Arizona Acquisition Worksheet

Description

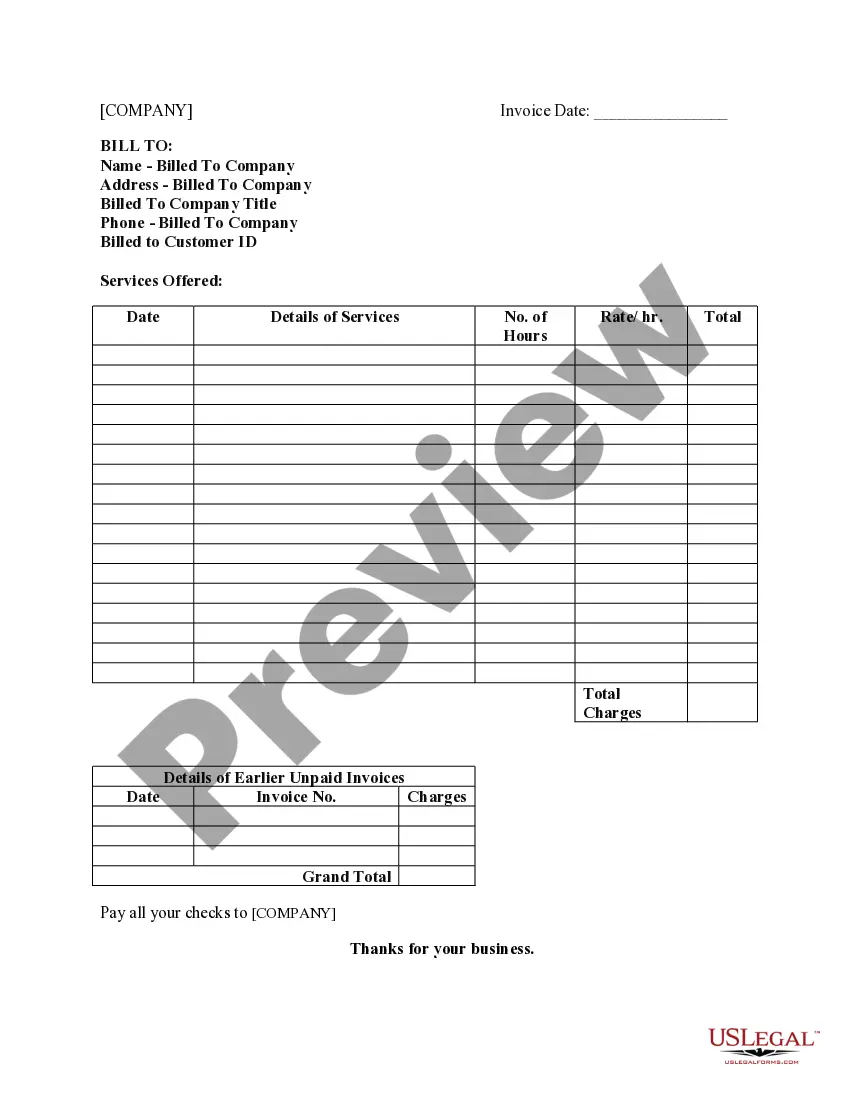

How to fill out Acquisition Worksheet?

If you want to total, down load, or printing lawful papers themes, use US Legal Forms, the largest assortment of lawful forms, that can be found on-line. Take advantage of the site`s simple and hassle-free search to discover the files you need. A variety of themes for company and person functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Arizona Acquisition Worksheet in a couple of mouse clicks.

Should you be presently a US Legal Forms customer, log in for your profile and click on the Acquire switch to get the Arizona Acquisition Worksheet. Also you can access forms you formerly downloaded from the My Forms tab of the profile.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form to the appropriate area/region.

- Step 2. Utilize the Preview solution to check out the form`s information. Do not forget about to read through the information.

- Step 3. Should you be unhappy together with the develop, utilize the Lookup discipline towards the top of the screen to discover other types of the lawful develop design.

- Step 4. Upon having located the form you need, click on the Purchase now switch. Pick the prices plan you like and include your credentials to sign up for an profile.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Select the file format of the lawful develop and down load it on your gadget.

- Step 7. Complete, revise and printing or indication the Arizona Acquisition Worksheet.

Every lawful papers design you purchase is your own for a long time. You may have acces to each and every develop you downloaded in your acccount. Click the My Forms segment and pick a develop to printing or down load once again.

Compete and down load, and printing the Arizona Acquisition Worksheet with US Legal Forms. There are many skilled and status-particular forms you can use for your personal company or person requirements.

Form popularity

FAQ

Calculating apportionment for income Identify your gross income for the quarter. ... Calculate your company's book value. ... Divide your gross income figure by the number of days in the relevant quarter. ... Multiply this number by the number of days in the year. ... Finally, divide your final figure by the value of your business.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

Apportionment is the assignment of a portion of a corporation's income to a particular state for the purposes of determining the corporation's income tax in that state. The state determines how much of your earnings are a result of business done in that state so it can charge you the right amount of income tax.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

States generally follow one of three common apportionment formulas: equally-weighted three-factor formulas; three-factor formulas with enhanced sales factors; or. single sales factor formulas.

¶11-520, Apportionment The double-weighted sales factor formula is a fraction consisting of the sum of the property factor, the payroll factor, and two times the sales factor, divided by four.

Yes, the employer should then select 2.0% as the default rate. This means by March 2023 the paychecks would have the default rate chosen for them.