Arizona Grant Agreement - From Government Assoc.

Description

How to fill out Grant Agreement - From Government Assoc.?

US Legal Forms - among the most significant libraries of authorized types in the States - gives a wide range of authorized file templates it is possible to acquire or print out. Utilizing the internet site, you can get thousands of types for enterprise and person purposes, sorted by groups, suggests, or keywords and phrases.You can find the latest types of types much like the Arizona Grant Agreement - From Government Assoc. in seconds.

If you have a membership, log in and acquire Arizona Grant Agreement - From Government Assoc. from the US Legal Forms catalogue. The Obtain switch will show up on every kind you perspective. You have access to all previously downloaded types within the My Forms tab of your respective account.

In order to use US Legal Forms initially, here are straightforward guidelines to help you started out:

- Make sure you have chosen the proper kind for the area/county. Click the Review switch to check the form`s content material. See the kind information to actually have chosen the appropriate kind.

- When the kind doesn`t suit your requirements, use the Research discipline near the top of the screen to get the the one that does.

- In case you are pleased with the shape, affirm your selection by clicking on the Purchase now switch. Then, pick the prices plan you prefer and supply your qualifications to sign up to have an account.

- Procedure the purchase. Utilize your credit card or PayPal account to perform the purchase.

- Choose the format and acquire the shape in your device.

- Make modifications. Fill out, modify and print out and indication the downloaded Arizona Grant Agreement - From Government Assoc..

Each template you added to your bank account lacks an expiry time and is your own property for a long time. So, in order to acquire or print out one more duplicate, just proceed to the My Forms area and click on in the kind you want.

Obtain access to the Arizona Grant Agreement - From Government Assoc. with US Legal Forms, by far the most comprehensive catalogue of authorized file templates. Use thousands of skilled and condition-particular templates that satisfy your company or person demands and requirements.

Form popularity

FAQ

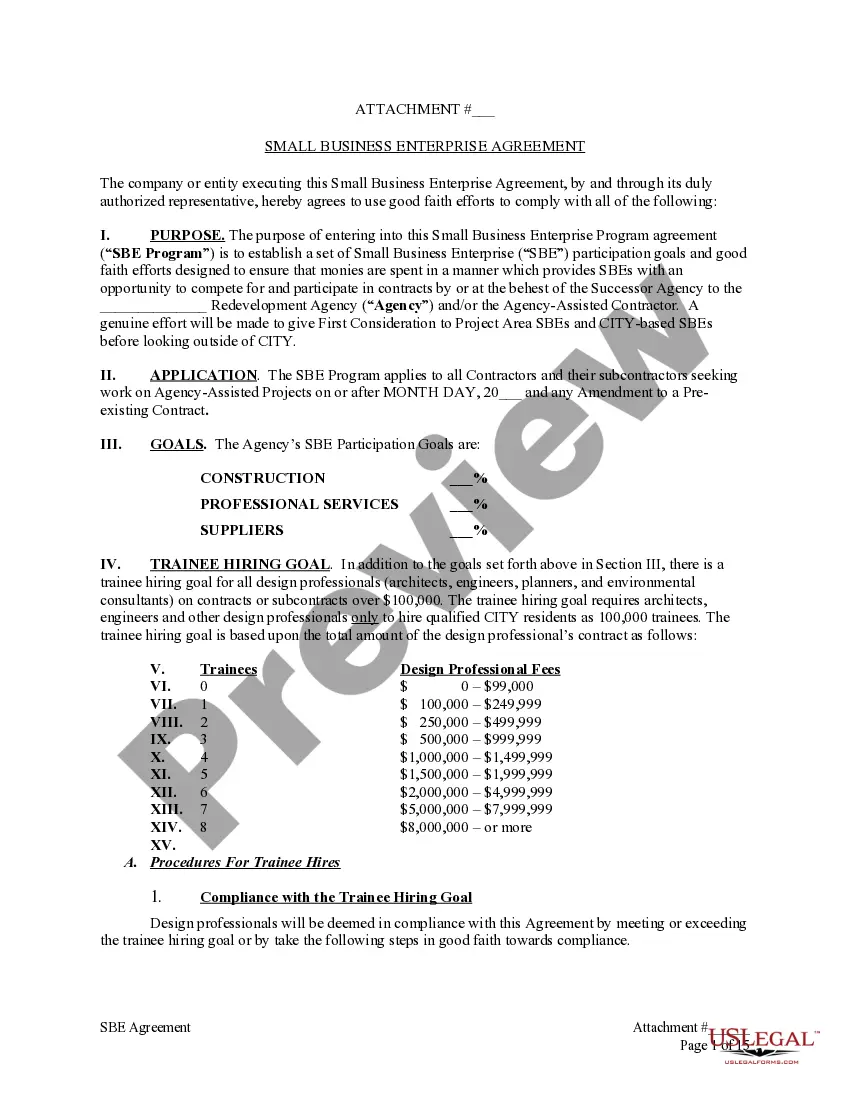

The grant agreement defines what activities will be undertaken, the project duration, overall budget, rates and costs, the EU budget's contribution, all rights and obligations and more.

Program Income Expended in ance with the Addition Alternative ? The amount of program income which was added to the funds committed to the total program costs and expended to further eligible project activities.

What is supplanting? Generally, supplanting occurs when a state, local, or Tribal Government reduces state, local, or tribal funds for an activity specifically because federal funds are available (or expected to be available) to fund that same activity.

Program income is gross income-earned by a recipient, a consortium participant, or a contractor under a grant-that was directly generated by the grant-supported activity or earned as a result of the award.

Program Income is the income earned by an awardee that is directly generated by a sponsored activity or earned as a result of a sponsored activity. Program income must be identified, appropriately documented, and the resulting revenue and expenses properly recorded and accounted for.

Capital grants are funds that are provided to assist in the acquisition, construction, renovation, repair of capital assets, or fixed assets. Capital grant revenue can be recorded as deferred revenue on the Statement of Financial position and revenue can be recognized as the capital assets are depreciated.

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

?Federal Award Identification Number (FAIN)? means the unique identifying number assigned to all Federal financial assistance awards. Also referred to as the agreement number.