Arizona Production Assistant Contract - Self-Employed Independent Contractor

Description

How to fill out Production Assistant Contract - Self-Employed Independent Contractor?

If you need to be thorough, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Arizona Production Assistant Contract - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded with your account. Navigate to the My documents section and choose a form to print or download again.

Complete and download, and print the Arizona Production Assistant Contract - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Arizona Production Assistant Contract - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate region/country.

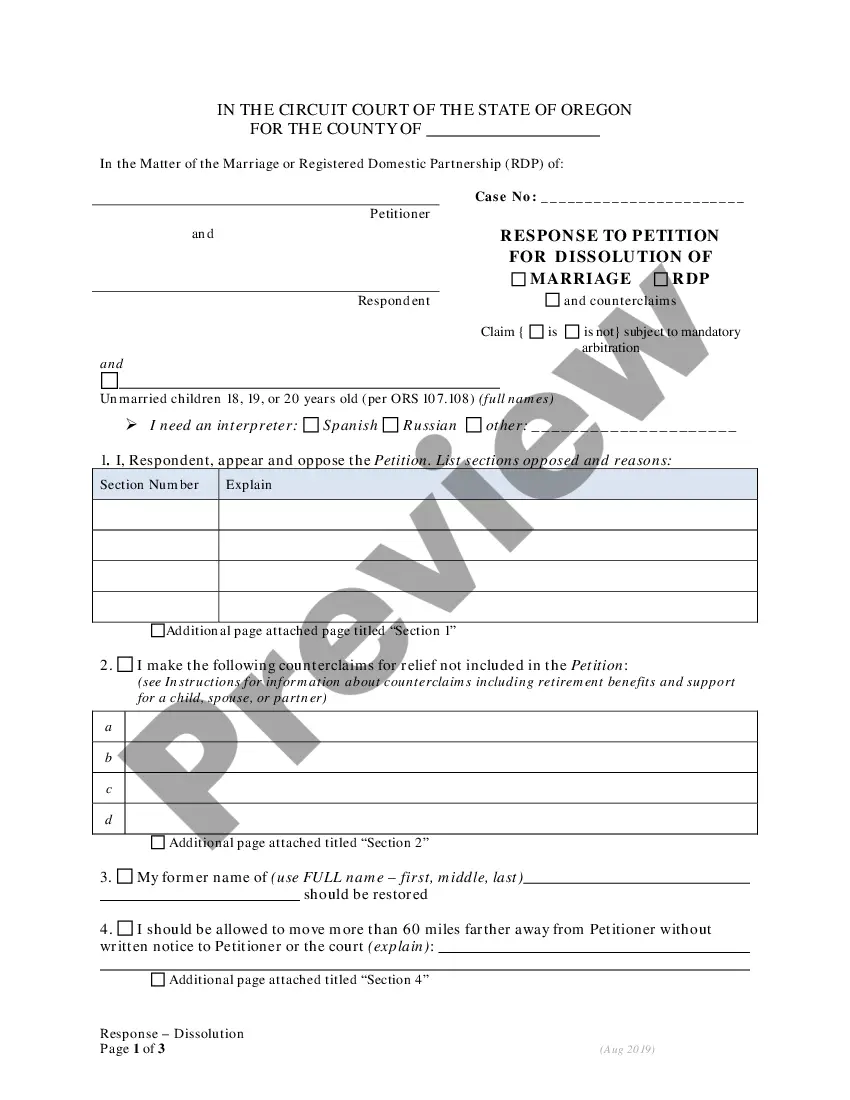

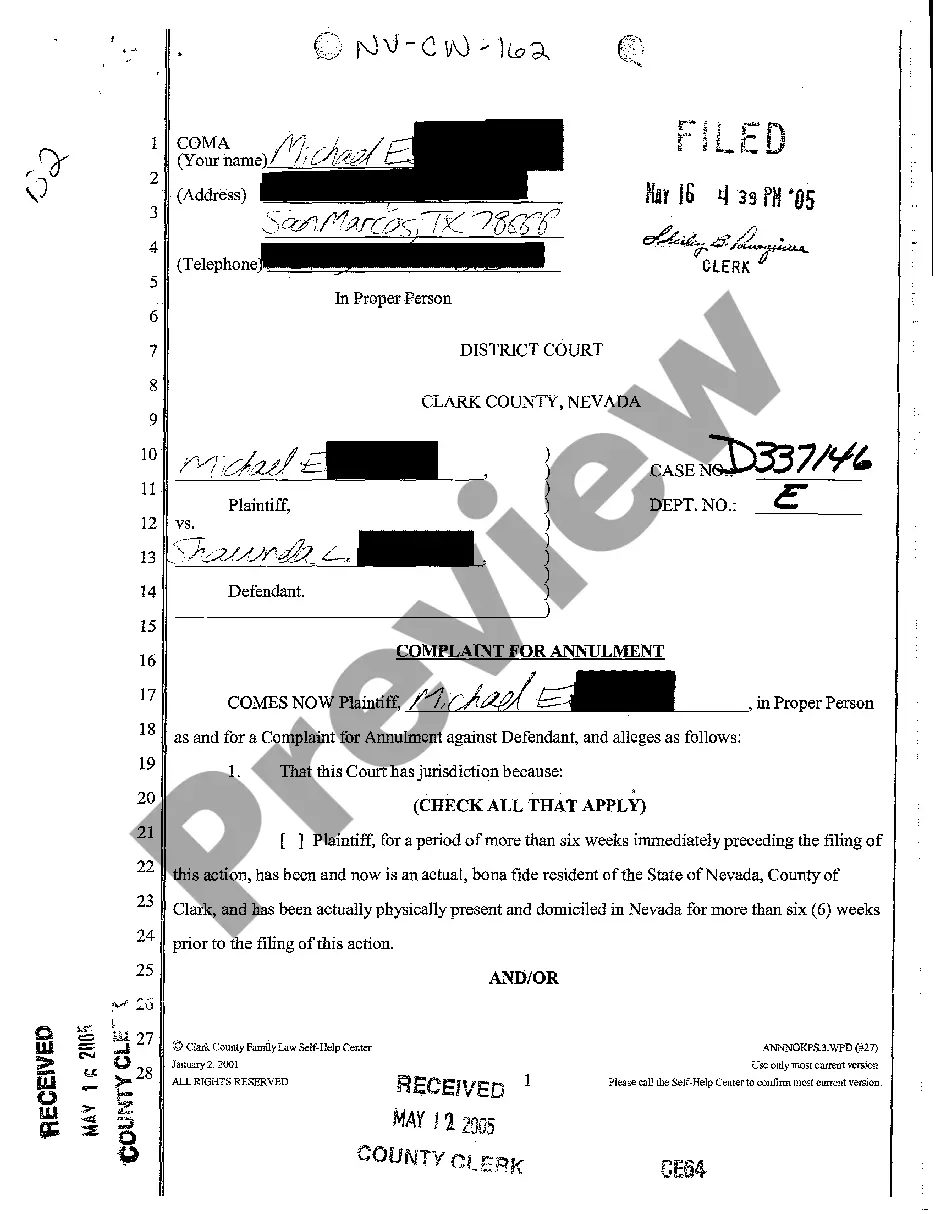

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you’ve found the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arizona Production Assistant Contract - Self-Employed Independent Contractor.

Form popularity

FAQ

In Arizona, whether you need a business license as an independent contractor depends on your location and the nature of your work. Most cities require a business license to conduct business legally. An Arizona Production Assistant Contract - Self-Employed Independent Contractor can also help navigate local regulations. Always check local laws to ensure compliance and avoid potential fines.

In Arizona, 1099 employees, or independent contractors, must follow specific rules regarding taxation and reporting. These individuals should ensure that they meet the Internal Revenue Service's criteria for independent contractor status. The Arizona Production Assistant Contract - Self-Employed Independent Contractor can be invaluable in clarifying these rules, providing a structured agreement to help you navigate the responsibilities of being a 1099 employee.

A production assistant can indeed function as an independent contractor, depending on the terms outlined in their employment agreement. Working under an Arizona Production Assistant Contract - Self-Employed Independent Contractor allows individuals to establish their role in the production industry without being tied to a single employer. This contract defines the expectations and duties, offering both flexibility and security.

Certainly, an assistant can be hired as an independent contractor. This setup allows the assistant to operate more flexibly and pursue various opportunities. By utilizing an Arizona Production Assistant Contract - Self-Employed Independent Contractor, you can outline specific terms, ensuring clarity for both the assistant and the hiring party.

Yes, a Production Assistant (PCA) can be classified as an independent contractor. As an independent contractor, the PCA has the freedom to manage their schedule and choose their projects. The Arizona Production Assistant Contract - Self-Employed Independent Contractor provides a clear framework for this arrangement, ensuring both parties understand their rights and responsibilities.

Filling out an Arizona Production Assistant Contract - Self-Employed Independent Contractor involves several key steps. First, clearly define the scope of work, including specific tasks and deadlines. Next, detail the payment terms, including rates and payment methods. Lastly, ensure you and the contractor both sign and date the document to make it legally binding. For an easier process, consider using the uslegalforms platform, which provides templates and guidance to help you complete your contract accurately.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an