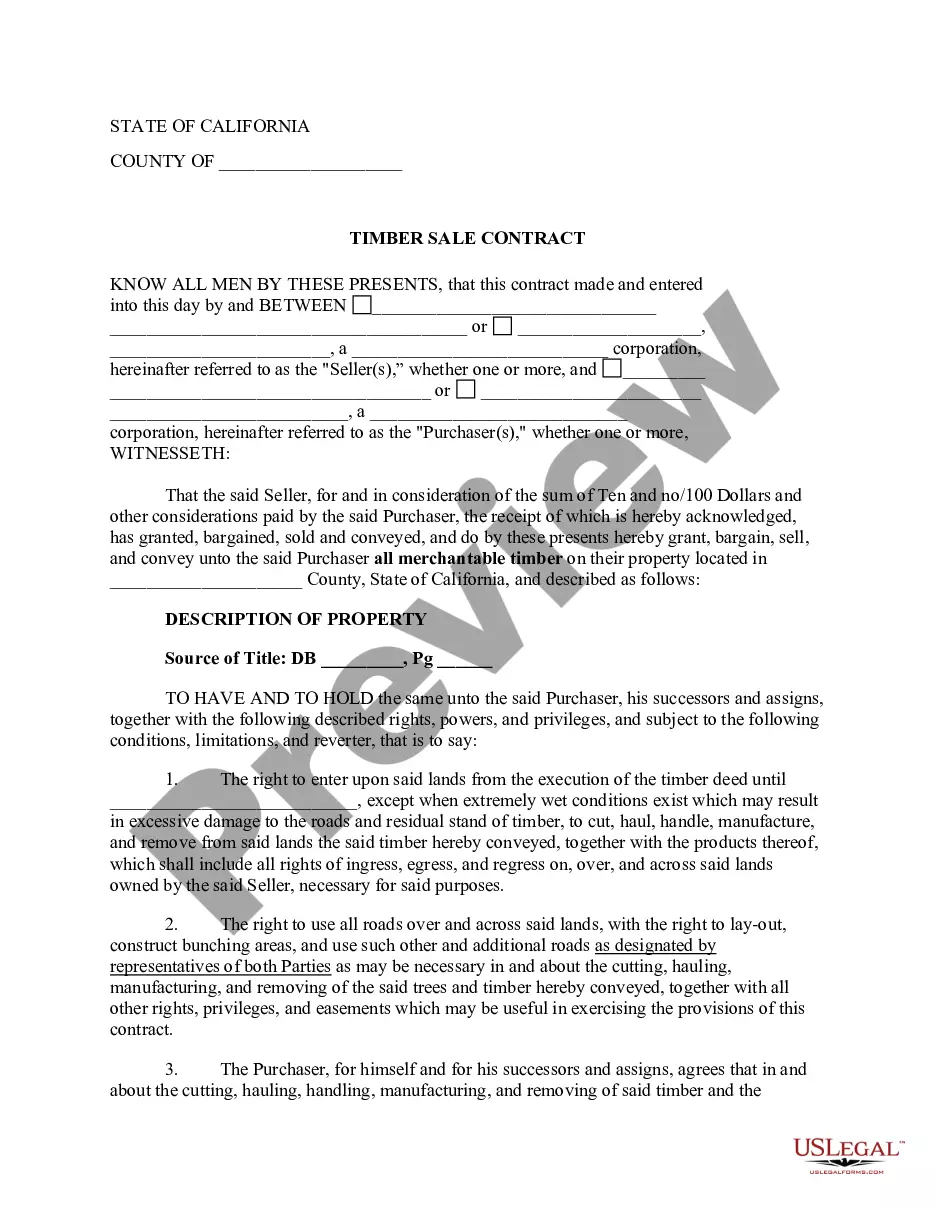

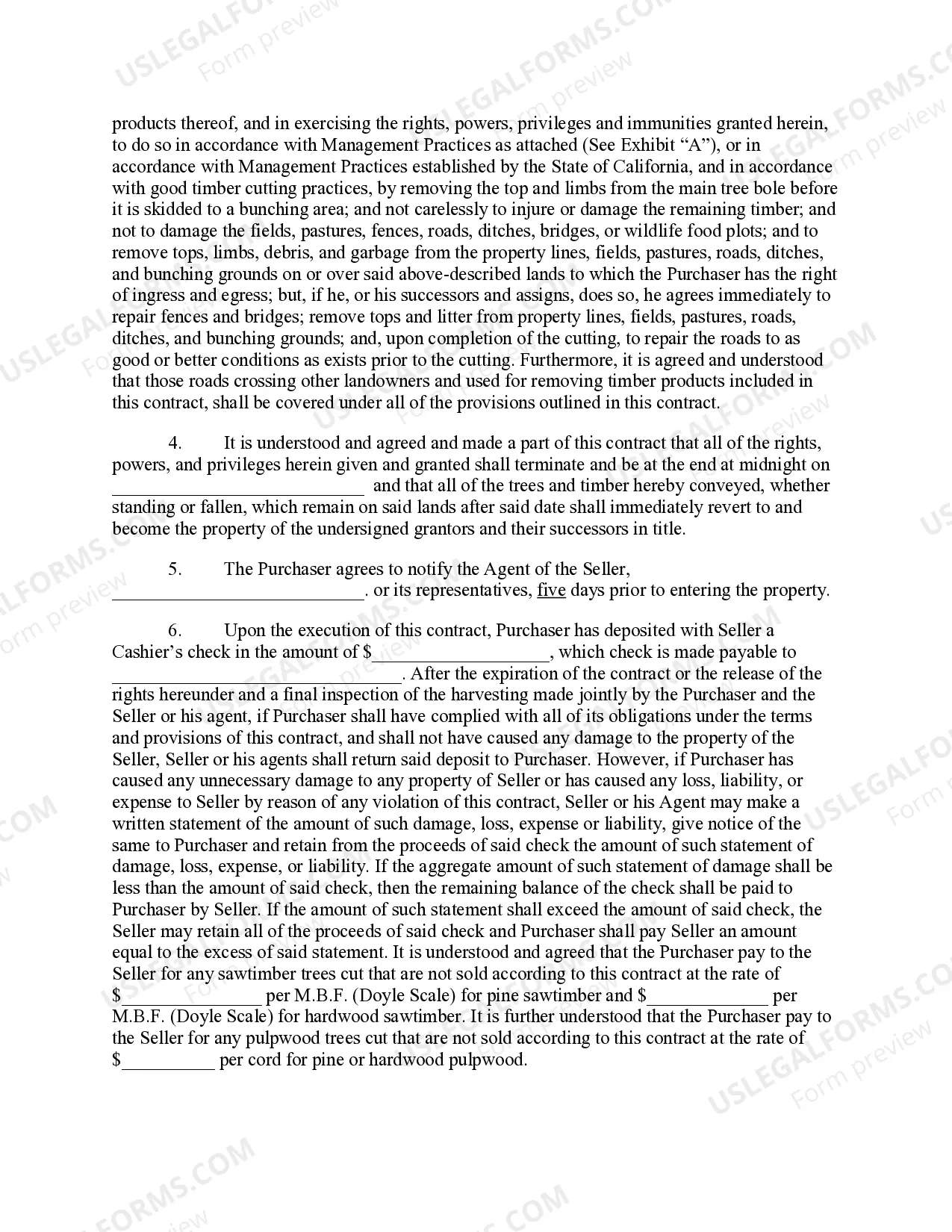

This is a contract whereby the buyer agrees to purchase all timber as designated for removal by the seller. Seller will also grant the buyer the right of ingress and egress to remove the timber from seller's land.

California Timber Sale Contract

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Timber Sale Contract?

If you're looking for accurate California Timber Sale Contract examples, US Legal Forms is exactly what you need; access documents created and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from stress related to legal documents; it also saves you time, effort, and finances! Downloading, printing, and completing a professional document is far less expensive than hiring an attorney to do it for you.

And that’s all. In just a few straightforward steps, you receive an editable California Timber Sale Contract. Once your account is created, all future requests will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button found on the form's page. Then, whenever you need to use this template again, you can always locate it in the My documents section. Avoid wasting your time comparing numerous forms on different platforms. Obtain precise templates from one reputable service!

- To get started, complete your registration by providing your email and creating a secure password.

- Follow the instructions below to set up your account and locate the California Timber Sale Contract sample to address your situation.

- Use the Preview feature or review the document description (if available) to confirm that the example is what you need.

- Verify its legitimacy in your residing state.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay using your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

Legally avoiding capital gains tax generally requires strategic planning and good timing. You might want to leverage tax-deferred exchanges or take advantage of specific deductions or credits. Consult a tax advisor who understands the intricacies of the California Timber Sale Contract to explore all the legal avenues available to you.

Selling livestock can be considered a capital gain, similar to timber sales. It essentially depends on how you treat the income on your tax return; profits from livestock should be reported under capital gains. If you fully understand the tax implications, especially when dealing with multiple assets, aligning this with your California Timber Sale Contract can ensure a clearer tax picture.

Avoiding capital gains tax on timber sales typically involves careful planning, such as reinvesting in a like-kind exchange. You might also consider holding the timber over longer periods to potentially qualify for reduced tax rates. Consulting with a tax professional familiar with the California Timber Sale Contract can provide tailored strategies for your situation.

To report the sale of timber using TurboTax, navigate to the 'Investment Income' section and enter your profit from the sale. Ensure you have your California Timber Sale Contract details handy, as you will need them to fill in the necessary fields. The software provides prompts to help you accurately report your figures and maximize your deductions.

To report the sale of timber, list the sale's total proceeds on Schedule D of your tax form. Divide the profits according to how long you held the timber, and refer to the California Timber Sale Contract to understand your basis. Remember to keep all your supporting documents organized, as they may be requested during an audit.

When reporting timber sales on your tax return, include any gains from the sale under capital gains. You must report the gross proceeds, which should align with your California Timber Sale Contract. Additionally, retain documentation of your expenses related to the timber to potentially offset some of the gains.

Yes, the sale of timber is generally taxed as a capital gain. However, using a California Timber Sale Contract can help you navigate specific tax implications and exemptions. It's wise to consult a tax advisor to understand how different factors might affect your tax situation when selling timber.

Selling timber on your property involves several steps, starting with assessing the value of your timber and understanding the market. You can use a California Timber Sale Contract to formalize agreements with potential buyers. Working with professionals, such as foresters or timber brokers, may enhance your chances of a successful sale.

Timber contracts are agreements between property owners and buyers that outline the terms for harvesting and purchasing timber. A California Timber Sale Contract typically specifies payment conditions, the type and amount of timber to be harvested, and is crucial for legal protection for both parties. Understanding these contracts helps ensure a smooth transaction and financial security.

When reporting the sale of timber on your tax return, it's crucial to detail your income derived from the sale as a specific line item. Utilizing a California Timber Sale Contract can help you track this income accurately. You may also need to report any expenses related to the sale, such as management costs, which can lower your overall taxable income.