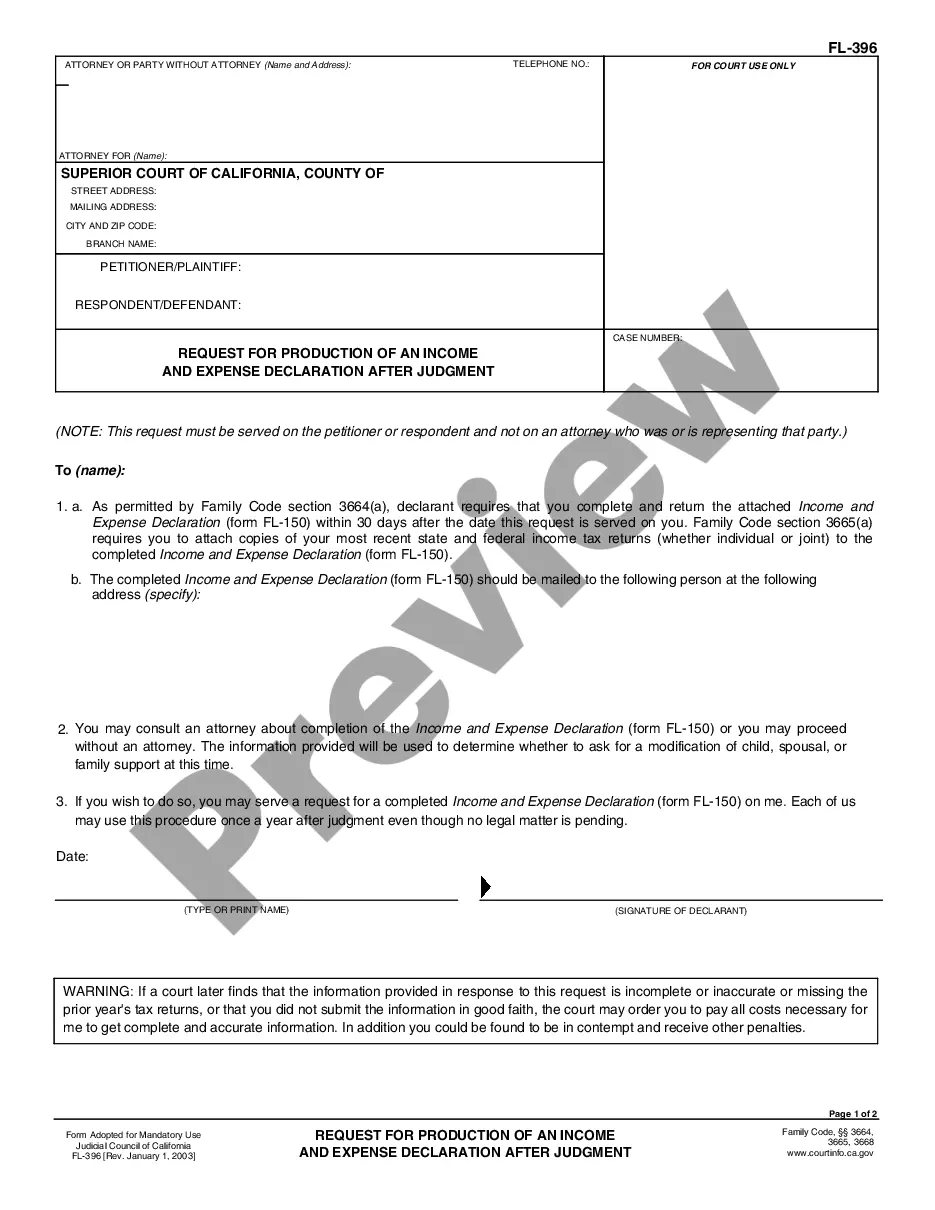

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

California Request for Income and Benefit Information From Employer

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Request For Income And Benefit Information From Employer?

If you're seeking exact California Request for Income and Benefit Information From Employer web templates, US Legal Forms is precisely what you require; discover documents prepared and validated by state-licensed attorneys.

Utilizing US Legal Forms not only alleviates your concerns regarding legal paperwork; moreover, you also save time, effort, and money!

Establish your account and pay with your credit card or PayPal. Select a convenient format and save the form. And there you go! In just a few simple steps, you obtain an editable California Request for Income and Benefit Information From Employer. Once you set up your account, all future orders will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download option available on the form's page. Then, whenever you need to access this sample again, you can always find it in the My documents section. Don’t waste your time and effort searching through numerous forms on different websites. Buy accurate templates from one secure platform!

- Downloading, printing, and submitting a professional template is significantly more affordable than hiring a lawyer to draft it for you.

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to set up your account and locate the California Request for Income and Benefit Information From Employer web template to solve your needs.

- Use the Preview option or review the document details (if accessible) to ensure that the sample is what you require.

- Verify its legality in your area.

- Click Buy Now to place an order.

- Choose a recommended pricing plan.

Form popularity

FAQ

In California, employers are generally required to provide certain benefits, including health insurance and workers' compensation. The specific requirements can vary based on the size of the company and the type of employment. Additionally, employees can request information on income and benefits through the California Request for Income and Benefit Information From Employer. For comprehensive guidance on benefits and rights, consider visiting USLegalForms, which offers valuable resources.

If you do not have a job, you can show proof of income through other means such as bank statements, tax returns, or documentation of any freelance or side work. In some cases, you may also provide letters or documents from previous employers. While these may not be directly related to the California Request for Income and Benefit Information From Employer, they can still support your income verification.

To register your employer for unemployment in California, you need to visit the Employment Development Department (EDD) website and follow their guidelines. This process involves submitting necessary forms and providing information about the employee's job status. Utilizing the California Request for Income and Benefit Information From Employer will facilitate accurate reporting and help ensure compliance.

A letter from your employer serves as official proof of income, detailing your salary, job title, and duration of employment. This document is often required for loans, rental agreements, or financial assistance. When asking for this letter, ensure it meets the criteria associated with the California Request for Income and Benefit Information From Employer.

In California, an employer can provide basic details for employment verification, such as your job title, dates of employment, and salary history. They may also share your work performance if necessary. However, employers must comply with privacy laws and should only disclose what is relevant to the California Request for Income and Benefit Information From Employer.

Yes, if you hire employees in California, it is essential to register as an employer. This registration ensures that you adhere to state regulations, and it allows you to manage unemployment insurance and workers' compensation accurately. For clarity and further details, consider utilizing resources like the California Request for Income and Benefit Information From Employer through U.S. Legal Forms. This can simplify the process and help you fulfill your obligations as an employer.

Registering as an employer involves submitting your business information to the necessary state authorities, such as the California Employment Development Department. This process not only provides you with an employer identification number but also keeps you compliant with state labor laws. If you are unsure about how to proceed, utilizing the California Request for Income and Benefit Information From Employer can guide you effectively. Platforms like U.S. Legal Forms can assist you in navigating the registration process smoothly.

To inform the EDD that you are working, you must report your employment status when you submit your weekly certifications. It’s important to accurately state your earnings during this time, as it can affect your benefits. If you want to learn more about the California Request for Income and Benefit Information From Employer, you can find helpful resources on the U.S. Legal Forms platform. This ensures proper communication with the EDD to avoid any complications.