Arizona Cameraman Services Contract - Self-Employed

Description

How to fill out Cameraman Services Contract - Self-Employed?

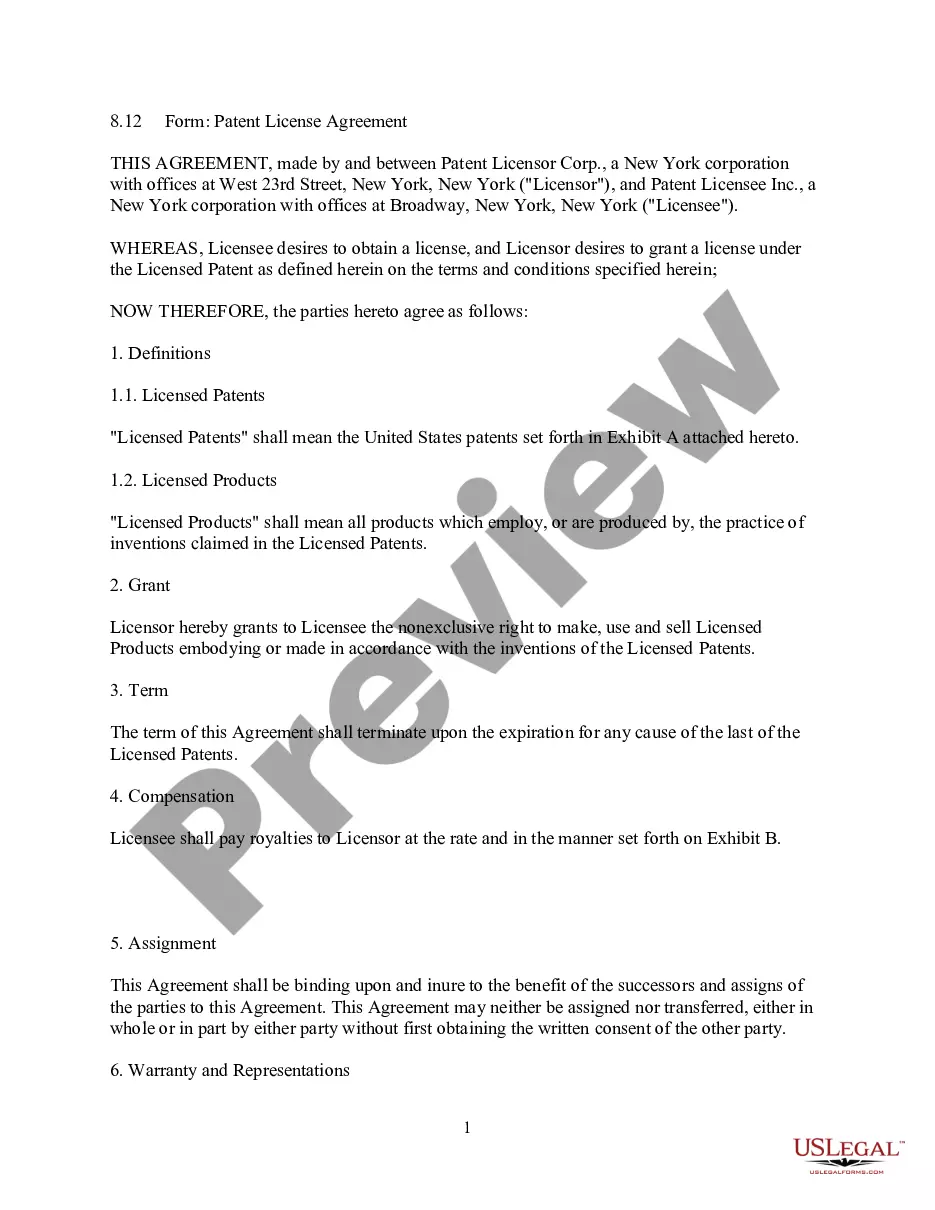

Finding the appropriate legal document template can be a challenge. Obviously, there are numerous templates accessible online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Arizona Cameraman Services Contract - Self-Employed, that you can use for business and personal purposes. All forms are verified by experts and meet state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Arizona Cameraman Services Contract - Self-Employed. Use your account to browse through the legal forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for the city/state. You can view the form using the Preview option and read the form description to ensure it is suitable for you. If the form does not meet your requirements, use the Search area to find the right form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for your order using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained Arizona Cameraman Services Contract - Self-Employed.

Utilize US Legal Forms to simplify your search for the right legal documents and ensure you have the proper forms for your needs.

- US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Take advantage of the service to obtain professionally-crafted paperwork that adhere to state regulations.

- The platform provides a user-friendly interface for easy navigation.

- All templates are designed to cater to both business and personal needs.

- Professionals verify the documents to ensure compliance with legal standards.

- A wide range of templates is available for different services and purposes.

Form popularity

FAQ

To write a contract agreement for services, start by outlining the key terms, including the scope of work, payment details, and deadlines. Incorporate elements specific to the Arizona Cameraman Services Contract - Self-Employed to address unique needs such as copyright and usage rights. Ensure all parties agree to the terms by having them sign the document. If you need assistance, consider using platforms like uslegalforms to access templates that simplify the process.

Yes, a photographer should use a contract to protect their interests and outline the details of the project. An Arizona Cameraman Services Contract - Self-Employed clearly specifies the scope of work, payment terms, and deadlines. This agreement helps avoid misunderstandings and ensures both parties are aligned on expectations. Using a contract can also enhance your professionalism and build trust with clients.

Yes, independent contractors may need a business license to operate legally in Arizona, depending on the city or county regulations. A local business license can protect you and your clients, and it may be necessary for contracts like the Arizona Cameraman Services Contract - Self-Employed. Checking with your local government ensures you adhere to the rules while providing your services. This preparation not only safeguards your business but also builds trust with clients.

In Arizona, 1099 employees, often categorized as independent contractors, must meet specific criteria regarding their work. They should have control over how they complete their tasks and typically work without oversight from the hiring party. Understanding the distinction is vital, especially with the Arizona Cameraman Services Contract - Self-Employed, as it helps clarify your responsibilities and rights under tax laws. Ensure you're aware of how these regulations might affect your income reporting.

In Arizona, registering your business as an independent contractor often depends on the business structure you choose. For instance, if you operate as a sole proprietor, registration may not be necessary, but if you choose to form an LLC or corporation, you must file appropriate documentation. Having a registered business can enhance your credibility and make it easier to enter into contracts like the Arizona Cameraman Services Contract - Self-Employed. Always consult local regulations to ensure compliance.

In Arizona, individuals can perform limited work without a contractor license, specifically for projects that do not exceed $1,000 in total labor and materials. However, for Arizona Cameraman Services Contract - Self-Employed, it is wise to obtain the appropriate licensing to avoid potential legal complications. Operating without a license can hinder your opportunities and may result in penalties. Therefore, understanding the licensing requirements before starting your work is crucial.

While it's not mandatory for freelance photographers to form an LLC, doing so offers valuable protections and benefits. An Arizona Cameraman Services Contract - Self-Employed combined with an LLC can shield your personal assets from business liabilities and simplify tax considerations. Many freelancers choose this route for better credibility and potential tax advantages. If you're looking for guidance in setting up your LLC and contract, platforms like uslegalforms can provide essential resources.

Yes, freelance photographers definitely need a contract to protect their business and clarify the expectations of each project. An Arizona Cameraman Services Contract - Self-Employed can outline key details such as payment terms, usage rights, and deadlines. This helps prevent misunderstandings and ensures both parties are on the same page. Using a solid contract not only secures your rights but also boosts your professionalism in the eyes of clients.

Writing a self-employed contract requires clarity on the services you will provide, payment terms, and duration of the agreement. Be explicit about any legal obligations and rights involved. Consider using an Arizona Cameraman Services Contract - Self-Employed to ensure you cover all necessary points effectively.

When writing a contract for a 1099 employee, clearly define the work relationship and specify the services to be performed. Include payment details, deadlines, and responsibilities of both parties. Utilizing an Arizona Cameraman Services Contract - Self-Employed can streamline your contracting process.