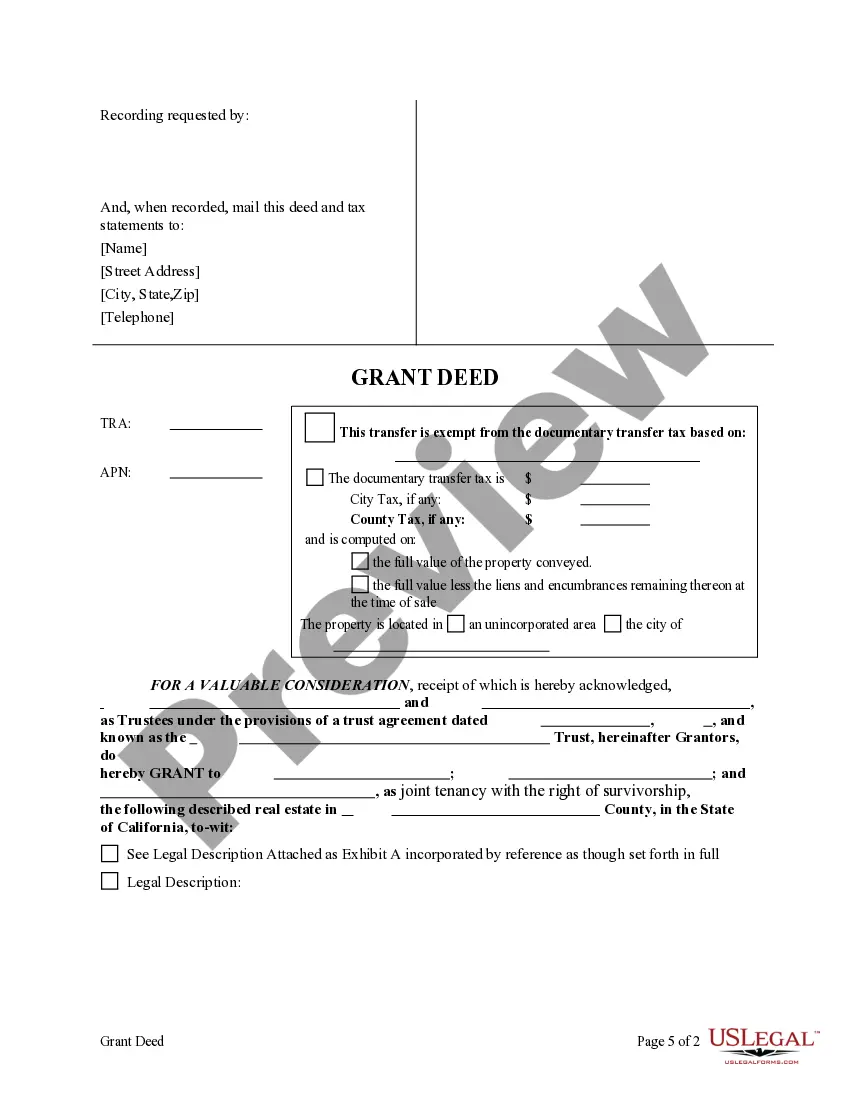

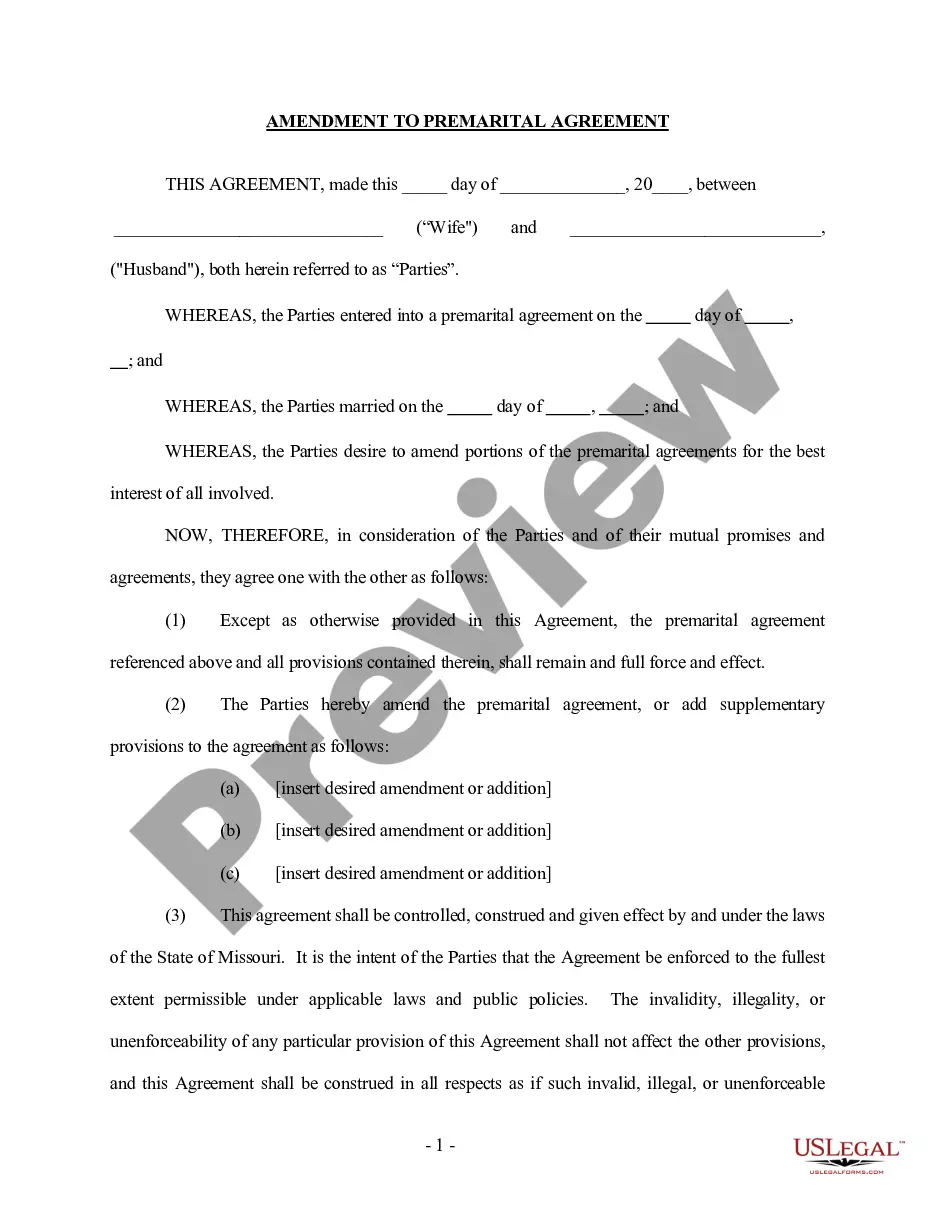

This form is a Grant Deed where the Grantor is a Trust, acting through two Trustees, and the Grantees are three individuals. Grantors convey and grant the described property to Grantees. Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

California Grant Deed - Trust (Two Trustees) to Three Individuals

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Grant Deed - Trust (Two Trustees) To Three Individuals?

If you're seeking precise California Grant Deed - Trust (Two Trustees) to Three Individuals web templates, US Legal Forms is precisely what you require; discover documents created and verified by state-certified lawyers.

Using US Legal Forms not only relieves you from concerns about legal documents; additionally, you save effort, time, and money! Downloading, printing, and completing a reliable form is considerably more cost-effective than hiring a lawyer to draft it for you.

And that's it. In just a few simple clicks, you obtain an editable California Grant Deed - Trust (Two Trustees) to Three Individuals. Once you create an account, all future purchases will be processed even more easily. If you have a US Legal Forms subscription, simply Log In to your account and then click the Download button you can find on the form's webpage. Then, when you wish to use this template again, you'll always have access to it in the My documents section. Don't squander your time and energy comparing countless forms across different platforms. Obtain precise templates from a single trusted source!

- To begin, complete your registration process by entering your email and establishing a secure password.

- Follow the steps below to create an account and acquire the California Grant Deed - Trust (Two Trustees) to Three Individuals template to meet your needs.

- Utilize the Preview feature or check the document description (if available) to ensure that the template is the one you want.

- Confirm its legitimacy in your state.

- Click Buy Now to place your order.

- Select a desired pricing plan.

- Create an account and pay with a credit card or PayPal.

- Choose an appropriate format and save the form.

Form popularity

FAQ

The best way to add someone to a deed is to execute a Grant Deed or Quitclaim Deed, depending on your specific needs. This process involves formally drafting and signing the deed, which is then submitted to the county recorder. Utilizing tools from USLegalForms can facilitate this process, ensuring all legal aspects are appropriately covered. Doing this helps maintain an accurate record of ownership under the California Grant Deed - Trust (Two Trustees) to Three Individuals.

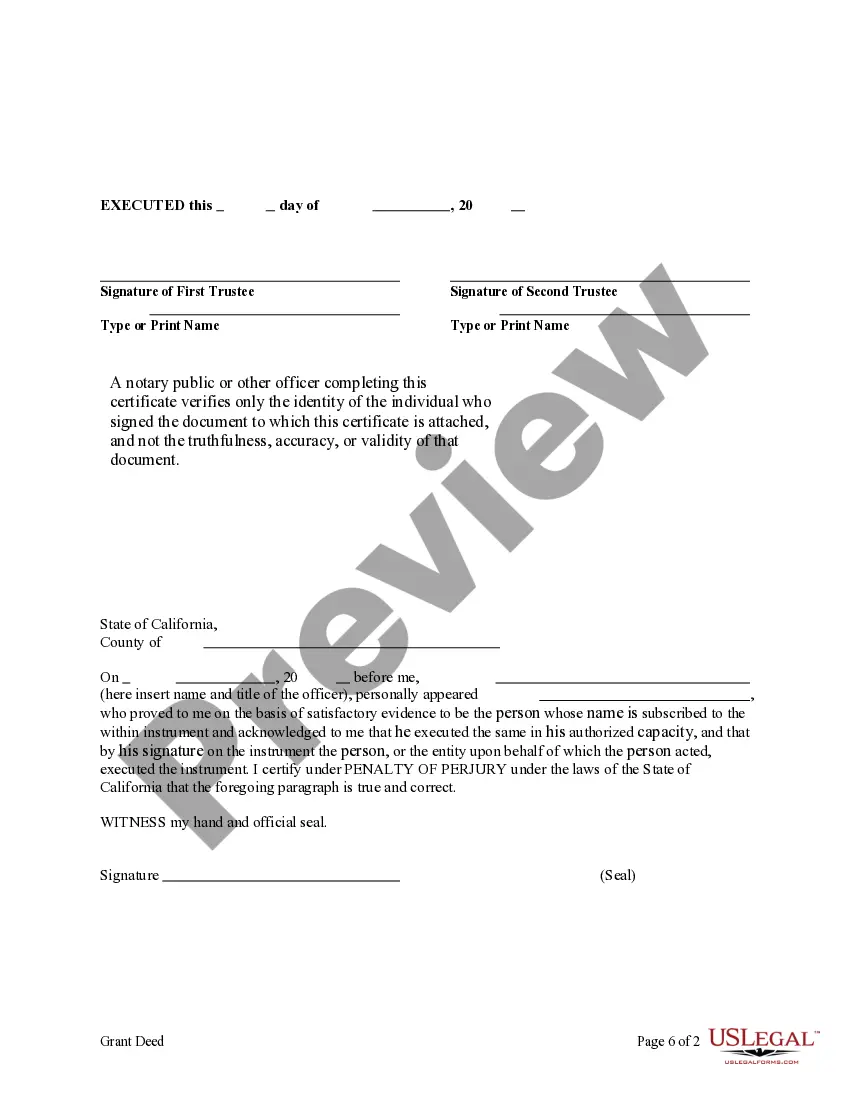

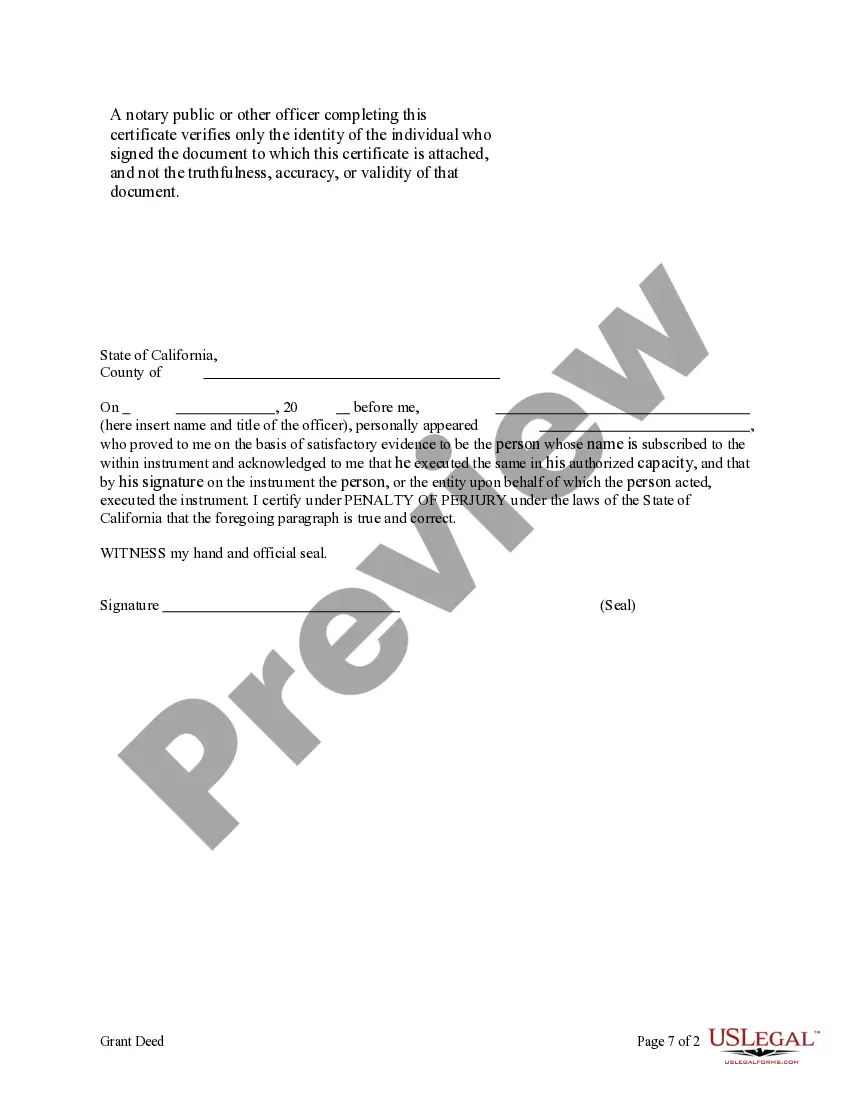

To execute a quitclaim deed in California, you need to draft the deed, clearly state the property details, and include the grantor's and grantee's information. It's essential to sign the deed in front of a notary public and then file it with the county recorder’s office. This method of transferring property can be straightforward and is particularly useful in scenarios involving the California Grant Deed - Trust (Two Trustees) to Three Individuals.

To add someone to a deed in California, you typically need to complete a new deed form. This could involve a Grant Deed or Quitclaim Deed, depending on your situation. The completed form should be signed, notarized, and then recorded with the county recorder’s office. Using platforms like USLegalForms can simplify this process, ensuring you have the correct documentation.

Yes, you can add someone to your house deed in California. This process is often essential for estate planning, and it’s a key feature of the California Grant Deed - Trust (Two Trustees) to Three Individuals. However, always consider potential tax implications and legal responsibilities before proceeding. Consulting with a professional can provide peace of mind during this process.

Yes, you can have three trustees in a trust. The California Grant Deed - Trust (Two Trustees) to Three Individuals allows for multiple individuals to serve in this role. This setup can enhance trust management and decision-making. Having three trustees can also provide a wider range of perspectives and expertise.

Filling out a California grant deed involves several key steps that require attention to detail. First, you need to identify the grantors and grantees, alongside a proper legal description of the property. For a California Grant Deed - Trust (Two Trustees) to Three Individuals, ensure that you clearly state the names of both trustees and the three individuals involved. You can also consider using platforms like USLegalForms to streamline the process and ensure you meet all legal requirements.

In California, any adult can serve as a trustee on a deed of trust. This includes individuals who are not related to the trustors, ensuring flexibility in choosing trustworthy and responsible individuals. When it comes to a California Grant Deed - Trust (Two Trustees) to Three Individuals, having two trustees can provide additional oversight and security. It is essential to select trustees who understand their responsibilities and can manage the trust effectively.

While it is not legally required to hire a lawyer to add someone to a deed in California, consulting with one can simplify the process and ensure compliance with legal standards. A legal expert can provide insights, especially with complex arrangements like a California Grant Deed - Trust (Two Trustees) to Three Individuals. If you feel unsure about the process, seeking professional advice may save you time and potential issues.

Adding someone to a deed can have tax implications, such as triggering a reassessment of property taxes or affecting capital gains taxes later. It’s vital to consult with a tax professional to understand how this may impact your financial situation. If you're considering a California Grant Deed - Trust (Two Trustees) to Three Individuals, getting expert advice can ensure you navigate any tax responsibilities effectively.

You can add a name to a grant deed in California by preparing a new grant deed form that lists all current and new owners. Make sure to have the document signed by the current owner, and then have it notarized. Recording this new deed with your local county office will officially update the property ownership, ensuring clear title for the California Grant Deed - Trust (Two Trustees) to Three Individuals.