Arizona Payout Agreement

Description

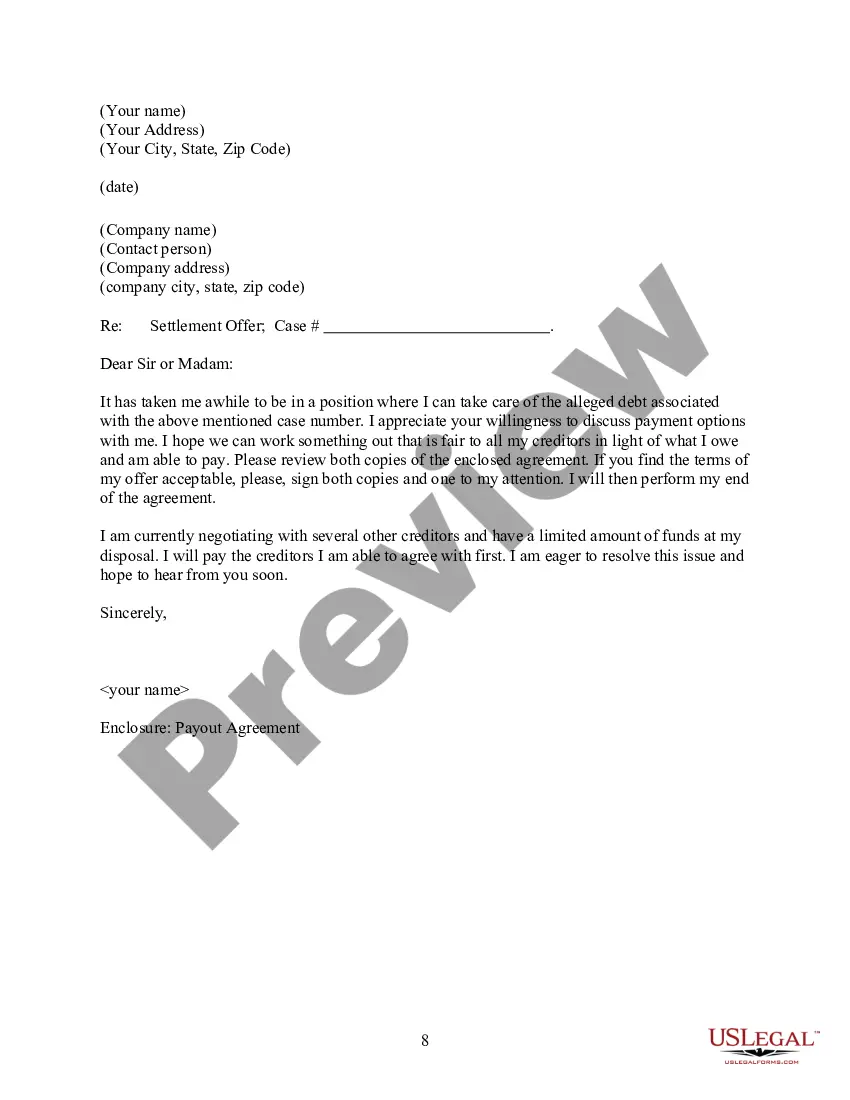

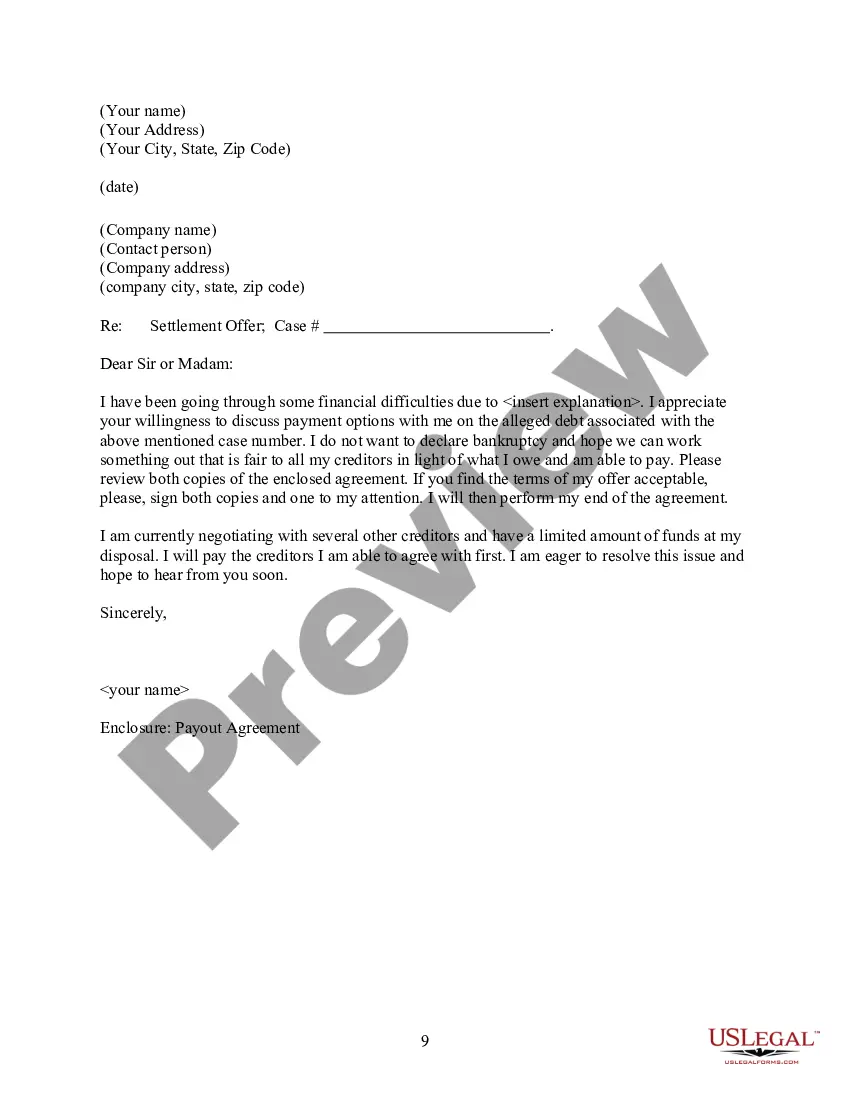

How to fill out Payout Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

With the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Arizona Payout Agreement in moments.

If you maintain a monthly subscription, Log In and download the Arizona Payout Agreement from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Arizona Payout Agreement. Each template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just visit the My documents area and click on the form you need. Access the Arizona Payout Agreement with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure you have selected the correct form for your location.

- Click the Preview button to review the form’s details.

- Check the form details to confirm you have the correct document.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Buy Now button.

- Then, choose your payment plan and provide your details to register for an account.

Form popularity

FAQ

AZTaxes.gov The state of Arizona provides a website that enables business taxpayers to file and pay state taxes online.

Corporations may use AZTaxes.gov or ACH Credit to make EFT payments. international businesses without a US bank can make electronic payments through ACH credit for routine payments, extension payments, and estimated payments. If you wish to use the ACH Debit option, please register at .

If you are approved for a Federal tax extension (IRS Form 4868), the Arizona Department of Revenue will automatically grant you a State extension for the period covered by your Federal extension. In this case, you do not need to submit Form 204.

The state of Arizona requires you to pay taxes if you're a resident or nonresident that receives income from an Arizona source. The state income tax rates range from 2.59% to 4.50%, and the sales tax rate is 5.6%, and an average local sales tax rate of 2.8%.

Arizona. The Arizona Department of Revenue grants a six-month extension of time to file a return to October 15, but it's not automatic. You must file Form 204 by April 15 to request an extension.

If you do not owe Arizona income taxes by the tax deadline of April 18, 2022, you do not have to prepare and file a AZ tax extension. In case you expect a AZ tax refund, you will need to file or e-File your AZ tax return in order to receive your tax refund money.

That's the case this year: Federal tax returns for 2021 are due April 18. So, too, for Arizona income-tax returns April 18 is this year's state filing deadline.

To make a payment on individual Arizona income tax owed, taxpayers can either do so electronically or by mail. Taxpayers who file electronically can authorize an electronic funds withdrawal (direct debit) from a checking or savings account.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

AZTaxes.gov The state of Arizona provides a website that enables business taxpayers to file and pay state taxes online.