Arizona Self-Employed Surveyor Services Contract

Description

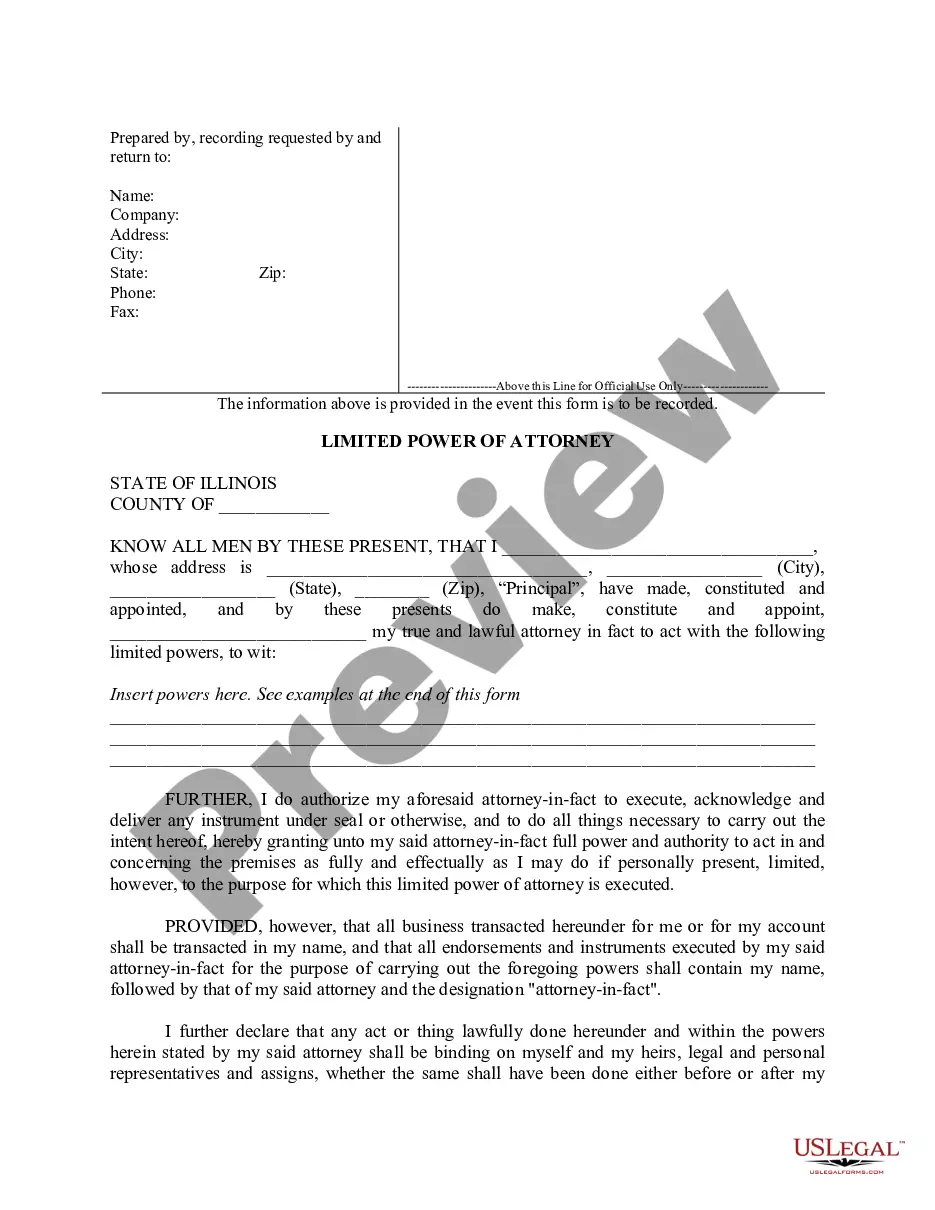

How to fill out Self-Employed Surveyor Services Contract?

If you wish to aggregate, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online. Take advantage of the website's straightforward and convenient search function to locate the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Arizona Self-Employed Surveyor Services Contract with just a few clicks.

If you are already a US Legal Forms subscriber, Log In to your account and click the Acquire button to access the Arizona Self-Employed Surveyor Services Contract. You can also access forms you have previously downloaded from the My documents section of your account.

If you are using US Legal Forms for the first time, refer to the following instructions: Step 1. Ensure you have selected the form for your relevant area/region. Step 2. Use the Review option to examine the form's content. Remember to read the description. Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions in the legal form template. Step 4. Once you have identified the form you need, click the Acquire now button. Choose the pricing plan you prefer and input your credentials to register for the account. Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction. Step 6. Retrieve the format of the legal form and download it to your device. Step 7. Fill out, modify and print or sign the Arizona Self-Employed Surveyor Services Contract.

- Every legal document template you acquire is yours permanently.

- You have access to each form you downloaded in your account.

- Select the My documents section and choose a form to print or download again.

- Complete and download, and print the Arizona Self-Employed Surveyor Services Contract with US Legal Forms.

- There are numerous professional and state-specific forms you can use for business or personal needs.

Form popularity

FAQ

Starting your own land surveying business in Arizona is entirely possible and can be rewarding. You will need to obtain the necessary licenses and permits, as well as consider liability insurance. Using an Arizona Self-Employed Surveyor Services Contract will provide a solid foundation for your business dealings, ensuring professional agreements with your clients.

In Arizona, 1099 employees are classified as independent contractors and are responsible for reporting their own income and taxes. This means you will not have taxes withheld from your payments, so keeping accurate records is essential. If you use an Arizona Self-Employed Surveyor Services Contract, it can assist you in outlining your independent status and responsibilities.

Self-employed land surveyors typically earn between $40,000 and $100,000 annually, depending on their expertise and the demand for their services. The income can fluctuate significantly based on the number of clients and projects undertaken. An Arizona Self-Employed Surveyor Services Contract can help manage your business effectively and maximize your earnings.

Yes, you can be a self-employed land surveyor in Arizona. Many professionals choose this route to have more control over their work and schedule. By establishing an Arizona Self-Employed Surveyor Services Contract, you can outline your services and terms clearly, making it easier to attract clients.

The salary of land surveyors in Arizona varies based on experience, location, and the complexity of projects. On average, land surveyors can expect to earn a competitive wage, particularly if they are operating under an Arizona Self-Employed Surveyor Services Contract. Experienced surveyors with a strong client base often enjoy higher earnings due to their specialized skills. For accurate salary information, consider checking resources like the Bureau of Labor Statistics or local job listings.

Proving you are an independent contractor involves maintaining clear documentation of your business operations. This includes contracts, invoices, and records of payments received, especially for services rendered under an Arizona Self-Employed Surveyor Services Contract. You should also demonstrate your independence by showing that you set your own hours and manage your own business expenses. By keeping organized records, you can easily validate your status when needed.

To become an independent contractor in Arizona, you need to register your business and obtain any necessary licenses specific to your field. For those offering Arizona Self-Employed Surveyor Services Contract, this may include obtaining a surveyor's license through the Arizona Board of Technical Registration. Additionally, you should familiarize yourself with tax obligations and insurance requirements. Utilizing platforms like US Legal Forms can help you navigate the paperwork involved in establishing your independent contractor status.

Independent contractors in Arizona need to complete various forms, including a W-9 for tax purposes and a contract that details the services provided. If you're utilizing an Arizona Self-Employed Surveyor Services Contract, make sure to include all relevant information about your services and payment expectations. USLegalForms offers templates that make this process straightforward, ensuring you have all the necessary paperwork in order.

In Arizona, a construction contract must clearly outline the scope of work, payment terms, and timelines. Additionally, it is important to include any required licenses and permits specific to the project. For those offering Arizona Self-Employed Surveyor Services Contract, ensuring compliance with state regulations is crucial. Using platforms like USLegalForms can help you draft a solid contract that meets all necessary legal requirements.

Yes, independent contractors in Arizona may need a business license depending on their location and the nature of their work. It's crucial to check local regulations to ensure compliance. If you are considering an Arizona Self-Employed Surveyor Services Contract, uslegalforms can provide resources to help you navigate the licensing requirements.