Arizona Qualified Written RESPA Request to Dispute or Validate Debt

Description

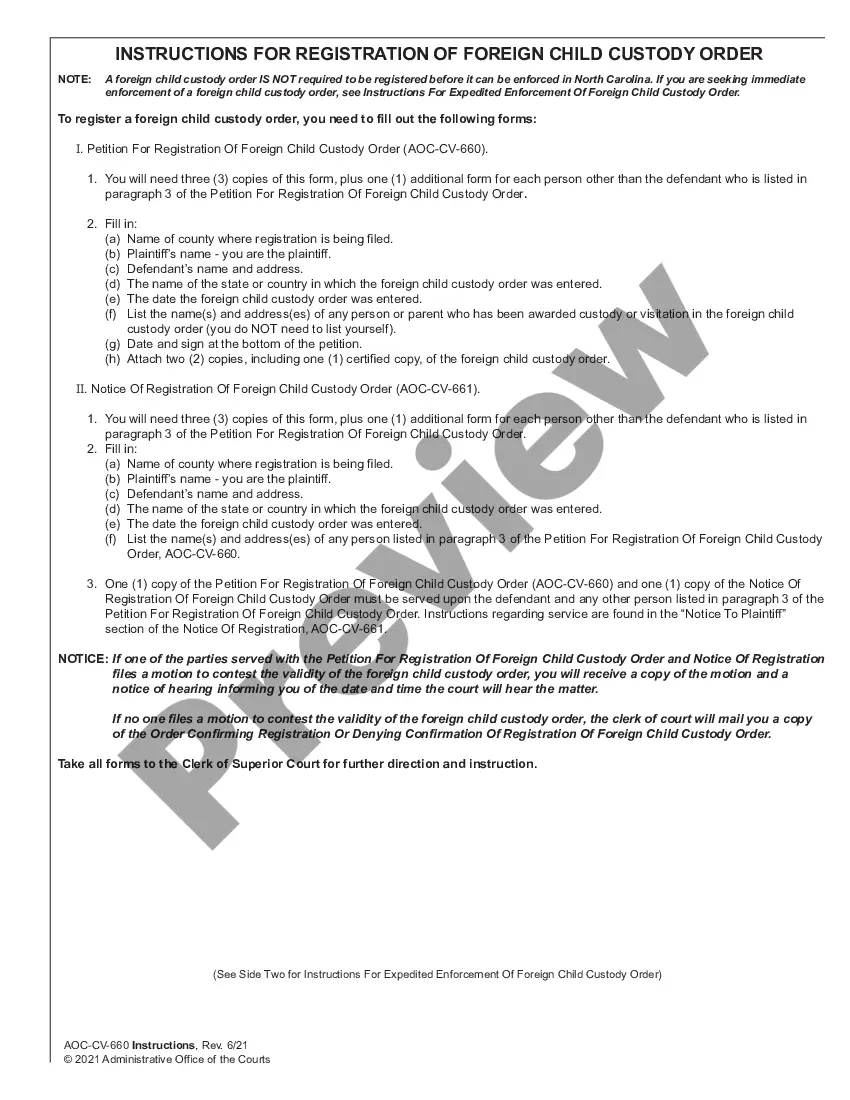

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you in a scenario where you require documentation for either a business or specific reasons almost every day.

There are numerous legal document templates available online, but finding versions you can trust is not straightforward.

US Legal Forms provides a vast selection of form templates, such as the Arizona Qualified Written RESPA Request to Challenge or Confirm Debt, which are crafted to comply with state and federal regulations.

Once you find the appropriate form, click Purchase now.

Select your preferred payment plan, provide the necessary details to create your account, and complete the transaction using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Qualified Written RESPA Request to Challenge or Confirm Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and make sure it is suitable for your specific location.

- Utilize the Review button to examine the form.

- Check the description to ensure you’ve selected the correct form.

- If the form does not match your needs, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

A lender must provide the required RESPA information to a buyer within a reasonable time frame, typically within 7 business days of receiving an Arizona Qualified Written RESPA Request to Dispute or Validate Debt. This response includes crucial details about the debt, ensuring the buyer has the necessary information to understand their financial obligations. If you have submitted a qualified written request, it is important that the lender acts promptly to meet this requirement. At US Legal Forms, we offer resources and templates that can assist you in making the most effective request.

To obtain a debt validation letter, you can use an Arizona Qualified Written RESPA Request to Dispute or Validate Debt. This formal request can help you ask your creditor for evidence of the debt you owe. It is important to send this request in writing, ensuring you keep a copy for your records. Using platforms like USLegalForms can simplify this process, providing templates that guide you in drafting an effective request.

A debt validation letter in Arizona is a written request sent to a debt collector demanding proof that the debt is valid and that they have the authority to collect it. This letter should outline details about the debt, including the amount owed and any information on the original creditor. Using an Arizona Qualified Written RESPA Request to Dispute or Validate Debt can serve as an effective tool for ensuring your rights are protected during this process.

Submitting a Qualified Written Request (QWR) does not automatically stop foreclosure proceedings. However, it can provide you with a means to address potential disputes regarding your mortgage payments or servicing errors. Utilizing an Arizona Qualified Written RESPA Request to Dispute or Validate Debt can be an important step to clarify your situation with the lender and potentially pause foreclosure actions while the matter is resolved.

RESPA prohibits two key practices: first, it forbids kickbacks or referral fees for settlement services in real estate transactions. Second, it restricts lenders from requiring borrowers to use a specific title company or settlement service provider as a condition for financing. Understanding these prohibitions can empower you when using an Arizona Qualified Written RESPA Request to Dispute or Validate Debt.

Validation of debt is the process wherein a borrower requests a detailed breakdown of the debt amount owed, which includes the original creditor, the amount, and any additional fees. This often involves verifying that the debt is legitimate and that the debt collector has the right to collect it. When you use an Arizona Qualified Written RESPA Request to Dispute or Validate Debt, you can ensure that you receive the necessary documentation from your mortgage servicer.

To make a qualified written request, you must send a letter to the servicer with the following information:your name and account information (or information that enables the servicer to be able to identify your account)a statement of the reasons why you believe that the account is in error, or.More items...

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.