Arizona Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

How to fill out Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

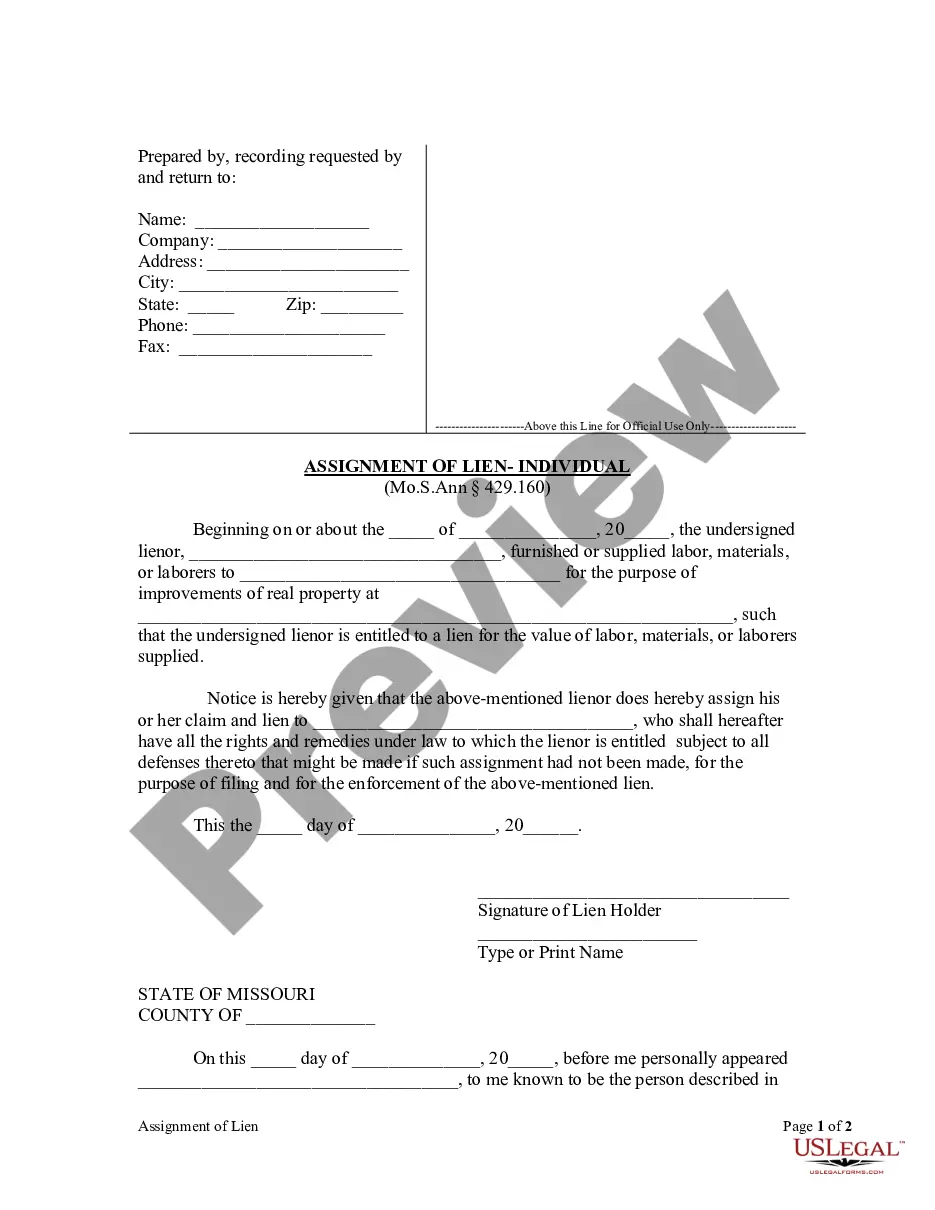

Discovering the right authorized file web template can be a have difficulties. Needless to say, there are plenty of templates available on the net, but how do you get the authorized form you require? Use the US Legal Forms site. The service gives a huge number of templates, like the Arizona Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, which you can use for organization and private requires. All the varieties are checked by experts and meet federal and state specifications.

In case you are previously listed, log in for your account and then click the Down load switch to obtain the Arizona Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service. Make use of your account to search through the authorized varieties you may have purchased formerly. Proceed to the My Forms tab of your respective account and have an additional duplicate in the file you require.

In case you are a whole new consumer of US Legal Forms, allow me to share basic instructions that you should adhere to:

- Very first, make certain you have selected the appropriate form for your personal area/state. You may look over the form using the Preview switch and read the form explanation to guarantee this is the best for you.

- In case the form is not going to meet your needs, take advantage of the Seach field to get the right form.

- When you are positive that the form is proper, click on the Purchase now switch to obtain the form.

- Pick the costs prepare you desire and enter the required details. Design your account and purchase the order making use of your PayPal account or Visa or Mastercard.

- Choose the document formatting and download the authorized file web template for your product.

- Total, edit and produce and sign the received Arizona Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service.

US Legal Forms is definitely the most significant catalogue of authorized varieties that you can see various file templates. Use the service to download expertly-produced files that adhere to express specifications.

Form popularity

FAQ

Additionally, the funded ratio of ASRS? actuarial value of assets divided by the actuarial accrued liability?increased from 71.5% to 72.7% as of June 30, 2022.

There are two portions to the ASRS contribution rate - the Retirement Pension & Health Insurance Benefit, and the Long Term Disability Income Plan. The Pension Plan contribution is a pre-tax deduction, and the Long-Term Disability deduction is post-tax.

The current contribution rate for retirement benefit and health benefit supplement is 12.14 percent for the pension plan and health benefit supplement, and 0.15 percent for the LTD plan. The total contribution rate of 12.29 percent will decrease slightly, to 12.24% beginning July 1, 2024.

If an employee is hired to work twenty weeks in a fiscal year at 20 or more hours per week they must begin contributing to the ASRS on day one*. *State employers ? Please assess whether the waiting period applies and once an employee meets membership edibility, contributions can begin.

Yes; membership in the ASRS is mandatory if you work for employers who are part of the ASRS and meet membership criteria. A couple of exceptions: 65+ Waiver.

Starting July 1, 2023, the new total contribution rate will be 12.29%, an increase of slightly more than a tenth of a percent from the FY 2022-23 rate of 12.17%. Visit azasrs.gov for more information.

ASRS Defined Benefit Plan It is a ?cost-sharing? model, meaning both the member and the employer contribute equally. Members also participate and contribute to the ASRS Long Term Disability Income Plan, which provides benefits for actively contributing members.

The limit on contributions: For fiscal year 2022, the ASRS cannot continue to receive contributions above $430,000 for members who joined before 07/01/1996, and $290,000 for members who joined on or after 07/01/1996. These limits are determined by the IRS, but they do not impact their service credit with the ASRS.