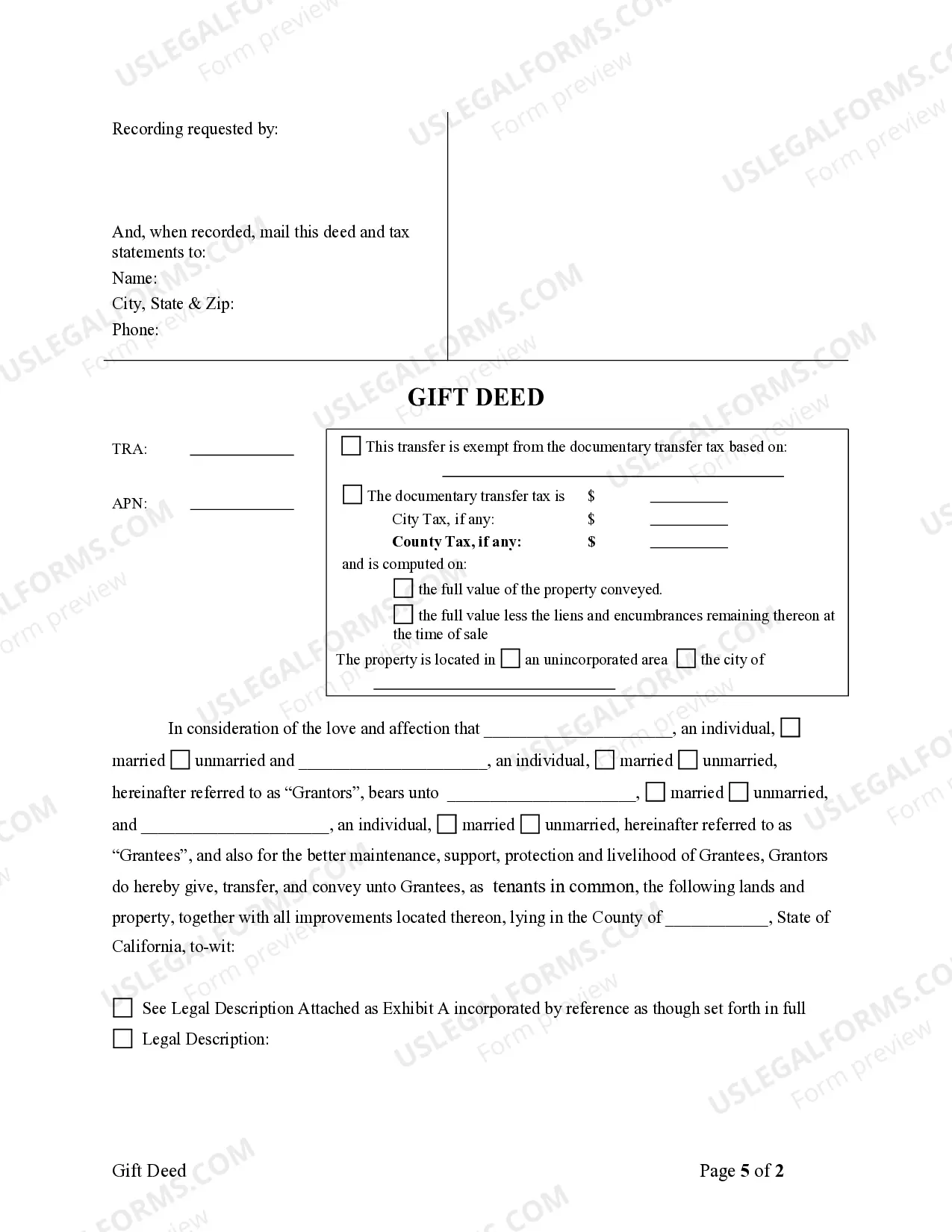

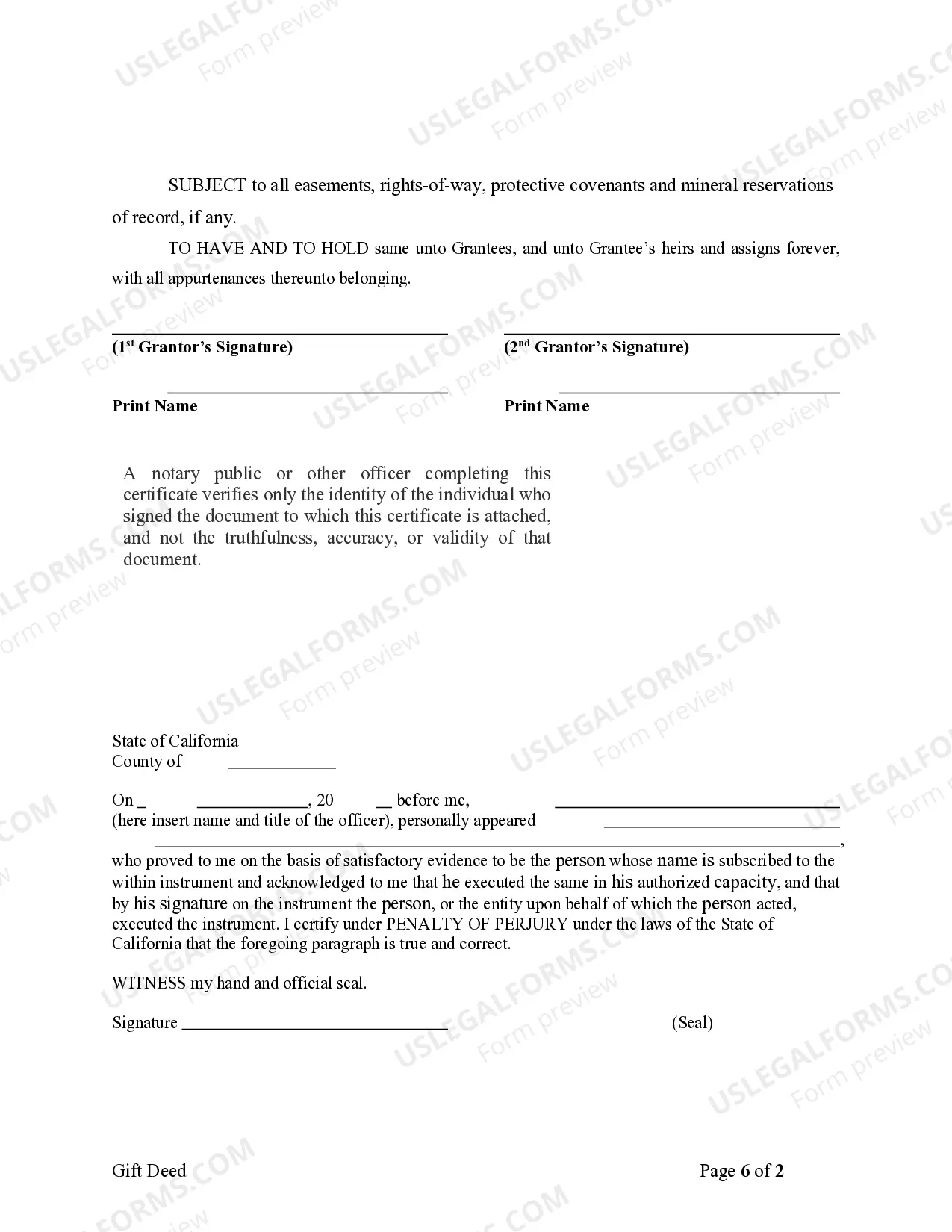

This form is a Gift Deed where the grantors are two individuals and the grantees are two individuals. Grantors grant and convey the described property to grantees. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

California Gift Deed - From Two Individual Grantors to Two Individual Grantees

Description

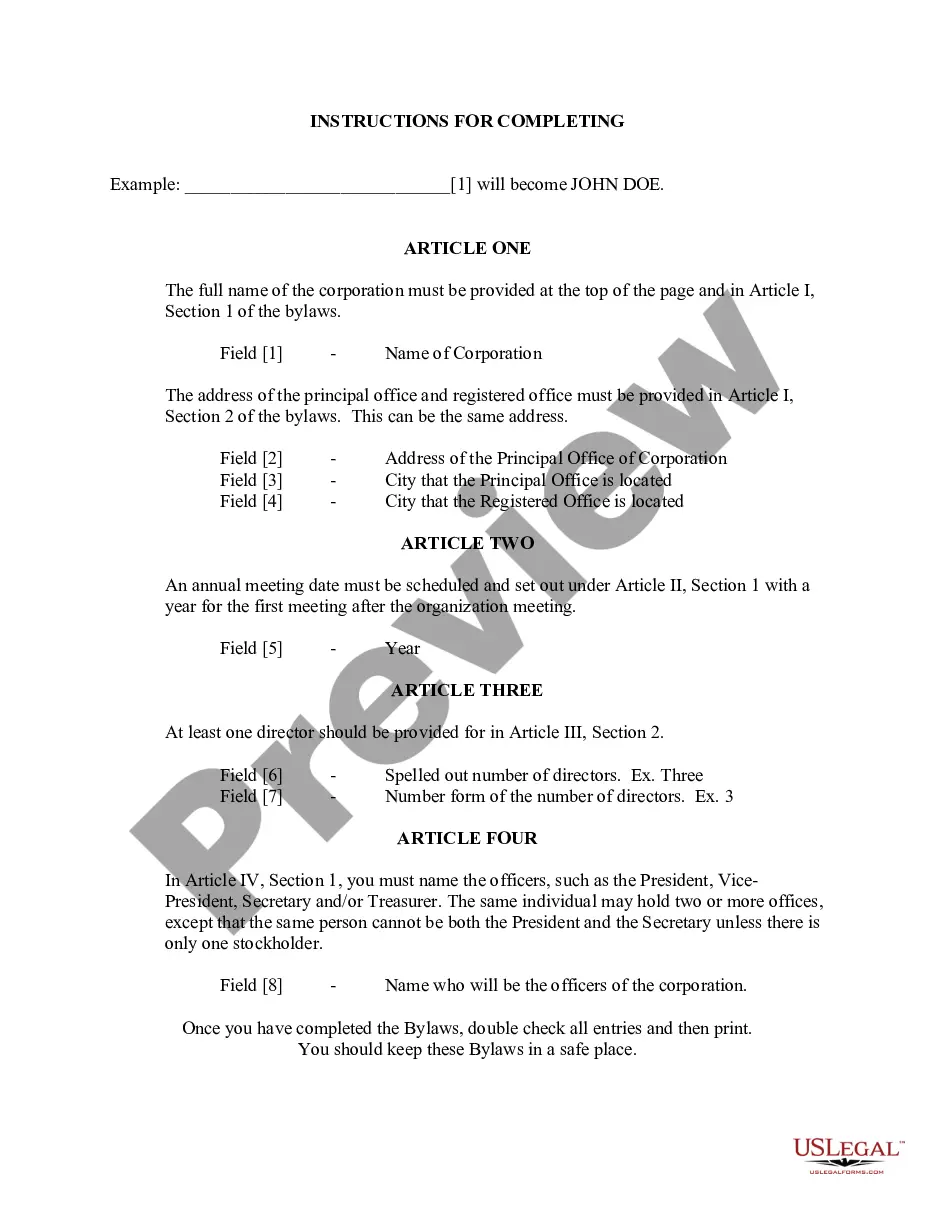

How to fill out California Gift Deed - From Two Individual Grantors To Two Individual Grantees?

If you are in search of appropriate California Gift Deed - From Two Individual Grantors to Two Individual Grantees samples, US Legal Forms is precisely what you require; access documents crafted and verified by state-accredited lawyers.

Using US Legal Forms not only safeguards you from issues related to legal documents; you also save time and effort, along with money!

And that is all. With just a few straightforward steps, you will have an editable California Gift Deed - From Two Individual Grantors to Two Individual Grantees. After registering, all subsequent orders will be processed even more easily. Once you have a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form’s webpage. Then, when you need to use this template again, you will always be able to locate it in the My documents section. Don’t waste your time searching through countless forms on different platforms. Obtain accurate templates from a single reliable source!

- Initiate your enrollment process by entering your email and creating a password.

- Follow the steps outlined below to set up an account and locate the California Gift Deed - From Two Individual Grantors to Two Individual Grantees sample to address your needs.

- Utilize the Preview option or review the document description (if available) to confirm that the template is the one you need.

- Verify its legality in your residing state.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Establish your account and make payment using your credit card or PayPal.

Form popularity

FAQ

The primary difference lies in the nature of the transfer. A quitclaim deed transfers any ownership interest the grantor has in the property, but offers no warranty of that interest. In contrast, an Interspousal transfer deed guarantees the transfer between spouses without taxation. Understanding these differences can help you choose the right type of deed for your circumstances. Consulting with uslegalforms can help clarify which option is best for your needs.

An Interspousal transfer deed is a specific type of deed used in California to transfer property between spouses without incurring additional transfer taxes. This deed allows for a smooth transfer of ownership, especially in cases like divorce or when one spouse is gifting property to the other. It ensures that both parties agree to the terms, maintaining transparency and fairness. Utilizing a California Gift Deed - From Two Individual Grantors to Two Individual Grantees can complement such transfers effectively.

Yes, there can definitely be more than one grantee when creating a California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This type of deed allows you to convey property to multiple individuals simultaneously. Just ensure that all grantees are properly named in the deed to avoid confusion or legal issues later on. Using a well-prepared deed from a reliable source, like uslegalforms, can streamline this process.

The most common way to transfer ownership is through a California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This method is straightforward and effective for transferring property between family members or friends without facing complex legal barriers. This option ensures that your ownership wishes are explicitly stated in a legally valid document. Platforms like uslegalforms offer tools to help you create this deed efficiently.

Transferring property to a family member can be accomplished smoothly with a California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This approach emphasizes the gifting aspect, which can be beneficial for both tax and emotional reasons. This method clarifies your intent, making it easier for your loved ones. Using uslegalforms can simplify the preparation and ensure compliance with California laws.

One effective way to leave property to a family member is through a California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed allows you to transfer property as a gift, which can avoid probate issues later. It ensures your wishes are honored while minimizing tax implications for the recipient. Consider using uslegalforms to create this document properly.

Transferring property within a family can be done efficiently using a California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This method allows family members to transfer ownership without the need for complicated legal processes. A gift deed simplifies matters, ensuring that your intentions are clear and legally binding. Using a platform like uslegalforms can help streamline the preparation of the document, making it easier for you.

To transfer property from one person to another in California, you can utilize the California Gift Deed - From Two Individual Grantors to Two Individual Grantees. This deed allows for a smooth transfer without the need for a formal sale, making it ideal for gifts or family transfers. Once completed, make sure to file the deed at your local county office. For assistance, uslegalforms provides practical resources and templates to help you navigate the process effectively.

The California Gift Deed - From Two Individual Grantors to Two Individual Grantees serves as a reliable method to transfer property title between family members. By using this deed, you ensure that the transfer is straightforward and legally recognized. It's important to record the deed with your local county recorder's office to solidify the transfer. You can find easy-to-use templates and guidance on uslegalforms that simplify this process.