California Letter to Lienholder to Notify of Trust

What this document covers

This Letter to Lienholder to Notify of Trust is a formal notification to a lienholder about the transfer of property into a living trust. This form is essential in estate planning, as it clarifies the legal ownership of property held in trust. By completing this form, the trustor communicates necessary information to the lienholder, ensuring records are updated in line with the transfer, which may not be covered by other legal documents such as a standard property deed.

Main sections of this form

- Date of the letter

- Name and address of the lienholder

- Trust name and date of establishment

- Identification of the trustor(s)

- Description of the property transferred

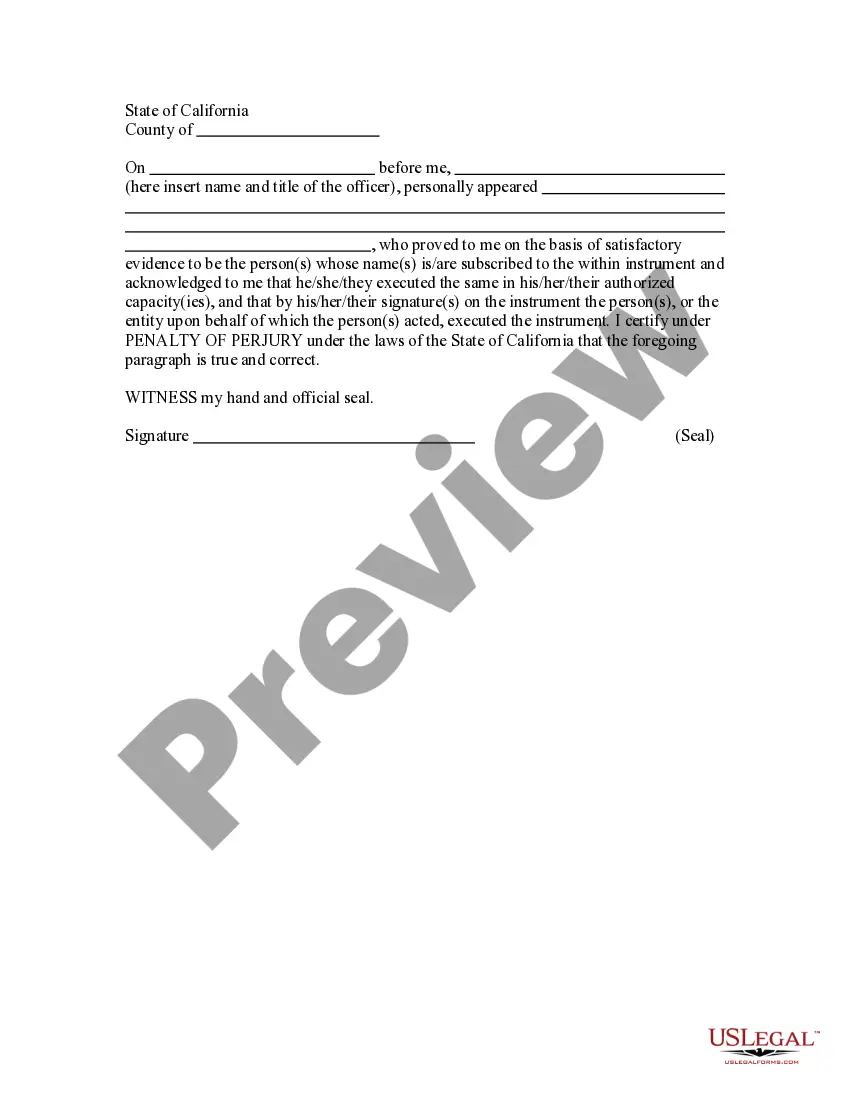

- Signature of the trustor(s) and notarization section

Situations where this form applies

This form should be used when a trustor has transferred property ownership into a living trust and needs to formally notify the lienholder of this change. Situations may include setting up a family estate plan, transferring real estate, or updating financial records to ensure creditors recognize the trust's legal ownership. Using this form helps prevent confusion or disputes regarding ownership and ensures all parties are adequately informed of the property's trust status.

Who needs this form

- Individuals establishing a living trust

- Trustors who have transferred property to a trust

- Property owners with existing liens seeking to clarify ownership

- Estate planners and legal professionals assisting clients with trusts

How to prepare this document

- Enter the current date at the top of the letter.

- Fill in the name and address of the lienholder.

- Specify the name of the living trust and the date it was established.

- Identify the trustor(s) who transferred the property.

- Clearly describe the property that has been transferred to the trust.

- Sign the letter and include the notarization section if required.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Typical mistakes to avoid

- Failing to accurately describe the property transferred.

- Not providing full details of the lienholder's address.

- Omitting the trustor's signature or failing to notarize the document if necessary.

- Using outdated or incorrect dates in the trust or transfer information.

Benefits of completing this form online

- Convenience of instant download and use from anywhere.

- Editable fields allowing customization to fit specific needs.

- Reliability of professionally drafted legal templates to ensure compliance.

State law considerations

This form is adapted for use in California, where specific legal terminology and requirements apply. Ensure compliance with local laws when notifying lienholders in other states, as rules and formalities may differ.

Form popularity

FAQ

Yes, you can place a lien on a trust if the trust holds property that is subject to a debt. The lien typically attaches to the real property owned by the trust and must be properly recorded with the county. It is crucial to follow all legal procedures for ensuring that the lien is valid. If appropriate, a California Letter to Lienholder to Notify of Trust should be sent to inform relevant parties about the lien.

California Form 541 must be filed by all estates and trusts that have gross income of $20,000 or more or have a beneficiary who resides in California. Additionally, any fiduciary responsible for managing the trust must ensure that the form is accurately filled and submitted on time. It is advisable to consult a tax professional to ensure compliance. Don’t forget to issue a California Letter to Lienholder to Notify of Trust if there are outstanding liens.

The IRS form required for filing a trust return is Form 1041, known as the U.S. Income Tax Return for Estates and Trusts. This form records income, deductions, credits, and distributions that the trust makes to its beneficiaries. It is important to accurately complete this form to comply with federal tax obligations. Additionally, remember that notifications may require a California Letter to Lienholder to Notify of Trust.

Finalizing a trust in California entails ensuring that all assets are properly titled in the name of the trust. You’ll also complete all necessary tax filings, such as the California Form 541. Lastly, consider drafting a termination document if the trust is revocable and is meant to end. If you're dealing with outstanding liens, using a California Letter to Lienholder to Notify of Trust might be essential.

Recording a trust in California involves creating a written declaration of trust and possibly funding the trust with assets. You typically do not file the trust document itself with any court or government entity; however, assets held in the trust, like real estate, need to be transferred to the trust. Always check with a legal professional to ensure compliance with state laws, and remember to send a California Letter to Lienholder to Notify of Trust if necessary.

In California, the form you need to file for a trust return is Form 541, also known as the California Fiduciary Income Tax Return. This form accounts for the income earned by the trust, distributions to beneficiaries, and any applicable deductions. Ensure you maintain records of all transactions related to the trust. Don’t forget, when notifying involved parties, you might need to issue a California Letter to Lienholder to Notify of Trust.

Changing your property title to a trust in California requires preparing a new deed that transfers ownership from you to the trust. You must fill out a grant deed or a quitclaim deed, depending on your situation. After preparing the deed, sign it in front of a notary, then record it with the county recorder's office. Keep in mind that a California Letter to Lienholder to Notify of Trust may be needed if there are existing liens on the property.

To file a tax return for a trust in California, you need to use California Form 541. This form specifically addresses income tax reporting for trusts. Additionally, ensure that you gather all relevant financial documents, such as income generated by the trust and any deductions. You might want to consult a tax professional for guidance, especially when drafting a California Letter to Lienholder to Notify of Trust.

The trustee has a legal obligation to keep beneficiaries informed about the trust's activities and financial status. This includes disclosing information such as asset values, income, and significant decisions affecting the trust. A well-crafted California Letter to Lienholder to Notify of Trust is an excellent tool for fulfilling this duty, especially when there are liens or loans associated with trust assets.

Beneficiaries in California should generally expect to be notified about a trust within 60 days after the person's death if they are named in the trust. The trustee is responsible for this communication, which may include sending a California Letter to Lienholder to Notify of Trust if there are assets involved. This timely notification helps beneficiaries understand their rights and the next steps in managing the trust.