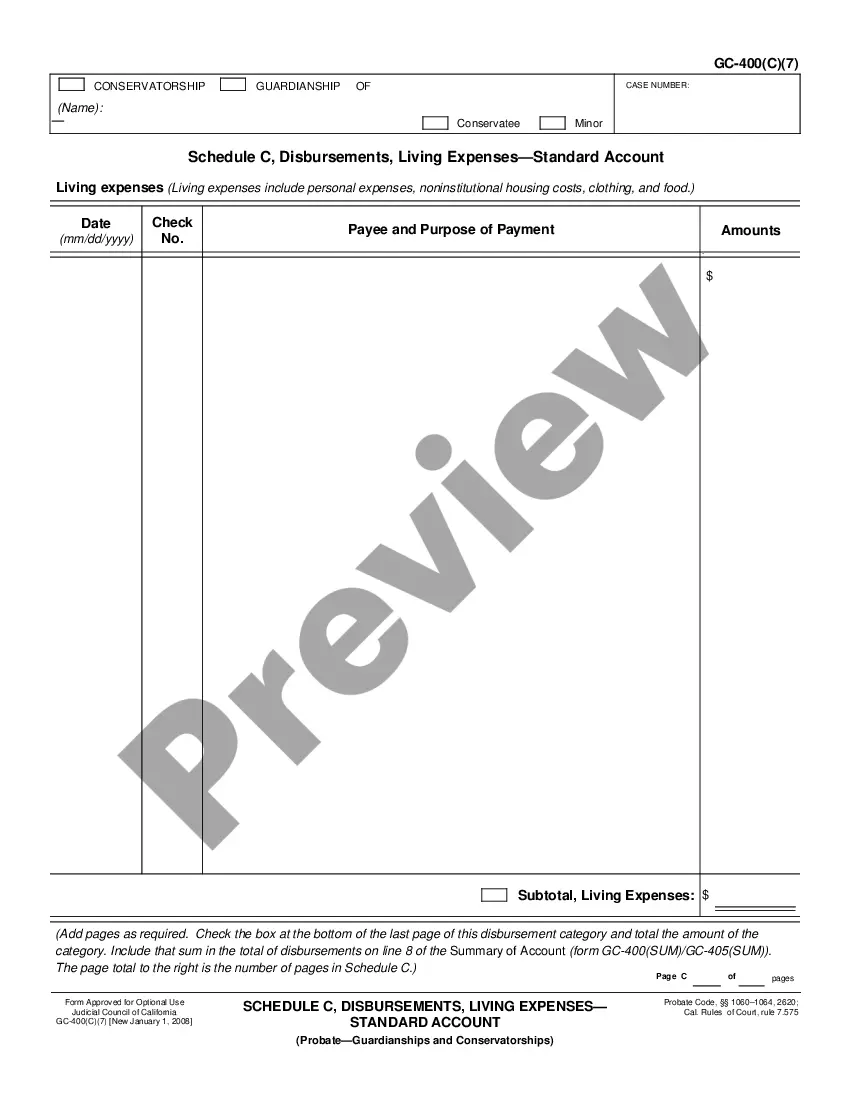

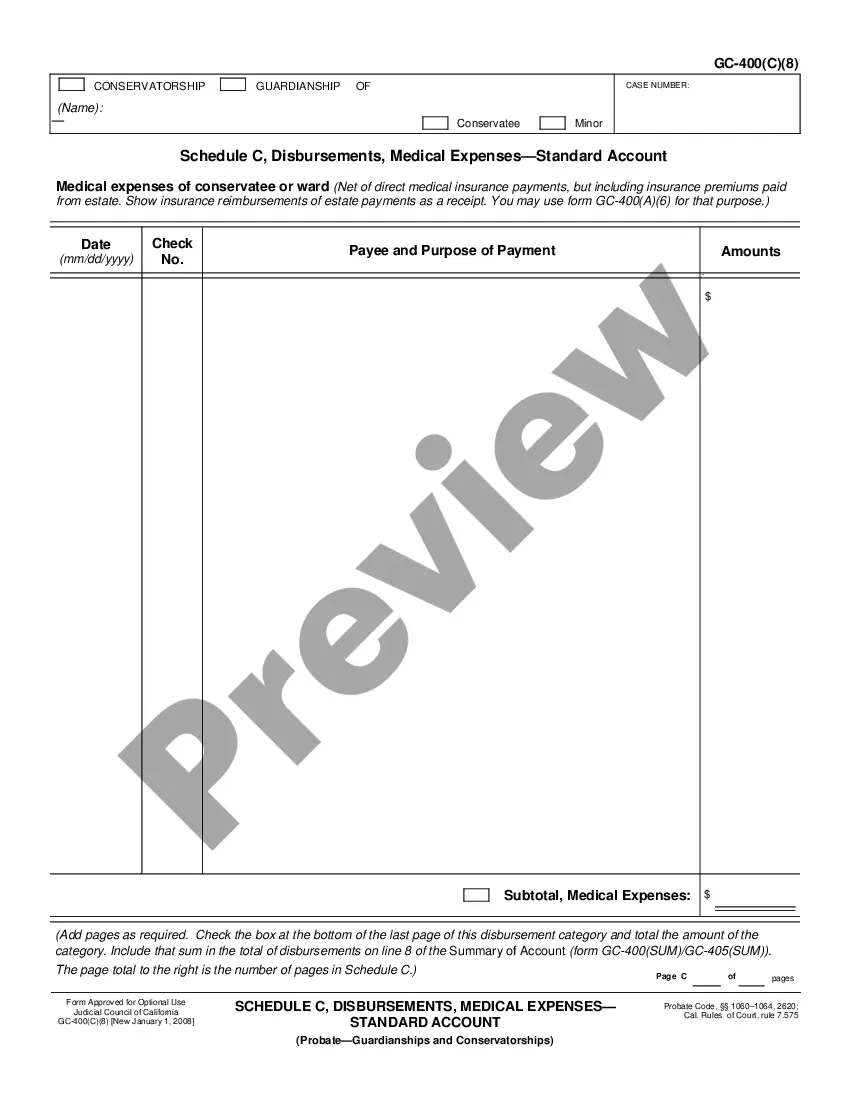

California Schedule C, Disbursements, Conservatee's Caregiver Expenses - Standard Account

Description

How to fill out California Schedule C, Disbursements, Conservatee's Caregiver Expenses - Standard Account?

If you are searching for precise California Schedule C, Disbursements, Conservatee's Caregiver Expenses - Standard Account forms, US Legal Forms is precisely what you require; access documents created and reviewed by state-authorized legal experts.

Utilizing US Legal Forms not only spares you from the troubles associated with correct documentation; furthermore, you won’t squander time, effort, or money! Acquiring, printing, and filling out a professional form is significantly more economical than hiring an attorney to do it for you.

And there you have it. In just a few simple clicks, you have an editable California Schedule C, Disbursements, Conservatee's Caregiver Expenses - Standard Account. Once you create an account, all future orders will be processed even more easily. If you possess a US Legal Forms subscription, just Log In to your account and click the Download button visible on the form’s page. Then, when you need to utilize this template again, you will always find it in the My documents section. Don’t waste your time and effort searching through numerous forms on various websites. Purchase professional templates from just one reliable service!

- To begin, finalize your enrollment process by entering your email and creating a password.

- Follow the steps outlined below to establish an account and locate the California Schedule C, Disbursements, Conservatee's Caregiver Expenses - Standard Account template to address your needs.

- Use the Preview feature or check the file description (if available) to ensure that the template is the one you require.

- Verify its relevance in the state where you reside.

- Click Buy Now to place your order.

- Select a preferred payment plan.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable format and save the form.

Form popularity

FAQ

Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.A disbursement is the actual delivery of funds from a bank account.

A payment made to suppliers on behalf of your customers is called a 'disbursement' if you pass the cost on to your customers when you invoice them.you pass on the exact amount of each cost to your customer when you invoice them. the goods and services you paid for are in addition to the cost of your own services.

Disbursement means paying out money. The term disbursement may be used to describe money paid into a business' operating budget, the delivery of a loan amount to a borrower, or the payment of a dividend to shareholders.A disbursement is the actual delivery of funds from a bank account.

Depending on the circumstances of the matter, disbursements may include expenses such as witness fees, court filing and hearing fees, interpreter's fees and fees for the service of court documents such as subpoenas. A legal aid grant may cover these fees.

Some examples of disbursements are payroll expenses, rent, taxes or insurance premiums. In organizational structures, the Finance Department is often the one that handles the disbursement program where all the company's financial commitments are scheduled to be paid at certain moment.

There is no absolute definition of disbursements, but are generally expenses a solicitor has to pay out on behalf of a client, for goods or services provided to the client, or on the client's behalf.The starting point for recoverability of any disbursement is whether it is covered in the contract.

When a business sends a disbursement on behalf of a client, the reimbursement is what the client pays to the company as a refund for the original payment.In general, the difference between a payment and disbursement is that one is the instance or process of disbursing while the other is the act of paying.

HMRC defines 'disbursements' as 'a payment made to suppliers on behalf of your customers'.you paid the supplier on your client's behalf and acted as the agent of your client. your client received, used or had the benefit of the goods or services you paid for on their behalf.

Disbursements, are out of pocket expenses which we incur on your behalf to a third party, whilst conducting your sale or purchase. Examples of disbursements are your search fees, your land registry fees and your CHAPS payment fees (same day electronic transfer of funds fees).